|

China Foods Limited (0506.HK) Valoración de DCF |

Completamente Editable: Adáptelo A Sus Necesidades En Excel O Sheets

Diseño Profesional: Plantillas Confiables Y Estándares De La Industria

Predeterminadas Para Un Uso Rápido Y Eficiente

Compatible con MAC / PC, completamente desbloqueado

No Se Necesita Experiencia; Fáciles De Seguir

China Foods Limited (0506.HK) Bundle

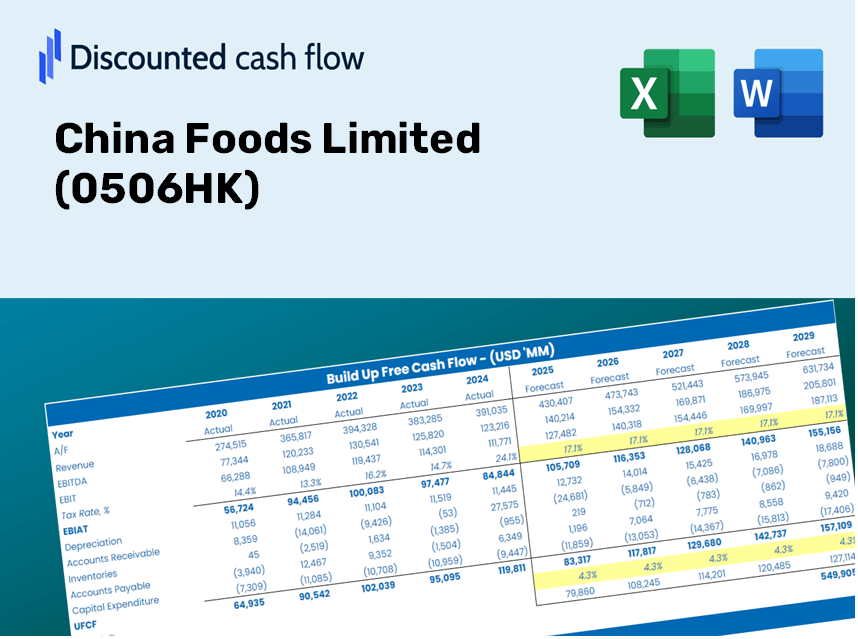

¡Descubra el potencial real de China Foods Limited (0506HK) con nuestra calculadora DCF avanzada! Ajuste los supuestos críticos, explore varios escenarios y evalúe los efectos de los diferentes cambios en la valoración de China Foods Limited (0506HK): todo lo que necesita está en una plantilla de Excel conveniente.

What You Will Receive

- Authentic China Foods Data: Preloaded financials – covering everything from revenue to EBIT – based on actual and projected metrics.

- Comprehensive Customization: Modify all key parameters (highlighted cells) such as WACC, growth %, and tax rates.

- Immediate Valuation Adjustments: Automatic recalculations to evaluate how changes affect the fair value of China Foods Limited (0506HK).

- Flexible Excel Template: Designed for quick adjustments, scenario analysis, and in-depth projections.

- Efficient and Precise: Eliminate the need to build models from the ground up while ensuring accuracy and adaptability.

Key Features

- Real-Life CFHK Data: Pre-filled with China Foods Limited's historical financials and forward-looking projections.

- Fully Customizable Inputs: Modify revenue growth, profit margins, WACC, tax rates, and capital expenditures as needed.

- Dynamic Valuation Model: Automatic calculation of Net Present Value (NPV) and intrinsic value based on your personalized inputs.

- Scenario Testing: Generate various forecast scenarios to assess different valuation outcomes.

- User-Friendly Design: Intuitive, organized layout suitable for both professionals and novices.

How It Functions

- 1. Access the Template: Download and open the Excel file containing China Foods Limited's (0506HK) preloaded data.

- 2. Modify Assumptions: Update essential inputs such as growth rates, WACC, and capital expenditures.

- 3. View Results in Real-Time: The DCF model automatically calculates the intrinsic value and NPV.

- 4. Explore Scenarios: Evaluate multiple forecasts to examine various valuation outcomes.

- 5. Utilize with Confidence: Present expert valuation insights to inform your decision-making.

Why Choose This Calculator for China Foods Limited (0506HK)?

- Reliable Data: Utilize authentic financial figures from China Foods Limited for trustworthy valuation outcomes.

- Personalizable: Modify essential variables such as growth rates, WACC, and tax rates to align with your forecasts.

- Efficiency: Pre-configured calculations save you the hassle of starting from ground zero.

- Professional-Quality Tool: Ideal for investors, analysts, and consultants focusing on China Foods Limited (0506HK).

- Easy to Use: User-friendly design and straightforward instructions cater to users of all experience levels.

Who Should Consider This Product?

- Individual Investors: Gain insights for making smart decisions regarding the purchase or sale of China Foods Limited (0506HK) stock.

- Financial Analysts: Enhance valuation efforts with comprehensive financial models tailored for China Foods Limited (0506HK).

- Consultants: Provide clients with expert valuation analyses of China Foods Limited (0506HK) efficiently and accurately.

- Business Owners: Learn how sizable firms like China Foods Limited (0506HK) are valued to inform your own business strategies.

- Finance Students: Master valuation methodologies using practical data and case studies related to China Foods Limited (0506HK).

Contents of the Template

- Pre-Filled DCF Model: China Foods Limited’s financial data preloaded for immediate application.

- WACC Calculator: Comprehensive calculations for the Weighted Average Cost of Capital.

- Financial Ratios: Assess China Foods Limited’s profitability, leverage, and efficiency.

- Editable Inputs: Modify assumptions such as growth rates, margins, and capital expenditures to match your scenarios.

- Financial Statements: Access annual and quarterly reports to facilitate in-depth analysis.

- Interactive Dashboard: Effortlessly visualize essential valuation metrics and outcomes.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.