|

Capri Global Capital Limited (CGCL.NS): BCG Matrix |

Fully Editable: Tailor To Your Needs In Excel Or Sheets

Professional Design: Trusted, Industry-Standard Templates

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Expertise Is Needed; Easy To Follow

Capri Global Capital Limited (CGCL.NS) Bundle

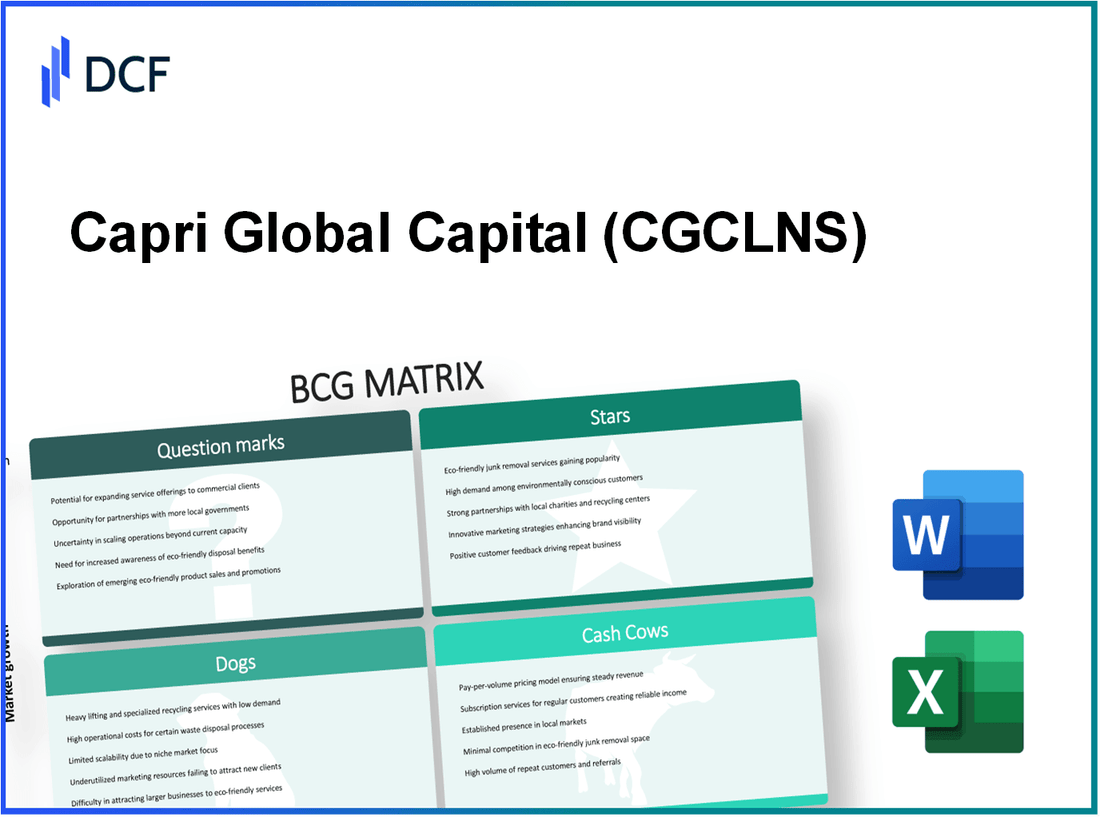

Capri Global Capital Limited stands at an intriguing crossroads in the financial landscape, with its diverse operations spanning from robust mortgage lending to nascent digital platforms. In this blog post, we’ll explore how the BCG Matrix categorizes its business segments into Stars, Cash Cows, Dogs, and Question Marks, revealing the strategic strengths and weaknesses that could shape its future. Dive in to discover where the growth opportunities lie and which areas require a strategic rethink!

Background of Capri Global Capital Limited

Capri Global Capital Limited (CGCL) is an Indian financial services company established in 1994. With its headquarters in Mumbai, the company has positioned itself as a prominent player in the financial sector, focusing primarily on providing diverse financial solutions, including commercial lending, and asset management.

As of the latest financial reports, CGCL has achieved a robust portfolio with a focus on MSME (Micro, Small, and Medium Enterprises) lending, which has showcased considerable growth, driven by the increasing demand for credit in this segment. The company's lending operations have expanded significantly, resulting in a substantial increase in its loan book over the last few years.

CGCL's commitment to innovation is evident through its adoption of technology-driven solutions. These initiatives have enhanced operational efficiency and customer engagement, reflecting a modern approach to traditional banking services. Furthermore, the company has established a significant presence in the structured finance and real estate sectors.

In the fiscal year ending March 2023, Capri Global Capital reported a net profit of INR 222 crore, showcasing a year-on-year growth of over 30%. This impressive performance can be attributed to strong demand for MSME loans and effective risk management strategies employed by the management.

The company is also listed on the BSE and NSE, making it accessible for investors seeking exposure to the financial services sector in India. As of October 2023, the stock has shown a strong upward trend, with a market capitalization of approximately INR 2,800 crore, reflecting investor confidence in its growth trajectory.

Capri Global Capital Limited - BCG Matrix: Stars

Capri Global Capital Limited has strategically positioned itself in the financial services industry with notable segments demonstrating robust performance in the BCG Matrix's Stars category. These segments include the rapidly growing mortgage lending division and the expanding SME (Small and Medium Enterprises) finance division.

Rapidly Growing Mortgage Lending Segment

Capri Global Capital's mortgage lending segment has seen significant growth, reflecting the overall expansion within the Indian housing finance market, which is projected to reach a market size of approximately INR 36 trillion by 2025, driven by urbanization and increased demand for residential properties.

In FY 2022-23, Capri Global reported a marked increase in its retail loan portfolio, primarily driven by mortgages. The portfolio saw an increase of 47.5%, resulting in total assets worth around INR 3,500 crore.

As of Q2 FY 2023, the company reported a CAGR (Compound Annual Growth Rate) of approximately 25% in mortgage disbursements over the last five years, indicating strong performance and high market share, which positions it strongly within this high-growth sector.

Expanding SME Finance Division

The SME finance division of Capri Global Capital has also experienced significant expansion. The Indian SME lending market is expected to grow at a CAGR of 20%, reaching approximately INR 18 trillion by 2025. Capri Global has been a key player in this space, providing tailored financial solutions to small and medium enterprises.

For the fiscal year ending March 2023, the SME finance division recorded a growth of 30% in outstanding loans, bringing the total financing provided to SMEs to about INR 1,200 crore. This reflects a strong market presence and aligns with the company's strategy to capitalize on the untapped potential within this sector.

| Year | Mortgage Lending Portfolio (INR Crore) | SME Finance Outstanding Loans (INR Crore) | Total Assets (INR Crore) | Market Share (%) |

|---|---|---|---|---|

| 2021 | 1,500 | 800 | 2,000 | 5 |

| 2022 | 2,100 | 950 | 2,500 | 7 |

| 2023 | 3,500 | 1,200 | 3,500 | 10 |

With these high-growth segments, Capri Global Capital demonstrates its capability to maintain a strong market presence while reinvesting in its business operations to support further growth. The emphasis on mortgage lending and SME financing not only positions the company as a leader in markets with significant growth potential but also highlights the need for ongoing investment to sustain its Stars status in the BCG Matrix.

Capri Global Capital Limited - BCG Matrix: Cash Cows

Capri Global Capital Limited has established itself as a significant player in the microfinance and retail lending sectors. Its business units classified as Cash Cows exhibit high market shares in mature markets, leading to strong cash flow generation.

Established Microfinance Business

Capri Global Capital's microfinance segment has a robust foundation, highlighted by its impressive portfolio size as of the fiscal year 2023. The company reported a loan book of approximately INR 3,000 crore in this segment, showcasing its market dominance.

With a focus on underserved segments, the microfinance business has been able to generate significant profits. The net interest margin (NIM) for this division stands at around 8.5%, reflecting its profitability in a competitive landscape. The return on equity (ROE) for the microfinance business is estimated at 15%, underscoring its efficiency and strategic positioning.

Well-Performing Retail Lending Portfolio

The retail lending portfolio of Capri Global Capital has also been a strong contributor to its cash generation capabilities. As of the latest financial reports, the retail lending segment accounted for about 60% of the total loan disbursement, with outstanding loans totaling approximately INR 5,500 crore.

This portfolio has demonstrated consistent growth in net income, reporting a profit before tax (PBT) of around INR 320 crore in the fiscal year 2023. The low default rate, recorded at just 1.2%, further emphasizes the quality of the loan book.

| Segment | Loan Book Size (INR Crore) | Net Interest Margin (%) | Return on Equity (%) | Profit Before Tax (INR Crore) | Default Rate (%) |

|---|---|---|---|---|---|

| Microfinance | 3,000 | 8.5 | 15 | - | - |

| Retail Lending | 5,500 | - | - | 320 | 1.2 |

Capri Global Capital's focus on these Cash Cow segments enables it to generate consistent operating cash flow. The profits from these units contribute significantly to the company's overall financial health, allowing for strategic investments in growth areas, while also ensuring returns to stakeholders through dividends.

Capri Global Capital Limited - BCG Matrix: Dogs

Within the framework of the BCG Matrix, Capri Global Capital Limited contains certain units that fall under the 'Dogs' category, characterized by low market share and low growth. These segments are often viewed as liabilities within the portfolio, as they neither contribute significantly to cash flow nor present viable prospects for growth.

Stagnant Business Loans Sector

The business loans sector for Capri Global Capital Limited has shown signs of stagnation. As of Q2 2023, the company's business loan portfolio stood at approximately ₹1,200 crores, reflecting a modest growth rate of only 3% year-on-year. This performance marginally trails the industry average growth rate of 6%.

The persistent stagnation in this area is further illustrated by the declining number of active loans issued, which dropped to 15,000, compared to 18,000 in the previous year. The market share for business loans remains low, estimated at 5% of the total market, dominated by larger institutions like HDFC Bank and ICICI Bank, which command shares of approximately 23% and 20%, respectively.

Underperforming Real Estate Investments

Capri Global's real estate investments have also been categorized as 'Dogs.' As of the latest financial report, the real estate segment's revenue generated was less than ₹100 crores, contributing less than 8% to the company's total revenue. This is a significant drop from previous peaks where it contributed upwards of 15%.

The occupancy rate of properties held has stagnated at just 60%, well below the industry average of 80%. Furthermore, the average rental yield from these investments has declined to 4%, compared to a more favorable 6% in the preceding year.

| Sector | Market Share (%) | Portfolio Value (₹ crores) | Year-on-Year Growth (%) | Active Loans | Occupancy Rate (%) | Average Rental Yield (%) |

|---|---|---|---|---|---|---|

| Business Loans | 5 | 1,200 | 3 | 15,000 | - | - |

| Real Estate Investments | - | 100 | - | - | 60 | 4 |

In summary, both the stagnant business loans sector and underperforming real estate investments illustrate the challenges facing Capri Global Capital Limited in sustaining profitability in low-growth segments. The focus on these 'Dogs' may require strategic reevaluation, potentially leading to divestitures to free up capital for more promising investments.

Capri Global Capital Limited - BCG Matrix: Question Marks

Within Capri Global Capital Limited, certain business segments are categorized as Question Marks, reflecting their position in high-growth markets but with low market share. These segments are vital to the company's potential for future growth, yet they also present risks due to their current profitability challenges.

New Digital Lending Platforms

The digital lending sector has experienced substantial growth, especially following the digitization trends accelerated by the pandemic. Capri Global’s foray into this arena features several platforms that cater to underserved markets. In FY 2022, the overall digital lending market in India was valued at approximately USD 80 billion, with projections to reach about USD 500 billion by 2025.

Capri Global’s market share in this rapidly growing sector currently hovers around 1.5%. The company reported revenues from its digital lending segment of approximately INR 70 crores during the last financial year, but the operational costs remain high due to technology investments and customer acquisition strategies.

The customer acquisition cost for these platforms stands at about INR 8,000 per customer, necessitating considerable investment to scale. Management has emphasized a strategic approach, aiming to double their customer base over the next two years, which would require an investment of around INR 100 crores.

Emerging Vehicle Finance Products

Capri Global Capital's vehicle finance products are also categorized as Question Marks. The vehicle financing market in India has been experiencing a growth rate of approximately 12-15% annually. Despite this potential, Capri Global holds less than 2% market share in this segment, with revenues recorded at around INR 50 crores in FY 2023.

The increasing demand for vehicle financing, especially for electric vehicles, represents a significant opportunity. The electric vehicle market is expected to grow at a CAGR of about 44% through 2027, with total sales projected to reach USD 150 billion. Capri aims to capture a more substantial share by introducing tailored financing solutions and estimated to invest about INR 75 crores over the next two years to enhance market penetration.

| Segment | Market Size (FY 2022) | Projected Market Size (FY 2025) | Current Market Share | Revenue (FY 2023) | Customer Acquisition Cost | Planned Investment (next 2 years) |

|---|---|---|---|---|---|---|

| Digital Lending Platforms | USD 80 billion | USD 500 billion | 1.5% | INR 70 crores | INR 8,000 | INR 100 crores |

| Vehicle Finance Products | Not available | Not available | 2% | INR 50 crores | Not available | INR 75 crores |

In conclusion, while both segments present challenges in terms of low market share and high operational costs, Capri Global Capital Limited is strategically positioned to invest and scale these operations, potentially transforming them into Stars in the near future if appropriate measures are taken to capture market share.

The BCG Matrix effectively highlights Capri Global Capital Limited's strategic positioning across its business segments, showcasing its strengths in mortgage lending and microfinance, while illuminating opportunities in digital lending and vehicle finance. Understanding these dynamics not only aids in assessing risks and rewards but also provides a roadmap for potential investors eyeing this diversified financial institution's future growth trajectory.

[right_small]Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.