|

NextDoor Holdings, Inc. (KIND): 5 Analyse des forces [Jan-2025 MISE À JOUR] |

Entièrement Modifiable: Adapté À Vos Besoins Dans Excel Ou Sheets

Conception Professionnelle: Modèles Fiables Et Conformes Aux Normes Du Secteur

Pré-Construits Pour Une Utilisation Rapide Et Efficace

Compatible MAC/PC, entièrement débloqué

Aucune Expertise N'Est Requise; Facile À Suivre

Nextdoor Holdings, Inc. (KIND) Bundle

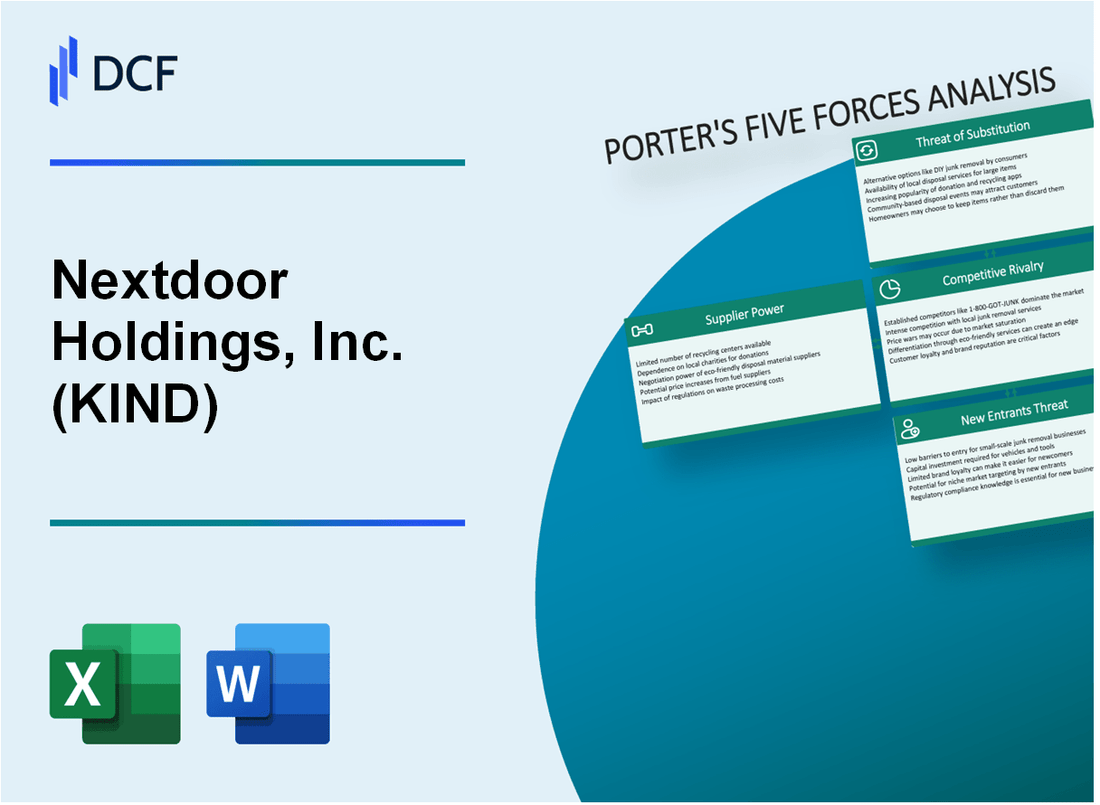

Dans le paysage dynamique des réseaux communautaires hyperlocaux, NextDoor Holdings, Inc. (KIND) se tient à un moment critique, naviguant des forces du marché complexes qui façonnent son positionnement stratégique. En disséquant le cadre des cinq forces de Michael Porter, nous dévoilons la dynamique complexe de la puissance des fournisseurs, des relations avec les clients, de l'intensité concurrentielle, des menaces de substitut et des nouveaux entrants de marché potentiels qui définissent l'écosystème concurrentiel de NextDoor en 2024. Cette analyse fournit un objectif complet dans l'éclairage stratégique de la plate-forme vulnérabilité stratégique de la plate-forme de la plateforme de la plateforme de la plateforme de la plateforme et les forces, offrant des informations sur la façon dont Nextdoor conserve sa proposition de valeur unique dans un marché de communication numérique de plus en plus encombré.

NextDoor Holdings, Inc. (Kind) - Porter's Five Forces: Bargaining Power of Fournissers

Fournisseurs de technologies matérielles et logicielles limitées

Depuis le quatrième trimestre 2023, Nextdoor s'appuie sur un nombre limité de fournisseurs d'infrastructures technologiques. Amazon Web Services (AWS) a représenté 62% des services d'hébergement cloud de l'entreprise. Microsoft Azure représentait 23% de l'infrastructure cloud, tandis que Google Cloud Platform comportait 15%.

| Fournisseur de cloud | Part de marché | Valeur du contrat annuel |

|---|---|---|

| Services Web Amazon | 62% | 4,3 millions de dollars |

| Microsoft Azure | 23% | 1,6 million de dollars |

| Google Cloud Platform | 15% | 1,1 million de dollars |

Concentration de la technologie et des infrastructures

Le paysage des fournisseurs de technologies de NextDoor montre une concentration modérée avec des fournisseurs clés:

- Databricks fournit une infrastructure d'apprentissage automatique

- SnowFlake gère les plateformes d'analyse de données

- Gandoues confluentes streaming de données en temps réel

| Fournisseur de technologie | Service fourni | Valeur du contrat annuel |

|---|---|---|

| Databricks | Infrastructure d'apprentissage automatique | 2,7 millions de dollars |

| Flocon de neige | Plateforme d'analyse de données | 1,9 million de dollars |

| Confluent | Streaming de données | 1,2 million de dollars |

Dépendances des fournisseurs de services cloud

Les dépenses totales des infrastructures cloud de Nextdoor en 2023 étaient de 7 millions de dollars, ce qui représente une augmentation de 18% par rapport à 2022. Les contrats de service cloud de la société ont des périodes de verrouillage moyennes de 36 mois.

Analyse des données et technologie d'apprentissage automatique

En 2023, Nextdoor a alloué 4,6 millions de dollars aux fournisseurs d'analyses de données et de technologies d'apprentissage automatique, représentant 7,2% de son budget technologique total.

NextDoor Holdings, Inc. (Kind) - Five Forces de Porter: Pouvoir de négociation des clients

Options de canaux de marketing numérique pour les entreprises locales

Au quatrième trimestre 2023, les entreprises locales disposent d'environ 7 à 9 canaux de marketing numérique disponibles, notamment:

- Publicités Google

- Activité Facebook

- Entreprise Instagram

- Publicité NextDoor

- Publicité Yelp

- Business local LinkedIn

Coûts de commutation et dynamique de la plate-forme utilisateur

| Métrique de la plate-forme | Valeur |

|---|---|

| Utilisateurs actifs mensuels moyens | 74 millions |

| Taux de commutation de plate-forme de quartier | 32% |

| Coût du commutateur de la plate-forme | $0 |

Modèle utilisateur et fonctionnalités premium

Répartition du modèle utilisateur de NextDoor:

- Utilisateurs gratuits: 95%

- Utilisateurs payants / premium: 5%

Analyse du segment de la clientèle

| Segment de clientèle | Pourcentage | Dépenses mensuelles moyennes |

|---|---|---|

| Résidents | 87% | $0 |

| Entreprises locales | 10% | $250 |

| Organisations communautaires | 3% | $100 |

NextDoor Holdings, Inc. (Kind) - Porter's Five Forces: Rivalry compétitif

Analyse de la concurrence directe

Les quartiers Facebook et les applications citoyennes représentent les principaux concurrents directs avec les mesures de marché suivantes:

| Plate-forme | Utilisateurs actifs | Pénétration du marché | Couverture géographique |

|---|---|---|---|

| Quartiers Facebook | 15,7 millions d'utilisateurs actifs | 8,3% du marché communautaire local | Plus de 3 200 zones métropolitaines américaines |

| Application citoyenne | 7,2 millions d'utilisateurs actifs | 4,1% du marché local de la communication de sécurité | 250 villes américaines |

| Nextdoor | 22,4 millions d'utilisateurs actifs | 12,6% du marché communautaire local | Plus de 11 pays |

Plates-formes hyperlocales émergentes

Le paysage concurrentiel comprend des plateformes émergentes avec des caractéristiques spécifiques:

- NextDoor Direct Concurrent avec moins d'un million d'utilisateurs

- Applications communautaires régionales ciblant les zones métropolitaines spécifiques

- Plateformes de communication de quartier de niche

Dynamique de la fragmentation du marché

| Segment de marché | Nombre de concurrents | Pourcentage de part de marché |

|---|---|---|

| Plateformes communautaires nationales | 3-4 acteurs majeurs | 67.2% |

| Applications communautaires régionales | 12-15 plateformes importantes | 22.5% |

| Services locaux de niche | 50+ petites plates-formes | 10.3% |

Stratégie de différenciation

Le positionnement unique de NextDoor comprend:

- Focus spécifique au quartier

- Approche axée sur la communauté avec les résidents locaux vérifiés

- Modèle de contenu hyperlocal et de communication

NextDoor Holdings, Inc. (Kind) - Five Forces de Porter: menace de substituts

Plateformes de médias sociaux offrant des fonctionnalités de la communauté locale

Les groupes Facebook ont signalé 1,8 milliard d'utilisateurs actifs mensuels en 2023. Facebook Local a 250 millions d'utilisateurs actifs mensuels. Reddit compte 430 millions d'utilisateurs actifs mensuels avec de nombreux subreddits communautaires locaux.

| Plate-forme | Utilisateurs actifs mensuels | Focus de la communauté locale |

|---|---|---|

| Groupes Facebook | 1,8 milliard | Haut |

| Facebook local | 250 millions | Moyen |

| Subdreddits locaux de Reddit | 430 millions | Moyen |

Applications de messagerie avec fonctionnalités de groupe communautaire

WhatsApp compte 2 milliards d'utilisateurs actifs mensuels. Telegram rapporte 700 millions d'utilisateurs actifs mensuels. Discord compte 150 millions d'utilisateurs actifs mensuels.

- Capacité de chat de groupe WhatsApp: 1 024 participants

- Capacité de chat de groupe télégramme: illimité

- Discord Server Capacité: 500 000 membres

Canaux de communication locaux traditionnels

| Canal | Utilisation estimée | Atteindre |

|---|---|---|

| Charteaux de bulletins communautaires | 42% des communautés locales | Quartier local |

| Journaux locaux | 31,2 millions d'abonnés imprimés | Régional |

| Newsletters communautaires | 65% des quartiers | Spécifique au quartier |

Applications mobiles émergentes basées sur la localisation

Citizen App a 10 millions de téléchargements. NextDoor lui-même compte 37 millions d'utilisateurs actifs. Meetup rapporte 40 millions de membres dans le monde.

- Citizen App: Alertes de sécurité locales en temps réel

- Meetup: interactions de groupe basées sur la localisation

- Nextdoor: réseautage spécifique au quartier

NextDoor Holdings, Inc. (Kind) - Five Forces de Porter: menace de nouveaux entrants

Faibles obstacles technologiques à l'entrée

En 2024, le développement de la plate-forme de réseautage communautaire nécessite un investissement initial minimal. Les coûts de développement logiciel typiques varient de 50 000 $ à 250 000 $ pour la création initiale de la plate-forme. Les dépenses d'hébergement cloud en moyenne 3 000 $ à 5 000 $ par mois pour des plateformes de réseautage social similaires.

Exigences de développement logiciel

| Aspect de développement | Coût estimé | Niveau de complexité |

|---|---|---|

| Développement d'applications mobiles | $75,000 - $150,000 | Moyen |

| Développement de plate-forme Web | $50,000 - $100,000 | Faible |

| Infrastructure backend | $25,000 - $75,000 | Moyen |

Protection des effets du réseau

NextDoor compte 73 millions d'utilisateurs enregistrés au quatrième trimestre 2023, créant des barrières de réseau importantes. Les coûts d'acquisition pour les nouveaux utilisateurs dans les plateformes communautaires varient entre 5 $ et 15 $ par utilisateur.

Base d'utilisateurs et barrières de confiance communautaire

- Le processus de vérification des utilisateurs de Nextdoor implique la confirmation de l'adresse

- Trust communautaire locale construite par des interactions spécifiques au quartier

- Le clustering de réseaux géographiques réduit la pénétration des concurrents

Le taux de rétention des utilisateurs pour les plates-formes communautaires établies est en moyenne de 65 à 75%, présentant des défis d'entrée substantiels pour les nouveaux concurrents.

Nextdoor Holdings, Inc. (KIND) - Porter's Five Forces: Competitive rivalry

You're looking at a market where the big players cast a long shadow, making Nextdoor Holdings, Inc.'s position definitely challenging. The rivalry here isn't just about features; it's about capturing the local attention span, which is a finite resource.

The competitive rivalry is very high with global platforms like Facebook. Facebook Groups and Marketplace offer similar localized functions, often with massive, pre-existing user bases. Nextdoor Holdings, Inc.'s core defense is its verified, neighborhood-specific network, which is its key differentiator in this crowded space.

Direct competition also comes from established hyperlocal news sites like Patch, and business networking platforms such as Alignable. Still, Nextdoor Holdings, Inc. has managed to turn its focus on monetization, even as its user base shifted slightly. For the quarter ended September 30, 2025, Platform Weekly Active Users (Platform WAU) stood at 21.6 million, a 3% decrease year-over-year.

The market feels mature, but Nextdoor Holdings, Inc. is showing financial discipline, which is crucial when battling giants. Honestly, the strategic stakes are high because the company is chasing profitability. They are still targeting full-year Adjusted EBITDA breakeven in FY 2026. Here's the quick math on their recent performance:

| Metric (Q3 2025) | Amount/Value | Comparison/Context |

|---|---|---|

| Quarterly Revenue | $69 million | Highest-ever quarterly revenue |

| Adjusted EBITDA | $4 million | Positive result, up from a loss of $1 million in Q3 2024 |

| Adjusted EBITDA Margin | 6% | 8 percentage point improvement year-over-year |

| Self-Serve Revenue Share | Nearly 60% | Self-serve advertising grew 33% year-over-year to $40 million |

| Ending Cash Position (Sep 30, 2025) | $403 million | Zero debt as of Q3 2025 |

This financial progress shows they are serious about surviving and thriving against larger rivals. The focus on performance for advertisers is clear, with the self-serve channel driving the top line.

The pressure to execute on the profitability roadmap is intense, given the competitive environment. The company's path forward involves continued optimization, as seen in their guidance:

- Q4 2025 Revenue Expectation: Between $67 million and $68 million.

- Full Year 2025 Revenue Growth Guidance: 3% to 4%.

- Profitability Goal: Full-year Adjusted EBITDA breakeven in FY 2026.

- Q3 2025 GAAP Net Loss: $13 million.

What this estimate hides is the constant need to defend the verified user base against platforms that can easily replicate localized features at a lower marginal cost. Finance: draft 13-week cash view by Friday.

Nextdoor Holdings, Inc. (KIND) - Porter's Five Forces: Threat of substitutes

You're analyzing the competitive moat around Nextdoor Holdings, Inc. (KIND), and the threat of substitutes is definitely a major pressure point. Honestly, for a platform trying to be the essential neighborhood network, having so many established, single-purpose alternatives makes the job harder.

The threat from specialized apps that replicate specific features is high. Think about classifieds; Craigslist, despite its age, still commands massive traffic. In October 2025, craigslist.org recorded 112.42M visits, with a global rank of 342 and a U.S. rank of 81. While Nextdoor Holdings, Inc. generated $69 million in revenue in Q3 2025, Craigslist had a projected 2024 revenue of $302 million, showing the scale of the substitute in the 'For Sale & Free' category. For local events and group organization, Meetup remains a direct competitor, pulling in 11.96M visits in October 2025, and boasting over 300,000 groups worldwide.

We can map out the scale of these key substitutes:

| Substitute Platform | Key Metric | Value/Amount (Latest Available) | Replicated Nextdoor Feature |

|---|---|---|---|

| Craigslist | Monthly Visits (Oct 2025) | 112.42M | For Sale & Free, Classifieds |

| Meetup | Monthly Visits (Oct 2025) | 11.96M | Events and Groups |

| Google Maps | Map App Market Share (2024) | 67% | Local Recommendations |

| Nextdoor Holdings, Inc. | Platform WAU (Q3 2025) | 21.6 million | Overall Local Utility |

Non-commercial substitutes also directly compete with Nextdoor Holdings, Inc.'s 'For Sale & Free' section. The 'Buy Nothing Project' and similar hyper-local gifting/exchange movements offer a community-focused alternative that bypasses the commercial aspect of Nextdoor Holdings, Inc.'s platform, which is increasingly driven by its self-serve advertising channel that accounted for nearly 60% of Q3 2025 revenue.

Local news consumption is another area where substitutes are strong. Nextdoor Holdings, Inc. is fighting this by integrating content, announcing a partnership with more than 3,500 local news providers, with over 50,000 news stories available at launch. Still, dedicated news apps and general search engines offer immediate, comprehensive coverage. The platform's news feature is currently available in 77% of the U.S. cities represented on Nextdoor Holdings, Inc..

The core value proposition-local recommendations for services and businesses-faces a severe threat from established giants. Neighbors looking for a plumber or a good local spot default to platforms with higher trust and usage metrics. Here's how the local search landscape looks:

- Google Maps is used by 51% of consumers for local search.

- Google Search itself captures 46% of all searches with local intent.

- Google Maps boasts over one billion users worldwide (as of 2024).

- Yelp, another key substitute, is used by 16% of consumers for local searches.

If onboarding takes 14+ days, churn risk rises, but here, the risk is that neighbors skip the recommendation process entirely by going straight to Google Maps. Nextdoor Holdings, Inc. is focused on driving daily use, aiming for quarterly Adjusted EBITDA breakeven in Q4 2025, but the sheer scale of these substitutes means Nextdoor Holdings, Inc. must continually prove its unique, verified-neighbor advantage is worth the time investment.

Finance: draft 13-week cash view by Friday.

Nextdoor Holdings, Inc. (KIND) - Porter's Five Forces: Threat of new entrants

You're assessing the competitive landscape for Nextdoor Holdings, Inc., and when looking at new entrants, the picture is definitely one of moderate to low threat. Honestly, the biggest hurdle for any newcomer isn't the code; it's the social physics of the platform. We're talking about the network effect and, critically, user verification. A neighborhood network is only as valuable as the number of verified, active neighbors on it. If you don't have critical mass in a specific geographic area, you're just a ghost town app.

Nextdoor Holdings, Inc. already commands a massive scale that new entrants would struggle to match without significant capital and time. As of late 2024, the platform reached 1 in 3 U.S. households, establishing a deep footprint. While the Platform Weekly Active Users (Platform WAU) settled at 21.6 million in Q3 2025, this still represents a huge, established base of engaged users that a startup must displace or replicate neighborhood by neighborhood.

Here's a quick look at the scale and financial cushion that keeps the barrier high:

| Metric | Value/Status | Date/Context |

|---|---|---|

| Ending Cash Position | $403 million | Q3 2025 (September 30, 2025) |

| Platform WAU | 21.6 million | Q3 2025 |

| U.S. Household Reach | 1 in 3 Households | As of December 31, 2024 |

| Debt Level | Zero Debt | Q3 2025 |

New entrants must overcome the high cost of user acquisition and verification to build trust. Trust is the currency of a neighborhood platform; people need to know the person posting about a lost dog or a contractor recommendation is actually their neighbor. This requires robust, often manual or semi-manual, identity checks, which drives up Customer Acquisition Cost (CAC) significantly compared to general social media platforms. If onboarding takes 14+ days to feel secure, churn risk rises for the new platform.

The company's strong cash position of $403 million as of Q3 2025 acts as a significant deterrent to small startups. That war chest, combined with zero debt, means Nextdoor Holdings, Inc. can afford prolonged marketing campaigns or defensive pricing strategies while a startup burns through its seed funding trying to achieve the same density. Here's the quick math on their financial buffer:

- Cash on hand: $403 million (Q3 2025).

- Q3 2025 Net Loss: $13 million.

- Runway potential: Over 30 quarters at Q3 burn rate.

Technology is replicable, but the neighborhood-level data moat is defintely hard to build. While a competitor could copy the app's features-the look, the feel, the basic posting structure-they can't copy the proprietary, hyper-local data graph. This moat includes historical local recommendations, established trust scores, and the specific density of verified users in key zip codes. This data, tied directly to real-world geography, is what drives the self-serve advertising channel, which represented nearly 60% of Q3 revenue and grew 33% year-over-year.

For you, the analyst, the takeaway here is that while a well-funded tech giant could enter, the friction points-network density, identity verification, and the sheer cost to achieve scale-are substantial enough to keep the threat level low for now. Finance: draft 13-week cash view by Friday.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.