|

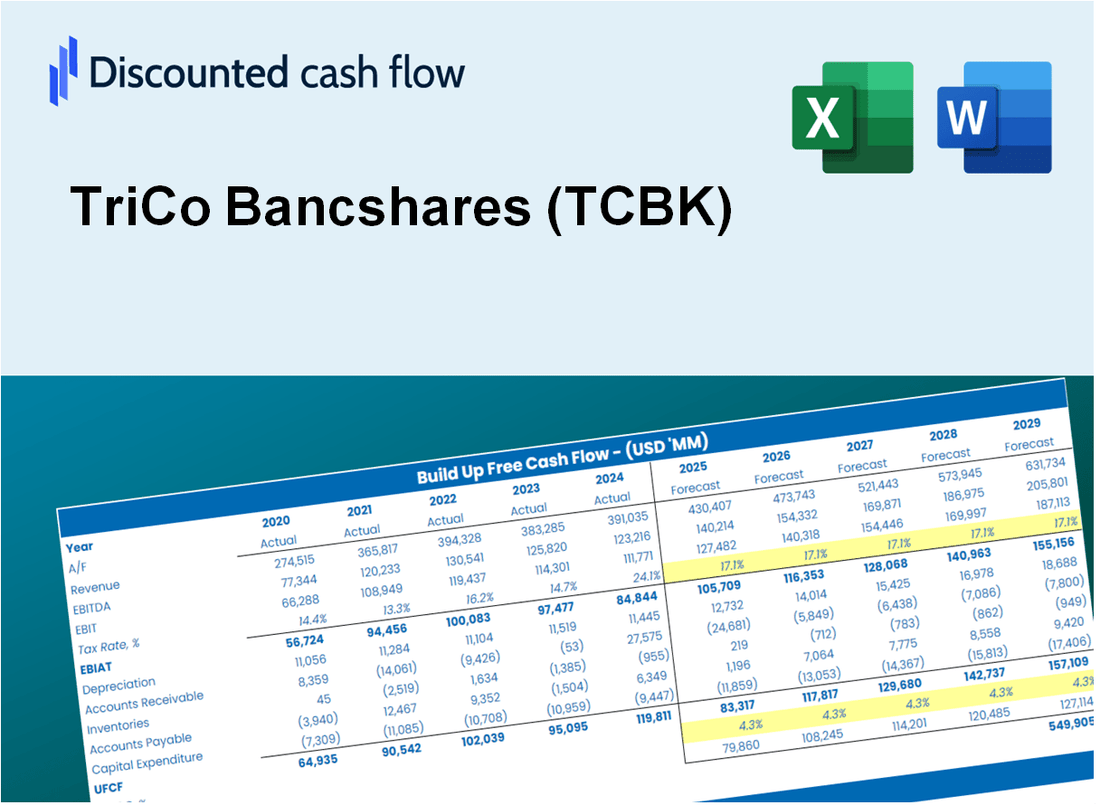

Trico Bancshares (TCBK) DCF -Bewertung |

Fully Editable: Tailor To Your Needs In Excel Or Sheets

Professional Design: Trusted, Industry-Standard Templates

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Expertise Is Needed; Easy To Follow

TriCo Bancshares (TCBK) Bundle

Möchten Sie den inneren Wert von Trico Bancshares bewerten? Unser TCBK DCF-Taschenrechner integriert reale Daten mit umfangreichen Anpassungsfunktionen, sodass Sie Ihre Prognosen verfeinern und Ihre Investitionsauswahl verbessern können.

Discounted Cash Flow (DCF) - (USD MM)

| Year | AY1 2020 |

AY2 2021 |

AY3 2022 |

AY4 2023 |

AY5 2024 |

FY1 2025 |

FY2 2026 |

FY3 2027 |

FY4 2028 |

FY5 2029 |

|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 317.2 | 341.7 | 412.0 | 492.8 | 524.0 | 595.0 | 675.7 | 767.3 | 871.4 | 989.5 |

| Revenue Growth, % | 0 | 7.74 | 20.58 | 19.6 | 6.32 | 13.56 | 13.56 | 13.56 | 13.56 | 13.56 |

| EBITDA | 105.0 | 181.0 | 192.3 | 179.8 | 171.2 | 240.2 | 272.8 | 309.8 | 351.8 | 399.5 |

| EBITDA, % | 33.1 | 52.96 | 46.67 | 36.48 | 32.67 | 40.37 | 40.37 | 40.37 | 40.37 | 40.37 |

| Depreciation | 17.6 | 17.3 | 18.4 | 18.8 | 16.1 | 26.1 | 29.7 | 33.7 | 38.2 | 43.4 |

| Depreciation, % | 5.54 | 5.06 | 4.46 | 3.82 | 3.07 | 4.39 | 4.39 | 4.39 | 4.39 | 4.39 |

| EBIT | 87.4 | 163.7 | 173.9 | 160.9 | 155.1 | 214.1 | 243.2 | 276.1 | 313.6 | 356.1 |

| EBIT, % | 27.56 | 47.91 | 42.21 | 32.65 | 29.6 | 35.99 | 35.99 | 35.99 | 35.99 | 35.99 |

| Total Cash | 2,083.8 | 2,976.4 | 2,559.7 | 2,251.2 | 152.8 | 510.7 | 580.0 | 658.6 | 747.9 | 849.3 |

| Total Cash, percent | .0 | .0 | .0 | .0 | .0 | .0 | .0 | .0 | .0 | .0 |

| Account Receivables | 23.8 | 25.9 | 39.6 | 45.0 | 41.6 | 49.7 | 56.4 | 64.1 | 72.8 | 82.6 |

| Account Receivables, % | 7.5 | 7.57 | 9.61 | 9.14 | 7.94 | 8.35 | 8.35 | 8.35 | 8.35 | 8.35 |

| Inventories | .0 | .0 | .0 | .0 | .0 | .0 | .0 | .0 | .0 | .0 |

| Inventories, % | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Accounts Payable | 1.4 | .9 | 1.2 | 8.4 | 11.5 | 5.8 | 6.6 | 7.5 | 8.5 | 9.7 |

| Accounts Payable, % | 0.42941 | 0.27157 | 0.28322 | 1.71 | 2.19 | 0.97857 | 0.97857 | 0.97857 | 0.97857 | 0.97857 |

| Capital Expenditure | -2.8 | -3.2 | -3.6 | -4.9 | -4.6 | -5.4 | -6.2 | -7.0 | -8.0 | -9.0 |

| Capital Expenditure, % | -0.88657 | -0.93528 | -0.87927 | -0.99146 | -0.86971 | -0.91246 | -0.91246 | -0.91246 | -0.91246 | -0.91246 |

| Tax Rate, % | 25.94 | 25.94 | 25.94 | 25.94 | 25.94 | 25.94 | 25.94 | 25.94 | 25.94 | 25.94 |

| EBITAT | 64.9 | 117.7 | 125.4 | 117.4 | 114.9 | 156.4 | 177.6 | 201.7 | 229.0 | 260.1 |

| Depreciation | ||||||||||

| Changes in Account Receivables | ||||||||||

| Changes in Inventories | ||||||||||

| Changes in Accounts Payable | ||||||||||

| Capital Expenditure | ||||||||||

| UFCF | 57.2 | 129.2 | 126.7 | 133.2 | 132.8 | 163.3 | 195.1 | 221.6 | 251.7 | 285.8 |

| WACC, % | 11.77 | 11.59 | 11.61 | 11.67 | 11.76 | 11.68 | 11.68 | 11.68 | 11.68 | 11.68 |

| PV UFCF | ||||||||||

| SUM PV UFCF | 788.1 | |||||||||

| Long Term Growth Rate, % | 2.00 | |||||||||

| Free cash flow (T + 1) | 292 | |||||||||

| Terminal Value | 3,012 | |||||||||

| Present Terminal Value | 1,734 | |||||||||

| Enterprise Value | 2,522 | |||||||||

| Net Debt | 71 | |||||||||

| Equity Value | 2,451 | |||||||||

| Diluted Shares Outstanding, MM | 33 | |||||||||

| Equity Value Per Share | 73.76 |

What You Will Get

- Real TriCo Data: Preloaded financials – from revenue to EBIT – based on actual and projected figures for TriCo Bancshares (TCBK).

- Full Customization: Adjust all critical parameters (yellow cells) like WACC, growth %, and tax rates to fit your analysis.

- Instant Valuation Updates: Automatic recalculations to assess the impact of changes on TriCo Bancshares’ (TCBK) fair value.

- Versatile Excel Template: Designed for quick edits, scenario testing, and detailed financial projections.

- Time-Saving and Accurate: Avoid building models from scratch while ensuring precision and flexibility in your evaluations.

Key Features

- 🔍 Real-Life TCBK Financials: Pre-filled historical and projected data for TriCo Bancshares (TCBK).

- ✏️ Fully Customizable Inputs: Adjust all critical parameters (yellow cells) like WACC, growth %, and tax rates.

- 📊 Professional DCF Valuation: Built-in formulas calculate TriCo Bancshares’ intrinsic value using the Discounted Cash Flow method.

- ⚡ Instant Results: Visualize TriCo Bancshares’ valuation instantly after making changes.

- Scenario Analysis: Test and compare outcomes for various financial assumptions side-by-side.

How It Works

- Step 1: Download the prebuilt Excel template with TriCo Bancshares (TCBK) data included.

- Step 2: Explore the pre-filled sheets to understand the key financial metrics.

- Step 3: Update forecasts and assumptions in the editable yellow cells (WACC, growth, margins).

- Step 4: Instantly view recalculated results, including TriCo Bancshares' (TCBK) intrinsic value.

- Step 5: Make informed investment decisions or generate reports using the outputs.

Why Choose This Calculator for TriCo Bancshares (TCBK)?

- Designed for Financial Experts: A sophisticated tool utilized by analysts, CFOs, and financial consultants.

- Accurate Financial Data: TriCo Bancshares’ historical and projected financial information is preloaded for precision.

- Flexible Scenario Analysis: Effortlessly simulate various forecasts and assumptions.

- Comprehensive Outputs: Automatically calculates intrinsic value, NPV, and essential financial metrics.

- User-Friendly Interface: Step-by-step guidance helps you navigate through the calculations smoothly.

Who Should Use TriCo Bancshares (TCBK)?

- Investors: Make informed investment choices with insights from a reputable financial institution.

- Financial Analysts: Streamline your analysis with comprehensive reports and data on TriCo Bancshares (TCBK).

- Consultants: Easily tailor financial information for client advisories and presentations.

- Finance Enthusiasts: Enhance your knowledge of banking operations and market strategies through TriCo's performance metrics.

- Educators and Students: Utilize TriCo Bancshares (TCBK) as a case study in finance and investment courses.

What the Template Contains

- Pre-Filled Data: Includes TriCo Bancshares' (TCBK) historical financials and forecasts.

- Discounted Cash Flow Model: Editable DCF valuation model with automatic calculations.

- Weighted Average Cost of Capital (WACC): A dedicated sheet for calculating WACC based on custom inputs.

- Key Financial Ratios: Analyze TriCo Bancshares' (TCBK) profitability, efficiency, and leverage.

- Customizable Inputs: Edit revenue growth, margins, and tax rates with ease.

- Clear Dashboard: Charts and tables summarizing key valuation results.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.