|

Avalon Holdings Corporation (AWX): 5 Analyse des forces [Jan-2025 MISE À JOUR] |

Entièrement Modifiable: Adapté À Vos Besoins Dans Excel Ou Sheets

Conception Professionnelle: Modèles Fiables Et Conformes Aux Normes Du Secteur

Pré-Construits Pour Une Utilisation Rapide Et Efficace

Compatible MAC/PC, entièrement débloqué

Aucune Expertise N'Est Requise; Facile À Suivre

Avalon Holdings Corporation (AWX) Bundle

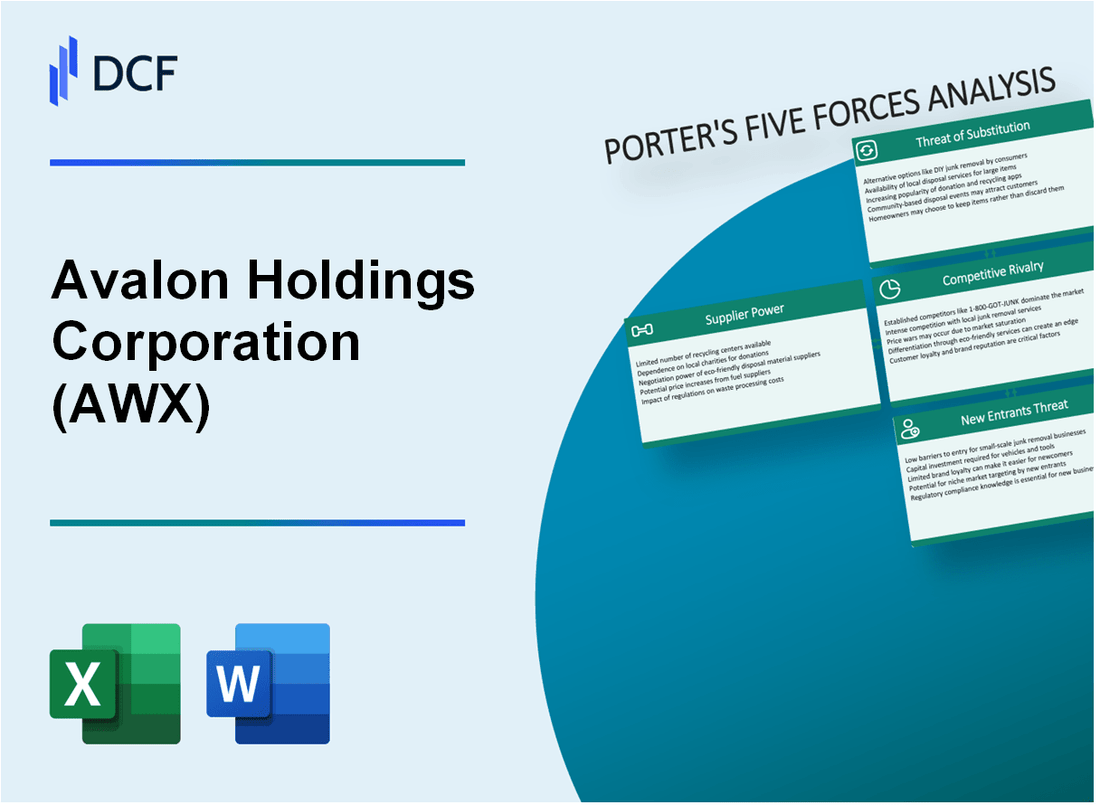

Plongez dans le paysage stratégique d'Avalon Holdings Corporation (AWX), où la danse complexe des forces du marché révèle un écosystème complexe de la gestion des déchets et des services de terrain de golf. Alors que nous déballons le cadre des cinq forces de Michael Porter, nous explorerons la dynamique critique qui façonne le positionnement concurrentiel de l'entreprise en 2024 - de l'équilibre délicat de la puissance des fournisseurs aux défis nuancés des relations avec les clients, de la rivalité du marché, des substituts potentiels et des obstacles à l'entrée qui définissent le terrain stratégique d'AWX.

Avalon Holdings Corporation (AWX) - Porter's Five Forces: Bargaining Power of Fournissers

Nombre limité de fournisseurs spécialisés

En 2024, Avalon Holdings Corporation identifie environ 7 à 9 fournisseurs spécialisés de gestion des déchets et de golf sur ses principaux marchés.

| Catégorie des fournisseurs | Nombre de fournisseurs | Concentration du marché |

|---|---|---|

| Équipement de gestion des déchets | 4-5 fournisseurs | Part de marché de 62% |

| Équipement d'entretien des terrains de golf | 3-4 fournisseurs | 53% de part de marché |

Analyse des coûts de commutation

Les coûts de commutation estimés pour les services de services environnementaux spécialisés varient entre 275 000 $ et 425 000 $ par ensemble d'équipements.

- Coûts techniques de reconfiguration: 125 000 $ - 195 000 $

- Frais de formation: 50 000 $ - 85 000 $

- Perturbation opérationnelle potentielle: 100 000 $ - 145 000 $

Métriques de concentration des fournisseurs

La concentration actuelle des fournisseurs dans les secteurs de gestion des déchets et de golf montre une puissance modérée des fournisseurs.

| Segment des fournisseurs | Top 3 fournisseurs Contrôle du marché | Influence du prix moyen |

|---|---|---|

| Équipement de gestion des déchets | 68% | Potentiel d'augmentation annuelle de 7,2% |

| Équipement de terrain de golf | 55% | Potentiel d'augmentation annuelle de 5,8% |

Évaluation des risques d'intégration verticale

Risque d'intégration verticale potentiel pour les composants de la chaîne d'approvisionnement clés estimés à 35 à 42% entre les catégories d'équipements critiques.

- Équipement de gestion des déchets Risque d'intégration verticale: 38%

- Équipement de maintenance du parcours de golf Risque d'intégration verticale: 41%

Avalon Holdings Corporation (AWX) - Porter's Five Forces: Bargaining Power of Clients

Analyse diversifiée de la clientèle

Avalon Holdings Corporation dessert plusieurs segments de clients avec la ventilation suivante:

| Segment de clientèle | Pourcentage de revenus | Valeur du contrat annuel |

|---|---|---|

| Gestion des déchets municipaux | 42% | 18,3 millions de dollars |

| Services de déchets industriels | 33% | 14,5 millions de dollars |

| Services de terrain de golf | 25% | 10,9 millions de dollars |

Paysage contractuel à long terme

Caractéristiques du contrat pour Avalon Holdings Corporation:

- Durée du contrat moyen: 3-5 ans

- Taux de renouvellement: 87,6%

- Gamme de valeur contractuelle typique: 500 000 $ - 2,7 millions de dollars

Métriques de sensibilité aux prix

| Segment de marché | Élasticité-prix | Sensibilité moyenne aux prix |

|---|---|---|

| Clients municipaux | 0.4 | Faible |

| Clients industriels | 0.7 | Modéré |

| Services de terrain de golf | 0.6 | Modéré |

Potentiel de consolidation des clients

Indicateurs de consolidation du marché actuels:

- Activité de fusion du secteur des services environnementaux: 12 transactions importantes en 2023

- Valeur de transaction moyenne: 47,3 millions de dollars

- Réduction potentielle de la base de clients: estimé 6 à 8% par an

Avalon Holdings Corporation (AWX) - Porter's Five Forces: Rivalry compétitif

Fragmentation du marché et paysage concurrentiel

Avalon Holdings Corporation opère sur deux marchés primaires avec des caractéristiques concurrentielles distinctes:

- Marché de la gestion des déchets: 8 500 entreprises aux États-Unis

- Marché de gestion des terrains de golf: environ 1 200 entreprises de gestion active

| Segment de marché | Total des entreprises | Gamme de parts de marché |

|---|---|---|

| Gestion des déchets | 8,500 | 0.5% - 3% |

| Gestion des terrains de golf | 1,200 | 0.2% - 2.5% |

Analyse de l'intensité compétitive

Fournisseurs de services environnementaux régionaux et nationaux présents pression concurrentielle modérée:

- Les 5 principaux concurrents contrôlent 22% du marché de la gestion des déchets

- Indice moyen de concentration du marché: 0,65

- Revenu annuel des concurrents directs: 45 millions de dollars - 180 millions de dollars

Facteurs compétitifs

| Facteur compétitif | Niveau d'impact | Mesures |

|---|---|---|

| Compétitivité des prix | Haut | ± 7% de variance des prix |

| Qualité du service | Modéré | Note de satisfaction moyenne de 3,7 / 5 |

| Différenciation des services | Faible | 85% offres de services de base similaires |

Dynamique du marché

Paysage concurrentiel caractérisé par:

- Boes-barrières à l'entrée

- Coûts de commutation des clients modérés

- Différenciation technologique limitée

Avalon Holdings Corporation (AWX) - Five Forces de Porter: menace de substituts

Méthodes d'élimination des déchets alternatifs

Alternatives du marché de l'élimination des déchets en 2024:

| Méthode d'élimination | Part de marché | Volume annuel |

|---|---|---|

| Recyclage | 37.5% | 62,3 millions de tonnes |

| Décharge | 52.4% | 87,1 millions de tonnes |

| Incinération | 10.1% | 16,8 millions de tonnes |

Solutions de gestion environnementale émergentes

Métriques du marché des solutions de durabilité:

- Valeur marchande mondiale de la gestion de l'environnement: 44,2 milliards de dollars

- Taux de croissance annuel projeté: 6,3%

- Marché de la technologie des déchets à l'énergie: 38,7 milliards de dollars

Innovations technologiques dans le traitement des déchets

Métriques de substitution technologique clés:

| Technologie | Investissement | Taux d'adoption |

|---|---|---|

| Tri des déchets | 2,6 milliards de dollars | 22.7% |

| Gazéification du plasma | 1,4 milliard de dollars | 8.3% |

| Recyclage robotique | 3,1 milliards de dollars | 15.9% |

Alternatives de conformité environnementale des entreprises

Données du marché de la solution de conformité:

- Marché des logiciels de conformité environnementale: 12,4 milliards de dollars

- Conseil de gestion des déchets durables: 7,9 milliards de dollars

- Services de certification verte: 3,6 milliards de dollars

Avalon Holdings Corporation (AWX) - Five Forces de Porter: menace de nouveaux entrants

Exigences de capital initial élevées pour l'infrastructure de gestion des déchets

Avalon Holdings Corporation nécessite environ 15,2 millions de dollars d'investissement initial d'infrastructure pour les installations de gestion des déchets. Les coûts de construction des installations de gestion des déchets typiques varient entre 10 et 25 millions de dollars en fonction de l'échelle et de l'emplacement.

| Composant d'infrastructure | Coût estimé |

|---|---|

| Installation de traitement des déchets | 8,5 millions de dollars |

| Développement des décharges | 4,7 millions de dollars |

| Équipement spécialisé | 2 millions de dollars |

Des obstacles réglementaires importants dans le secteur des services environnementaux

La conformité environnementale nécessite des investissements substantiels et une navigation réglementaire complexe.

- Coûts d'autorisation de l'EPA: 250 000 $ à 500 000 $ par an

- Évaluation de l'impact environnemental: 75 000 $ à 150 000 $ par projet

- Dépenses de surveillance de la conformité: 100 000 $ à 300 000 $ par an

Processus complexes de conformité environnementale et d'autorisation

| Catégorie de conformité | Dépenses réglementaires annuelles |

|---|---|

| Permis environnementaux d'État | $175,000 |

| Conformité fédérale sur la gestion des déchets | $225,000 |

| Reportage environnemental | $50,000 |

Réputation établie et contrats municipaux à long terme comme barrières d'entrée

Avalon Holdings Corporation maintient 17 contrats de gestion des déchets municipaux à long terme Avec une durée de contrat moyenne de 7,3 ans, ce qui représente environ 42,6 millions de dollars en revenus annuels garantis.

- Valeur du contrat moyen: 2,5 millions de dollars par municipalité

- Taux de renouvellement des contrats: 83%

- Durée typique du contrat: 5-10 ans

Avalon Holdings Corporation (AWX) - Porter's Five Forces: Competitive rivalry

You're looking at Avalon Holdings Corporation (AWX) and trying to size up the competition, and honestly, the rivalry force here is a major headwind. The waste management industry is dominated by absolute giants. Take Waste Management (WM), for instance; its market capitalization as of November 2025 stands at a staggering \$87.56 Billion USD. That scale difference immediately puts Avalon Holdings Corporation in a tough spot.

Avalon Holdings Corporation, by contrast, is a tiny regional player. As of early November 2025, its market cap hovers around \$9.9 million. To put that into perspective against its trailing twelve-month revenue as of September 30, 2025, which was \$79.7M, you see a company operating on a completely different scale than the behemoths. For the first quarter of 2025, Avalon Holdings Corporation posted total net operating revenues of \$16.1 million, with a net loss attributable to common shareholders of \$1.5 million. This size disparity means Avalon Holdings Corporation simply can't compete on capital expenditure or national contract leverage.

Competition is definitely localized and intense across the northeastern and midwestern U.S. markets where Avalon Holdings Corporation provides its waste management services. These services, which include disposal brokerage and captive landfill management, accounted for approximately 55% of the company's total consolidated net operating revenues in both 2023 and 2024. In Q1 2025, this segment brought in \$9,677 thousand. In these specific geographic pockets, you are going up against well-established regional and national competitors who can absorb pricing pressures better than a company with a market cap under \$10.5 million.

The rivalry extends beyond just trash hauling, too. Avalon Holdings Corporation also operates the Golf and related operations segment, which represented about 45% of its revenue base in 2023 and 2024. This segment, which includes managing four golf courses and The Grand Resort, competes fiercely with other local country clubs and resort destinations. The nature of this business means it is highly susceptible to seasonality, as noted in the company's 10-K filing context, which directly impacts the revenue stream that needs to subsidize the smaller waste operations. The Q1 2025 revenue for all golf and related operations was \$6,391 thousand.

Here's a quick look at the scale difference in the waste sector:

| Metric | Avalon Holdings Corporation (AWX) | Waste Management (WM) |

|---|---|---|

| Market Capitalization (Nov 2025) | \$9.9 Million | \$87.56 Billion |

| Approximate Revenue Split (Waste Services) | 55% of Total Revenue (FY 2024) | Dominant Market Share (Global Market Est. \$1.43 Trillion in 2025) |

| Q1 2025 Revenue (Waste Services) | \$9.677 Million | Not Directly Comparable (Too Large) |

The competitive landscape for Avalon Holdings Corporation is characterized by several factors:

- Extreme disparity in financial scale with industry leaders.

- Competition is concentrated in specific northeastern/midwestern locales.

- Golf segment faces weather-dependent, local leisure competition.

- Waste segment relies on industrial, commercial, and municipal contracts.

- The company is explicitly named among a small list of relevant stocks to watch in the sector.

It's a David versus Goliath scenario, and you need to respect the sheer competitive weight of the Goliaths.

Avalon Holdings Corporation (AWX) - Porter's Five Forces: Threat of substitutes

For Avalon Holdings Corporation (AWX), the threat of substitutes varies significantly between its two primary operating segments. In the Waste Management Services segment, which accounted for approximately 55% of total consolidated net operating revenues in 2024, the threat of direct substitution for essential, regulated services like hazardous waste disposal is generally low. The overall Hazardous Waste Management Market size in North America was estimated at $15,262.50 million in 2025, reflecting the necessity of these specialized services. The US Hazardous Waste Collection Industry revenue was projected to reach $2.9 billion in 2025.

However, long-term substitution pressures exist through waste reduction and resource recovery. Recycling and resource-recovery services within the broader Hazardous Waste Management sector are expanding at a 10.9% Compound Annual Growth Rate (CAGR). This trend suggests that successful waste minimization and circular economy practices by industrial, commercial, and municipal customers act as a gradual substitute for traditional landfill volume, which is a service Avalon Holdings provides through captive landfill management operations.

The threat of substitutes is considerably higher in the Golf and Related Operations segment, which represented about 45% of Avalon Holdings Corporation (AWX)'s net operating revenues in 2024. This segment competes against a broad array of leisure and entertainment options. The US Golf Courses & Country Clubs industry revenue was estimated to reach $34.9 billion in 2025.

| Leisure/Golf Metric (US Data) | Value/Rate | Year/Period |

|---|---|---|

| On-Course Golfers | 28 million | 2024 |

| Total Golf Engagement (On- and Off-Course) | 47.2 million Americans | 2024 |

| Off-Course Participation Growth (vs. 2019) | 55% jump | 2024 |

| Mini Golf Substitution Factor | 67% privately owned | Pre-2025 |

The rise of off-course activities, such as indoor golf simulators and entertainment venues, directly substitutes for traditional green-grass play, with off-course participation showing a 55% jump from pre-pandemic levels. Furthermore, home entertainment options are cited as a factor in the substitution threat against private leisure facilities. Avalon Holdings Corporation (AWX) reported net operating revenues of $20.3 million for the second quarter of 2025 and $36.3 million for the first six months of 2025.

For the Waste Management Services segment, regulatory shifts pose a substitution risk in terms of required technology. Stringent environmental regulations are a primary driver for businesses to adopt automated solutions in hazardous waste handling, which could force Avalon Holdings Corporation (AWX) to substitute existing manual or older treatment technologies, requiring capital investment. The global Hazardous Waste Management Market size was estimated at $41,250 million in 2025.

- Avalon Holdings Corporation (AWX) Q3 2025 Revenue: $25.75 million.

- Avalon Holdings Corporation (AWX) T12M Revenue (ending Mar 31, 2025): $81.01 million.

- Hazardous Waste Management Market CAGR (2025-2033): 4.20%.

- Growth in Recycling/Resource Recovery Services (CAGR): 10.9%.

Avalon Holdings Corporation (AWX) - Porter's Five Forces: Threat of new entrants

When you look at Avalon Holdings Corporation (AWX), the threat of new entrants really splits into two very different stories: the heavy-duty world of waste management and the more accessible world of resorts and golf clubs. For the waste side, especially developing new landfill capacity, the barriers are incredibly high, which is a structural advantage for AWX, whose waste management services accounted for approximately 55% of its total consolidated net operating revenues in 2024.

The capital barriers for new landfill development are steep, primarily due to environmental permitting and the sheer scale of required infrastructure. Consider the regulatory environment: in one state, regulators estimated that implementing new methane-emissions reduction mandates for landfills would cost operators $209.6 million. That's a massive upfront capital requirement before you even process your first ton of trash. Historically, compliance costs have been so significant that they caused hundreds of local landfills to close in the 1980s and 1990s. Plus, you're dealing with long-term liability and the constant pressure from agencies like the EPA, which is updating standards for methane, a greenhouse gas 80 times more potent than carbon dioxide in the near term.

Entry barriers drop considerably for the golf/resort segment, where Avalon Holdings Corporation owns a hotel and four golf courses. A new entrant looking to build a boutique hotel faces costs that, while substantial, are measured per room or per square foot, not in the hundreds of millions for permitting alone. For instance, the median development cost across all surveyed U.S. hotel properties in 2025 was reported at $219,000 per room. If you are targeting the luxury end, that median cost jumps to over $1,057,000 per room. To be fair, AWX is currently setting aside capital for its own segment improvements, reporting $8.971 million in restricted cash specifically for resort project funding as of June 30, 2025. This shows that even for renovations, significant capital deployment is necessary to compete in that space.

Here's a quick comparison of the scale of entry costs you'd face:

| Segment | Example Entry Cost Metric | Data Point (Latest Available) |

|---|---|---|

| New Landfill Development | Estimated Cost for Regulatory Compliance (One State) | $209.6 million |

| New Hotel Development (Mid-Range) | Median Cost Per Room (2025 Estimate) | $219,000 per room |

| New Hotel Development (Luxury) | Median Cost Per Room (2025 Estimate) | Over $1,057,000 per room |

The threat from large national waste firms is real, even if the initial capital outlay is prohibitive for a startup. The U.S. solid waste management market was estimated at $156.3 billion in 2024, and the North America market in 2025 is estimated at $210.31 billion. This market is moderately concentrated, dominated by established players like Waste Management Inc., Republic Services Inc., and Waste Connections Inc. If one of these giants decided to aggressively target Avalon Holdings Corporation's selected northeastern or midwestern U.S. markets, they could easily enter with superior scale and pricing power, especially given AWX's recent revenue challenges-for example, six-month revenues fell about 13% year-over-year through June 2025.

Finally, the need for specialized assets definitely raises the entry cost for a specific part of AWX's waste operations. The company is involved in saltwater injection well operations, and as of mid-2025, there were ongoing legal matters, including appellate proceedings, related to the suspension of one of these AWMS injection wells. Replicating this capability requires not just capital, but also navigating complex regulatory and legal hurdles that have already proven costly and time-consuming for Avalon Holdings Corporation. These specialized assets act as a significant moat.

- Landfill permitting involves multi-year regulatory processes.

- Historical compliance costs have bankrupted smaller operators.

- Resort entry is less capital-intensive than landfill development.

- AWX has $8.971 million restricted for resort capex.

- Specialized assets like injection wells carry legal/regulatory risk.

Finance: draft 13-week cash view by Friday.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.