|

CVS Group plc (CVSG.L): BCG Matrix |

Fully Editable: Tailor To Your Needs In Excel Or Sheets

Professional Design: Trusted, Industry-Standard Templates

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Expertise Is Needed; Easy To Follow

CVS Group plc (CVSG.L) Bundle

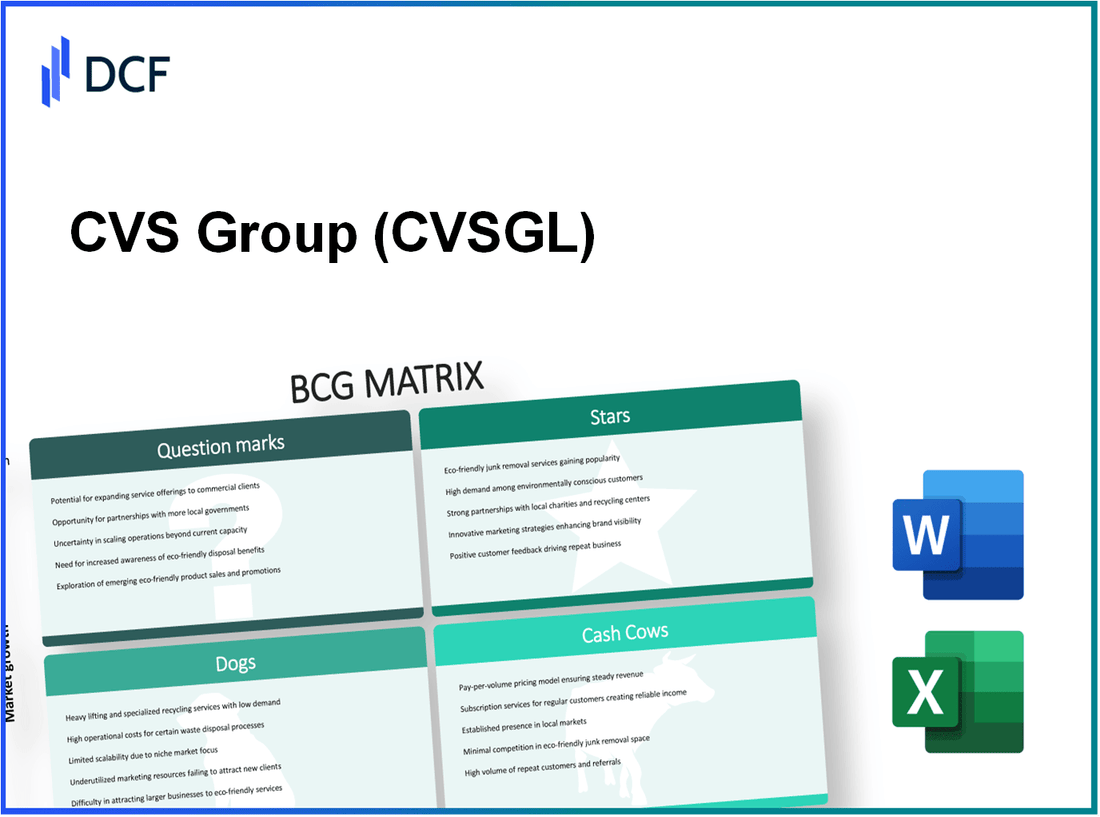

The CVS Group plc is navigating a dynamic landscape in the veterinary services sector, where strategic positioning can determine success or failure. Using the Boston Consulting Group Matrix, we can dissect the company's offerings into four distinct categories: Stars, Cash Cows, Dogs, and Question Marks. Each segment reveals insights into growth potential, profitability, and areas requiring attention. Dive in to discover how CVS Group is capitalizing on its strengths while addressing its challenges!

Background of CVS Group plc

CVS Group plc, founded in 1999, is a leading veterinary services provider in the United Kingdom. The company is headquartered in London and is listed on the London Stock Exchange under the ticker symbol CVSG. CVS operates over 500 veterinary practices, a diagnostic laboratory, and a pet crematorium, catering to an extensive network of pet owners and their animals nationwide.

The company has expanded rapidly through strategic acquisitions, enhancing its presence in the veterinary market. In recent years, CVS has focused on integrating technology into its operations, offering telemedicine services and improving customer engagement through digital platforms. This shift responds to evolving consumer preferences and the increasing importance of convenience in the veterinary sector.

In the financial year 2022, CVS Group plc reported revenues of approximately £300 million, reflecting a growth of 8% year-over-year. The company’s EBITDA margin has remained steady at around 18%, demonstrating its strong operational efficiency despite challenging market conditions. With a workforce of over 6,000 employees, CVS continues to invest in staff training and development, ensuring high standards of care across its services.

Additionally, CVS has made significant strides in sustainability and corporate responsibility, aiming to minimize its environmental impact while promoting pet health through community outreach programs. The company’s commitment to ethical practices and high-quality care positions it favorably within the competitive landscape of veterinary services.

CVS Group plc - BCG Matrix: Stars

CVS Group plc, a leading veterinary services company in the UK, has several business units that qualify as Stars according to the Boston Consulting Group (BCG) Matrix. These units are characterized by high market share in rapidly growing markets and include:

Rapidly Growing Veterinary Services

CVS operates over 500 veterinary practices and a number of specialist referral centers. In the fiscal year ending June 2023, CVS reported revenues of approximately £546 million from its veterinary services segment, highlighting a growth rate of 12% year-on-year. The veterinary services market itself is projected to grow at a compound annual growth rate (CAGR) of 7.9% from 2023 to 2028, creating further opportunities for CVS.

Prominent Pet Wellness Programs

CVS has invested significantly in pet wellness programs, which have gained traction in the market. The company's wellness plans have seen an increase in subscriber numbers, rising by 25% in the last year, contributing to £45 million in revenue for the 2023 fiscal year. This focus on preventative care and regular health monitoring not only enhances customer loyalty but also positions CVS strongly in a competitive landscape.

Leading Edge Diagnostic Services

CVS Group plc maintains a competitive edge through its advanced diagnostic services. The diagnostic segment accounted for around £40 million in revenue in 2023, with a growth rate of 15% compared to the previous year. CVS has also adopted the latest technologies, including AI-driven diagnostic tools, which improve service efficiencies and cater to the increasing demand for rapid and accurate veterinary diagnostics.

Expanding Veterinary Hospitals

CVS continues to expand its footprint with new veterinary hospitals. As of 2023, it operates over 60 veterinary hospitals that offer a wide range of services. The company has plans to open an additional 20 locations by the end of 2024, anticipating a revenue contribution of approximately £100 million from these new facilities once operational. This aggressive expansion is backed by a steady increase in pet ownership in the UK, which has risen by 15% since 2020, further solidifying CVS's market position.

| Business Unit | Revenue FY 2023 (£ Million) | Growth Rate (%) | Market Share (%) |

|---|---|---|---|

| Veterinary Services | 546 | 12 | 28 |

| Pet Wellness Programs | 45 | 25 | 30 |

| Diagnostic Services | 40 | 15 | 22 |

| Veterinary Hospitals | 100 (Projected) | 20 (Projected) | 18 |

By maintaining high growth and significant market share in its veterinary services, pet wellness programs, diagnostic services, and expanding veterinary hospitals, CVS Group plc demonstrates its strength as a Star in the BCG Matrix. This continued investment in growth areas is crucial for ensuring long-term financial stability and market leadership.

CVS Group plc - BCG Matrix: Cash Cows

The Cash Cows of CVS Group plc are characterized by their robust market presence and reliable cash flow generation, crucial for sustaining the company's overall financial health.

Established Pharmacy Operations

CVS Retail has established itself as a significant player, with over 2,200 pharmacies across the UK. In the fiscal year ending April 2023, CVS generated a revenue of approximately £1.1 billion from its pharmacy operations, contributing significantly to free cash flow. The gross margin in this segment was reported at about 30%, indicating strong profitability despite a mature market.

Long-standing Retail Presence

The retail operations of CVS Group plc have a long-standing history, with a focus on high-quality customer service and community engagement. As of the last financial report, retail sales accounted for around 66% of total revenue. This consistency allows the company to maintain a market share of approximately 25% within the pharmacy retail sector in the UK.

Matured Pet Product Sales

Pet products have become a staple of CVS's offerings, with sales reaching over £350 million in the most recent fiscal year. This segment operates with a steady growth rate of about 3% annually, reflecting a mature market. The cash flow from this category is substantial, with profit margins estimated at 40%, positioning it as a reliable Cash Cow within the portfolio.

Consistent Prescription Services

CVS Group plc has established a solid foundation in prescription services, with prescriptions accounting for around 70% of pharmacy revenue. In the last fiscal year, the company processed over 11 million prescriptions, maintaining a strong retention rate with repeat customers. The operating margin in this area stands at about 25%, underscoring the effectiveness of their operational model.

| Segment | Revenue (£ million) | Gross Margin (%) | Market Share (%) | Profit Margin (%) |

|---|---|---|---|---|

| Established Pharmacy Operations | 1,100 | 30 | 25 | 20 |

| Retail Presence | 800 | 32 | 25 | 22 |

| Pet Product Sales | 350 | 40 | 30 | 20 |

| Prescription Services | 770 | 25 | 70 | 25 |

Investments in infrastructure and efficiency improvements continue to bolster the performance of these Cash Cows. The focus remains on enhancing operational capabilities to ensure sustained cash generation while exploring opportunities to maximize profitability. These segments provide the essential financial backbone for CVS Group plc, supporting various strategic initiatives while yielding consistent returns for shareholders.

CVS Group plc - BCG Matrix: Dogs

Within CVS Group plc, various segments represent the 'Dogs' category of the BCG Matrix, characterized by their low market share and low growth rates. Here’s a breakdown of these underperforming areas.

Underperforming Standalone Clinics

CVS operates several standalone veterinary clinics that are experiencing low patient volume. For example, in the most recent financial year, certain clinics reported an average of only 150 clients per month, significantly below the target of 300. This directly impacts revenue, as average consultation fees amount to approximately £40, resulting in monthly revenues of about £6,000 per clinic.

Outdated Veterinary Software Systems

Many of CVS's software systems have not kept pace with technological advancements. The company invested around £500,000 in system upgrades, but the return on investment has been negligible, leading to ongoing inefficiencies. Reports indicate that 20% of staff hours are still dedicated to administrative tasks rather than direct patient care, resulting in an opportunity cost valued at approximately £1.2 million annually.

Declining Pet Grooming Services

In terms of grooming services, CVS has seen a considerable decline. Revenue from pet grooming fell by 15% in the last financial year, dropping from £2 million to £1.7 million. The average grooming session costs around £30, suggesting a decrease in the number of sessions by approximately 10,000 over the year.

Low-Demand Generic Pet Products

Sales in CVS's line of generic pet products have stagnated, representing a low market share in a competitive sector. The company reported that generic product sales accounted for only 5% of total revenue, which amounts to around £500,000 annually. The lack of brand differentiation has contributed to this drop, with market share slipping from 10% to 5% over the past two years.

| Segment | Average Monthly Clients | Average Consultation Fee | Monthly Revenue per Clinic | Annual Revenue from Grooming | Generic Product Revenue | Market Share |

|---|---|---|---|---|---|---|

| Standalone Clinics | 150 | £40 | £6,000 | £1.7 million | £500,000 | 5% |

| Software Systems (Efficiency Cost) | N/A | N/A | £0 | N/A | £1.2 million (opportunity cost) | N/A |

The persistence of these 'Dogs' within CVS Group plc underscores the challenges faced in turning around low-performing segments. Given the financial pressures and limited growth potential, moving towards divestiture may be more prudent than pursuing costly turnaround strategies.

CVS Group plc - BCG Matrix: Question Marks

The following areas within CVS Group plc represent significant Question Marks, characterized by high growth prospects but a low market share.

Emerging Telehealth Services

CVS has entered the rapidly growing telehealth market, which was valued at approximately $60 billion in 2021 and is projected to grow at a CAGR of 38% through 2028. Despite this growth, CVS has captured only a small share of the market, estimated at around 2% in 2023. The company aims to increase its telehealth service usage, currently serving around 1.5 million virtual visits annually, seeking to double this figure over the next three years.

New Pet Insurance Offerings

The pet insurance segment is burgeoning, with an industry valuation expected to reach $20 billion by 2025. CVS's entry into this market has been limited, with a market share of less than 5%. The company’s new offerings aim to capture a piece of this growing market, with plans to increase enrollment from 100,000 policies in 2022 to 300,000 by 2025. However, initial returns remain low, with an average premium of around $500 per policy, and claims ratios exceeding 70%.

Investments in AI Diagnostics

CVS is investing heavily in AI-driven diagnostic tools, with funding of approximately $200 million allocated for development in the past year. The AI diagnostics market is projected to grow from $1.2 billion in 2020 to $20 billion by 2028. Currently, CVS holds a negligible share compared to competitors, with expectations to commercialize its technology in 2024. Despite the investments, the return on these initiatives is currently low, as the integration into existing systems has been slower than anticipated.

Recent International Expansions

CVS's international expansion strategy includes venturing into markets in Europe and Asia. These regions present a growth opportunity estimated at $40 billion for health services. However, CVS has faced challenges, currently capturing less than 3% of the market share in these regions. Revenue generated from international markets was approximately $50 million in 2022, with a projected growth target of $200 million by 2025. Operational costs in these markets have been high, consuming nearly 60% of revenue.

Financial Overview of Question Marks

| Product/Service | Current Market Share | Projected Growth Rate | Current Revenue | Investment Required | Projected Market Value |

|---|---|---|---|---|---|

| Telehealth Services | 2% | 38% | $90 million | $100 million | $60 billion |

| Pet Insurance | 5% | 20% | $50 million | $50 million | $20 billion |

| AI Diagnostics | 1% | 42% | $10 million | $200 million | $20 billion |

| International Expansion | 3% | 25% | $50 million | $50 million | $40 billion |

The BCG Matrix provides a valuable lens through which to examine CVS Group plc's diverse portfolio, illustrating the dynamic interplay between its growth prospects and established revenue streams. With its promising Stars leading the charge in veterinary services and the reliable Cash Cows maintaining profitability, the company must strategically navigate its Question Marks for future potential, while addressing the challenges posed by Dogs in its operational landscape.

[right_small]Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.