|

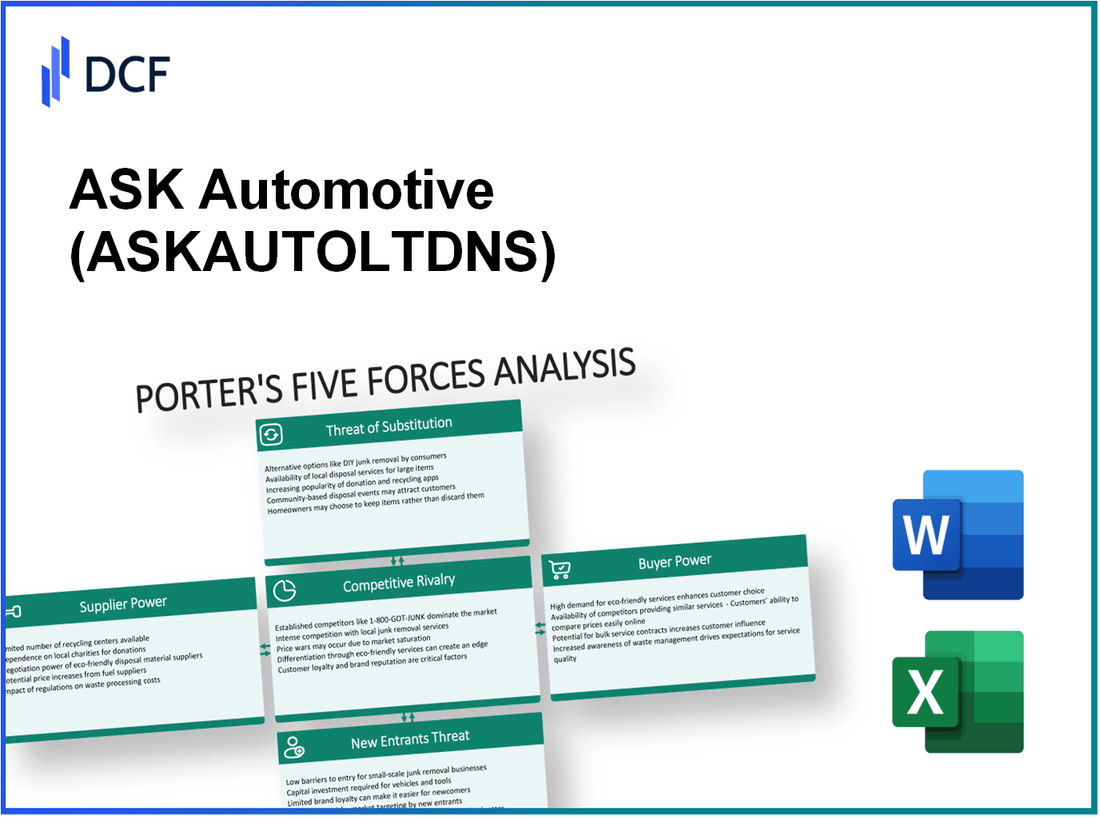

ASK Automotive Limited (ASKAUTOLTD.NS): Porter's 5 Forces Analysis |

Fully Editable: Tailor To Your Needs In Excel Or Sheets

Professional Design: Trusted, Industry-Standard Templates

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Expertise Is Needed; Easy To Follow

ASK Automotive Limited (ASKAUTOLTD.NS) Bundle

The automotive industry is a landscape of constant evolution, where companies like ASK Automotive Limited navigate complex market forces to thrive. Understanding the dynamics of Michael Porter’s Five Forces—bargaining power of suppliers, bargaining power of customers, competitive rivalry, threat of substitutes, and threat of new entrants—can provide deep insights into the challenges and opportunities facing the business. Discover how these forces shape ASK Automotive's strategy and market positioning below.

ASK Automotive Limited - Porter's Five Forces: Bargaining power of suppliers

The bargaining power of suppliers is a critical factor in assessing the competitive dynamics within the automotive parts industry, particularly for a company like ASK Automotive Limited. Various elements contribute to the strength of supplier power in this market.

Dependence on few key suppliers

ASK Automotive Limited relies on a limited number of suppliers for essential components. For instance, as of 2022, approximately 60% of ASK's raw materials were sourced from just three key suppliers. This concentration increases the vulnerability of the company to price changes and supply disruptions.

Limited alternative sources for specialized components

The market for specialized automotive components is niche, with limited suppliers able to meet specific quality and technical requirements. For example, components such as high-performance automotive filters are predominantly supplied by two key manufacturers, making it challenging for ASK to switch suppliers without incurring significant costs or delays.

Potential for supplier consolidation

The trend of supplier consolidation further exacerbates the bargaining power of suppliers. Reports indicate that the top 10 suppliers in the automotive sector accounted for 70% of the market share in 2023. This consolidation limits ASK’s options and gives existing suppliers more leverage in negotiations.

Impact of raw material price fluctuations

Raw material prices have exhibited high volatility, impacting the overall cost structure for ASK Automotive. In 2023, the average cost of steel, a primary input, surged by 15% compared to the previous year, significantly impacting profit margins. This volatility places suppliers in a strong position to increase prices as they adjust to market conditions.

Suppliers' ability to integrate forward into manufacturing

Many of ASK's suppliers have the capability to integrate vertically into manufacturing. This is evident in the increasing number of suppliers that have begun to establish manufacturing units, potentially encroaching on areas traditionally dominated by companies like ASK. In 2023, 25% of suppliers reported plans to expand their operations into direct manufacturing, further increasing their bargaining power.

| Factor | Details |

|---|---|

| Dependence on Key Suppliers | 60% of materials from three suppliers |

| Limited Alternatives | Two manufacturers dominate specialized components |

| Supplier Consolidation | Top 10 suppliers hold 70% market share |

| Raw Material Price Fluctuations | Steel prices increased by 15% in 2023 |

| Forward Integration | 25% of suppliers plan to move into manufacturing |

ASK Automotive Limited - Porter's Five Forces: Bargaining power of customers

The bargaining power of customers in the automotive parts industry is notably significant, primarily due to the diverse customer base and fluctuating market dynamics.

Wide range of automotive customers

ASK Automotive Limited serves a wide variety of customers, including large automotive manufacturers and smaller automotive firms. This diversified customer base allows for a larger market share but also increases competitive pressure as each customer segment may have differing demands and expectations.

High price sensitivity among OEMs

Original Equipment Manufacturers (OEMs) exhibit high price sensitivity. According to a report by IHS Markit, in 2022, the average profit margins for automotive manufacturers ranged from 5% to 10%. This narrow margin compels OEMs to seek cost-effective suppliers, thereby intensifying their negotiating power over suppliers like ASK Automotive.

Availability of alternative part suppliers

The automotive components market is characterized by numerous alternative suppliers, enhancing buyer power. As of 2023, there were approximately 16,000 automotive parts suppliers globally. The presence of these alternatives significantly empowers customers to negotiate better pricing and terms. A comparative analysis illustrates that price competition can reduce component pricing by up to 20% in certain segments.

| Year | Number of Suppliers | Price Reduction (%) |

|---|---|---|

| 2021 | 15,500 | 15% |

| 2022 | 16,000 | 20% |

| 2023 | 16,200 | 25% |

Importance of product quality and reliability

While price plays a critical role, the importance of product quality and reliability cannot be overstated. According to a 2023 survey by J.D. Power, 67% of automotive manufacturers cited quality as a primary concern when selecting suppliers. The automotive sector invests heavily in quality control—Ford, for example, has increased its quality assurance budget by 15% in the last fiscal year, underscoring the weight of quality in purchase decisions.

Customers' ability to backward integrate

Many automotive manufacturers possess the financial strength to backward integrate, which further enhances their bargaining power. A 2023 analysis by Deloitte highlights that approximately 30% of OEMs are exploring vertical integration strategies to produce critical parts in-house. This trend creates an additional layer of pressure on suppliers like ASK Automotive to innovate and offer competitive pricing.

Overall, the bargaining power of customers in the automotive industry is influenced by several factors, including the wide range of manufacturers, high price sensitivity, availability of alternatives, quality expectations, and the potential for vertical integration. These dynamics require ASK Automotive to engage actively in maintaining competitiveness while ensuring quality and reliability in its offerings.

ASK Automotive Limited - Porter's Five Forces: Competitive rivalry

ASK Automotive Limited operates in a highly competitive environment characterized by the presence of numerous domestic and international competitors. As of 2022, the global automotive parts market was valued at approximately $1.4 trillion and is projected to grow at a CAGR of 4.5% from 2023 to 2030. Key players include companies such as Bosch, Denso, and Delphi Technologies, which collectively hold significant market share, intensifying competition.

The industry exhibits low product differentiation in auto components, which further escalates competitive rivalry. Most automotive parts, such as filters, brake systems, and electrical components, have comparable functionality across different brands. This lack of differentiation leads to price-based competition, making it challenging for ASK Automotive to command premium pricing for its products.

High fixed costs are prevalent in the automotive parts sector, with manufacturing facilities requiring substantial initial investments. For instance, the capital expenditure for setting up an automotive component manufacturing plant can range from $10 million to $150 million based on capacity and technology employed. Such fixed costs compel companies to maximize production efficiency and volume to achieve profitability, thereby increasing competitive pressure to fill production quotas.

Aggressive pricing strategies are commonly employed by competitors to capture market share. In recent years, discounting and promotional strategies have become more pronounced. Reports indicate that price competition for certain components has reduced profit margins to around 3%-5% for suppliers like ASK Automotive, influencing strategic pricing decisions.

Innovation plays a crucial role in maintaining a competitive edge in the automotive components sector. Companies are regularly updating their product offerings to meet evolving consumer and regulatory demands. For instance, the rapid shift towards electric vehicles (EVs) has prompted numerous manufacturers to innovate in battery management systems, with investments in R&D expected to exceed $100 billion globally by 2025. ASK Automotive's ability to adapt to these innovations directly impacts its competitive standing.

| Factor | Details |

|---|---|

| Competitors | Key players include Bosch, Denso, Delphi Technologies, Valeo |

| Market Size | Global automotive parts market: $1.4 trillion |

| Growth Rate | Market projected CAGR: 4.5% (2023-2030) |

| Fixed Costs | Capital expenditure for manufacturing plant: $10 million to $150 million |

| Profit Margins | Profit margins in components: 3%-5% |

| R&D Investment | Global investment in EV-related R&D: > $100 billion by 2025 |

In conclusion, ASK Automotive Limited faces intense competitive rivalry due to numerous players, low product differentiation, high fixed costs, aggressive pricing tactics, and the need for constant innovation. These forces collectively shape the strategic landscape in which the company operates.

ASK Automotive Limited - Porter's Five Forces: Threat of substitutes

The threat of substitutes for ASK Automotive Limited is significant due to several factors affecting the automotive parts industry.

Potential use of alternative materials

Recent industry trends have shown a shift towards alternative materials such as composites and plastics, which can replace traditional metals in automotive components. For instance, the global composite materials market was valued at approximately $31.7 billion in 2021 and is expected to reach $54.6 billion by 2027, according to Mordor Intelligence.

Advancements in technology reducing reliance on traditional components

Technological advancements, particularly in manufacturing processes such as 3D printing, have enabled the creation of parts that can easily substitute traditional components. The global 3D printing market for automotive applications is projected to grow from $1.2 billion in 2022 to $6 billion by 2027, witnessing a CAGR of approximately 39% (Mordor Intelligence).

Possible shift to electric vehicle-specific parts

With the increasing adoption of electric vehicles (EVs), there is a growing demand for EV-specific components. In 2022, global electric vehicle sales reached 10.5 million units, reflecting a 55% increase from 2021. As a result, conventional auto parts may face substitution by EV-specific parts which could capture a significant market share, influencing purchasing decisions for consumers.

Cost-effectiveness of substitute imports

The importation of substitute automotive components has also become more viable due to cost advantages. According to the International Trade Centre, the global import value of automotive parts reached approximately $1 trillion in 2022, with countries like China, Mexico, and Germany being major suppliers. The potential for lower prices from these substitutes could lead customers to opt for imported alternatives instead of domestic products.

| Year | Global Composite Market Value (USD) | 3D Printing Market Value (Automotive) (USD) | EV Sales (Units) | Global Import Value of Automotive Parts (USD) |

|---|---|---|---|---|

| 2021 | 31.7 billion | N/A | N/A | N/A |

| 2022 | N/A | 1.2 billion | 10.5 million | 1 trillion |

| 2027 | 54.6 billion | 6 billion | N/A | N/A |

These factors highlight the strategic importance of monitoring substitute threats as they can significantly impact ASK Automotive Limited's market position and pricing strategies.

ASK Automotive Limited - Porter's Five Forces: Threat of new entrants

The threat of new entrants in the automotive manufacturing sector presents unique challenges and opportunities. Various factors influence this dynamic, particularly for companies like ASK Automotive Limited.

High capital investment required for manufacturing setups

Establishing a manufacturing facility demands substantial capital. The average cost for setting up a new automotive plant can exceed $1 billion. This includes machinery, technology, land acquisition, and facility construction. Additionally, ongoing operational costs can further deter potential entrants.

Strong brand loyalty among existing customers

In the automotive industry, brand loyalty is a critical factor. Companies like ASK Automotive benefit from long-standing relationships and trust built over years. Customer retention rates for established brands can be as high as 75%, creating a barrier for new entrants who must invest significantly in marketing to gain a foothold in the market.

Established distribution networks and relationships

Existing companies have well-developed distribution channels, often secured through long-term contracts with suppliers and dealers. For instance, ASK Automotive has a network of over 200 distributors in India alone, making it challenging for newcomers to navigate and penetrate this established ecosystem.

Economies of scale achieved by incumbents

Incumbent firms typically benefit from economies of scale, reducing their per-unit costs as production levels increase. For example, larger manufacturers can have production costs up to 20%-30% lower than those of new entrants, due to bulk purchasing and optimized production techniques.

Regulatory compliance barriers in automotive manufacturing

The automotive industry is heavily regulated. Compliance with emission standards, safety regulations, and quality certifications requires significant time and financial resources. In 2022, the average cost of compliance-related activities for automotive manufacturers in India was estimated at $50 million annually. These barriers serve to deter new entrants wary of the financial and logistical implications.

| Factor | Impact on New Entrants | Estimated Cost/Percentage |

|---|---|---|

| Capital Investment | High initial setup challenge | $1 billion+ |

| Brand Loyalty | High retention rates | 75% |

| Distribution Networks | Existing strong relationships | 200 distributors in India |

| Economies of Scale | Lower production costs for incumbents | 20%-30% lower |

| Regulatory Compliance | High ongoing costs and bureaucracy | $50 million/year |

In summary, the threat of new entrants for ASK Automotive Limited is mitigated by substantial capital requirements, strong customer loyalty, established distribution relationships, economies of scale, and regulatory barriers, all of which collectively protect the company’s market position.

In the dynamic landscape of the automotive industry, ASK Automotive Limited navigates significant challenges and opportunities through Porter's Five Forces, from managing the intricate relationships with suppliers to addressing the competition's fierce rivalry, all while adapting to evolving customer demands and potential substitutes. Understanding these forces provides a strategic lens to evaluate the company's position and future growth prospects within a rapidly changing marketplace.

[right_small]Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.