|

AIB Group plc (A5G.IR): BCG Matrix |

Fully Editable: Tailor To Your Needs In Excel Or Sheets

Professional Design: Trusted, Industry-Standard Templates

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Expertise Is Needed; Easy To Follow

AIB Group plc (A5G.IR) Bundle

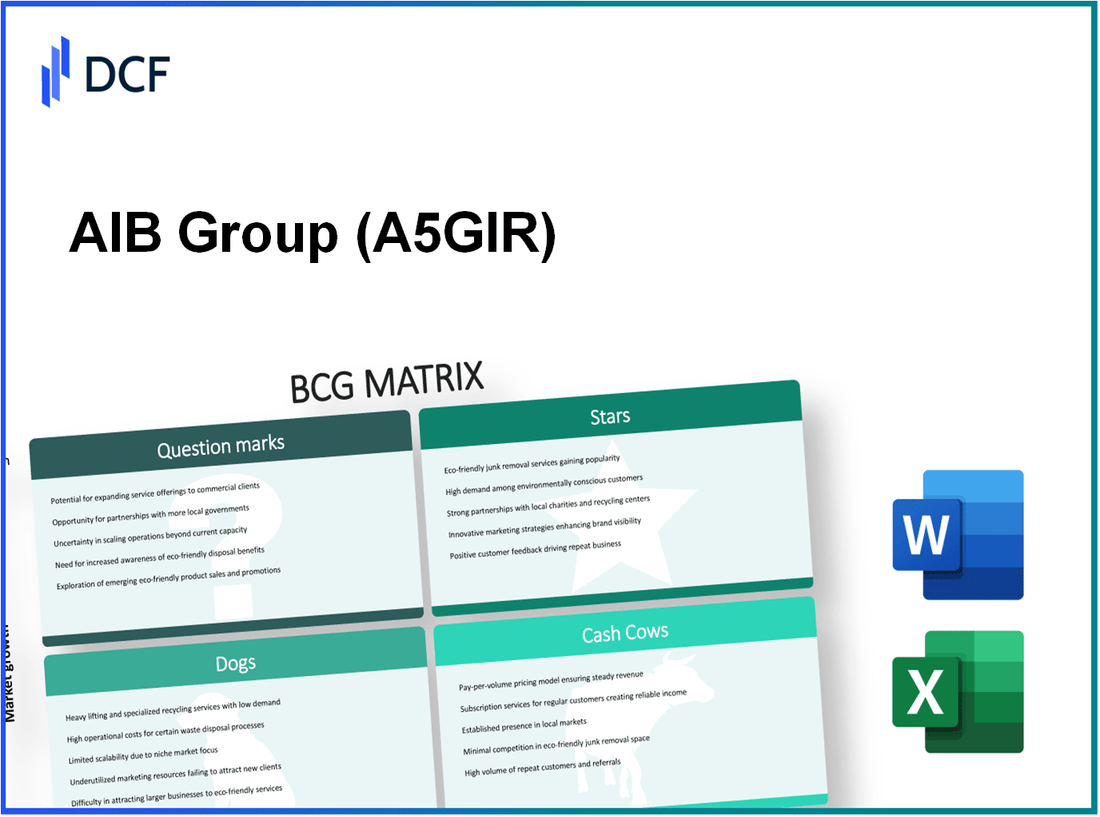

The Boston Consulting Group Matrix offers a powerful framework to analyze AIB Group plc's diverse business segments, categorizing them into Stars, Cash Cows, Dogs, and Question Marks. From cutting-edge digital banking innovations to traditional branch services facing decline, each quadrant reveals unique insights about the bank's strategic positioning and future potential. Dive deeper to explore how AIB's offerings stack up in this competitive landscape and what it means for investors and customers alike.

Background of AIB Group plc

AIB Group plc is a prominent financial services provider based in Ireland, specializing in banking and related financial services. Established in 1966, the company has grown significantly, becoming one of Ireland's leading banks. As of 2023, AIB operates a vast network, with over 200 branches across Ireland, catering to various customer segments including personal, business, and corporate clients.

In recent years, AIB has focused on digital transformation, aiming to enhance customer experience through innovative technology. The bank launched several digital banking solutions, significantly increasing its online customer base. For instance, as of Q2 2023, the digital banking platform recorded over 1.6 million users, illustrating a shift in consumer preferences towards online services.

Financially, AIB reported a strong performance in its latest earnings report for FY 2022, with a net profit of €1.3 billion, representing a 49% increase from the previous year. This growth was attributed to improved net interest margins and a reduction in loan impairment charges. The bank's focus on operational efficiency and cost management contributed substantially to this uptick in profitability.

AIB's balance sheet reflects a solid capital position, with a Common Equity Tier 1 (CET1) ratio of 14.5%, well above the regulatory requirements, indicating a robust buffer against potential losses. Furthermore, the bank has resumed dividend payments, declaring a dividend of €0.10 per share in 2023, signaling confidence in sustainable profitability and shareholder returns.

On the market front, AIB Group plc is listed on the Euronext Dublin and has a notable presence in the FTSE index. Its stock has seen fluctuations, with a current market capitalization of approximately €7.5 billion. The stock price reflects investor sentiment, influenced by macroeconomic factors and the broader banking sector's performance across Europe.

Overall, AIB Group plc continues to navigate the evolving financial landscape, leveraging its market position and technological advancements to cater to the growing needs of its customers.

AIB Group plc - BCG Matrix: Stars

The AIB Group plc has demonstrated significant strengths in various segments, particularly its digital banking services. As of 2023, AIB reported approximately 41% of its total transactions were completed through digital channels, indicating a robust adoption of online banking solutions among its customer base.

Digital Banking Services

AIB's digital initiatives have led to substantial growth. The total number of active digital banking users reached 1.2 million in Q2 2023, which is an increase of 15% year-over-year. The bank's investment in its digital infrastructure has positioned it effectively in a high-growth market, allowing it to capture significant market share.

Mobile App Features

The AIB mobile banking app has received high customer ratings, averaging 4.5 stars on both Android and iOS platforms. In 2023, the app recorded over 500,000 downloads, reflecting its growing popularity. Features like biometric login, instant payments, and budget management tools cater to a tech-savvy customer segment and enhance user retention.

Customer Experience Enhancements

In a bid to provide superior customer service, AIB has implemented various enhancements. In 2023, customer satisfaction scores indicated an impressive 85% satisfaction rate, a rise from 80% the previous year. The bank invested €25 million in improving customer service channels, including chatbots and personalized customer interactions, thereby fostering loyalty.

Online Customer Acquisition

AIB's online marketing strategies have translated into effective customer acquisition. The bank reported acquiring approximately 200,000 new customers in 2023 through its online campaigns, which is a 20% increase compared to 166,000 new customers in 2022. This aligns with AIB's focus on expanding its reach in the digital market.

| Metric | 2022 | 2023 | Change (%) |

|---|---|---|---|

| Active digital banking users | 1.04 million | 1.2 million | 15% |

| Customer satisfaction rate | 80% | 85% | 6.25% |

| New online customers acquired | 166,000 | 200,000 | 20.5% |

| App download count | 350,000 | 500,000 | 42.86% |

| Investment in customer service enhancements | €20 million | €25 million | 25% |

AIB Group plc - BCG Matrix: Cash Cows

AIB Group plc has established a strong position in the financial services market, particularly through its cash cow products. These offerings generate substantial cash flow due to their high market share in mature sectors. Below is a detailed analysis of the cash cow segments.

Mortgage Products

AIB's mortgage products maintain a robust share of the Irish mortgage market. As of Q2 2023, AIB’s mortgage market share was approximately 29%, solidifying its position as a leader in this segment. The total lending in residential mortgages reached around €30 billion, contributing significantly to the bank’s annual profitability.

Personal Loans

The personal loan segment is another cash cow for AIB. As of December 2022, personal lending totaled approximately €5.3 billion, marking a consistent growth trajectory. AIB reported a 7% year-over-year increase in personal loan applications, showcasing strong demand within a mature market. The return on equity (ROE) from this segment is estimated at around 12%, reflecting healthy profit margins.

Business Banking Services

AIB's business banking services have established a significant presence in the market, with a market share of approximately 25% in Irish business loans. As of 2023, the division reported total business loans of around €14 billion. AIB is focused on enhancing its service offerings, leading to a projected 10% increase in cash flow from this segment over the next fiscal year. The operating profit margin for the business banking unit stands at about 40%, indicating a solid cash generation capability.

Deposit Accounts

Deposit accounts represent a critical cash cow for AIB, with a total deposit base exceeding €65 billion as of Q1 2023. This segment accounts for approximately 30% of all deposits in the Irish banking sector. The average interest rate on deposits is around 0.1%, leading to a net interest margin (NIM) of about 1.5%, which is considerably higher than the industry average. AIB's ability to attract and retain depositors enables it to fund its lending activities effectively.

| Segment | Market Share | Loan Amount (€ billion) | Annual Growth (%) | Return on Equity (%) | Profit Margin (%) |

|---|---|---|---|---|---|

| Mortgage Products | 29% | 30 | - | - | - |

| Personal Loans | - | 5.3 | 7% | 12% | - |

| Business Banking Services | 25% | 14 | 10% (Project) | - | 40% |

| Deposit Accounts | 30% | 65 | - | - | 1.5% |

In summary, AIB Group plc's cash cows play a vital role in the company’s overall financial structure. These products not only generate significant cash flow but also provide stability in a competitive banking environment.

AIB Group plc - BCG Matrix: Dogs

Within AIB Group plc, certain business units can be classified as 'Dogs.' These units present characteristics associated with low market share and low growth potential. This categorization highlights areas that may require strategic reassessment.

Traditional Branch Services

AIB Group has been adapting to the shift toward digital banking. As of 2023, traditional branch services accounted for approximately 20% of total banking transactions, a significant decrease from 40% in 2018. The decline in foot traffic has led to reduced revenues from this segment, with annual revenue contribution dropping to €150 million in 2022 from €300 million in 2019.

Paper-based Banking Solutions

Paper-based banking products, such as cheques and physical statements, are increasingly viewed as outdated. In 2023, AIB reported a 30% decrease in the use of paper statements compared to the previous year, with only 5% of transactions being paper-based. This shift reflects a wider trend, as the cost to maintain these services was around €20 million annually, yielding minimal return on investment.

Some Legacy IT Systems

AIB's legacy IT systems have become a significant burden. In 2022, the operational costs associated with maintaining these systems reached approximately €100 million, accounting for 15% of the overall IT budget. Upgrading or replacing these systems could require an estimated €250 million in capital investment, with a projected return on investment that remains uncertain.

Outdated Marketing Channels

Marketing efforts focused on traditional channels such as print advertising and direct mail have proven ineffective. In 2023, AIB reported that these channels generated a mere 3% of new customer acquisitions, with annual spend on these channels at about €10 million. Conversion rates from these efforts have plummeted to below 1%, demonstrating the need for a strategic pivot towards digital marketing.

| Segment | Key Metrics | Financial Impact |

|---|---|---|

| Traditional Branch Services | 20% of transactions | Revenue contribution: €150 million |

| Paper-based Banking Solutions | 30% decrease in usage | Annual cost: €20 million |

| Legacy IT Systems | 15% of IT budget | Maintenance costs: €100 million |

| Outdated Marketing Channels | 3% of new acquisitions | Annual spend: €10 million |

AIB Group plc - BCG Matrix: Question Marks

In examining AIB Group plc's positioning within the BCG Matrix, the category of Question Marks highlights areas with potential growth yet currently low market share. These segments have significant implications for the bank's strategic direction.

Fintech Collaborations

AIB Group has entered multiple fintech collaborations aimed at enhancing digital banking services. For instance, their partnership with fintech company Plaid in 2021 aimed to improve customer experience by integrating banking services with various apps. As of mid-2023, approximately 5% of new banking transactions were processed through these fintech integrations. However, this percentage indicates a low market penetration compared to traditional banking solutions.

Cryptocurrency Services

AIB has shown increased interest in cryptocurrency services in response to growing market demand. In 2023, the global cryptocurrency market capitalization reached $1.1 trillion, reflecting a growth of 12% year-over-year. AIB's position in this sector remains nascent, with only 1.2% of its customer base actively participating in crypto transactions through the bank. The low adoption rate signifies a potential growth opportunity, but also high initial costs associated with regulatory compliance and infrastructure development.

International Expansion Efforts

AIB Group's international expansion strategy is focused on increasing its footprint across Europe and the US. As of 2023, AIB reported a 15% increase in international assets, totaling €5 billion. Despite this growth, the bank holds only a 2.5% market share in these regions relative to larger competitors like HSBC and Barclays, indicating a critical need for investment to accelerate growth and capture market share.

Green Financing Products

The demand for sustainable finance is on the rise, with AIB developing green financing products to cater to this growing market. In 2022, green loans issued amounted to €1 billion, a significant jump from €300 million in 2021. However, this still represents less than 3% of AIB's total loan portfolio. The European green bond market reached €500 billion in issuance by mid-2023, illustrating the substantial opportunity AIB has in capturing a larger share of this segment.

| Segment | Current Market Share | Growth Rate | Investment Required |

|---|---|---|---|

| Fintech Collaborations | 5% | - | €50 million |

| Cryptocurrency Services | 1.2% | 12% | €30 million |

| International Expansion | 2.5% | 15% | €100 million |

| Green Financing Products | 3% | - | €20 million |

The BCG Matrix provides a clear framework for AIB Group plc to evaluate its strategic position in a rapidly evolving financial landscape, highlighting its strong digital initiatives as Stars, the robust performance of established offerings as Cash Cows, the challenges posed by Dogs, and the potential for growth in Question Marks. By leveraging these insights, AIB can navigate the complexities of modern banking and align its resources effectively to ensure sustainable growth and competitive advantage.

[right_small]Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.