|

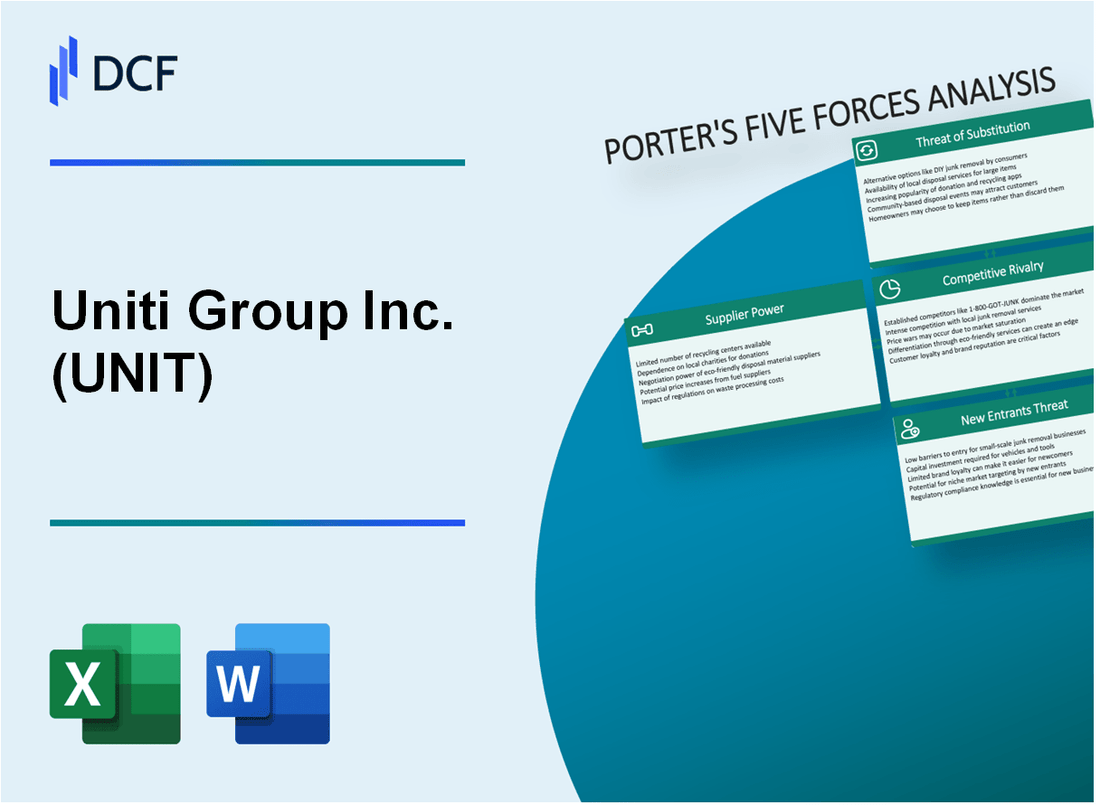

Uniti Group Inc. (UNIT): 5 Analyse des forces [Jan-2025 MISE À JOUR] |

Entièrement Modifiable: Adapté À Vos Besoins Dans Excel Ou Sheets

Conception Professionnelle: Modèles Fiables Et Conformes Aux Normes Du Secteur

Pré-Construits Pour Une Utilisation Rapide Et Efficace

Compatible MAC/PC, entièrement débloqué

Aucune Expertise N'Est Requise; Facile À Suivre

Uniti Group Inc. (UNIT) Bundle

Dans le paysage dynamique de l'infrastructure de télécommunications, Uniti Group Inc. (UNIT) navigue dans un écosystème complexe de forces concurrentielles qui façonnent son positionnement stratégique. Au fur et à mesure que l'industrie évolue avec des progrès technologiques rapides et une dynamique de marché changeant, la compréhension de l'interaction complexe de la puissance des fournisseurs, des relations avec les clients, de l'intensité concurrentielle, des substituts technologiques et des nouveaux entrants potentiels devient crucial pour les investisseurs et les observateurs de l'industrie. Cette plongée profonde dans le cadre des Five Forces de Porter révèle les défis et les opportunités nuancées qui définissent la stratégie concurrentielle du groupe Uniti en 2024, offrant un aperçu de la résilience et du potentiel de la croissance de l'entreprise dans un marché hypercompatibles des infrastructures de télécommunications.

Uniti Group Inc. (Unit) - Five Forces de Porter: Pouvoir de négociation des fournisseurs

Marché spécialisé des équipements d'infrastructure

En 2024, le marché des équipements d'infrastructure de télécommunications se caractérise par un nombre limité de fabricants spécialisés. Les fournisseurs clés comprennent:

| Fabricant | Part de marché | Équipement spécialisé |

|---|---|---|

| Commscope | 38.5% | Infrastructure à fibre optique |

| Corning | 22.7% | Câbles à fibre optique |

| Nokia | 15.3% | Équipement de tour réseau |

Composants techniques à coût élevé

Les composants des infrastructures de télécommunications nécessitent un investissement important:

- Coût du câble à fibre optique: 15 $ à 25 $ par compteur linéaire

- Coût moyen de l'équipement de la tour: 250 000 $ par installation

- Équipement de commutation réseau: 75 000 $ - 150 000 $ par unité

Dynamique de la chaîne d'approvisionnement

Les relations avec les fournisseurs du groupe Uniti sont caractérisées par:

- Contrats d'approvisionnement à long terme avec des engagements de 3 à 5 ans

- Volume annuel des achats: environ 180 millions de dollars en équipement d'infrastructure

- Concentration des vendeurs: 2-3 fournisseurs d'équipements primaires

Dépendances des fournisseurs technologiques

| Catégorie des vendeurs | Nombre de vendeurs | Niveau de dépendance |

|---|---|---|

| Infrastructure de fibre | 4 | Haut |

| Équipement réseau | 3 | Modéré |

| Technologie de la tour | 2 | Critique |

Uniti Group Inc. (Unit) - Five Forces de Porter: Poste de négociation des clients

GRANDES clients d'entreprise et de télécommunications

Depuis le quatrième trimestre 2023, Uniti Group Inc. dessert environ 45 clients de grandes entreprises et télécommunications, les 10 meilleurs clients représentant 68% des revenus totaux.

| Segment de clientèle | Nombre de clients | Contribution des revenus |

|---|---|---|

| Grandes télécommunications | 15 | 52% |

| Entreprenants | 30 | 16% |

Coûts d'investissement d'infrastructure de réseau

Les investissements dans les infrastructures de réseau d'Uniti Group ont totalisé 872 millions de dollars en 2023, créant des barrières de commutation importantes.

- Coût de remplacement du réseau de fibres: 350 $ - 500 $ par mile linéaire

- Investissement moyen d'interconnexion du centre de données: 2,3 millions de dollars par site

- Dépenses de mise à niveau des équipements de réseau: 125 millions de dollars par an

Métriques de concentration du client

L'analyse de la concentration du client révèle des dépendances critiques:

| Top client | Pourcentage de revenus | Durée du contrat |

|---|---|---|

| Windstream Holdings | 35.6% | 15 ans |

| Autres principaux clients de télécommunications | 32.4% | 10-12 ans |

Caractéristiques du contrat de service à long terme

Taille des contrats moyens pour les clients clés du groupe Uniti:

- Durée minimale du contrat: 10 ans

- Valeur du contrat annuel moyen: 18,5 millions de dollars

- Taux de renouvellement: 92% pour les clients d'entreprise

Uniti Group Inc. (Unit) - Five Forces de Porter: rivalité compétitive

Concurrence intense sur le marché des infrastructures de télécommunications

En 2024, Uniti Group Inc. est confrontée à une rivalité concurrentielle importante sur le marché des infrastructures des télécommunications. La société opère dans un paysage avec environ 23 principaux fournisseurs d'infrastructures aux États-Unis.

| Concurrent | Part de marché | Couverture réseau |

|---|---|---|

| Crown Castle International | 22.7% | 40 États |

| American Tower Corporation | 19.3% | 45 États |

| Communications SBA | 15.6% | 35 États |

| Uniti Group Inc. | 8.9% | 29 États |

Plusieurs fournisseurs d'infrastructures régionales et nationales

Le marché des infrastructures de télécommunications comprend plusieurs concurrents avec diverses capacités:

- 23 principaux fournisseurs d'infrastructures

- Valeur marchande totale estimée de 98,4 milliards de dollars en 2024

- Environ 327 000 tours de communication totales à l'échelle nationale

Tendances de consolidation de l'industrie des infrastructures de télécommunications

Les données récentes du marché indiquent des activités de consolidation importantes:

- 5 Transactions de fusion et d'acquisition majeures en 2023

- Valeur totale de la transaction de 6,2 milliards de dollars

- Taille moyenne des transactions: 1,24 milliard de dollars

Différenciation par la couverture du réseau et les capacités technologiques

| Technologie | Pourcentage de déploiement | Investissement moyen |

|---|---|---|

| Infrastructure 5G | 62.3% | 487 millions de dollars |

| Réseaux à fibre optique | 48.6% | 329 millions de dollars |

| Technologie de petite cellule | 37.2% | 214 millions de dollars |

Uniti Group Inc. est en concurrence grâce à des investissements technologiques et à des extensions de réseau stratégique, avec un investissement annuel sur l'infrastructure de 412 millions de dollars en 2024.

Uniti Group Inc. (Unit) - Five Forces de Porter: Menace des substituts

Technologies de communication sans fil et satellite émergentes

Au quatrième trimestre 2023, le marché mondial de la communication par satellite était évalué à 18,3 milliards de dollars, avec un TCAC projeté de 6,2% à 2028. La constellation de starlink de SpaceX a atteint 5 000 satellites opérationnels, offrant une couverture mondiale du large bande.

| Technologie | Taille du marché 2023 | Croissance projetée |

|---|---|---|

| Haut débit satellite | 18,3 milliards de dollars | 6,2% CAGR |

| Réseaux de faibles orbitations terrestres | 3,5 milliards de dollars | 12,5% CAGR |

Augmentation des plateformes de communication basées sur le cloud

Le marché mondial de la communication cloud a atteint 32,7 milliards de dollars en 2023, avec des fournisseurs majeurs comme Amazon Web Services, Microsoft Azure et Google Cloud offrant des solutions d'infrastructure compétitives.

- Services d'infrastructure AWS: 80,1 milliards de dollars de revenus en 2022

- Microsoft Azure: 67,5 milliards de dollars de revenus en 2022

- Google Cloud: 23,2 milliards de dollars de revenus en 2022

Alternatives potentielles d'infrastructure informatique 5G et Edge

Le marché des infrastructures 5G prévoyait de atteindre 47,8 milliards de dollars d'ici 2025, avec Edge Computing Market estimé à 15,7 milliards de dollars en 2023.

| Technologie | 2023 Taille du marché | 2025 projection |

|---|---|---|

| Infrastructure 5G | 28,5 milliards de dollars | 47,8 milliards de dollars |

| Informatique Edge | 15,7 milliards de dollars | 25,6 milliards de dollars |

Avancées technologiques en cours remettant en cause les modèles d'infrastructure traditionnels

Les tendances de substitution sans fil indiquent une perturbation importante du marché. L'investissement sur les infrastructures sans fil mobile a atteint 35,2 milliards de dollars en 2023, ce qui remet en question les infrastructures traditionnelles à ligne fixe.

- Investissement sur les infrastructures sans fil mobile: 35,2 milliards de dollars

- Déploiements de réseau privé 5G: augmentation de 47% d'une année à l'autre

- Investissement de transformation des infrastructures mondiales de télécommunications: 215 milliards de dollars en 2023

Uniti Group Inc. (Unit) - Five Forces de Porter: Menace des nouveaux entrants

Exigences de capital élevé pour les infrastructures de télécommunications

Uniti Group Inc. nécessite environ 500 à 1 à 1 milliard de dollars d'investissement en capital initial pour le déploiement des infrastructures du réseau de télécommunications.

| Catégorie d'investissement dans l'infrastructure | Plage de coûts estimés |

|---|---|

| Déploiement du réseau à fibre optique | 250 à 450 millions de dollars |

| Construction du centre de données | 150 à 300 millions de dollars |

| Équipement réseau | 100 $ - 250 millions de dollars |

Des obstacles réglementaires importants à l'entrée du marché

L'entrée du marché des télécommunications implique une conformité réglementaire complexe.

- Frais de licence FCC: 50 000 $ - 500 000 $

- Coûts d'acquisition du spectre: 10 millions de dollars - 100 millions de dollars

- Frais de documentation de conformité: 250 000 $ - 1,5 million de dollars par an

Expertise technique complexe nécessaire pour le déploiement du réseau

| Catégorie de compétences techniques | Salaire annuel moyen |

|---|---|

| Architectes réseau | $145,000 |

| Ingénieurs de télécommunications | $125,000 |

| Spécialistes de la cybersécurité | $135,000 |

Investissement initial substantiel dans les infrastructures physiques

L'investissement dans les infrastructures physiques nécessite un capital initial important.

- Infrastructure de tour: 2 à 5 millions de dollars par tour

- Installation de câble à fibre optique souterraine: 25 000 $ - 50 000 $ par mile

- Équipement de commutation: 500 000 $ à 2 millions de dollars par emplacement

Relations établies avec les principaux fournisseurs de télécommunications

Les relations de marché existantes créent des barrières d'entrée substantielles.

| Métrique relationnelle du fournisseur | Valeur |

|---|---|

| Durée du contrat moyen | 7-10 ans |

| Clauses d'exclusivité typiques | Conditions de 3 à 5 ans |

| Coûts de commutation | 5-15 millions de dollars |

Uniti Group Inc. (UNIT) - Porter's Five Forces: Competitive rivalry

The competitive rivalry facing Uniti Group Inc. is shaped by the scale achieved post-merger and a deliberate strategic pivot away from direct, head-to-head competition in the densest markets. You see, the landscape is defined by massive incumbents, but Uniti is trying to carve out its own lane as the 'premier insurgent fiber provider.'

The merger with Windstream instantly scaled the operation. The combined entity possesses approximately 240,000 fiber route miles. This scale is crucial because it allows Uniti to compete for larger, more complex wholesale and enterprise contracts, especially those driven by hyperscalers (major cloud and technology companies). The total addressable market for AI and hyperscalers is now assessed as approximately 50% higher than what was originally estimated at the beginning of the year.

Rivalry with large fiber players like Zayo, Lumen, and regional overbuilders for enterprise and wholesale contracts is managed through this scale and a focus on high-return builds. For instance, Uniti is seeing strong growth in its core fiber businesses, with Fiber Infrastructure growing 3% year-over-year in Q3 2025, and Fiber Infrastructure contribution margin expected at $770 million for the full-year 2025 outlook. The company has secured a combined Uniti and Windstream hyperscaler sales funnel representing approximately $1.5 billion in total contract value, with internal rates of return exceeding 40% on leveraging the existing network for these deals.

The intensity of rivalry in certain segments is evident, yet Uniti is taking share. In dense markets where Uniti Fiber competes, market share might be less than 10% or even less than 5%, but the segment is growing at 15% or 20%. This growth is reflected in the 13% Total Fiber Year-over-Year Revenue Growth reported in Q3 2025.

To quantify the scale and growth defining this rivalry:

| Metric | Value (Late 2025/2025 Outlook) | Context |

|---|---|---|

| Total Fiber Route Miles (Combined) | Approx. 240,000 | Instantly increased scale post-merger |

| Fiber Enabled Homes (Approx.) | Approx. 1.8 Million | Key asset for consumer and wholesale competition |

| Kinetic Consumer Fiber Revenue (2025 Target) | Approx. $500 million | Represents 25% year-over-year growth |

| Fiber Infrastructure Revenue (2025 Outlook Midpoint) | $1.1 billion | Wholesale and enterprise segment |

| Fiber ARPU Growth (YoY Q3 2025) | 10% | Indicates pricing power or better tier mix |

| Third-Party Build Crews | 115 active | Used to accelerate build and compete on deployment speed |

Intense competition exists from major cable operators overbuilding fiber in Tier II/III markets, which is a significant threat. However, Uniti is actively mitigating this by prioritizing its build-out strategy. The company is using its existing footprint to its advantage, aiming to build fiber to 3.5 million of Kinetic's 4.5 million homes by 2029.

The strategic focus on Tier II/III markets is explicitly designed to reduce direct rivalry with national Tier I fiber providers. Management has stated that Uniti is prioritizing these markets to avoid competition and improve returns. This focus is supported by operational changes:

- Market prioritization focuses on clustering for better economies of scale.

- Deprioritizing subsidized builds in denser areas.

- Accelerating construction using 115 active third-party crews, a 2.5x increase since the merger.

- Targeting a blended penetration rate of 40% across its footprint.

Still, the threat from non-fiber alternatives is present. Fixed wireless is noted as a stronger competitor than initially anticipated. This means that while fiber's reliability is a key advantage, Uniti must compete on speed of deployment and cost-effectiveness against newer, faster-to-market wireless solutions in some of its target markets.

Uniti Group Inc. (UNIT) - Porter's Five Forces: Threat of substitutes

You're assessing the competitive landscape for Uniti Group Inc. (UNIT), and the threat from substitute services, particularly wireless options, is definitely something to watch closely. These substitutes don't use Uniti Group Inc.'s physical fiber assets, but they solve the same end-user need: high-speed internet access.

5G Fixed Wireless Access (FWA) is a rapidly growing, affordable substitute, especially in the lower-density markets where Uniti Group Inc. is heavily invested. FWA leverages existing cellular networks to deliver broadband without laying new cable. As of June 2025, FWA adoption grew by 47% nationwide, reaching a total of 11.8 million subscribers across the US. You see this as a direct challenge because FWA is often cheaper; the average monthly cost for wireless internet was $72, which is $9 less than the average wired internet plan at $81. To be fair, 70% of FWA customers agree their plan is affordable, which is a strong value proposition for consumers in lower-density areas. Residential FWA is projected to capture 72% of the FWA market share in 2025.

The scale of this wireless push is significant. While the exact number for mobile operators by year-end 2025 isn't pinned down to the 'nearly 15 million' figure you mentioned, the current subscriber base is already at 11.8 million as of mid-2025. Globally, the forecast for 5G subscriptions by the end of 2025 is over 2.9 billion, with the US expected to be a key market reaching 20 million subscriptions by 2030.

Still, fiber maintains a clear technical advantage over FWA, which is critical for high-demand users. Fiber optic networks offer speeds up to 10 Gbps in some areas and boast ultra-low latency, sometimes as low as 1-5 ms. FWA, while improving, faces inherent risks related to network congestion at peak times due to reliance on shared wireless spectrum. The comparison of key performance indicators shows where the trade-offs lie for the end-user:

| Metric | Fiber Optic (Gold Standard) | 5G FWA (Representative) | Satellite (Starlink Q1 2025) |

|---|---|---|---|

| Median Download Speed | Up to 10 Gbps | Gigabit-level connections possible | 104.71 Mbps |

| Median Upload Speed | About 100 Mbps | Varies, generally lower than fiber | 14.84 Mbps |

| Median Latency (Ping) | 1-5 ms | Lower than traditional satellite, but higher than fiber | 45 ms |

Satellite broadband, like Starlink, is another viable substitute, particularly in the most remote rural areas where even FWA struggles for consistent coverage. Starlink's median download speed in Q1 2025 was 104.71 Mbps, with uploads at 14.84 Mbps, and its median latency clocked in at 45 ms. To put that in perspective for the most demanding users, only 17.4% of U.S. Starlink Speedtest users met the FCC's minimum benchmark of 100 Mbps download and 20 Mbps upload speeds as of Q1 2025. The cost structure is also different; Starlink advertises a $120-a-month residential service, and the self-installed receiver kit was priced at $349, though some state programs are now offering free equipment.

The threat from these substitutes is concentrated in specific areas, but the trend is clear:

- FWA average monthly cost is $72, cheaper than wired at $81.

- FWA nationwide adoption reached 11.8 million subscribers by June 2025.

- Starlink median latency in Q1 2025 was 45 ms.

- Fiber latency is as low as 1-5 ms.

- Fiber revenues are a growing share for Uniti Group Inc., targeting 75% fiber-based revenue by 2029.

Finance: draft a sensitivity analysis on the impact of $10 ARPU erosion in Tier III markets due to FWA competition by next Tuesday.

Uniti Group Inc. (UNIT) - Porter's Five Forces: Threat of new entrants

You're looking at how easily a new competitor could set up shop and start taking market share from Uniti Group Inc. The threat of new entrants in fiber infrastructure is usually low, but government money and new business models are changing the calculus. Let's break down the specific financial and structural factors at play as of late 2025.

Initial capital expenditure is a huge barrier, with Uniti projecting full-year 2025 Adjusted EBITDA of up to $1,100 million to support operations and growth. That scale-backed by a consolidated net CapEx expectation of around $875 million for 2025-shows the sheer financial muscle required to build a competitive footprint from scratch. Honestly, replicating Uniti Group Inc.'s existing assets, which include approximately 147,000 fiber route miles as of March 31, 2025, is a multi-billion dollar proposition that scares off most pure-play startups. Still, this high barrier is being chipped away at by external factors.

Government programs like BEAD and RDOF lower the capital barrier for new, smaller fiber builders. The Broadband Equity, Access, and Deployment (BEAD) program, with $42.45 billion in federal funding, is designed to connect the unconnected. While the NTIA shifted its policy in mid-2025 to a 'technology-neutral, lowest-cost-per-location model' away from a previous 'fiber preference,' this funding still provides massive subsidies that reduce the out-of-pocket capital requirement for any new entrant willing to navigate the new scoring rubrics. For context, fiber still holds a structural edge, as it naturally meets the performance benchmarks like 100/20 Mbps service that BEAD rewards. Here's a quick look at the funding landscape:

| Program/Metric | Associated Value (2025 Context) |

|---|---|

| Total BEAD Funding Available | $42.45 billion |

| Uniti Group Inc. Projected 2025 Adj. EBITDA | $1.1 billion |

| Uniti Group Inc. Projected 2025 Net CapEx | $875 million |

| Fiber Passes in U.S. (End of 2024) | 88.1 million homes |

Regulatory and physical barriers remain high, including difficulties with permitting and utility pole access. Getting permission to attach new fiber lines to existing utility poles can be a major time sink, often taking months or even years for permit approval. The FCC has tried to streamline this, clarifying timelines for the first 3,000 poles or 5 percent of a utility's poles in a state to speed up initial access. However, new entrants still face risks where large utilities use self-imposed safety standards that exceed national norms, forcing competitors to bear the full, often high, cost of pole replacement.

The rise of open-access network models lowers the barrier for new service providers (ISPs) to enter the market. This model, where multiple carriers share one physical fiber infrastructure, is gaining traction in the U.S. in 2025. For a new ISP, this is a game-changer because it means they can focus on marketing and service innovation rather than the massive initial capital outlay for trenching and laying fiber. This approach leads to less up-front capital investment per carrier and reduced risk. The market reflects this shift:

- Open Access Fiber market size reached $8.7 billion globally in 2024.

- Projected global growth at a CAGR of 12.4% through 2033.

- North America market size was $1.9 billion in 2024.

- Open access fosters competition at the service level.

- It helps smaller ISPs offer niche packages.

So, while building the physical fiber network is tough for a new entrant, becoming a service provider on an existing open-access network is much easier. Finance: draft 13-week cash view by Friday.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.