|

Clearfield, Inc. (CLFD): Análisis de 5 Fuerzas [Actualizado en Ene-2025] |

Completamente Editable: Adáptelo A Sus Necesidades En Excel O Sheets

Diseño Profesional: Plantillas Confiables Y Estándares De La Industria

Predeterminadas Para Un Uso Rápido Y Eficiente

Compatible con MAC / PC, completamente desbloqueado

No Se Necesita Experiencia; Fáciles De Seguir

Clearfield, Inc. (CLFD) Bundle

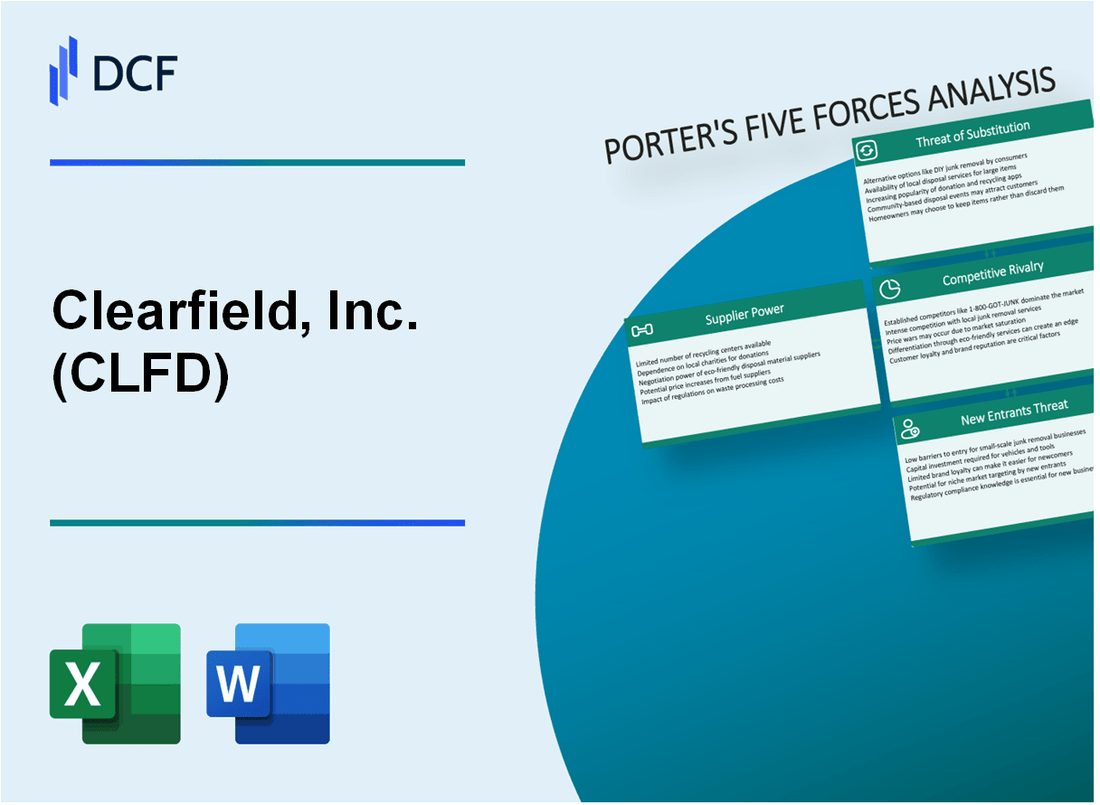

En el paisaje en rápida evolución de las telecomunicaciones de fibra óptica, Clearfield, Inc. (CLFD) navega por un complejo ecosistema de desafíos tecnológicos y oportunidades estratégicas. A medida que la industria experimenta una transformación sin precedentes impulsada por 5G, computación en la nube y soluciones innovadoras de conectividad, comprender la dinámica competitiva se vuelve crucial. Este análisis de inmersión profunda del marco de las cinco fuerzas de Porter revela el intrincado posicionamiento estratégico de Clearfield, que ofrece información sobre el potencial de crecimiento, resistencia competitiva y adaptabilidad del mercado en el desafiante sector de infraestructura de telecomunicaciones.

Clearfield, Inc. (CLFD) - Las cinco fuerzas de Porter: poder de negociación de los proveedores

Número limitado de fabricantes especializados de componentes de fibra óptica

A partir del cuarto trimestre de 2023, Clearfield, Inc. identifica aproximadamente 7-9 proveedores globales críticos para componentes especializados de fibra óptica. El mercado global de fabricación de componentes de fibra óptica se concentra, con un valor de mercado estimado de $ 6.2 mil millones en 2023.

| Categoría de proveedor | Número de proveedores clave | Concentración de mercado |

|---|---|---|

| Componentes de fibra óptica | 7-9 fabricantes | Alta concentración (Control de 3 proveedores principales ~ 55% de participación de mercado) |

Alta dependencia de proveedores clave de materias primas

La adquisición de materia prima de Clearfield muestra una concentración significativa de proveedores. En 2023, la compañía informó dependencia de:

- Proveedores de fibra óptica: 3 fabricantes mundiales principales

- Proveedores de componentes semiconductores: 4-5 proveedores críticos

- Proveedores de materias primas de polímero y plástico: 6-8 proveedores clave

Posibles restricciones de la cadena de suministro en componentes semiconductores y ópticos

| Tipo de componente | Riesgo de la cadena de suministro | Disponibilidad global |

|---|---|---|

| Componentes semiconductores | Alto riesgo (escasez global) | Capacidad de fabricación global limitada |

| Componentes de fibra óptica | Riesgo moderado | Capacidades de producción restringidas |

Asociaciones estratégicas con proveedores de tecnología seleccionados

Clearfield mantiene asociaciones estratégicas con proveedores de tecnología clave, que incluyen:

- Corning Incorporated (componentes de fibra óptica)

- Finisar Corporation (componentes ópticos de semiconductores)

- 3M Company (materiales especializados)

En 2023, estas asociaciones estratégicas representaron aproximadamente el 65-70% del abastecimiento de componentes críticos de Clearfield, con acuerdos de suministro a largo plazo que van desde 3-5 años.

Clearfield, Inc. (CLFD) - Las cinco fuerzas de Porter: poder de negociación de los clientes

Base de clientes concentrados

Clearfield, Inc. sirve una base de clientes concentrada en redes de telecomunicaciones y empresas. A partir del cuarto trimestre de 2023, la compañía reportó 87 clientes de telecomunicaciones únicos, con los 10 principales clientes que representan el 62% de los ingresos totales.

| Segmento de clientes | Contribución de ingresos | Número de clientes |

|---|---|---|

| Nivel 1 Proveedores de telecomunicaciones | 42% | 8 |

| Operadores de telecomunicaciones regionales | 28% | 35 |

| Redes empresariales | 20% | 44 |

Enterprise Cliente Power de compra

Los grandes clientes empresariales demuestran un poder adquisitivo significativo. En 2023, el valor contractual promedio de Clearfield para clientes empresariales fue de $ 1.3 millones, con algunos contratos superiores a $ 5 millones para soluciones integrales de conectividad de fibra óptica.

Soluciones de conectividad personalizadas

La demanda de soluciones de fibra óptica personalizadas continúa creciendo. En 2023, el 47% de los pedidos de productos de Clearfield involucraron ingeniería personalizada o configuraciones especializadas.

- Las solicitudes de diseño personalizadas aumentaron en un 22% año tras año

- Tiempo de personalización promedio reducido a 15 días hábiles

- Rangos premium de precios de soluciones personalizadas 18-25%

Dinámica de sensibilidad de precios

El mercado de telecomunicaciones demuestra una alta sensibilidad a los precios. La estrategia de precios competitivos de Clearfield reveló que un aumento del precio del 5% podría reducir el volumen de pedidos en un 12-15%.

| Cambio de precio | Impacto de volumen de pedido estimado |

|---|---|

| +5% | -12% a -15% |

| +10% | -22% a -28% |

Clearfield, Inc. (CLFD) - Las cinco fuerzas de Porter: rivalidad competitiva

Panorama competitivo Overview

A partir del cuarto trimestre de 2023, Clearfield, Inc. opera en un mercado competitivo de infraestructura de fibra óptica con los siguientes competidores clave:

| Competidor | Capitalización de mercado | Ingresos anuales |

|---|---|---|

| Corning Inc. | $ 35.2 mil millones | $ 14.3 mil millones |

| Commscope Holding Company | $ 1.8 mil millones | $ 4.6 mil millones |

| Clearfield, Inc. (CLFD) | $ 1.1 mil millones | $ 271.4 millones |

Métricas de intensidad competitiva

El análisis de la competencia del mercado revela:

- Número de competidores directos en infraestructura de fibra óptica: 7

- Ratio de concentración de mercado (CR4): 62%

- Cuota de mercado de Clearfield: 8.3%

Investigación de investigación y desarrollo

| Compañía | R&D Gasto 2023 | I + D como % de ingresos |

|---|---|---|

| Clearfield, Inc. | $ 16.3 millones | 6.0% |

| Corning Inc. | $ 1.2 mil millones | 8.4% |

| Comunicación | $ 285 millones | 6.2% |

Métricas de diferenciación de productos

- Nuevas presentaciones de productos en 2023: 12

- Solicitudes de patentes presentadas: 7

- Ciclo promedio de desarrollo de productos: 9 meses

Indicadores de intensidad competitivos

Intensidad de la competencia de precios: moderado

| Métrico | Valor 2023 |

|---|---|

| Margen bruto promedio | 42.7% |

| Varianza de precios entre los competidores | ±6.2% |

Clearfield, Inc. (CLFD) - Las cinco fuerzas de Porter: amenaza de sustitutos

Tecnologías inalámbricas emergentes desafiando la infraestructura tradicional de fibra óptica

El mercado de tecnología inalámbrica 5G proyectada para alcanzar los $ 248.8 mil millones para 2027, creciendo en 43.9% CAGR de 2020 a 2027.

| Tecnología | Penetración del mercado | Índice de crecimiento |

|---|---|---|

| 5G inalámbrico | 23.4% | 43.9% CAGR |

| Redes satelitales | 15.7% | 22.3% CAGR |

Soluciones de conectividad alternativas

Se espera que el mercado global de infraestructura 5G alcance los $ 47.8 mil millones para 2026.

- Constelación satelital de Starlink: más de 5,000 satélites desplegados

- OneWeb Global Network: 648 satélites planeados

- Amazon Project Kuiper: 3,236 satélites planeados

Posibles interrupciones tecnológicas

El mercado de comunicación satelital de bajo órbita terrestre (LEO) proyectado para alcanzar los $ 11.2 mil millones para 2030.

| Tecnología de comunicación | Valor de mercado 2024 | Crecimiento proyectado |

|---|---|---|

| Leo Satellite Networks | $ 4.7 mil millones | 136% para 2030 |

| Redes privadas 5G | $ 2.3 mil millones | 41.2% CAGR |

Alternativas de computación en la nube y borde

Global Edge Computing Market estimado en $ 36.5 mil millones en 2021, se espera que alcance los $ 87.3 mil millones para 2026.

- Crecimiento del mercado de la computación de borde: 37.4% CAGR

- Gasto global de infraestructura en la nube: $ 474 mil millones en 2022

- Hybrid Cloud Market proyectado para llegar a $ 145.3 mil millones para 2026

Clearfield, Inc. (CLFD) - Las cinco fuerzas de Porter: amenaza de nuevos participantes

Requisitos de capital en fabricación de fibra óptica

Clearfield, Inc. informó que los gastos de capital de $ 14.8 millones en el año fiscal 2023. La inversión de equipos iniciales para la fabricación de fibra óptica oscila entre $ 5 millones y $ 25 millones.

| Costo de equipos de fabricación | Rango |

|---|---|

| Torre de dibujo de fibra óptica | $ 2.5M - $ 4.5M |

| Máquina de recubrimiento de fibra | $ 1.2M - $ 3M |

| Equipo de prueba de fibra | $ 750k - $ 1.5M |

Barreras de experiencia tecnológica

La inversión de I + D de Clearfield fue de $ 10.2 millones en 2023, lo que representa el 4.3% de los ingresos totales.

- Se requieren habilidades avanzadas de ingeniería óptica

- Se necesita experiencia especializada mínima de 5 a 7 años

- Adaptación tecnológica continua esencial

Paisaje de propiedad e intelectual de patentes e intelectuales

Clearfield posee 37 patentes activas a partir de diciembre de 2023.

| Categoría de patente | Número de patentes |

|---|---|

| Soluciones de conectividad de fibra | 18 |

| Infraestructura de red | 12 |

| Procesos de fabricación | 7 |

Desafíos de cumplimiento regulatorio

El cumplimiento de la infraestructura de telecomunicaciones requiere aproximadamente $ 750,000 en gastos anuales de certificación regulatoria.

- Costos de certificación de la FCC: $ 250,000

- Cumplimiento de estándares de la industria: $ 350,000

- Pruebas de seguridad y rendimiento: $ 150,000

Clearfield, Inc. (CLFD) - Porter's Five Forces: Competitive rivalry

You're looking at a market where Clearfield, Inc. fights hard against some very large, well-funded players. The rivalry here is definitely intense. You see Clearfield, Inc. competing directly with giants like Corning Incorporated and CommScope Holding Company, Inc. in the fiber infrastructure space. To put this in perspective, CommScope Holding Company, Inc.'s Connectivity and Cable Solutions segment saw a 19.7% revenue increase year over year in the first quarter of 2025, showing the momentum of larger entities. Still, Clearfield, Inc. carves out its space.

Clearfield, Inc. operates as a niche provider, which is clear when you look at the revenue rankings. Its revenue is ranked 8th among its top 10 competitors. The average revenue for those top 10 competitors sits around $3 Billion (3B). For fiscal year 2025, Clearfield, Inc.'s consensus revenue estimate was pegged at $183.65 million, though TTM sales were reported at $179.32 million. The company finalized the divestiture of its Nestor Cables business in November 2025, which sharpens the focus entirely on its core North American offerings.

Here's a quick comparison of Clearfield, Inc.'s scale versus the competitor average:

| Metric | Clearfield, Inc. (FY2025 Estimate/TTM) | Top 10 Competitor Average |

| Annual Revenue | $183.65 million (Estimate) / $179.32 million (TTM) | $3 Billion |

| Competitive Rank | 8th out of top 10 | N/A |

| Gross Margin (FY2025) | 33.7% | N/A |

The company counters this scale disadvantage by leaning heavily on differentiation. Clearfield, Inc. bases its competitive edge on proprietary, rapid-deployment solutions. These products are designed to lower the total cost of ownership and speed up network build-outs, which is a major factor in the high-labor cost North American market.

The key differentiators you need to track are:

- Proprietary, rapid-deployment solutions.

- FieldShield pushable fiber technology.

- FieldSmart platform for fiber management.

- FieldSmart FiberFlex 600 recognized in 2025.

- Focus on user-defined configurability.

Still, the overall industry environment helps temper the intensity of this rivalry. Both the Fiber-to-the-Home (FTTH) and 5G build-outs are driving strong demand. The fiber industry, for example, is projected to grow at a 12.5% compound annual growth rate. The 5G infrastructure market itself saw its size grow from $61.24 billion in 2024 to $80.28 billion in 2025. This rising tide lifts all boats, to an extent, by creating more deployment opportunities for everyone, including Clearfield, Inc. The growth in the Large Regional Service Provider market for Clearfield, Inc. was staggering at 255% year-over-year to $11.3 million in one quarter, showing where the immediate, large-scale demand is flowing.

Clearfield, Inc. (CLFD) - Porter's Five Forces: Threat of substitutes

You're assessing Clearfield, Inc. (CLFD) and wondering just how much the rise of wireless broadband threatens its core fiber business. It's a fair question, given the headlines. Fixed Wireless Access (FWA) is definitely gaining traction as a last-mile alternative to fiber-to-the-home (FTTH).

The numbers show FWA is expanding fast. The global Fixed Wireless Access Market size stood at USD 39.06 billion in 2025, and it's forecast to hit USD 92.72 billion by 2030, growing at an 18.87% CAGR. In the OECD, FWA subscriptions grew 17% from June 2023 to June 2024. Still, FWA only represents 5.8% of all fixed broadband subscriptions across the OECD. Satellite broadband, like Starlink, also eats into the market, with satellite subscriptions growing 22.6% in the past year alone in OECD countries where data is available.

Here's the quick math on where the market stands:

| Metric | Value | Year/Period |

|---|---|---|

| Clearfield, Inc. FY 2025 Net Sales (Continuing Ops) | $150.1 million | FY 2025 |

| Global FWA Market Size | $39.06 billion | 2025 |

| Global FWA Market CAGR (Forecast) | 18.87% | 2025-2030 |

| Global Fiber Management Systems Market Size | $7,430.17 million | 2023 |

| Fiber Share of OECD Fixed Broadband | 44.6% | Latest Data |

But Clearfield, Inc. isn't selling the fiber line itself; they sell the management hardware. This is where their moat is defintely stronger. Their focus on fiber management-enclosures, panels, and cassettes-means the direct substitution risk for their actual product is lower than for a pure-play fiber provider. Clearfield's core segment, which drives the majority of their business, saw net sales of $29.7 million in Q1 FY2025, up 6% YoY. For the full fiscal year 2025, Clearfield, Inc.'s continuing operations revenue grew 20% to $150.1 million. This growth suggests their specialized hardware is still essential for the fiber buildout.

Customers could, however, substitute Clearfield's modular systems with traditional, non-modular fiber management hardware. The global Fiber Management Systems market was valued at USD 7,430.17 million in 2023. Clearfield's strategy hinges on the labor savings and faster time-to-revenue their modular platform offers, which is a competitive advantage against older, non-modular setups. They are even launching a next-generation cassette optimized for non-hyperscale data centers, a market segment where their modular design is intended to provide a unique edge.

The long-term picture still favors fiber, which reduces the existential threat from wireless. High-bandwidth applications are demanding more capacity than FWA can consistently deliver at scale. This favors Clearfield, Inc.'s core market:

- FTTH industry growth is anticipated at a 12% CAGR over the next five years.

- 5G backhaul and data centers require fiber connections.

- The hardware segment of the Fiber Management Systems market is expected to grow at a CAGR of over 12.0% through 2030.

- Total 5G subscriptions across the OECD grew 48% over the last year.

The continued expansion of 5G and the accelerating bandwidth demands from AI and data centers mean the underlying need for robust fiber infrastructure remains strong. If onboarding takes 14+ days, churn risk rises, but fiber deployment, even with its challenges, is the long-term pipe for massive data loads.

Finance: Review the $160 million to $170 million revenue guidance for FY 2026 against the current $24.7 million order backlog as of September 30, 2025, by next Tuesday.

Clearfield, Inc. (CLFD) - Porter's Five Forces: Threat of new entrants

You're looking at the barriers to entry for a new competitor in the fiber connectivity space as of late 2025. Honestly, the hurdles are substantial, built on capital requirements, regulatory mandates, and established technology moats.

High capital investment and specialized manufacturing expertise are necessary entry barriers.

To even attempt to compete, a newcomer needs serious backing. Look at Clearfield, Inc.'s scale in fiscal 2025: they reported net sales from continuing operations of \$150.1 million. Building out the necessary North American manufacturing capacity to serve this market, especially under current regulatory pressures, demands significant upfront spending. Furthermore, achieving the operational efficiency Clearfield, Inc. demonstrated-improving gross margin from 20.6% in fiscal 2024 to 33.7% in fiscal 2025-requires years of process refinement and specialized expertise. A new entrant would need to absorb high initial operating costs, which were \$48.4 million in operating expenses from continuing operations for Clearfield, Inc. in fiscal 2025, before achieving any meaningful scale.

Here's a quick look at the financial scale that sets the bar:

| Metric (FY 2025) | Amount | Source Context |

| Net Sales (Continuing Operations) | \$150.1 million | Full Year Revenue |

| Cash & Investments (Year-End) | \$166 million | Balance Sheet Strength |

| Operating Expenses (Continuing Operations) | \$48.4 million | Annualized Overhead Cost |

What this estimate hides is the working capital needed to manage the inventory and receivables cycle for large infrastructure projects.

Existing intellectual property like the patented Smart Clearfield® Ring creates a hurdle.

While the specific 'Smart Clearfield® Ring' patent status isn't immediately detailed, Clearfield, Inc.'s portfolio is actively being reinforced with new protections. They secured multiple new patent grants throughout 2025, for instance, one on July 1, 2025, for a fiber distribution hub design, and another on June 24, 2025, for a cable pulling device. These grants signal an ongoing commitment to proprietary technology that competitors must design around, which adds time and legal risk to any market entry attempt.

- New patent grants in 2025 confirm active IP defense.

- Proprietary designs reduce immediate product parity.

- Legal costs for new entrants to navigate the patent landscape are high.

Regulatory compliance with the Build America, Buy America (BABA) Act favors established domestic manufacturers.

The BABA mandate, which requires U.S.-made iron, steel, manufactured products, and construction materials for federally funded projects, is a massive advantage for incumbents with existing U.S. production footprints. This isn't just theoretical; the industry response shows the scale of this shift. Fiber Broadband Association members reported nearly \$650 million in investments to onshore manufacturing capacity to comply with BABA for the BEAD program. This investment has already added over 1,325,000 square feet of capacity across 72+ facilities in 28 states. A new entrant faces the immediate, expensive mandate to establish or secure domestic supply chains that are already being rapidly built out by established players.

The delayed and complex rollout of the $42.45 billion BEAD program slows down market entry for newcomers.

The \$42.45 billion Broadband Equity, Access, and Deployment (BEAD) program is the primary demand driver, but its execution is messy. Recent 2025 policy changes, like the 'Benefit of the Bargain' notice, have caused preliminary awards to be rescinded and forced states to potentially rerun selection processes. This complexity and the resulting uncertainty mean that the market demand surge is not a smooth ramp-up. Industry leaders anticipate the real construction crunch-when demand for materials like Clearfield, Inc.'s products will peak-will occur between late 2025 and 2027. New entrants need to time their market entry to capture this wave, but the current state-by-state delays and process resets make forecasting and securing initial large orders incredibly difficult.

The regulatory environment is definitely favoring those who have already made the capital and compliance investments.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.