|

Green Dot Corporation (GDOT): Análisis de 5 Fuerzas [Actualizado en Ene-2025] |

Completamente Editable: Adáptelo A Sus Necesidades En Excel O Sheets

Diseño Profesional: Plantillas Confiables Y Estándares De La Industria

Predeterminadas Para Un Uso Rápido Y Eficiente

Compatible con MAC / PC, completamente desbloqueado

No Se Necesita Experiencia; Fáciles De Seguir

Green Dot Corporation (GDOT) Bundle

En el panorama de la banca digital en rápida evolución, Green Dot Corporation (GDOT) navega por un complejo ecosistema de interrupción tecnológica, presiones competitivas y expectativas cambiantes del consumidor. Como pionero en soluciones bancarias prepagas y digitales, la compañía enfrenta desafíos sin precedentes de las startups de fintech emergentes, las preferencias cambiantes de los clientes y las plataformas de pago innovadoras que están reformando la industria de los servicios financieros. Comprender la dinámica estratégica a través de las cinco fuerzas de Michael Porter proporciona una lente crítica en el posicionamiento competitivo de GDOT, revelando el equilibrio intrincado de las fuerzas del mercado que determinarán su éxito futuro y sostenibilidad en un mundo financiero cada vez más digital.

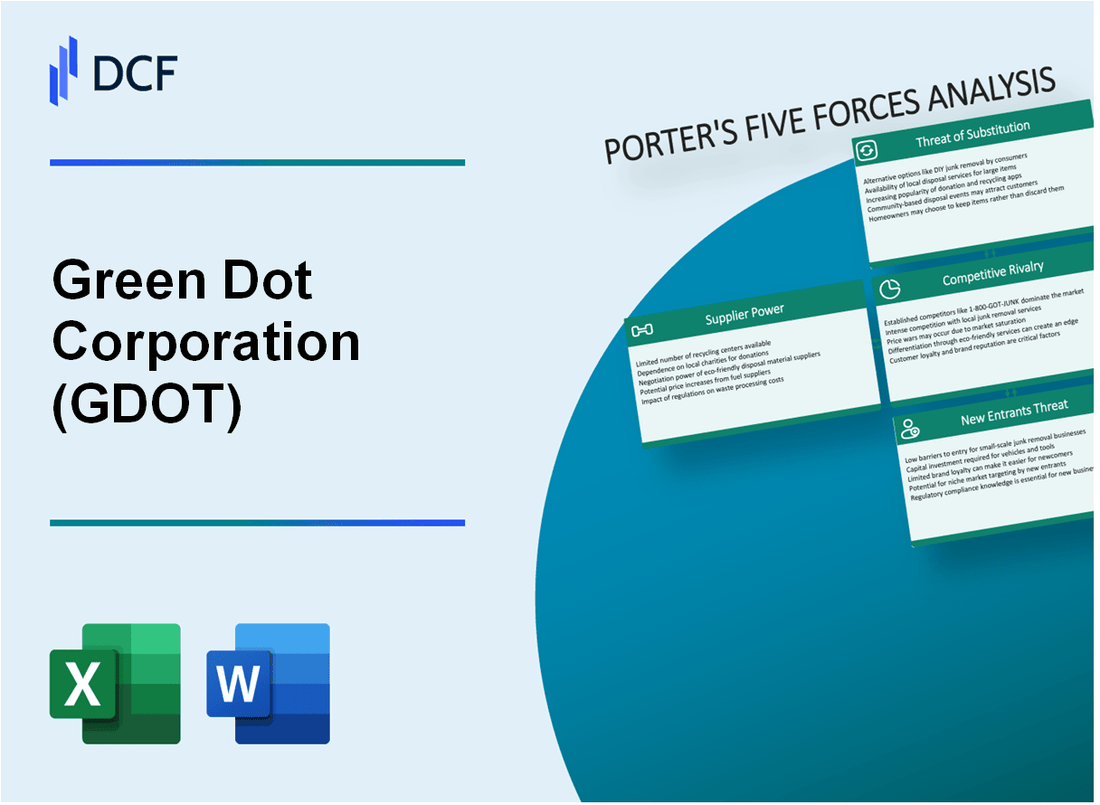

Green Dot Corporation (GDOT) - Las cinco fuerzas de Porter: poder de negociación de los proveedores

Número limitado de socios bancarios y tecnológicos

Green Dot Corporation se basa en un ecosistema restringido de socios de tecnología financiera. A partir del cuarto trimestre de 2023, la compañía tiene asociaciones estratégicas con:

| Tipo de socio | Número de socios | Relación clave |

|---|---|---|

| Socios bancarios | 5 | Relaciones bancarias aseguradas por la FDIC |

| Proveedores de infraestructura tecnológica | 3 | Plataformas de procesamiento de pagos básicos |

Dependencia de los proveedores de redes de tarjetas

La infraestructura de tarjeta prepaga de Green Dot depende críticamente de las principales redes de tarjetas:

- Visa: 68% del volumen de transacción

- MasterCard: 32% del volumen de transacción

Confianza en el proveedor de tecnología de terceros

Desglose del proveedor de tecnología para 2023:

| Categoría de proveedor | Gasto total de proveedores | Porcentaje de presupuesto tecnológico |

|---|---|---|

| Infraestructura en la nube | $ 12.4 millones | 37% |

| Desarrollo de software | $ 8.6 millones | 26% |

| Ciberseguridad | $ 6.2 millones | 19% |

Costos de cambio potenciales para los proveedores de tecnología

Costos de cambio estimados para la infraestructura de tecnología central:

- Costo de migración promedio: $ 3.7 millones

- Tiempo de implementación estimado: 9-12 meses

- Posible interrupción de los ingresos: $ 5.2 millones por trimestre

Green Dot Corporation (GDOT) - Las cinco fuerzas de Porter: poder de negociación de los clientes

Bajos costos de cambio en el mercado de tarjetas de banca digital y prepago

Green Dot Corporation enfrenta un poder significativo de negociación de clientes debido a las barreras de cambio mínimas. A partir del cuarto trimestre de 2023, el mercado de tarjetas prepagas demuestra un bajo bloqueo del cliente, con aproximadamente el 47% de los consumidores dispuestos a cambiar los proveedores de servicios financieros dentro de los 6 meses.

| Métrica de costos de cambio | Porcentaje |

|---|---|

| Disposición del consumidor para cambiar las tarjetas prepagas | 47% |

| Tiempo promedio para cambiar el proveedor de servicios financieros | 6 meses |

Sensibilidad a los precios entre los consumidores que no tienen banco

El grupo demográfico objetivo de Green Dot exhibe una alta sensibilidad al precio. La población subjuiciosa, que representa a 14.1 millones de hogares estadounidenses en 2022, demuestra una toma de decisiones significativa en los precios en los servicios financieros.

- Hogares de bancarrojo: 14.1 millones

- Tolerancia promedio a la tarifa mensual: $ 5.23

- Umbral diferencial de precio: 12-15%

Expectativas del cliente para funciones de banca digital

Las expectativas de las características de la banca digital impulsan el poder de negociación del cliente. En 2023, el 72% de los consumidores priorizan la funcionalidad de las aplicaciones móviles y el seguimiento de las transacciones en tiempo real al seleccionar servicios financieros.

| Función de banca digital | Porcentaje de preferencia del consumidor |

|---|---|

| Funcionalidad de la aplicación móvil | 72% |

| Seguimiento de transacciones en tiempo real | 68% |

| Transferencia de dinero instantáneo | 61% |

Opciones de servicio financiero alternativo

El mercado ofrece numerosas alternativas, aumentando el poder de negociación de los clientes. A partir de 2023, más de 237 plataformas de banca digital compiten directamente con las ofertas de servicios de Green Dot.

- Plataformas de banca digital totales: 237

- Aplicaciones de pago móvil: 89

- Proveedores de tarjetas prepagas: 42

Green Dot Corporation (GDOT) - Las cinco fuerzas de Porter: rivalidad competitiva

Análisis de paisaje competitivo

Green Dot Corporation enfrenta una intensa competencia en el mercado de tarjetas de banca digital y prepago. A partir del cuarto trimestre de 2023, la participación de mercado de la compañía era del 12,3% en el segmento de tarjeta prepaga.

| Competidor | Cuota de mercado | Ingresos anuales |

|---|---|---|

| Paypal | 28.5% | $ 27.5 mil millones |

| Repicar | 15.7% | $ 1.1 mil millones |

| Punto verde | 12.3% | $ 1.3 mil millones |

Presiones competitivas de teclas

Desafíos competitivos directos:

- Dominio de pago digital de PayPal

- El rápido crecimiento de la banca digital de Chime

- Servicios de tarjetas prepagas del banco tradicional

Innovación y posición del mercado

Green Dot invirtió $ 78.4 millones en I + D durante 2023 para mantener un posicionamiento competitivo.

| Métrica de innovación | Valor 2023 |

|---|---|

| Gastos de I + D | $ 78.4 millones |

| Nuevos lanzamientos de productos | 3 productos bancarios digitales |

Análisis de presión de tarifa

Las tarifas de transacción promedio en el mercado de banca digital disminuyeron en un 22.6% de 2022 a 2023.

- 2022 Tarifa de transacción promedio: $ 0.87

- 2023 Tarifa de transacción promedio: $ 0.67

Green Dot Corporation (GDOT) - Las cinco fuerzas de Porter: amenaza de sustitutos

Aumento de plataformas de pago digital

Apple Pay procesó $ 1.9 billones en volumen de transacciones en 2022. Google Wallet manejó $ 347 mil millones en pagos móviles durante el mismo año. Estas plataformas representan amenazas de sustitución significativas para los servicios tradicionales de tarjetas prepagas.

| Plataforma de pago digital | Volumen de transacción (2022) | Base de usuarios |

|---|---|---|

| Apple Pay | $ 1.9 billones | 507 millones de usuarios |

| Billetera de Google | $ 347 mil millones | 250 millones de usuarios |

Servicios financieros de criptomonedas y blockchain

La capitalización del mercado de criptomonedas alcanzó los $ 2.1 billones en 2022. El volumen de la transacción de bitcoin fue de aproximadamente $ 15.8 billones en el mismo año.

- Coinbase reportó 108 millones de usuarios verificados en 2022

- Los servicios financieros con sede en Blockchain crecieron un 35% año tras año

Aplicaciones de banca móvil

Las aplicaciones de banca móvil procesaron $ 9.3 billones en transacciones durante 2022. Venmo procesó $ 230 mil millones en volumen de pago total en el mismo año.

| Plataforma de banca móvil | Volumen de transacción | Usuarios activos |

|---|---|---|

| Venmo | $ 230 mil millones | 83 millones de usuarios |

| Aplicación en efectivo | $ 180 mil millones | 44 millones de usuarios |

Soluciones de pago por igual

El tamaño del mercado de pagos de igual a igual se estimó en $ 1.2 billones en 2022, con una tasa de crecimiento anual compuesta proyectada del 21,4%.

- Zelle procesó $ 806 mil millones en transacciones en 2022

- Las transacciones entre pares de PayPal alcanzaron los $ 277 mil millones

Green Dot Corporation (GDOT) - Las cinco fuerzas de Porter: amenaza de nuevos participantes

Bajas barreras de entrada en el mercado de tarjetas de banca digital y prepago

A partir del cuarto trimestre de 2023, el tamaño del mercado bancario digital se valoró en $ 8.51 mil millones. El mercado de tarjetas prepagas se estimó en $ 2.1 billones a nivel mundial.

| Segmento de mercado | Valor comercial | Tasa de crecimiento anual |

|---|---|---|

| Banca digital | $ 8.51 mil millones | 13.7% |

| Mercado de tarjetas prepago | $ 2.1 billones | 8.9% |

Requisitos de capital significativos para la infraestructura tecnológica

Las inversiones en infraestructura tecnológica para plataformas de banca digital oscilan entre $ 5 millones y $ 50 millones para los nuevos participantes del mercado.

- Costos de desarrollo de tecnología inicial: $ 7.2 millones

- Configuración de infraestructura en la nube: $ 1.5 millones

- Sistemas de ciberseguridad: $ 2.3 millones

Desafíos de cumplimiento regulatorio

| Área de cumplimiento | Costo de cumplimiento anual |

|---|---|

| Licencia regulatoria | $750,000 |

| Sistemas KYC/AML | $ 1.2 millones |

Requisitos de prevención de ciberseguridad y fraude

Inversión promedio de ciberseguridad anual para empresas de tecnología financiera: $ 4.5 millones.

- Tecnología de prevención de fraude: $ 2.1 millones

- Infraestructura de seguridad: $ 1.8 millones

- Sistemas de monitoreo continuo: $ 600,000

Green Dot Corporation (GDOT) - Porter's Five Forces: Competitive rivalry

You're looking at a market where the heat from rivals is intense, especially as Green Dot Corporation navigates its structural split. The competitive rivalry force is definitely cranked up because of the digital-first players.

Intense competition from digital-first fintechs like Chime is a major factor. Chime Financial, Inc. (CHYM) had an estimated valuation of $7.75 billion in 2025, which puts Green Dot Corporation in a tough spot when you consider valuation multiples. Green Dot Corporation's Q3 2025 total operating revenues hit $494,826 thousand, and the full-year 2025 non-GAAP total operating revenue guidance sits between $2.0 billion and $2.1 billion.

Here's a quick look at how the context of valuation stacks up against that key digital rival:

| Metric | Green Dot Corporation (GDOT) Context (Late 2025) | Chime (CHYM) Context (Late 2025) |

|---|---|---|

| Q3 2025 Operating Revenue (in millions) | $494.83 | N/A (Private) |

| Full Year 2025 Revenue Guidance (in billions) | $2.0 - $2.1 | $2.2 |

| Valuation Context (Estimated) | Implied value per share $14.23 - $19.18 | Estimated Valuation $7.75 billion |

| Valuation Multiple Context | Trades at 5-10x lower multiples than Chime | Trades at 5-10x higher multiples than GDOT |

Direct competition in Banking-as-a-Service (BaaS) comes from other sponsor banks and embedded finance platforms. Green Dot Corporation built its resume serving major partners like Apple Pay, Uber, Walmart, and Intuit. Still, the field is crowded with players like Sila, Solid, and others offering developer-friendly payment APIs and full-stack BaaS solutions.

For the legacy Consumer segment, you're fighting traditional banks and credit unions for those direct deposit customers. This is where Green Dot Corporation's established physical footprint matters, even as the industry digitizes. Consider the scale of the market it serves:

- More than 48 million unbanked/underbanked Americans relied on prepaid cards as a primary financial tool in 2025.

- The US prepaid card market is projected to hit $749.5 billion by the end of 2025.

- Governments distributed over $1.24 trillion via prepaid cards in 2025.

Rivalry is definitely heightened by the industry's secular shift away from physical prepaid cards toward digital banking. You see this trend reflected in consumer preference data. Over 70% of US millennials now prefer prepaid cards for smarter budgeting, which is an interesting counterpoint to the digital-only narrative, but the digital adoption is undeniable. Mobile wallet-based prepaid card usage surged 32% in 2025, showing where the transaction volume is flowing. If onboarding takes too long, churn risk rises.

Green Dot Corporation (GDOT) - Porter's Five Forces: Threat of substitutes

The threat of substitutes for Green Dot Corporation remains high, driven by the rapid evolution of digital-first financial tools that directly compete with its core prepaid and banking services.

Significant threat from digital-only bank accounts and mobile payment apps offering similar, often lower-fee, services.

- The digital banking platform market is expected to grow by 10.9% in 2025, reaching $8.12 billion from $7.33 billion in 2024.

- Over 76% of people in the US use online or mobile banking in 2025.

- Mobile banking transactions in the US are projected to exceed $796.68 billion in 2025.

- 80% of U.S. consumers have linked their bank accounts to third-party financial apps.

- Neobanks captured 44% of new checking account openings in 2024.

- Green Dot Corporation's Consumer Services direct deposit active accounts were down 9% year-over-year as of Q2 2025.

- The US prepaid card market size is projected to reach $28.37 billion in 2025.

Traditional bank accounts and credit cards are substitutes, especially for higher-income, banked consumers.

Here's a quick look at the penetration of traditional accounts versus the willingness to switch:

| Account Type | Ownership Percentage (2025) | Monthly Transactions (Avg. Debit Holder) | Avg. Monthly Spend (Credit Card Holder) |

|---|---|---|---|

| Traditional Bank Account | 83% | N/A | N/A |

| Debit Card (Bank Linked) | 85% | 35 transactions | N/A |

| Credit Card | 71% | N/A | Approx. $3,500 |

Still, 17% of consumers indicated they are likely to change financial institutions in 2025. Over 80% of U.S. consumers use a debit or credit card for daily purchases. Total U.S. credit card debt reached $1.2 trillion in 2025.

Growth of stablecoin issuers and other regulated digital finance products presents a long-term substitute risk.

- The total market capitalization of stablecoins exceeded $250 billion by mid-2025.

- Stablecoin on-chain settlement volume reached $28 trillion in 2025, surpassing Visa and Mastercard volumes.

- Digital asset and stablecoin users could reach 80 million in 2025.

- Retail adoption shows credit card fees at 3.5% versus stablecoin fees as low as 0.1%.

- The U.S. GENIUS Act was signed into law on July 18, 2025, formalizing regulation.

Cash-to-digital services (Money Movement) are substituted by direct deposit and P2P platforms like PayPal or Venmo.

Green Dot Corporation's Q3 2025 Total operating revenues were $494.83 million. The company's Money Processing division saw third party transactions account for approximately 72% of total cash transfers as of Q2 2025.

P2P platforms are capturing significant money movement volume:

- Venmo's estimated Total Payment Volume (TPV) for 2025 is over $325 billion.

- Venmo's Q1 2025 revenue grew 20% year-over-year.

- Zelle processed nearly $600 billion in transactions during H1 2025.

- PayPal's P2P segment accounted for 30% of all transactions in 2025.

Finance: draft 13-week cash view by Friday.

Green Dot Corporation (GDOT) - Porter's Five Forces: Threat of new entrants

You're analyzing the barriers to entry for new players looking to challenge Green Dot Corporation in the fintech and banking space as of late 2025. Honestly, the hurdles are substantial, largely because Green Dot Corporation has spent two decades building regulated infrastructure and scale.

The threat is significantly mitigated by the massive capital and regulatory overhead required to obtain a bank charter, which has been a core asset for Green Dot Corporation until the planned split. Green Dot Bank, before the concurrent transactions announced in November 2025, held about $5 billion in assets and $4.7 billion in deposits. Entering this space requires navigating the Federal Reserve Board's scrutiny, a process that is neither fast nor cheap. The planned separation of the bank and fintech business, expected to close in the second quarter of 2026, means that for the immediate future, the charter remains a key differentiator Green Dot Corporation possesses.

Next, consider the physical footprint needed to service the underbanked and unbanked population. Building a nationwide cash-in/cash-out network from scratch is a monumental task. Green Dot Corporation's Green Dot Network (GDN) boasts more than 95,000 retail distribution and cash access locations nationwide. A new entrant would need to replicate this vast physical reach or convince a massive user base to adopt a purely digital model without easy cash on-ramps. To put this into perspective, here's the scale of the network Green Dot Corporation has established:

| Metric | Green Dot Corporation Scale (Latest Data) | Hypothetical New Entrant Challenge |

|---|---|---|

| GDN Retail Locations | More than 95,000 | Requires securing thousands of retailer agreements. |

| Third-Party Transaction Mix (Money Processing) | Approximately 72% of total cash transfers | Must build trust and volume to reach parity in cash flow. |

| Total Operating Revenues (9M 2025) | $1.56 billion | Must secure funding to match operational scale. |

Furthermore, new entrants must overcome the established need for large-scale Banking-as-a-Service (BaaS) partnerships, which inherently favors incumbents like Green Dot Corporation with deep, proven relationships. You see this with their major partners; for instance, the Apple relationship previously drove 44% of Green Dot Corporation's total revenue at one point. Landing a partner of that magnitude is incredibly difficult for a newcomer. Green Dot Corporation is projecting its BaaS division will see growth in the low-to-mid 30% range for the full year 2025, showing the value of these existing, scaled contracts.

Finally, the risk of regulatory missteps acts as a powerful deterrent for under-capitalized entrants. The cost of compliance failure is concrete and severe. Green Dot Corporation was hit with a $44 million civil money penalty by the Federal Reserve Board in July 2024 related to consumer compliance breakdowns and deficient risk management programs. This fine, plus the required investment in remediation-including hiring independent third parties to strengthen compliance and AML programs-represents a massive, non-revenue-generating expense that smaller, less capitalized firms simply cannot absorb without risking insolvency.

The barriers to entry are high due to:

- The need for a regulated bank charter or a deep, exclusive issuing bank partnership.

- The established physical cash access network exceeding 95,000 locations.

- The high cost of compliance, evidenced by the $44 million fine in 2024.

- The difficulty in displacing existing, large-scale BaaS partners like Apple.

Finance: draft 13-week cash view by Friday.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.