|

شركة Zhejiang Dun 'an Artificial Environment Co.، Ltd (002011.SZ) تقييم DCF |

Fully Editable: Tailor To Your Needs In Excel Or Sheets

Professional Design: Trusted, Industry-Standard Templates

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Expertise Is Needed; Easy To Follow

Zhejiang Dun'an Artificial Environment Co., Ltd (002011.SZ) Bundle

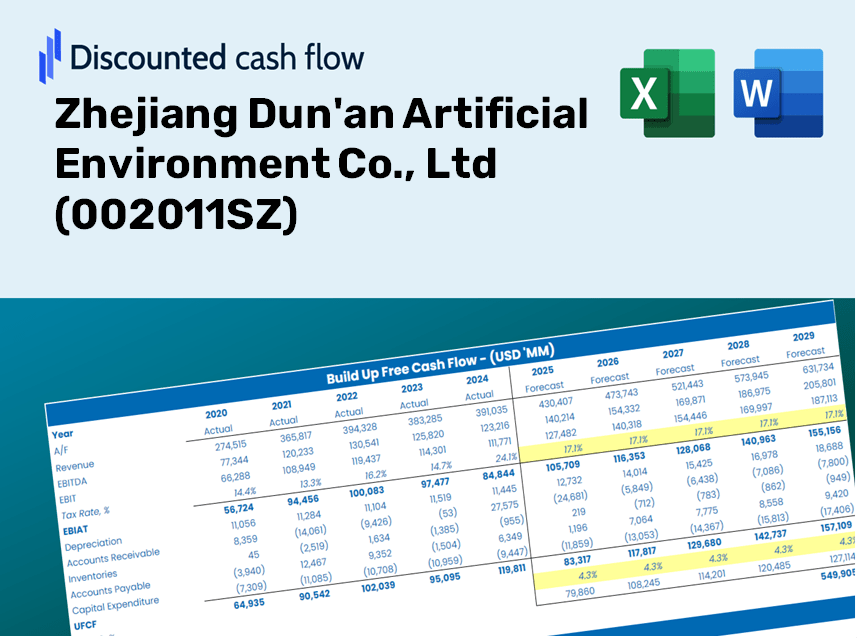

Evaluate the financial future of Zhejiang Dun'an Artificial Environment Co., Ltd like an expert! This (002011SZ) DCF Calculator provides pre-filled financial data along with the flexibility to modify revenue growth, WACC, margins, and other essential assumptions to align with your projections.

Discounted Cash Flow (DCF) - (USD MM)

| Year | AY1 2020 |

AY2 2021 |

AY3 2022 |

AY4 2023 |

AY5 2024 |

FY1 2025 |

FY2 2026 |

FY3 2027 |

FY4 2028 |

FY5 2029 |

|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 7,380.6 | 9,837.0 | 10,208.9 | 11,382.4 | 12,678.4 | 14,578.3 | 16,763.0 | 19,275.1 | 22,163.7 | 25,485.1 |

| Revenue Growth, % | 0 | 33.28 | 3.78 | 11.5 | 11.39 | 14.99 | 14.99 | 14.99 | 14.99 | 14.99 |

| EBITDA | 504.8 | 745.1 | 879.2 | 1,166.0 | 1,288.8 | 1,266.4 | 1,456.2 | 1,674.4 | 1,925.4 | 2,213.9 |

| EBITDA, % | 6.84 | 7.57 | 8.61 | 10.24 | 10.17 | 8.69 | 8.69 | 8.69 | 8.69 | 8.69 |

| Depreciation | 234.3 | 172.5 | 179.8 | 181.0 | 191.8 | 285.5 | 328.3 | 377.5 | 434.1 | 499.1 |

| Depreciation, % | 3.17 | 1.75 | 1.76 | 1.59 | 1.51 | 1.96 | 1.96 | 1.96 | 1.96 | 1.96 |

| EBIT | 270.5 | 572.6 | 699.4 | 985.0 | 1,097.0 | 980.9 | 1,127.9 | 1,297.0 | 1,491.3 | 1,714.8 |

| EBIT, % | 3.67 | 5.82 | 6.85 | 8.65 | 8.65 | 6.73 | 6.73 | 6.73 | 6.73 | 6.73 |

| Total Cash | 1,572.5 | 1,063.7 | 1,589.2 | 3,026.2 | 3,216.2 | 2,905.1 | 3,340.5 | 3,841.1 | 4,416.7 | 5,078.6 |

| Total Cash, percent | .0 | .0 | .0 | .0 | .0 | .0 | .0 | .0 | .0 | .0 |

| Account Receivables | 3,388.4 | 3,693.0 | 3,431.1 | 4,402.8 | 4,686.4 | 5,618.7 | 6,460.7 | 7,428.8 | 8,542.1 | 9,822.2 |

| Account Receivables, % | 45.91 | 37.54 | 33.61 | 38.68 | 36.96 | 38.54 | 38.54 | 38.54 | 38.54 | 38.54 |

| Inventories | 1,234.9 | 1,476.4 | 1,205.2 | 1,278.7 | 1,660.4 | 1,979.0 | 2,275.6 | 2,616.6 | 3,008.7 | 3,459.6 |

| Inventories, % | 16.73 | 15.01 | 11.81 | 11.23 | 13.1 | 13.58 | 13.58 | 13.58 | 13.58 | 13.58 |

| Accounts Payable | 2,024.1 | 2,543.4 | 2,442.1 | 3,346.2 | 3,891.2 | 4,002.9 | 4,602.8 | 5,292.6 | 6,085.7 | 6,997.8 |

| Accounts Payable, % | 27.42 | 25.86 | 23.92 | 29.4 | 30.69 | 27.46 | 27.46 | 27.46 | 27.46 | 27.46 |

| Capital Expenditure | -230.8 | -243.6 | -195.1 | -430.4 | -441.7 | -430.9 | -495.5 | -569.7 | -655.1 | -753.3 |

| Capital Expenditure, % | -3.13 | -2.48 | -1.91 | -3.78 | -3.48 | -2.96 | -2.96 | -2.96 | -2.96 | -2.96 |

| Tax Rate, % | 10.57 | 10.57 | 10.57 | 10.57 | 10.57 | 10.57 | 10.57 | 10.57 | 10.57 | 10.57 |

| EBITAT | 281.6 | 518.6 | 630.5 | 849.0 | 981.1 | 895.3 | 1,029.4 | 1,183.7 | 1,361.1 | 1,565.1 |

| Depreciation | ||||||||||

| Changes in Account Receivables | ||||||||||

| Changes in Inventories | ||||||||||

| Changes in Accounts Payable | ||||||||||

| Capital Expenditure | ||||||||||

| UFCF | -2,314.1 | 420.9 | 1,046.8 | 458.5 | 610.9 | -389.2 | 323.5 | 372.0 | 427.8 | 491.9 |

| WACC, % | 5.57 | 5.52 | 5.52 | 5.5 | 5.52 | 5.52 | 5.52 | 5.52 | 5.52 | 5.52 |

| PV UFCF | ||||||||||

| SUM PV UFCF | 959.3 | |||||||||

| Long Term Growth Rate, % | 2.00 | |||||||||

| Free cash flow (T + 1) | 502 | |||||||||

| Terminal Value | 14,238 | |||||||||

| Present Terminal Value | 10,881 | |||||||||

| Enterprise Value | 11,841 | |||||||||

| Net Debt | -2,418 | |||||||||

| Equity Value | 14,259 | |||||||||

| Diluted Shares Outstanding, MM | 1,055 | |||||||||

| Equity Value Per Share | 13.51 |

What You Will Receive

- Adjustable Forecast Parameters: Effortlessly modify assumptions (growth %, profit margins, WACC) to generate various scenarios.

- Real-World Financial Data: Pre-loaded financial information for Zhejiang Dun'an Artificial Environment Co., Ltd (002011SZ) to kickstart your analysis.

- Automatic DCF Calculations: The template computes Net Present Value (NPV) and intrinsic value automatically for you.

- Tailor-Made and Professional: A sleek Excel model designed to fit your valuation requirements.

- Designed for Analysts and Investors: Perfect for assessing projections, validating strategies, and optimizing your time.

Key Features

- Comprehensive Historical Data: Access Zhejiang Dun'an Artificial Environment Co., Ltd’s financial statements and insightful forecasts.

- Customizable Parameters: Adjust WACC, tax rates, revenue growth, and EBITDA margins to fit your analysis.

- Real-Time Valuation: Observe the recalculation of intrinsic value for Zhejiang Dun'an Artificial Environment Co., Ltd ([002011SZ]) instantly.

- Intuitive Visual Representations: Interactive dashboard charts showcase valuation results and essential metrics.

- Designed for Precision: A reliable tool tailored for analysts, investors, and finance professionals.

How It Works

- Step 1: Download the Excel file for Zhejiang Dun'an Artificial Environment Co., Ltd (002011SZ).

- Step 2: Review the pre-filled financial data and forecasts specific to Dun'an.

- Step 3: Adjust key variables such as revenue growth, WACC, and tax rates (marked cells).

- Step 4: Observe the DCF model refresh in real-time as you modify your assumptions.

- Step 5: Evaluate the results and leverage the insights for your investment strategies.

Reasons to Choose This Calculator for Zhejiang Dun'an Artificial Environment Co., Ltd (002011SZ)

- Accuracy: Utilizes genuine financial data to ensure precise calculations.

- Flexibility: Offers users the ability to experiment with and adjust inputs easily.

- Time-Saving: Avoid the complexities of creating a DCF model from the ground up.

- Professional-Grade: Crafted with the expertise and standards expected by CFOs.

- User-Friendly: Intuitive interface that is accessible to users with varying levels of financial modeling skills.

Who Can Benefit from This Product?

- Finance Students: Master valuation methods while utilizing real-world data relevant to Zhejiang Dun'an Artificial Environment Co., Ltd (002011SZ).

- Academics: Enhance your curriculum or research by integrating industry-standard models focused on (002011SZ).

- Investors: Validate your investment strategies and examine valuation projections for Zhejiang Dun'an Artificial Environment Co., Ltd (002011SZ).

- Analysts: Optimize your analysis process with a ready-to-use, customizable DCF model tailored for (002011SZ).

- Small Business Owners: Discover how major public companies, like Zhejiang Dun'an Artificial Environment Co., Ltd (002011SZ), are evaluated in the marketplace.

Contents of the Template

- Detailed DCF Model: An editable template featuring comprehensive valuation calculations.

- Real-Time Financial Data: Zhejiang Dun'an Artificial Environment Co., Ltd's historical and forecasted financials are preloaded for your analysis.

- Adjustable Parameters: Tailor WACC, growth rates, and tax assumptions to explore various scenarios.

- Financial Statements: Complete annual and quarterly breakdowns providing in-depth insights.

- Essential Ratios: Integrated analysis covering profitability, efficiency, and leverage metrics.

- Visualization Dashboard: Graphs and tables presenting clear, actionable insights.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.