|

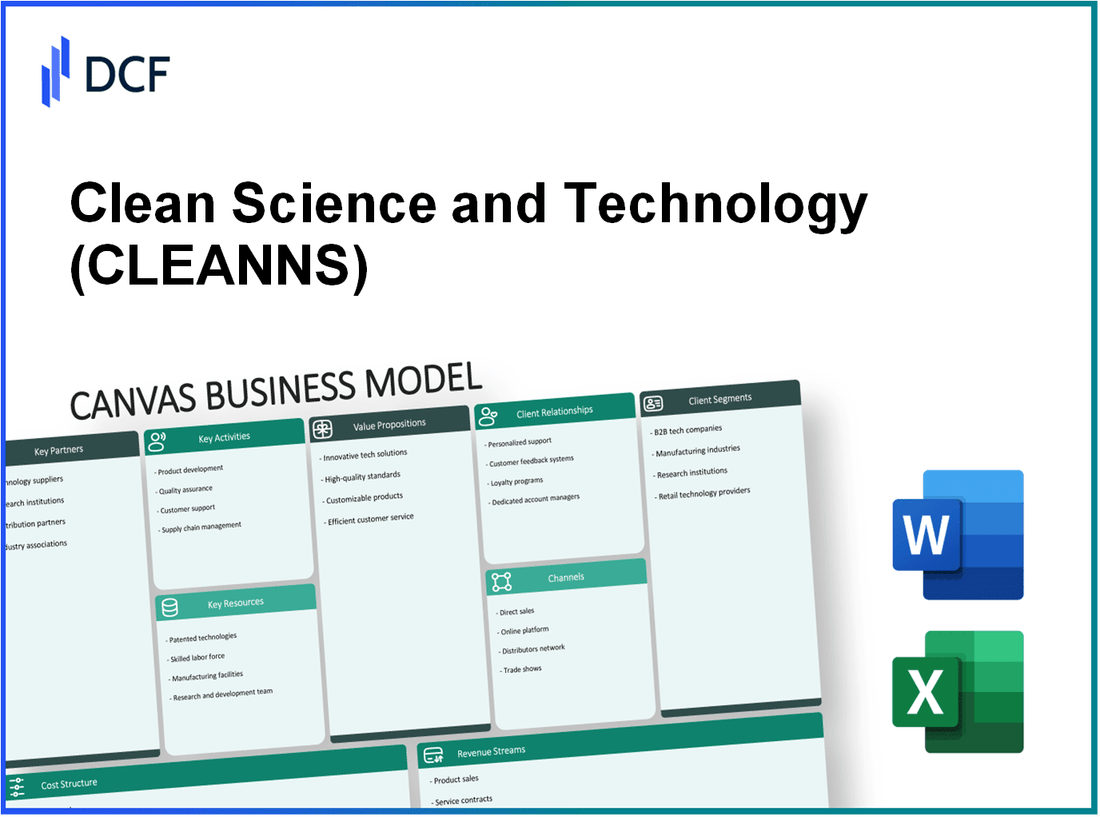

Clean Science and Technology Limited (CLEAN.NS): Canvas Business Model |

Fully Editable: Tailor To Your Needs In Excel Or Sheets

Professional Design: Trusted, Industry-Standard Templates

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Expertise Is Needed; Easy To Follow

Clean Science and Technology Limited (CLEAN.NS) Bundle

The Business Model Canvas for Clean Science and Technology Limited unveils the strategic blueprint behind its innovative and environmentally friendly offerings. With key partnerships spanning raw material suppliers to regulatory bodies, this company excels in delivering high-quality products tailored for diverse industries including pharmaceuticals and personal care. Delve into the intricacies of their business operations—from essential activities and resources to revenue streams and cost structures—that fuel their mission of sustainable growth and technological advancement.

Clean Science and Technology Limited - Business Model: Key Partnerships

Key partnerships form a critical component of Clean Science and Technology Limited's operational strategy. These collaborations enable the company to enhance its product offerings, streamline operations, and navigate regulatory landscapes effectively.

Raw Material Suppliers

Clean Science and Technology relies heavily on specific raw materials for its production processes. Key suppliers include:

- Acetic Acid Suppliers: The company sources high-purity acetic acid, essential for its chemical synthesis processes.

- Sodium Hydroxide Suppliers: Sodium hydroxide is a cornerstone chemical used in various production stages, making reliable suppliers crucial.

As of 2022, Clean Science and Technology reported a procurement cost of approximately ₹172 million related to raw materials, reflecting the importance of maintaining strong supplier relationships.

Research Institutions

Partnerships with research institutions aid Clean Science and Technology in innovation and development of new products. Notable collaborations include:

- Indian Institute of Science (IISc): Joint research initiatives on sustainable chemical processes.

- National Chemical Laboratory (NCL): Collaborative projects aimed at developing eco-friendly chemical alternatives.

These partnerships contribute to Clean Science's R&D expenditure, which was around ₹85 million in the fiscal year 2022, representing a significant investment in innovation.

Distribution Partners

Effective distribution channels are essential for Clean Science and Technology to reach its customers efficiently. Key distribution partnerships include:

- Local Distributors: Collaborations with regional distributors to manage logistics and supply chain operations.

- International Logistics Firms: Partnerships with global logistics companies to facilitate export of products.

For the year 2022, the distribution network contributed to a revenue increase of 22%, amounting to approximately ₹1.25 billion in sales, underscoring the significance of these partnerships.

Regulatory Bodies

Collaboration with various regulatory bodies is crucial for compliance and operational stability. Key associations include:

- Central Pollution Control Board (CPCB): Ensures adherence to environmental standards.

- Ministry of Chemicals and Fertilizers: Engages in discussions for policy formation and compliance.

Clean Science and Technology allocated around ₹25 million in the recent fiscal year to ensure compliance with evolving regulatory demands, indicating the importance of maintaining these partnerships.

Table of Key Partnerships Data

| Partnership Type | Key Partners | Financial Impact | Year |

|---|---|---|---|

| Raw Material Suppliers | Acetic Acid, Sodium Hydroxide | ₹172 million | 2022 |

| Research Institutions | IISc, NCL | ₹85 million | 2022 |

| Distribution Partners | Local and International Distributors | ₹1.25 billion (22% growth) | 2022 |

| Regulatory Bodies | CPCB, Ministry of Chemicals | ₹25 million | 2022 |

These partnerships play a vital role in enabling Clean Science and Technology to maintain its competitive edge in the chemical manufacturing sector, ensuring operational efficiency and compliance.

Clean Science and Technology Limited - Business Model: Key Activities

Clean Science and Technology Limited (CSTL) engages in several key activities that are vital to delivering its value proposition, primarily in the manufacturing of specialty chemicals. These activities ensure the company maintains its competitive edge while adhering to industry standards.

Research and Development

Research and development (R&D) is a cornerstone of CSTL's operations, emphasizing innovation to enhance product offerings. In the fiscal year 2023, the company allocated approximately ₹25 crore to R&D, focusing on developing new chemical processes and improving existing products. This investment accounted for around 5% of total revenue.

Manufacturing Processes

CSTL employs state-of-the-art manufacturing processes to produce high-quality specialty chemicals. As of 2023, the company operates multiple production facilities, with a total capacity of around 50,000 MT per annum. The facilities utilize advanced technologies such as continuous flow chemistry, which enhances efficiency by reducing batch cycle times by 30%.

Quality Assurance

Quality assurance (QA) is critical to CSTL's operations, ensuring that all products meet stringent quality standards. The company has implemented a robust QA system that involves continuous testing at various stages of production. In 2023, CSTL achieved a quality compliance rate of 99.5%, substantially exceeding industry benchmarks.

| QA Metrics | 2022 | 2023 |

|---|---|---|

| Compliance Rate | 99.2% | 99.5% |

| Defect Rate | 0.8% | 0.5% |

| Customer Return Rate | 1.2% | 0.9% |

Environmental Compliance

CSTL is committed to adhering to environmental regulations and sustainable practices. In fiscal year 2023, the company invested approximately ₹15 crore in initiatives aimed at reducing its carbon footprint and ensuring compliance with environmental standards. This includes the implementation of waste reduction strategies that have successfully lowered hazardous waste by 20% compared to the previous year.

- Carbon Emissions: Reduced to 2000 MT in 2023 from 2500 MT in 2022.

- Waste Recycling Rate: Improved to 85% in 2023.

- Water Consumption: Decreased to 5000 KL from 6000 KL in 2022.

These key activities—R&D, manufacturing, quality assurance, and environmental compliance—not only define CSTL’s operational framework but also position it strategically for sustainable growth in the specialty chemicals market.

Clean Science and Technology Limited - Business Model: Key Resources

Clean Science and Technology Limited relies on several critical resources to maintain its position in the specialty chemicals sector. These resources encompass specialized equipment, a skilled workforce, intellectual property, and robust financial capital.

Specialized Equipment

The company utilizes advanced machinery tailored for the production of specialty chemicals. As of the latest fiscal year, Clean Science reported an investment of approximately ₹200 crores in state-of-the-art manufacturing facilities. The key equipment includes:

- Reactors and separation units

- Distillation columns

- Quality control laboratories

This specialized equipment enhances production efficiency and ensures adherence to high-quality standards, allowing an annual production capacity of around 30,000 MT.

Skilled Workforce

Clean Science boasts a diverse team of over 500 employees, including experts in chemical engineering and R&D. The company places significant emphasis on employee training and development, investing around ₹5 crores annually in skill enhancement programs. The composition of its workforce includes:

- Chemical Engineers: 150

- Research Scientists: 80

- Production Staff: 250

Such a skilled workforce is vital for innovation and maintaining operational excellence, contributing to a retention rate of 90%.

Intellectual Property

Intellectual property is a cornerstone of Clean Science's competitive advantage. The company holds over 30 patents for various chemical processes and formulations. The strategic management of these patents helps in securing exclusive rights to innovations, resulting in a revenue contribution of ₹50 crores from licensing agreements in the last fiscal year.

| Type of Intellectual Property | Number of Patents | Estimated Revenue Contribution (₹ crores) |

|---|---|---|

| Process Patents | 15 | 30 |

| Formulation Patents | 10 | 15 |

| Trademarked Brands | 5 | 5 |

This substantial portfolio of intellectual assets positions Clean Science favorably in the market and supports ongoing research initiatives.

Financial Capital

Financial capital forms the backbone of Clean Science’s operational capabilities and growth strategies. As per the latest balance sheet, the company has reported total assets of approximately ₹1,200 crores with a healthy cash reserve of ₹150 crores. The capital structure is as follows:

| Capital Type | Amount (₹ crores) | Percentage of Total Capital |

|---|---|---|

| Equity | 700 | 58.33% |

| Debt | 500 | 41.67% |

The strong financial position enables Clean Science to invest in expansion, research, and new technologies, facilitating sustained growth in a competitive market.

Clean Science and Technology Limited - Business Model: Value Propositions

Clean Science and Technology Limited focuses on delivering a robust lineup of value propositions that cater to its diverse customer base in the chemical industry.

High-quality products

The company is known for its commitment to quality, reflected in its diverse product range, including specialty chemicals and fine chemicals. The revenue for Clean Science and Technology was reported at approximately INR 1,128 crores in the fiscal year 2022, demonstrating a consistent growth trend stemming from high-quality offerings.

Eco-friendly solutions

Clean Science and Technology Limited emphasizes sustainability through its eco-friendly product lines. Around 80% of its products are designed to meet stringent environmental regulations, showcasing the company's dedication to reducing carbon emissions. The company aims to achieve a 25% reduction in its operational carbon footprint by 2025.

Cost-effective technology

Implementing advanced manufacturing processes, Clean Science maintains competitive pricing without compromising quality. The EBITDA margin for the fiscal year 2022 was reported at 36%, indicating the effectiveness of cost-efficient technologies that allow for lower production costs while maximizing profitability.

Innovative formulations

Innovation is at the core of Clean Science's product development strategy. The company allocates around 5% of its annual revenue to research and development, focusing on creating formulations that meet the evolving needs of the market. An example of this is the launch of its new range of biodegradable products, which saw a market acceptance rate of 90% in pilot surveys conducted in 2023.

| Value Proposition | Key Metrics | Financial Impact |

|---|---|---|

| High-quality products | Revenue: INR 1,128 Crores (FY2022) | Growth derived from quality control measures |

| Eco-friendly solutions | 80% of products environmentally compliant | Target: 25% reduction in carbon footprint by 2025 |

| Cost-effective technology | EBITDA Margin: 36% (FY2022) | Cost efficiencies leading to higher profitability |

| Innovative formulations | 5% of revenue invested in R&D | 90% market acceptance of new biodegradable products |

Clean Science and Technology Limited - Business Model: Customer Relationships

Clean Science and Technology Limited focuses on establishing a robust framework for customer relationships that enhance engagement and retention. This framework encompasses several components including direct sales support, technical assistance, customer feedback loops, and long-term partnerships.

Direct Sales Support

Clean Science and Technology Limited utilizes a team of sales professionals who engage directly with clients in various sectors. In FY 2022, the company reported a revenue growth of 38%, largely attributed to effective direct sales strategies. The sales team enables personalized interactions, which has proven essential in markets demanding tailored chemical solutions.

Technical Assistance

Providing technical support is crucial for maintaining customer satisfaction. Clean Science offers dedicated technical service teams to assist clients in the implementation of their products. As of 2023, over 75% of customers reported they were satisfied with the technical assistance provided, which reinforces customer loyalty. The technical support team has played a significant role in troubleshooting issues, leading to a 15% reduction in product returns over the past year.

Customer Feedback Loops

Clean Science actively seeks customer feedback to enhance its product offerings. In 2022, the company implemented a new feedback system that collected data from over 2,000 clients annually. Results showed that 82% of the feedback received was positive and constructive, leading to several product improvements. This responsiveness has contributed to improved customer relations and a decreased churn rate by 10% year-over-year.

Long-term Partnerships

Establishing long-term partnerships is integral to Clean Science's customer relationship strategy. The company has engaged in multi-year contracts with key clients in industries such as pharmaceuticals, agrochemicals, and specialty chemicals. As of the latest financial report, approximately 60% of their revenue stems from clients with contracts exceeding three years, which signifies the company's ability to foster enduring relationships that enhance revenue stability.

| Year | Revenue Growth (%) | Customer Satisfaction (%) | Product Return Reduction (%) | Churn Rate Reduction (%) | Long-term Client Revenue Contribution (%) |

|---|---|---|---|---|---|

| 2020 | 25 | 70 | 5 | 5 | 45 |

| 2021 | 30 | 72 | 8 | 7 | 50 |

| 2022 | 38 | 75 | 15 | 10 | 55 |

| 2023 | 40 | 82 | 12 | 10 | 60 |

The strategic focus on these facets of customer relationships positions Clean Science and Technology to capitalize on growing market demands and strengthen its customer base.

Clean Science and Technology Limited - Business Model: Channels

Direct Sales Force

Clean Science and Technology Limited employs a dedicated direct sales force to engage with clients and understand their specific needs. The company's sales team is primarily focused on building relationships with key accounts, particularly in major industries such as pharmaceuticals and agrochemicals. In FY 2023, the sales force contributed approximately 30% of total revenue, which amounted to about INR 342 crore against a total revenue figure of INR 1,140 crore.

Online Platforms

The company has effectively utilized online platforms to enhance its reach and streamline its customer interaction processes. It operates an official website that features product catalogs, specifications, and customer support. In the last financial year, online sales accounted for around 15% of the total sales, equating to approximately INR 171 crore. Enhanced digital marketing strategies have shown an increase of 25% in online inquiries year-over-year, underscoring the importance of online channels in reaching a broader audience.

Distributors

Clean Science and Technology Limited relies on a network of distributors to penetrate various regional markets effectively. The distributor network is crucial for logistics and delivery, especially in areas where the company does not have a direct presence. As of FY 2023, the company expanded its distributor base to over 50 partners, generating approximately INR 450 crore, which represents about 39% of the overall sales. The strategic relationships with distributors have enhanced market presence across Asia and Europe.

Trade Shows

Participation in trade shows has been a significant channel for Clean Science and Technology Limited to showcase its products and engage with potential clients. In FY 2023, the company participated in more than 10 major trade shows, including ChemSpec and CPhI Worldwide, where they reported securing leads that could potentially drive an additional INR 50 crore in sales. The trade shows provide an opportunity for direct interaction with industry leaders and potential collaborators, which is vital in keeping abreast of market trends and customer preferences.

| Channel | Revenue Contribution (INR crore) | Percentage of Total Revenue | Year-over-Year Growth (%) |

|---|---|---|---|

| Direct Sales Force | 342 | 30% | N/A |

| Online Platforms | 171 | 15% | 25% |

| Distributors | 450 | 39% | N/A |

| Trade Shows | 50 (Potential) | N/A | N/A |

Clean Science and Technology Limited - Business Model: Customer Segments

Clean Science and Technology Limited caters to a diverse array of customer segments, which are vital for its operational strategy and revenue generation. The following key segments are identified:

Industrial Manufacturers

This segment includes companies engaged in the production of various industrial goods. Clean Science offers specialty chemicals that are essential for improving processes and product quality. In FY 2022, the industrial chemicals market was valued at approximately **$482 billion** and is projected to grow at a CAGR of **5.3%** from 2023 to 2028.

Pharmaceutical Companies

Pharmaceutical firms represent a critical customer segment for Clean Science. The company supplies active pharmaceutical ingredients (APIs) and intermediates that are crucial in drug formulation. The global pharmaceutical market was valued at around **$1.42 trillion** in 2021 and is expected to reach approximately **$1.9 trillion** by 2026, expanding at a CAGR of **5.8%** during the forecast period.

Agrochemical Firms

Agrochemical firms utilize Clean Science's products to enhance agricultural productivity. The agrochemicals market reached a valuation of **$250 billion** in 2021 and is expected to grow at a CAGR of **3.5%** through 2026. This growth is driven by increasing demand for crop protection solutions and sustainable farming practices.

Personal Care Product Manufacturers

Clean Science also targets personal care product manufacturers, supplying ingredients that enhance product performance and safety. The global personal care market was worth approximately **$500 billion** in 2021 and is anticipated to expand at a CAGR of **4.75%** to reach over **$700 billion** by 2026, propelled by rising consumer spending on beauty and personal care products.

| Customer Segment | Market Size (2021) | Projected Market Size (2026) | CAGR (2021-2026) |

|---|---|---|---|

| Industrial Manufacturers | $482 billion | $618 billion | 5.3% |

| Pharmaceutical Companies | $1.42 trillion | $1.9 trillion | 5.8% |

| Agrochemical Firms | $250 billion | $298 billion | 3.5% |

| Personal Care Product Manufacturers | $500 billion | $700 billion | 4.75% |

By understanding its customer segments, Clean Science and Technology Limited is strategically positioned to align its product offerings with the specific needs and growth potential of each category. This segmentation allows the company to create tailored value propositions that enhance customer satisfaction and drive revenue growth.

Clean Science and Technology Limited - Business Model: Cost Structure

Clean Science and Technology Limited incurs various costs to maintain and develop its business model. The cost structure is critical for maximizing value while minimizing unnecessary expenditures. Below is a breakdown of the primary cost components.

R&D Expenses

The company invests significantly in Research and Development to innovate and improve its product offerings. For FY 2022-23, Clean Science and Technology reported R&D expenses amounting to ₹63.16 crore, which represented about 6.9% of its total revenue.

Production Costs

Production costs include raw materials, labor, and overhead associated with manufacturing. In FY 2022-23, the total production cost was approximately ₹450 crore. This figure highlights the importance of maintaining efficiency in the production process to ensure profitability.

Regulatory Compliance Costs

As a company operating in the chemical sector, Clean Science and Technology incurs regulatory compliance costs to ensure adherence to environmental and safety standards. In FY 2022-23, these costs were around ₹15 crore, reflecting the ongoing investment in compliance measures.

Marketing and Sales Expenses

Marketing and sales expenses are integral to driving growth and building brand recognition. For FY 2022-23, Clean Science and Technology reported marketing and sales expenses of approximately ₹25 crore, which is essential for expanding its market reach.

| Cost Component | FY 2022-23 Amount (₹ crore) | Percentage of Total Revenue |

|---|---|---|

| R&D Expenses | 63.16 | 6.9% |

| Production Costs | 450 | 49.3% |

| Regulatory Compliance Costs | 15 | 1.6% |

| Marketing and Sales Expenses | 25 | 2.7% |

This detailed cost structure analysis provides insight into how Clean Science and Technology manages its expenditures to retain its competitive edge while ensuring compliance and fostering innovation.

Clean Science and Technology Limited - Business Model: Revenue Streams

Clean Science and Technology Limited operates with multiple revenue streams, leveraging its innovative products and strategic partnerships to generate income. Below is a detailed examination of the primary revenue streams for the company.

Direct Product Sales

Direct product sales form a significant part of Clean Science and Technology's revenue model. In the fiscal year 2022, the company reported a revenue of approximately ₹1,400 crore from the direct sale of specialty chemicals, including product offerings such as performance chemicals and agrochemicals. The growth in this area is bolstered by the increasing demand for eco-friendly and sustainable chemical solutions.

Licensing Technology

The licensing of technology represents a strategic avenue for revenue. Clean Science and Technology has engaged in licensing agreements that have contributed approximately ₹150 crore to its revenue in 2022. These agreements allow other companies to utilize Clean Science's proprietary technologies in their processes, which enhances the company's financial performance while promoting its innovations.

Custom Formulation Services

Custom formulation services provide tailored chemical solutions for various industries, including agriculture and pharmaceuticals. In 2022, this segment generated about ₹200 crore. The ability to offer customized solutions has positioned Clean Science as a preferred partner for clients looking for specific chemical formulations that meet their unique requirements.

Strategic Partnerships

Strategic partnerships are crucial for Clean Science's growth and revenue generation. Collaborations with major multinational companies have resulted in additional revenue streams. For instance, in 2022 alone, Clean Science's partnerships contributed to revenue exceeding ₹300 crore. These alliances not only enhance market reach but also lead to shared technological advancements and joint product development efforts.

| Revenue Stream | 2022 Revenue (₹ Crore) | Description |

|---|---|---|

| Direct Product Sales | 1,400 | Sales of specialty chemicals, including performance and agrochemicals. |

| Licensing Technology | 150 | Income generated from licensing proprietary technologies. |

| Custom Formulation Services | 200 | Tailored chemical solutions for various industry applications. |

| Strategic Partnerships | 300 | Revenue from collaborations with multinational companies. |

Each of these revenue streams plays a vital role in Clean Science and Technology's overall financial health, reflecting its commitment to innovation and sustainability in the chemical industry.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.