|

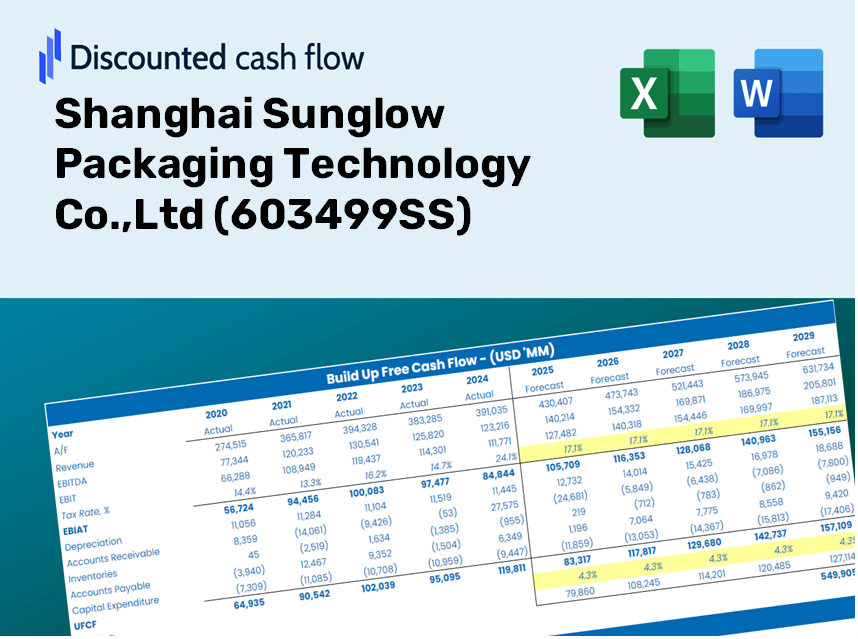

Shanghai Sunglow Packaging Technology Co., Ltd (603499.SS) Évaluation DCF |

Entièrement Modifiable: Adapté À Vos Besoins Dans Excel Ou Sheets

Conception Professionnelle: Modèles Fiables Et Conformes Aux Normes Du Secteur

Pré-Construits Pour Une Utilisation Rapide Et Efficace

Compatible MAC/PC, entièrement débloqué

Aucune Expertise N'Est Requise; Facile À Suivre

Shanghai Sunglow Packaging Technology Co.,Ltd (603499.SS) Bundle

Évaluez les perspectives financières de Shanghai Sunglow Packaging Technology Co., Ltd comme un expert! Cette calculatrice DCF (603499SS) fournit des données financières pré-remplies et offre une flexibilité totale pour modifier la croissance des revenus, le WACC, les marges et d'autres hypothèses essentielles pour s'aligner sur vos prévisions.

Discounted Cash Flow (DCF) - (USD MM)

| Year | AY1 2020 |

AY2 2021 |

AY3 2022 |

AY4 2023 |

AY5 2024 |

FY1 2025 |

FY2 2026 |

FY3 2027 |

FY4 2028 |

FY5 2029 |

|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 483.9 | 647.7 | 663.1 | 694.1 | 885.3 | 1,036.8 | 1,214.2 | 1,422.0 | 1,665.3 | 1,950.2 |

| Revenue Growth, % | 0 | 33.84 | 2.37 | 4.68 | 27.55 | 17.11 | 17.11 | 17.11 | 17.11 | 17.11 |

| EBITDA | 55.0 | 59.5 | 77.4 | 75.8 | 169.8 | 129.2 | 151.3 | 177.2 | 207.5 | 243.0 |

| EBITDA, % | 11.36 | 9.18 | 11.67 | 10.93 | 19.18 | 12.46 | 12.46 | 12.46 | 12.46 | 12.46 |

| Depreciation | 42.3 | 63.1 | 61.0 | 58.7 | 71.3 | 91.6 | 107.3 | 125.7 | 147.2 | 172.4 |

| Depreciation, % | 8.75 | 9.74 | 9.19 | 8.46 | 8.06 | 8.84 | 8.84 | 8.84 | 8.84 | 8.84 |

| EBIT | 12.6 | -3.6 | 16.4 | 17.1 | 98.5 | 37.6 | 44.0 | 51.5 | 60.4 | 70.7 |

| EBIT, % | 2.61 | -0.55503 | 2.48 | 2.47 | 11.12 | 3.62 | 3.62 | 3.62 | 3.62 | 3.62 |

| Total Cash | 161.8 | 93.8 | 111.9 | 70.0 | 73.9 | 172.6 | 202.1 | 236.7 | 277.2 | 324.6 |

| Total Cash, percent | .0 | .0 | .0 | .0 | .0 | .0 | .0 | .0 | .0 | .0 |

| Account Receivables | 193.5 | 268.2 | 269.4 | 273.3 | 346.6 | 415.9 | 487.0 | 570.3 | 667.9 | 782.2 |

| Account Receivables, % | 39.99 | 41.41 | 40.62 | 39.37 | 39.15 | 40.11 | 40.11 | 40.11 | 40.11 | 40.11 |

| Inventories | 85.0 | 101.8 | 92.0 | 95.9 | 105.6 | 151.2 | 177.1 | 207.4 | 242.8 | 284.4 |

| Inventories, % | 17.57 | 15.72 | 13.88 | 13.82 | 11.92 | 14.58 | 14.58 | 14.58 | 14.58 | 14.58 |

| Accounts Payable | 88.8 | 173.7 | 168.7 | 122.2 | 206.4 | 231.3 | 270.9 | 317.2 | 371.5 | 435.1 |

| Accounts Payable, % | 18.36 | 26.82 | 25.44 | 17.61 | 23.32 | 22.31 | 22.31 | 22.31 | 22.31 | 22.31 |

| Capital Expenditure | -55.5 | -90.4 | -108.0 | -83.1 | -98.0 | -134.3 | -157.2 | -184.1 | -215.6 | -252.5 |

| Capital Expenditure, % | -11.47 | -13.95 | -16.28 | -11.97 | -11.07 | -12.95 | -12.95 | -12.95 | -12.95 | -12.95 |

| Tax Rate, % | 23.76 | 23.76 | 23.76 | 23.76 | 23.76 | 23.76 | 23.76 | 23.76 | 23.76 | 23.76 |

| EBITAT | 13.0 | -2.6 | 61.8 | 8.8 | 75.1 | 30.1 | 35.2 | 41.3 | 48.3 | 56.6 |

| Depreciation | ||||||||||

| Changes in Account Receivables | ||||||||||

| Changes in Inventories | ||||||||||

| Changes in Accounts Payable | ||||||||||

| Capital Expenditure | ||||||||||

| UFCF | -189.9 | -36.5 | 18.4 | -69.8 | 49.6 | -102.5 | -72.1 | -84.5 | -98.9 | -115.8 |

| WACC, % | 7.19 | 7.11 | 7.19 | 7.04 | 7.12 | 7.13 | 7.13 | 7.13 | 7.13 | 7.13 |

| PV UFCF | ||||||||||

| SUM PV UFCF | -384.4 | |||||||||

| Long Term Growth Rate, % | 3.00 | |||||||||

| Free cash flow (T + 1) | -119 | |||||||||

| Terminal Value | -2,889 | |||||||||

| Present Terminal Value | -2,048 | |||||||||

| Enterprise Value | -2,432 | |||||||||

| Net Debt | 190 | |||||||||

| Equity Value | -2,622 | |||||||||

| Diluted Shares Outstanding, MM | 212 | |||||||||

| Equity Value Per Share | -12.37 |

Benefits You Will Receive

- Authentic SHG Financial Data: Pre-loaded with Shanghai Sunglow Packaging's historical and forecasted figures for accurate assessments.

- Completely Customizable Template: Easily alter critical inputs such as revenue growth, WACC, and EBITDA margins.

- Instantaneous Calculations: Watch the intrinsic value of SHG update in real-time as you make adjustments.

- Advanced Valuation Tool: Tailored for investors, analysts, and consultants who need reliable DCF analysis.

- Intuitive Layout: User-friendly design with straightforward instructions suitable for all skill levels.

Key Features

- Comprehensive DCF Calculator: Offers detailed unlevered and levered DCF valuation models tailored for Shanghai Sunglow Packaging Technology Co., Ltd (603499SS).

- WACC Calculator: Built-in Weighted Average Cost of Capital sheet with adjustable parameters for accurate analysis.

- Customizable Forecast Assumptions: Adjust growth rates, capital expenditures, and discount rates according to your needs.

- Integrated Financial Ratios: Evaluate profitability, leverage, and efficiency ratios specifically for Shanghai Sunglow Packaging Technology Co., Ltd (603499SS).

- Visual Dashboard and Charts: Graphical representations highlight essential valuation metrics for straightforward analysis.

How It Works

- 1. Access the Template: Download and open the Excel file containing Shanghai Sunglow Packaging Technology Co., Ltd’s preloaded data.

- 2. Modify Inputs: Adjust essential parameters such as growth rates, WACC, and capital expenditures.

- 3. View Instant Results: The DCF model automatically computes intrinsic value and NPV in real-time.

- 4. Explore Different Scenarios: Analyze various forecasts to evaluate diverse valuation results.

- 5. Present with Assurance: Offer professional valuation insights to aid your decision-making process.

Why Opt for This Calculator?

- All-in-One Solution: Offers DCF, WACC, and financial ratio analyses within a single platform.

- Adjustable Parameters: Modify the yellow-highlighted fields to experiment with different scenarios.

- In-Depth Analysis: Automatically computes the intrinsic value and Net Present Value for Shanghai Sunglow Packaging Technology Co., Ltd (603499SS).

- Ready-to-Use Data: Historical and projected data provide reliable starting points for your analysis.

- High-Quality Standards: Perfect for financial analysts, investors, and business consultants in the packaging industry.

Who Can Benefit from This Product?

- Investors: Make informed investment choices by accurately assessing the fair value of Shanghai Sunglow Packaging Technology Co., Ltd (603499SS).

- CFOs: Utilize a high-quality DCF model for enhanced financial reporting and analysis.

- Consultants: Effortlessly customize the template for client valuation reports.

- Entrepreneurs: Acquire valuable insights into financial modeling practices employed by leading companies.

- Educators: Implement this tool in your curriculum to illustrate various valuation methodologies.

Contents of the Template

- Pre-Filled DCF Model: Financial data for Shanghai Sunglow Packaging Technology Co., Ltd (603499SS) preloaded for immediate use.

- WACC Calculator: Comprehensive computations for Weighted Average Cost of Capital.

- Financial Ratios: Assess Shanghai Sunglow's profitability, leverage, and efficiency metrics.

- Editable Inputs: Customize assumptions such as growth rates, profit margins, and CAPEX to suit your scenarios.

- Financial Statements: Access annual and quarterly reports for in-depth analysis.

- Interactive Dashboard: Effortlessly visualize key valuation metrics and outcomes.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.