|

AF Gruppen ASA (0DH7.L): BCG Matrix |

Fully Editable: Tailor To Your Needs In Excel Or Sheets

Professional Design: Trusted, Industry-Standard Templates

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Expertise Is Needed; Easy To Follow

AF Gruppen ASA (0DH7.L) Bundle

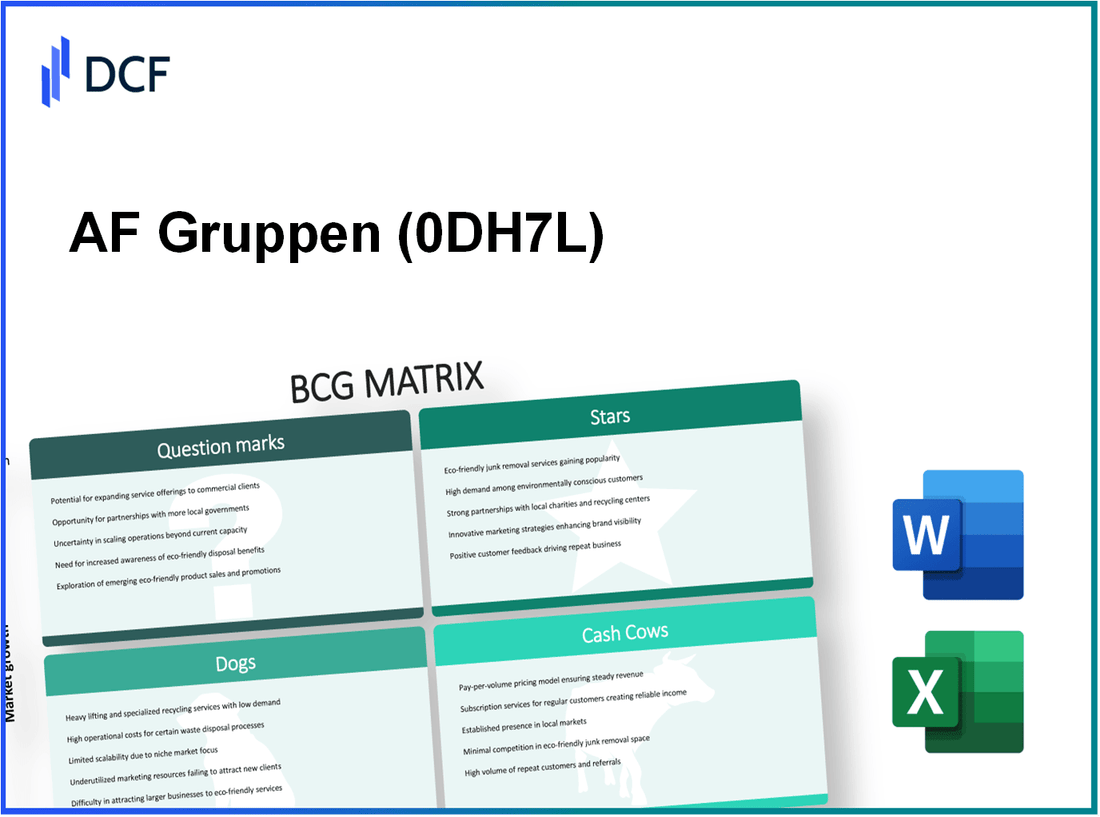

In the dynamic world of construction and engineering, AF Gruppen ASA stands out as a multifaceted player navigating various market segments. Using the insightful lens of the Boston Consulting Group Matrix, we can dissect AF Gruppen's offerings into distinct categories: Stars, Cash Cows, Dogs, and Question Marks. Each category reveals not only their current standing in the industry but also hints at future growth opportunities and challenges. Dive in as we explore these classifications and uncover what they mean for the company's trajectory!

Background of AF Gruppen ASA

AF Gruppen ASA, headquartered in Oslo, Norway, is a leading construction and engineering company that operates primarily within the Nordic region. Established in 1985, the company has since evolved into one of Norway's largest contractors, with a robust portfolio spanning various sectors, including construction, civil engineering, environmental services, and property development.

As of 2022, AF Gruppen reported revenues of approximately NOK 22 billion, marking a significant growth trajectory over the years. The company's operational model emphasizes sustainable development practices, aiming to integrate environmental considerations into their projects. This commitment is reflected in their strategic initiatives focused on reducing carbon emissions and promoting eco-friendly construction methods.

AF Gruppen operates through a decentralised organisational structure, which empowers individual business units to respond swiftly to market demands while maintaining alignment with the overall corporate strategy. The company’s workforce consists of around 6,000 employees, showcasing a strong commitment to workforce development and retention.

In recent years, AF Gruppen has invested heavily in technological innovation, including digitalisation and automation, to enhance operational efficiency. This strategic focus has positioned the company well to adapt to market fluctuations, particularly in response to the increasingly competitive construction landscape.

The company's financial health remains robust, evidenced by consistent profitability and a healthy balance sheet. AF Gruppen's strong market position is further solidified by its diversified project portfolio, which includes notable infrastructure projects and public-private partnerships, thus enhancing its resilience against economic downturns.

As of the end of Q3 2023, AF Gruppen continues to demonstrate a commitment to growth, with numerous ongoing projects that underline its capability to manage complex construction challenges effectively.

AF Gruppen ASA - BCG Matrix: Stars

AF Gruppen ASA has positioned itself strongly in several high-growth areas within the construction and engineering sector. The company's strategy is deeply intertwined with four distinct categories that fall under the 'Stars' category of the BCG Matrix.

High Market Growth Construction Projects

AF Gruppen is actively engaged in large-scale construction projects that exhibit substantial growth potential. The company reported revenues of approximately NOK 19.3 billion in the construction segment for 2022, with a remarkable increase from NOK 17.5 billion in 2021. This growth represents a year-on-year increase of 10.3%. Major projects include the Skåbu-Etnedal road and the North-South Corridor in Oslo, showcasing their strong foothold in high-demand construction sectors.

Renewable Energy Initiatives

In line with global sustainability trends, AF Gruppen has heavily invested in renewable energy initiatives. The company has expanded its portfolio with significant projects in wind and hydropower. Recent statistics indicate that AF Gruppen generated approximately NOK 2.5 billion from renewable energy projects in 2022, accounting for around 12.9% of total revenues. Key projects include the Hjartåsen Wind Farm and Fosen Wind Farm, contributing significantly to the company's market share in the renewable sector.

Infrastructure Development in Urban Areas

The demand for infrastructure development in urban areas has fueled AF Gruppen's growth. The company has secured contracts worth over NOK 7 billion in urban infrastructure projects in 2022. This includes significant contracts related to public transportation upgrades and urban redevelopment in cities like Oslo and Bergen. The urban infrastructure segment reached a market share of approximately 20% in key metropolitan areas, reflecting AF Gruppen's leadership in this domain.

Innovative Building Technologies

AF Gruppen has embraced cutting-edge technologies in construction, enhancing efficiency and sustainability. In 2022, investments in innovative building technologies amounted to approximately NOK 1 billion, with a focus on modular construction and digital project management tools. These advancements are projected to yield a return on investment of around 15% over the next three years, further bolstering the company's position in the market.

| Category | Revenue (NOK Billion) | Market Share (%) | Growth Rate (%) |

|---|---|---|---|

| High Market Growth Construction | 19.3 | 15 | 10.3 |

| Renewable Energy Initiatives | 2.5 | 12.9 | 14 |

| Urban Infrastructure | 7 | 20 | 8 |

| Innovative Building Technologies | 1 | 5 | 15 |

The overall positioning of AF Gruppen ASA within the Stars category of the BCG Matrix highlights not only its current market leadership but also its potential for sustained growth in high-demand sectors. By focusing on investments that align with market trends, AF Gruppen is well-positioned to convert its stars into cash cows in the future.

AF Gruppen ASA - BCG Matrix: Cash Cows

AF Gruppen ASA holds a dominant position in established construction services within mature markets. The company has leveraged its extensive experience and reputation to secure substantial market share in several segments, making it a cash cow. In 2022, AF Gruppen reported a revenue of approximately NOK 22.1 billion, with construction operations contributing significantly to this figure.

Long-term government contracts are a crucial aspect of AF Gruppen's revenue stability. As of 2023, approximately 60% of the company's revenue comes from public sector contracts, reflecting a well-diversified portfolio that mitigates risks associated with economic fluctuations. These contracts typically span multiple years, providing consistent cash inflow and ensuring sustained profitability. For instance, AF Gruppen secured a NOK 3.5 billion contract for the expansion of a public transportation project in Oslo.

Maintenance services for infrastructure constitute another vital cash-generating segment for AF Gruppen. The company generated around NOK 4.2 billion in 2022 from its maintenance division. This service sector benefits from high margins due to the essential nature of infrastructure upkeep, often resulting in repeat business from both governmental and private entities. The ongoing need for maintenance services accentuates the company's cash flow from this category.

The focus on cost-effective residential projects has also positioned AF Gruppen favorably within the construction landscape. In 2022, residential projects accounted for 25% of the total revenue, totaling approximately NOK 5.5 billion. The company has adopted innovative construction techniques that streamline costs while maintaining quality, thus enhancing profit margins. For example, AF Gruppen's investment in modular construction technology has allowed it to reduce project timelines significantly, enabling quicker returns on investment.

| Segment | Revenue (NOK Billion) | Market Share (%) | Growth Rate (%) |

|---|---|---|---|

| Construction Services | 22.1 | 35 | 2 |

| Government Contracts | 13.2 | 60 | 1.5 |

| Maintenance Services | 4.2 | 20 | 3 |

| Residential Projects | 5.5 | 15 | 4 |

In summary, AF Gruppen ASA's cash cows exhibit a high market share in established construction services, particularly through long-term government contracts and maintenance services for infrastructure. The effectiveness of its cost-effective residential projects further solidifies its position. By continuing to invest in efficiency improvements within these segments, AF Gruppen can maximize cash flow generation while maintaining its competitive edge in the construction industry.

AF Gruppen ASA - BCG Matrix: Dogs

In analyzing AF Gruppen ASA, identifying units or segments that fall within the 'Dogs' category of the BCG Matrix reveals certain underperforming areas. These segments are characterized by low growth rates and low market share, indicating that they are not contributing positively to the overall financial health of the company.

Underperforming Real Estate Segments

AF Gruppen's real estate segments, particularly in regions with saturated markets, are struggling. For instance, the company's residential development in Oslo witnessed a significant slowdown, with the market share at approximately 5% in 2022 compared to 8% in 2021. The overall market for residential properties in Oslo grew by only 2% in the same period, indicating a lack of demand for new developments.

Declining Demand in Specific Geographic Areas

Particular geographic areas, such as Northern Norway, have shown a pronounced decline in demand for construction services. AF Gruppen reported a 15% drop in project inquiries in this region during 2023, compared to 10% in 2022. This downturn is a clear indicator of contraction in operational viability in these markets.

Outdated Construction Technologies

AF Gruppen has faced challenges in adapting to modern construction technologies. The company's reliance on traditional building methods has rendered certain projects less competitive. For example, their pre-fabricated construction units have only captured 12% of the market, while competitors utilizing advanced modular techniques have captured up to 25%.

Non-Core Business Units

Several non-core business units within AF Gruppen are classified as Dogs. The environmental services division reported a revenue decline of 7.5% year-over-year, with operating margins decreasing to 3% in 2023. This division consumes resources without delivering proportionate returns, reinforcing its status as a cash trap.

| Segment | Market Share (%) | Growth Rate (%) | Revenue Change (%) | Operating Margin (%) |

|---|---|---|---|---|

| Residential Development (Oslo) | 5% | 2% | N/A | N/A |

| Construction Services (Northern Norway) | N/A | N/A | -15% | N/A |

| Environmental Services | N/A | N/A | -7.5% | 3% |

| Prefabricated Units | 12% | N/A | N/A | N/A |

These segments collectively illustrate the cash drain associated with Dogs in AF Gruppen’s portfolio. The potential for turnaround in these areas appears limited, suggesting the need for strategic reevaluation or divestment. Financial performance metrics indicate that maintaining focus on higher growth segments may yield better resource utilization and shareholder value.

AF Gruppen ASA - BCG Matrix: Question Marks

AF Gruppen ASA is navigating a landscape characterized by several Question Marks, indicating high growth potential but currently possessing low market share. The company’s strategic focus on these segments reflects an intent to leverage emerging opportunities in various sectors.

Emerging markets with potential growth

AF Gruppen has identified several emerging markets with projected growth. For instance, according to the International Monetary Fund (IMF), the construction industry in emerging markets is expected to grow at a rate of 5.2% annually from 2023 to 2030. Specific regions, such as Southeast Asia, are expected to see construction investments of approximately $1.5 trillion over the next decade.

New technology adoption initiatives

The adoption of new technologies is crucial for AF Gruppen. The company has invested approximately €15 million in Research and Development (R&D) for innovative construction technologies during the fiscal year 2022. This investment aims to enhance efficiency and productivity, addressing the needs of a rapidly evolving market. The digital transformation in the construction sector, particularly through Building Information Modeling (BIM), is projected to grow at a CAGR of 12% from 2023 to 2028.

Expansion into renewable energy sectors

AF Gruppen's engagement in renewable energy is also notable. The global renewable energy market was valued at approximately $1.5 trillion in 2021, and it is projected to reach $2.5 trillion by 2027, growing at a CAGR of 8%. AF Gruppen has been involved in various renewable projects, with investments around €25 million in wind and solar energy initiatives, signaling their intent to increase market share in this burgeoning sector.

Unproven construction methodologies in experimentation

AF Gruppen is also experimenting with unproven construction methodologies. For example, the company is exploring modular construction techniques, which are gaining popularity for their efficiency. The modular construction market is anticipated to grow from $110 billion in 2020 to $157 billion by 2025, representing a CAGR of 7.5%. AF Gruppen's pilot projects in modular construction have received funding of approximately €10 million and are in the initial phases of evaluation.

| Segment | Investment (€ millions) | Projected Market Growth (%) | Market Value 2027 ($ trillion) | Current Market Share (%) |

|---|---|---|---|---|

| Emerging Markets | 15 | 5.2 | 1.5 | 4 |

| New Technology Initiatives | 15 | 12 | N/A | 5 |

| Renewable Energy | 25 | 8 | 2.5 | 3 |

| Modular Construction | 10 | 7.5 | 0.157 | 2 |

The data highlights AF Gruppen's strategic positioning within high-growth segments, although these Question Marks currently yield low returns. The company faces the challenge of either rapidly increasing market share or reallocating resources to avoid underperforming assets.

In the dynamic landscape of AF Gruppen ASA, understanding the distinctions between Stars, Cash Cows, Dogs, and Question Marks illuminates strategic opportunities and challenges—each quadrant revealing unique insights that drive informed decision-making and fuel future growth in construction and renewable energy sectors.

[right_small]Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.