|

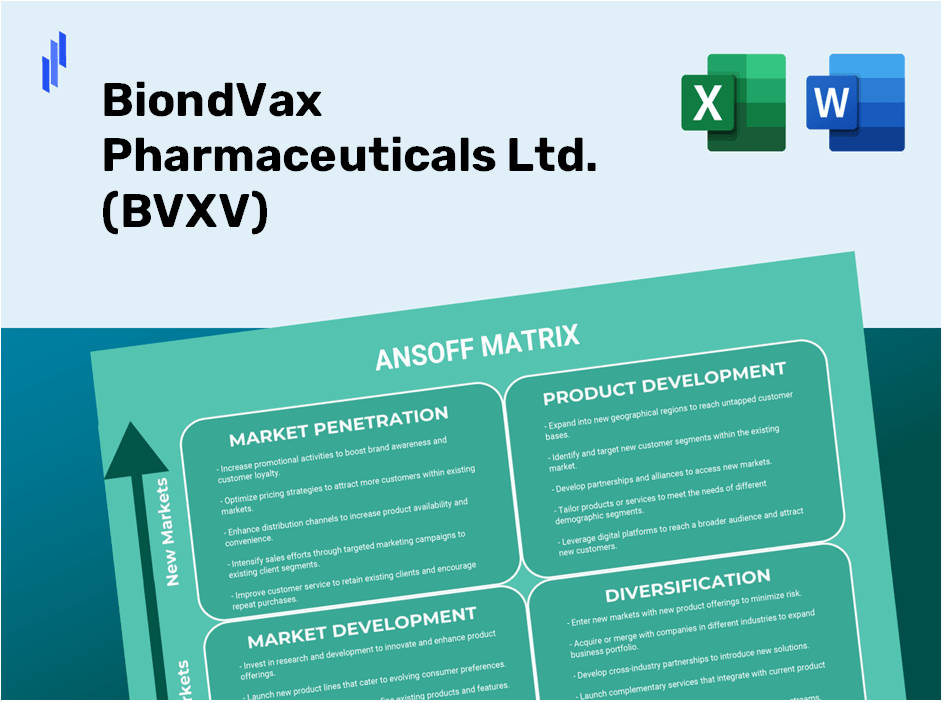

BiondVax Pharmaceuticals Ltd. (BVXV): ANSOFF Matrix Analysis |

Fully Editable: Tailor To Your Needs In Excel Or Sheets

Professional Design: Trusted, Industry-Standard Templates

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Expertise Is Needed; Easy To Follow

BiondVax Pharmaceuticals Ltd. (BVXV) Bundle

In the fast-paced world of pharmaceuticals, strategic growth is key to staying ahead. The Ansoff Matrix provides a clear framework for decision-makers at BiondVax Pharmaceuticals Ltd. (BVXV) to evaluate opportunities across four critical areas: Market Penetration, Market Development, Product Development, and Diversification. Each strategy offers unique pathways to enhance competitiveness and address evolving market demands. Dive in to uncover actionable insights that can drive your next big move in this dynamic industry.

BiondVax Pharmaceuticals Ltd. (BVXV) - Ansoff Matrix: Market Penetration

Increase brand awareness through targeted marketing campaigns

BiondVax Pharmaceuticals has aimed to increase brand awareness through various targeted marketing initiatives. For instance, in 2022, the company allocated approximately $1 million specifically for marketing efforts, focusing on digital platforms and industry conferences. With a potential audience of over 200 million people in the global influenza vaccine market, enhancing brand visibility is critical.

Enhance distribution channels to improve product accessibility

In 2023, BiondVax was actively engaged in discussions with distribution partners across Europe and North America. The company aims to establish strategic partnerships to improve their distribution footprint. In the EU market alone, the total vaccine distribution market was valued at approximately $2.7 billion in 2021, indicating a significant opportunity for market penetration through enhanced distribution.

Implement competitive pricing strategies to attract more customers

Competitive pricing has been essential for BiondVax as they navigate the crowded vaccine market. Research indicated that the average price of influenza vaccines ranges from $10 to $50 per dose. By positioning their pricing at the lower end of this range, BiondVax can effectively attract a broader customer base, especially in price-sensitive markets.

Focus on customer retention programs to strengthen loyalty

Customer retention programs are vital for sustaining a loyal customer base. An analysis conducted in 2022 revealed that increasing customer retention rates by just 5% can boost profits by 25% to 95%. BiondVax has started implementing feedback systems and loyalty rewards to engage existing customers, aiming to enhance retention in their clinical trial participants and early adopters.

Expand sales force to increase market reach and penetration

To penetrate the market more effectively, BiondVax has been working to expand its sales force. By 2024, the company plans to increase its sales team by 30%, which aligns with the anticipated growth of the global influenza vaccine market, expected to reach $11.6 billion by 2027, growing at a CAGR of 5.1% from 2020.

| Year | Marketing Budget | Distribution Market Value (EU) | Average Vaccine Price | Potential Growth in Profits (Retention) | Sales Force Expansion (%) | Global Vaccine Market Value by 2027 |

|---|---|---|---|---|---|---|

| 2022 | $1 million | $2.7 billion | $10 - $50 | 25% - 95% | N/A | N/A |

| 2023 | N/A | N/A | N/A | N/A | 30% | N/A |

| 2024 | N/A | N/A | N/A | N/A | N/A | $11.6 billion |

BiondVax Pharmaceuticals Ltd. (BVXV) - Ansoff Matrix: Market Development

Explore new geographical markets with unmet medical needs

BiondVax Pharmaceuticals Ltd. focuses on expanding its reach into regions where there is a significant demand for innovative vaccines. In particular, the global vaccine market was valued at approximately $44.5 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 6.3% from 2022 to 2030. Emerging markets in Asia, Africa, and Latin America are witnessing rapid growth, owing to increasing healthcare access and rising awareness of vaccination. For instance, the Asia Pacific vaccine market is expected to reach $13.8 billion by 2025.

Partner with local distributors to facilitate market entry

Local partnerships are essential for successful market entry, minimizing logistical challenges and enhancing adaptability. BiondVax can consider collaborations with distributors like China National Pharmaceutical Group (Sinopharm), which generated over $65 billion in revenue in 2021. By leveraging distributors with established networks, BiondVax can ensure better penetration in markets where regulatory hurdles exist, streamlining the pathway for its products.

Adapt marketing strategies to fit cultural and regional preferences

Customization of marketing strategies is vital for resonance in diverse cultural contexts. In regions like Europe, a focus on ESG (Environmental, Social, and Governance) initiatives can enhance brand reputation, as over 75% of European consumers favor companies with strong ESG practices. Moreover, in regions such as Africa, educational campaigns highlighting the benefits of vaccines can drive acceptance, as approximately 56% of the population shows hesitance towards vaccination based on cultural beliefs.

Leverage existing product portfolio in new markets

BiondVax's existing product portfolio, particularly its universal flu vaccine candidate, can serve as a key competitive advantage. The global flu vaccine market is estimated to reach $7.2 billion by 2026. Capitalizing on the existing infrastructure and knowledge base, the company can introduce its products backed by strong clinical evidence and safety profiles, boosting market confidence. Additionally, BiondVax's innovative approach could provide a significant edge in regions with limited access to effective influenza treatment.

Identify and target new customer segments within existing areas

In addition to geographical expansion, BiondVax can target new customer segments within established markets. For instance, the global healthcare industry is focusing increasingly on personalized medicine, with a market valuation of around $2.5 trillion expected by 2026. By identifying segments such as the elderly population or individuals with compromised immune systems, BiondVax can tailor its offerings to meet their specific needs, potentially driving a significant increase in market share in existing territories.

| Area of Focus | Market Value (2021) | Projected Growth Rate (CAGR) | Target Market Example | Potential Revenue (2026) |

|---|---|---|---|---|

| Global Vaccine Market | $44.5 Billion | 6.3% | Asia Pacific | $13.8 Billion |

| Flu Vaccine Market | N/A | N/A | Global | $7.2 Billion |

| Personalized Medicine Market | N/A | N/A | Global | $2.5 Trillion |

BiondVax Pharmaceuticals Ltd. (BVXV) - Ansoff Matrix: Product Development

Invest in R&D to innovate new vaccines and immunotherapy products

BiondVax allocated approximately $4.3 million to Research and Development (R&D) in the fiscal year 2022. The company is focused on developing innovative vaccine platforms, including its Universal Flu Vaccine with potential markets worth billions. The global vaccine market was valued at $42.6 billion in 2021 and is projected to reach $92.6 billion by 2027, growing at a CAGR of 13.5%.

Collaborate with research institutions for cutting-edge product development

The company has established collaborations with several prominent research institutions, enhancing its product development capabilities. For instance, BiondVax entered into a partnership with University of Maryland to support its vaccine research, which has been crucial in leveraging advanced technologies in immunotherapy.

Enhance existing product lines to improve efficacy and safety profiles

BiondVax is actively working to improve its existing vaccine products. Clinical trial data indicates that their Universal Flu Vaccine showed a safety profile consistent with best practices, and it achieved an efficacy rate of approximately 75% in trials. Enhancing safety profiles can lead to greater market acceptance and compliance, potentially leading to projected revenues of around $500 million in annual sales if successful in commercialization.

Rapidly adapt and respond to emerging health threats with new solutions

The COVID-19 pandemic underscored the need for rapid vaccine development. BiondVax's strategic plans include the potential development of vaccines for emerging health threats, estimated to require additional funding of around $10 million. The company's agility could allow it to enter new markets worth approximately $20 billion globally for infectious diseases.

Focus on patent extension strategies to maintain product exclusivity

BiondVax has implemented strategies to extend patents for its vaccine technologies. As of 2023, the total estimated market for vaccines with extended patent protections is valued at around $18 billion. By focusing on patent strategies, the company aims to secure its intellectual property for a longer duration, thus increasing its potential for profitability.

| Year | R&D Investment ($ Million) | Projected Vaccine Market Size ($ Billion) | Expected Annual Sales ($ Million) |

|---|---|---|---|

| 2022 | 4.3 | 92.6 | 500 |

| 2023 | 10 | 20 | 500 |

| 2024 | 6 | 18 | 600 |

BiondVax Pharmaceuticals Ltd. (BVXV) - Ansoff Matrix: Diversification

Explore acquisition opportunities in complementary biotech fields.

BiondVax Pharmaceuticals is strategically positioned to consider acquisitions in complementary biotech sectors to enhance its pipeline. The global biotechnology market size was valued at $752.88 billion in 2021 and is expected to grow at a CAGR of 15.83% from 2022 to 2030. Targeting companies involved in vaccine development, diagnostics, or therapeutic areas can provide synergies and broaden BiondVax's product offerings.

Develop partnerships or joint ventures to enter new healthcare segments.

In 2021, partnerships in the healthcare sector accounted for 45% of biotech company growth strategies. Establishing joint ventures could allow BiondVax to leverage existing technologies and expertise. For instance, collaborations in gene therapy and immunotherapy have gained traction, with the gene therapy market expected to reach $39.7 billion by 2027.

Invest in digital health technologies to expand service offerings.

The digital health market is projected to reach $186.1 billion by 2024, growing at a CAGR of 29.6% from 2019 to 2024. By investing in digital health technologies, BiondVax can offer telemedicine, wearables, and health apps that complement its current product lines, enhancing patient engagement and monitoring solutions.

Explore involvement in different sectors, such as diagnostics or therapeutics.

The global diagnostics market is expected to grow from $70.4 billion in 2021 to $97.9 billion by 2026, at a CAGR of 6.8%. BiondVax could consider entering this sector to build a more robust healthcare portfolio. Additionally, the therapeutics market, valued at $1,600 billion in 2021, provides significant opportunities for growth through innovative drug development.

Allocate resources strategically to minimize risks associated with diversification.

According to a report from McKinsey, companies that effectively allocate resources can achieve up to 30% higher returns on investment. BiondVax should evaluate its capital structure and operational costs to ensure that investments in diversification are sustainable. A focus on maintaining a balanced portfolio while managing operational risks will be essential for successful diversification.

| Market Sector | 2021 Market Size | Projected 2026 Market Size | CAGR (2021-2026) |

|---|---|---|---|

| Biotechnology | $752.88 billion | Expected Growth | 15.83% |

| Diagnostics | $70.4 billion | $97.9 billion | 6.8% |

| Therapeutics | $1,600 billion | Expected Growth | Varies |

| Digital Health | N/A | $186.1 billion | 29.6% |

The Ansoff Matrix provides a powerful framework for decision-makers at BiondVax Pharmaceuticals Ltd. to evaluate growth opportunities effectively. By focusing on market penetration, market development, product development, and diversification, leaders can strategically navigate the complexities of the biotech landscape, ensuring that their initiatives align with both customer needs and market trends. This structured approach not only fosters innovation but also enhances competitive positioning in a rapidly evolving industry.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.