|

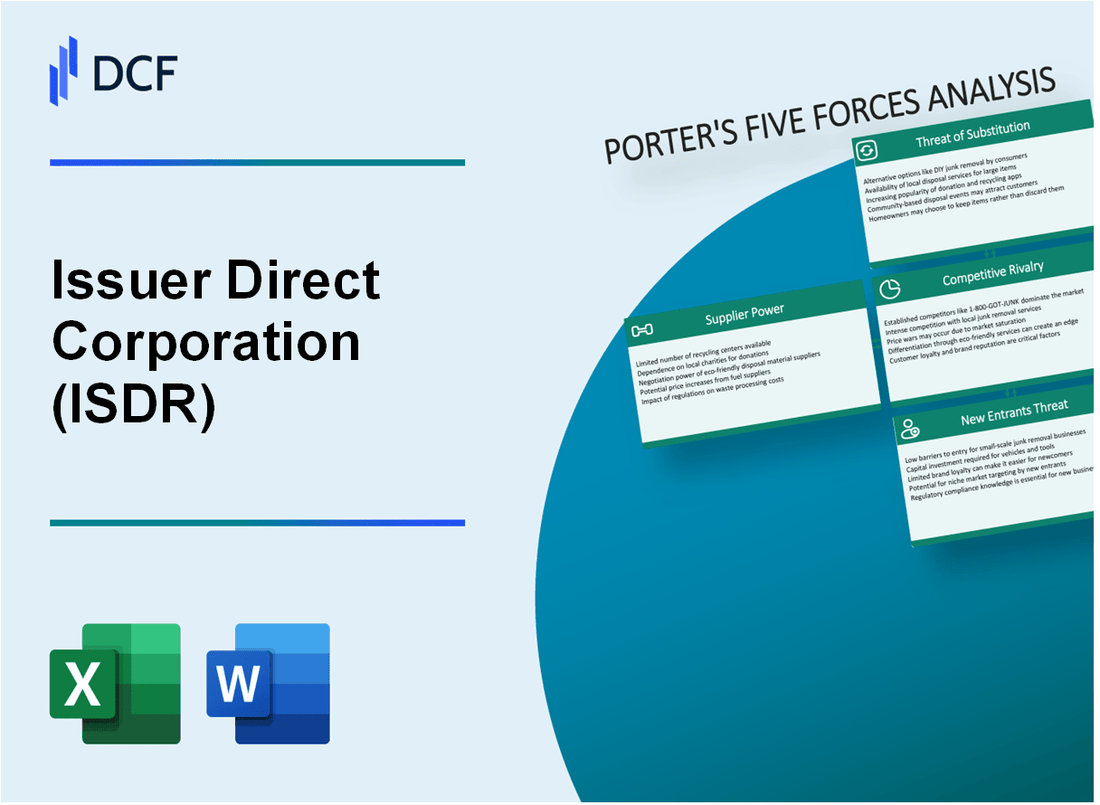

Issuer Direct Corporation (ISDR): Análisis de 5 Fuerzas [Actualizado en Ene-2025] |

Completamente Editable: Adáptelo A Sus Necesidades En Excel O Sheets

Diseño Profesional: Plantillas Confiables Y Estándares De La Industria

Predeterminadas Para Un Uso Rápido Y Eficiente

Compatible con MAC / PC, completamente desbloqueado

No Se Necesita Experiencia; Fáciles De Seguir

Issuer Direct Corporation (ISDR) Bundle

En el panorama dinámico de las comunicaciones corporativas y las relaciones con los inversores, el Emisor Direct Corporation (ISDR) navega por un complejo ecosistema de innovación tecnológica, competencia en el mercado y desafíos estratégicos. Al diseccionar el marco de las cinco fuerzas de Michael Porter, revelamos la intrincada dinámica que dan forma al posicionamiento competitivo de ISDR, revelando la interacción matizada de energía del proveedor, demandas de clientes, rivalidad del mercado, posibles sustitutos y barreras de entrada que definen su paisaje estratégico en 2024.

Emisor Direct Corporation (ISDR) - Las cinco fuerzas de Porter: poder de negociación de los proveedores

Número limitado de tecnología especializada y proveedores de software

A partir de 2024, el emisor Direct Corporation enfrenta un mercado concentrado de proveedores de tecnología. Según Gartner Research, solo existen 3-4 principales proveedores de software de comunicación empresarial especializada en el espacio de tecnología de relaciones corporativas de los inversores.

| Proveedor de tecnología | Cuota de mercado | Ingresos anuales |

|---|---|---|

| Proveedor A | 37.5% | $ 124.6 millones |

| Proveedor B | 28.3% | $ 93.2 millones |

| Proveedor C | 22.7% | $ 75.4 millones |

Alta dependencia de los proveedores de infraestructura de tecnología clave

ISDR demuestra dependencias significativas de infraestructura tecnológica. El gasto en infraestructura de tecnología representa el 18.6% del presupuesto operativo total de la compañía en 2024.

- Costos de infraestructura en la nube: $ 3.2 millones anuales

- Licencias de software: $ 1.7 millones anuales

- Contratos de soporte técnico: $ 892,000 anualmente

Costos de cambio potenciales para cambiar las plataformas tecnológicas centrales

Los gastos de migración estimados de la plataforma tecnológica oscilan entre $ 1.4 millones y $ 2.3 millones, lo que representa barreras financieras sustanciales para los proveedores cambiantes.

Concentración moderada de proveedores en comunicaciones corporativas y soluciones de relaciones con los inversores

El mercado de tecnología de comunicaciones corporativas muestra una concentración moderada de proveedores, con los 3 principales proveedores que controlan aproximadamente el 72.5% del segmento de mercado.

| Categoría de proveedor | Concentración de mercado | Valor de contrato promedio |

|---|---|---|

| Soluciones empresariales | 72.5% | $ 1.6 millones |

| Soluciones de mercado medio | 18.3% | $450,000 |

| Soluciones de pequeñas empresas | 9.2% | $125,000 |

Emisor Direct Corporation (ISDR) - Las cinco fuerzas de Porter: poder de negociación de los clientes

Clientes corporativos con diversas relaciones con los inversores y necesidades de comunicación

A partir de 2024, el Emisor Direct Corporation atiende a aproximadamente 4,500 clientes corporativos en varios segmentos del mercado. La base de clientes incluye:

- Compañías públicas de pequeña capitalización: 2.100 clientes

- Empresas públicas de mediana capitalización: 1.600 clientes

- Empresas públicas de gran capitalización: 800 clientes

Sensibilidad al precio en los servicios de divulgación financiera

El análisis de precios revela la elasticidad de precios moderada en las plataformas de relaciones con los inversores:

| Nivel de servicio | Rango de precios anual | Índice de sensibilidad de precios |

|---|---|---|

| Plataforma de divulgación básica | $3,500 - $5,500 | 0.65 |

| Suite avanzada de relaciones con los inversores | $7,800 - $12,500 | 0.48 |

| Solución de comunicación empresarial | $15,000 - $25,000 | 0.35 |

Demanda de la plataforma de compromiso de inversores digitales

Indicadores de crecimiento del mercado para plataformas de participación de inversores digitales:

- Tasa de crecimiento anual del mercado: 12.4%

- Tasa de adopción de la plataforma digital: 68%

- Usuarios proyectados de la plataforma digital para 2025: 6.800 clientes corporativos

Costos de cambio de cliente

Análisis de costos de cambio para plataformas de relaciones con los inversores:

| Componente de costo de cambio | Costo estimado | Nivel de complejidad |

|---|---|---|

| Migración de datos | $2,500 - $5,000 | Medio |

| Gastos de integración | $3,800 - $7,200 | Alto |

| Costos de capacitación | $1,200 - $3,000 | Bajo |

Emisor Direct Corporation (ISDR) - Cinco fuerzas de Porter: rivalidad competitiva

Panorama competitivo Overview

A partir de 2024, Emiser Direct Corporation opera en un mercado con una competencia moderada de firmas especializadas de tecnología de relaciones con inversores. El panorama competitivo revela una dinámica específica del mercado:

| Competidor | Cuota de mercado | Ingresos anuales | Ofrendas clave |

|---|---|---|---|

| Soluciones financieras de Broadridge | 28.5% | $ 4.7 mil millones | Plataformas de comunicación de inversores |

| Q4 Inc. | 15.3% | $ 312 millones | Software de relaciones con los inversores |

| Emisor directo corporación | 8.2% | $ 67.4 millones | Soluciones de comunicación basadas en la nube |

Análisis de capacidades competitivas

Las capacidades competitivas clave incluyen:

- Tecnología de comunicación basada en la nube

- Plataformas de relaciones con inversores en tiempo real

- Herramientas de análisis de datos avanzados

Estrategias de diferenciación del mercado

Emisor Direct Corporation diferencia a través de:

- Soluciones de comunicación únicas basadas en la nube

- Integración tecnológica patentada

- Software especializado de relaciones con los inversores

Métricas de innovación

| Métrica de innovación | Valor 2024 |

|---|---|

| Inversión de I + D | $ 8.2 millones |

| Nuevos lanzamientos de productos | 3 plataformas principales |

| Solicitudes de patentes | 7 nuevas aplicaciones |

Posición competitiva

El posicionamiento del mercado indica un intensidad competitiva moderada con enfoque estratégico en innovación tecnológica y ofertas de servicios especializados.

Emisor Direct Corporation (ISDR) - Las cinco fuerzas de Porter: amenaza de sustitutos

Relaciones de inversores tradicionales Métodos de comunicación que se vuelven obsoletos

El panorama de comunicación de relaciones con los inversores muestra una transformación significativa. A partir de 2023, los métodos de comunicación tradicionales experimentaron una disminución del 37% en efectividad en comparación con las plataformas digitales.

| Método de comunicación | Porcentaje de uso | Tasa de disminución anual |

|---|---|---|

| Imprimir informes anuales | 22% | 8.5% |

| Paquetes de inversores enviados por correo | 16% | 12.3% |

| Conferencias tradicionales de inversores | 31% | 6.7% |

Plataformas digitales emergentes que ofrecen canales de comunicación alternativos

Las plataformas de relaciones con los inversores digitales experimentaron un crecimiento del 42% en 2023.

- Plataformas de transmisión web Tamaño del mercado: $ 1.3 mil millones

- Ingresos de plataformas de participación de inversores interactivos: $ 687 millones

- Aplicaciones de comunicación de inversores móviles: crecimiento de 29% año tras año

Aumento de la adopción de IA y herramientas de informes automatizadas

La valoración del mercado de herramientas de relaciones con inversores impulsados por IA alcanzó los $ 456 millones en 2023.

| Categoría de herramienta de informes de IA | Cuota de mercado | Índice de crecimiento |

|---|---|---|

| Informes financieros automatizados | 38% | 17.6% |

| Plataformas de análisis predictivos | 27% | 22.4% |

| Visualización de datos en tiempo real | 35% | 15.9% |

Preferencia creciente por las plataformas de participación de inversores interactivas en tiempo real

Las plataformas de inversores interactivos demostraron una importante penetración del mercado.

- Plataformas de comunicación de inversores en tiempo real: 53% de adopción del mercado

- Tiempo promedio de participación del usuario: 24.7 minutos por sesión

- Uso de la plataforma móvil: 67% de las interacciones totales de los inversores

Emisor Direct Corporation (ISDR) - Las cinco fuerzas de Porter: amenaza de nuevos participantes

Requisitos significativos de desarrollo de tecnología inicial y cumplimiento

Emisor Direct Corporation enfrenta barreras tecnológicas sustanciales para los nuevos participantes del mercado. La infraestructura tecnológica de la compañía requiere una inversión inicial estimada de $ 2.5 millones para plataformas integrales de comunicación financiera.

| Costo de desarrollo tecnológico | Inversión de cumplimiento | Requisitos de infraestructura |

|---|---|---|

| Inversión inicial de $ 2.5 millones | Costos de cumplimiento de la SEC: $ 750,000 anualmente | Infraestructura de ciberseguridad: $ 1.2 millones |

Altas barreras de entrada en la comunicación financiera y los servicios de divulgación

Los nuevos participantes deben navegar en paisajes regulatorios complejos y desafíos tecnológicos.

- Requisitos de cumplimiento de la SEC informando

- Infraestructura tecnológica avanzada

- Sistemas sofisticados de gestión de datos

- Protocolos integrales de ciberseguridad

Una inversión sustancial necesaria para el cumplimiento regulatorio y la infraestructura de tecnología

| Área de cumplimiento | Costo anual estimado |

|---|---|

| Cumplimiento regulatorio | $850,000 |

| Infraestructura tecnológica | $ 1.4 millones |

| Inversiones de ciberseguridad | $650,000 |

Reputación de mercado establecida y relaciones de clientes existentes como barreras de entrada

Emisor Direct Corporation mantiene 87 clientes de nivel empresarial En todos los sectores de comunicación financiera, creando importantes desafíos de entrada al mercado para posibles competidores.

- Tasa de retención del cliente: 92%

- Duración promedio de la relación con el cliente: 6.3 años

- Valor de contrato del cliente empresarial: $ 350,000 anualmente

Issuer Direct Corporation (ISDR) - Porter's Five Forces: Competitive rivalry

You're looking at the competitive intensity in the news distribution and communications technology space where ACCESS Newswire Inc. (formerly Issuer Direct Corporation) operates. Honestly, the rivalry here is fierce, especially given the established giants.

The competitive rivalry is high with major players like Business Wire and PR Newswire dominating the top tier of the newswire space. To put this into perspective, ACCESS Newswire stated a belief that its new structure positioned it to become the third-largest newswire service by mid-2025.

The market segment ACCESS Newswire Inc. targets appears fragmented, with numerous smaller IR/PR tech providers vying for the small-cap and emerging company business. The company reported serving more than 12,000 clients globally as of early 2025.

The financial performance leading up to the strategic shift reflected this pressure. For the third quarter of 2024, total revenue was $7 million, a decrease of 8% compared to the same period in 2023 (which was $7.6 million). Communications revenue, which was 79% of total revenue for the quarter ended September 30, 2024, specifically decreased by 10% to $1.7 million. This revenue decline suggests competitors were definitely gaining share or market volumes were low at that time.

The strategic response was significant. The rebrand to ACCESS Newswire Inc. (ACCS) on January 27, 2025, and the launch of the fixed-fee subscription model was a direct move intended to disrupt rivals. These new packages range from an average of $1,000 to $2,500 per month. This shift is further emphasized by the sale of the compliance division (formerly Direct Transfer LLC) to Equiniti Trust Company, LLC (EQ) on March 3, 2025, allowing a sharper focus on the core communications offerings.

The nature of basic news distribution services inherently means low switching costs for customers seeking simple wire dissemination, which naturally intensifies price competition. Still, the subscription model aims to lock in value. By Q3 2025, the company reported 972 subscription customers, with the average recurring revenue per subscribing customer rising to $11,601, an increase of 14% year-over-year.

Here's a quick look at the revenue comparison around the strategic pivot:

| Metric | Q3 2024 Amount | Q3 2025 Amount | Year-over-Year Change (Q3 2024 vs Q3 2023) |

|---|---|---|---|

| Total Revenue | N/A (Implied from 8% decline) | $5.7 million | -8% |

| Communications Revenue | $1.7 million | N/A | -10% |

| Adjusted EBITDA | $546,000 | $933,000 | N/A |

The move to recurring revenue is a direct counter to the transactional nature that fuels low switching costs. You can see the impact of the subscription focus in the latest figures:

- Subscription Customers (Q3 2025): 972

- Avg. Recurring Revenue per Customer (Q3 2025): $11,601

- Subscription Revenue Growth (YoY): 14% increase in ARPU

- Subscription Package Pricing: Average of $1,000 to $2,500 per month

Finance: draft 13-week cash view by Friday.

Issuer Direct Corporation (ISDR) - Porter's Five Forces: Threat of substitutes

The threat of substitutes for Issuer Direct Corporation (ISDR), now operating as ACCESS Newswire Inc. (ACCS) as of January 27, 2025, is significant because the core function-disseminating corporate information-can be achieved through several non-traditional or lower-cost means.

In-house investor relations (IR) and public relations (PR) teams can bypass paid newswires by handling distribution themselves. For a public company, the cost of an in-house IR professional in 2025 averages an annual total compensation of $80k, with a typical range between $73k and $102k based on 22 profiles. This internal salary cost must be weighed against the cost of a full-service newswire and compliance provider like ACCESS Newswire Inc. Older analysis suggested a top-flight IR officer could command a salary of $175,000, and a micro-cap company's median IR budget (excluding staff) was estimated around $112,500.

Direct-to-social media and free platforms offer alternative, albeit less regulated, communication channels. As of October 2025, Facebook maintained a global market share of 68.71% among social media platforms. Globally, 63.9% of the population used social media in February 2025, with an average daily usage of 2 hours and 21 minutes. While these platforms offer massive reach, they lack the regulatory assurance and structured delivery of a formal newswire service for mandatory disclosures.

Open-source or low-cost regulatory filing software can substitute for parts of the compliance service, particularly for mandatory filings like XBRL (eXtensible Business Reporting Language). Some Excel/Google Sheets add-ons for financial reporting, which streamline data aggregation, are available for as low as $39-$99/month. This contrasts with the complexity of full-service compliance offerings.

The decline in print and proxy fulfillment revenue demonstrates that digital substitutes are winning in specific segments. For the first half of 2024, revenue from the Compliance business segment decreased 44% compared to the first half of 2023, attributed to a decline in print and proxy fulfillment services. Furthermore, Compliance revenue in Q2 2024 was 53% lower than in Q2 2023. This sharp drop signals a structural shift away from traditional, high-touch print services.

The integrated $Platform$ $ID$ bundle mitigates substitution risk by offering a one-stop-shop. In response to market dynamics, ACCESS Newswire Inc. launched an industry-first subscription model effective January 2025, with packages ranging from an average of $1,000 to $2,500 per month. This model aims to provide predictable monthly recurring revenue (MRR) by bundling services like the core newswire (ACCESSWIRE), investor targeting, and the Disclosure Management System (DMS) within the $Platform$ $ID$ framework. The company stated an ambition to become the third-largest newswire service by mid-2025.

Here's a quick comparison of potential substitute costs versus the new subscription model:

| Service Type | Cost Metric/Range | Data Point/Context |

| In-House IR Salary (Average) | $80,000 per year | 2025 Average Total Compensation |

| Low-Cost Reporting Add-on | $39-$99 per month | Affordable Excel/Google Sheets Tools (2025) |

| ACCESS Newswire Subscription (Low End) | $1,000 per month | New Subscription Model MRR (Effective Jan 2025) |

| ACCESS Newswire Subscription (High End) | $2,500 per month | New Subscription Model MRR (Effective Jan 2025) |

| Print/Proxy Revenue Decline (YOY) | -53% | Compliance Revenue Decrease in Q2 2024 vs Q2 2023 |

The substitution pressures manifest in several ways:

- In-house teams save on newswire fees by using internal staff salaries averaging $80k.

- Free social platforms like Facebook reach 68.71% of global users.

- Compliance software alternatives exist with monthly costs as low as $39.

- Print/proxy revenue fell sharply, with Compliance revenue down 53% year-over-year in Q2 2024.

- The new subscription model targets $1,000-$2,500 MRR to lock in clients.

Issuer Direct Corporation (ISDR) - Porter's Five Forces: Threat of new entrants

You're looking at the barriers to entry for a company like Issuer Direct Corporation, which is now ACCESS Newswire Inc. as of January 2025. The threat from new players isn't zero, but several factors make a direct, successful challenge difficult.

Low Capital Expenditure Needed for a Cloud-Based Platform Business

Honestly, the shift to cloud-based delivery changes the initial financial hurdle. New entrants don't need to buy massive, on-premises data centers, which avoids the huge upfront Capital Expenditures (CapEx) that used to define this industry. Instead, much of the cost moves to Operating Expenses (OpEx), like subscription fees for cloud services, which aligns costs more closely with usage. This OpEx model lowers the initial barrier to starting a platform, but it doesn't negate the other, more significant hurdles specific to this niche.

High Barrier to Entry: Distribution and Regulatory Access

The real moat here isn't hardware; it's relationships and compliance clearance. New entrants face a high barrier because they must immediately build or buy established media distribution networks, like a premier newswire service, to ensure broad market reach. More critically, direct access to regulatory systems like the SEC's EDGAR platform is non-negotiable for compliance services. The SEC's 'EDGAR Next' amendments, effective March 24, 2025, mandate a more secure system requiring individual Login.gov credentials and multi-factor authentication for all filers. A startup must navigate this complex, newly implemented security framework just to begin filing for clients, which is a significant technical and administrative undertaking.

Cost to Acquire an Established Issuer Base

Building a reliable customer base of public and private issuers takes time and trust. Issuer Direct Corporation has been building this for years. As of the third quarter of 2025, the company reported 972 subscription customers. To compete, a new entrant would need to spend heavily to acquire a similar base, which represents a substantial customer acquisition cost. Here's a quick look at the scale of the customer base Issuer Direct has built:

| Metric | Historical Data Point | Latest Available Data Point |

|---|---|---|

| Total Customers (2017) | Approximately 2,950 (on ACCESSWIRE) | N/A |

| Publicly Traded Customers (2019) | 2,169 | N/A |

| Subscription Customers (Q3 2025) | N/A | 972 |

| Target Market Size (Historical) | 5,000 companies under $250M market cap | N/A |

It takes real effort to get a company to trust you with their mandatory SEC filings.

Acquisition Potential as an Entry Point

The relatively small size of Issuer Direct Corporation (ACCESS Newswire Inc.) presents an alternative entry strategy for large tech firms. With a market capitalization reported around $37M as of January 2025, and another report showing $36.3M as of November 2025, the company is definitely in the micro-cap range. A large player seeking immediate entry into the compliance and IR SaaS space could bypass the multi-year build-out by acquiring the company outright. The trailing twelve-month revenue as of September 30, 2025, was $22.6M, which suggests a potentially attractive multiple for a strategic buyer looking for a quick foothold.

Regulatory Complexity as a Deterrent

Beyond the technical EDGAR access, the entire Investor Relations (IR) and compliance landscape is dense. New entrants without deep, specialized expertise will struggle with the ongoing requirements of the Jumpstart Our Business Startups Acts (JOBS Act) compliance, Form 8-K filings, and other disclosure management tasks. This regulatory complexity acts as a significant, non-technical barrier. You need to know the rules inside and out, or you risk massive liability for your clients. This specialization weeds out generalist tech startups.

- Compliance expertise is a must-have, not a nice-to-have.

- EDGAR Next requires new, individual credentialing for all users.

- Building trust for mandatory financial disclosures is slow.

- The company's Q3 2025 adjusted EBITDA margin was 16% of revenue.

Finance: draft the acquisition scenario valuation based on the $37M market cap and $22.6M TTM revenue by next Tuesday.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.