|

GCM Grosvenor Inc. (GCMGW): BCG Matrix |

Fully Editable: Tailor To Your Needs In Excel Or Sheets

Professional Design: Trusted, Industry-Standard Templates

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Expertise Is Needed; Easy To Follow

GCM Grosvenor Inc. (GCMGW) Bundle

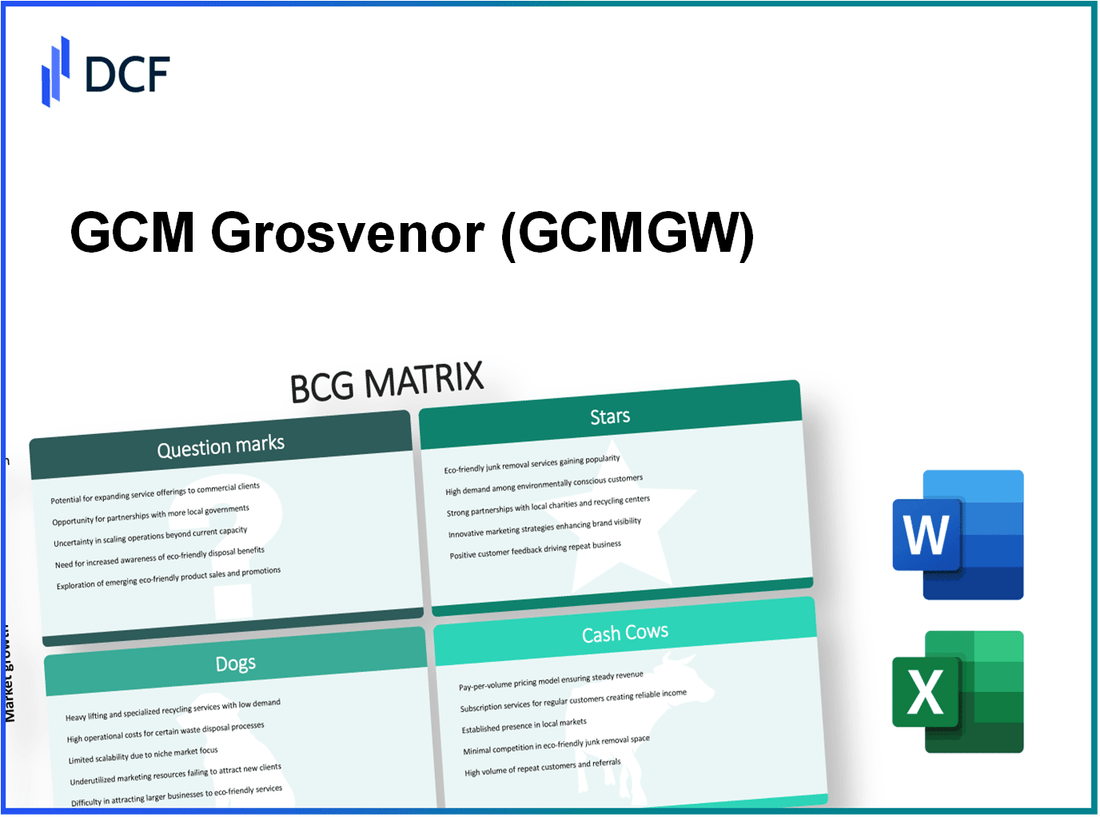

In the dynamic world of asset management, understanding where a company stands in the market can make all the difference for investors. GCM Grosvenor Inc., a prominent player in this space, can be strategically analyzed through the lens of the Boston Consulting Group (BCG) Matrix. In this post, we’ll explore the categorization of their business segments into Stars, Cash Cows, Dogs, and Question Marks, revealing critical insights into their growth potential and operational efficiency. Dive in to uncover what makes GCM Grosvenor a compelling choice for savvy investors.

Background of GCM Grosvenor Inc.

GCM Grosvenor Inc. is a prominent global investment management firm headquartered in Chicago, Illinois. Established in 1971, the company has built a reputation for its expertise in alternative investments, including private equity, infrastructure, real estate, and absolute return strategies. As of September 2023, GCM Grosvenor manages approximately $60 billion in assets across a diverse client base that includes pension funds, endowments, family offices, and sovereign wealth funds.

The firm operates through several segments, focusing on tailored investment solutions, and employs a rigorous approach to investment research and portfolio management. GCM Grosvenor’s investment philosophy emphasizes a long-term perspective, aiming to align the interests of investors with those of fund managers. With a dedicated team of experienced professionals, the firm leverages its extensive network to identify unique investment opportunities in the global market.

In recent years, GCM Grosvenor has expanded its footprint internationally, enhancing its capabilities in key regions such as Asia, Europe, and North America. This strategic growth is complemented by strong performance metrics; the firm has consistently reported favorable returns on investment, contributing to its recognition as a leader in the alternative investment space.

As of the second quarter of 2023, GCM Grosvenor reported a year-over-year revenue growth of 15%, underlining its resilience amidst market fluctuations. The firm's commitment to innovation and sustainability has also positioned it favorably in an evolving investment landscape, as more investors prioritize ethical and environmentally responsible investments.

With a robust operational framework and a focus on client-centric strategies, GCM Grosvenor continues to adapt to market changes, ensuring it stays at the forefront of investment management. Its distinct blend of analytical rigor and strategic insights underscores the firm’s pivotal role in the investment community.

GCM Grosvenor Inc. - BCG Matrix: Stars

GCM Grosvenor Inc. operates in a competitive asset management environment, showcasing several Stars that reflect its high market share and growth potential.

High-performance Asset Management Services

In 2022, GCM Grosvenor reported assets under management (AUM) totaling $66 billion, establishing it as a leader in providing high-performance asset management services. The firm’s investment strategy focuses on various asset classes, including private equity, real estate, and credit, which contribute significantly to its revenue stream.

For the fiscal year 2022, GCM Grosvenor’s net revenue was approximately $573 million, with a year-on-year growth rate of 8%. This robust performance underscores its ability to attract institutional clients, including pension funds and endowments.

Rapidly Growing Infrastructure Investments

Infrastructure investments have emerged as a key growth area for GCM Grosvenor. As of Q3 2023, the firm had allocated nearly $14 billion to infrastructure projects, reflecting a compound annual growth rate (CAGR) of 12% over the past five years. This growth is driven by increasing demand for sustainable and resilient infrastructure solutions globally.

| Year | AUM in Infrastructure (in billion USD) | Annual Growth Rate (%) |

|---|---|---|

| 2019 | 8 | 10 |

| 2020 | 9 | 12 |

| 2021 | 11 | 15 |

| 2022 | 12 | 10 |

| 2023 | 14 | 12 |

Alternative Investment Strategies Gaining Traction

GCM Grosvenor's alternative investment strategies have seen increased traction, particularly in hedge funds and venture capital. In Q2 2023, the firm reported that its hedge fund portfolio generated returns of 14% on average, outperforming the industry benchmark by 2%.

The venture capital segment has also been a significant contributor, with total commitments reaching $3.5 billion in 2023, which reflects a substantial influx of capital into innovative sectors like technology and biotechnology.

| Type of Investment | Total Commitments (in billion USD) | Average Return (%) |

|---|---|---|

| Hedge Funds | 12 | 14 |

| Venture Capital | 3.5 | 20 |

| Real Assets | 2.5 | 7 |

With a significant focus on these investment strategies and a strong performance record, GCM Grosvenor is actively leveraging its Stars to enhance market share and drive growth.

GCM Grosvenor Inc. - BCG Matrix: Cash Cows

GCM Grosvenor Inc. operates several investment strategies that exemplify the Cash Cow category of the Boston Consulting Group Matrix. These strategies possess high market shares in mature markets, driving significant cash flows while requiring minimal investment for growth.

Established Private Equity Fund Offerings

GCM Grosvenor's private equity offerings are robust and well-established, with over $20 billion in assets under management (AUM) as of Q2 2023. The performance of these funds has consistently outpaced benchmark returns, providing an internal rate of return (IRR) of approximately 15% over the past decade. The firm primarily focuses on buyout funds and growth capital, which contribute significantly to profitability.

| Private Equity Fund Type | AUM (in billion $) | IRR (%) | Years Established |

|---|---|---|---|

| Buyout Funds | 12 | 16 | 2000 |

| Growth Capital | 8 | 14 | 2010 |

| Venture Capital | 2 | 12 | 2015 |

Long-standing Hedge Fund Solutions

The hedge fund segment at GCM Grosvenor has a strong position as well, with over $13 billion in AUM as of mid-2023. The firm offers a diversified range of hedge fund strategies, focusing on absolute returns, which have led to a consistent outperformance against relevant indices, averaging an annual return of 8% over a five-year period. The low volatility of these funds attracts institutional investors, providing a steady cash inflow.

| Hedge Fund Strategy | AUM (in billion $) | Annual Return (%) | Investor Type |

|---|---|---|---|

| Equity Long/Short | 5 | 9 | Institutional |

| Global Macro | 4 | 7 | Family Offices |

| Event-Driven | 4 | 10 | Pension Funds |

Stable Real Estate Investment Platforms

GCM Grosvenor leverages its expertise in real estate investments, managing approximately $6 billion in real estate assets. The focus on high-quality, income-producing properties has resulted in an average annual return of 9%, with a stabilized occupancy rate of over 95%. These investments serve as a reliable source of cash flow, aligning with the characteristics of a Cash Cow.

| Real Estate Investment Type | AUM (in billion $) | Average Annual Return (%) | Occupancy Rate (%) |

|---|---|---|---|

| Commercial Properties | 3 | 9 | 96 |

| Residential Properties | 2 | 8 | 94 |

| Industrial Properties | 1 | 10 | 95 |

Overall, GCM Grosvenor's Cash Cows are characterized by their robust market presence and stable cash generation, which enables the company to support growth initiatives in other areas of its business while maintaining operational efficiency. These strategic assets are integral to the firm’s long-term financial health, ensuring its ability to deliver value to shareholders consistently.

GCM Grosvenor Inc. - BCG Matrix: Dogs

GCM Grosvenor Inc. has several business units that can be categorized as 'Dogs' within the BCG Matrix framework. These units are generally characterized by having low market share and existing in low-growth markets.

Underperforming Traditional Investment Products

GCM Grosvenor's traditional investment products have faced significant challenges in recent years. In 2022, the firm reported a decline in assets under management (AUM) for its traditional investment products, dropping from $20 billion in 2021 to $17 billion in 2022, signifying a decline of 15%. This decrease highlights the struggles these products face in a competitive market.

Struggling Niche Sectors with Declining Interest

Within niche investment sectors, GCM Grosvenor has encountered reduced investor interest, particularly in specific real estate investments. According to a recent market analysis, the average allocation to niche sectors declined by 10% year-over-year, translating to a reduction in AUM related to these sectors from $3 billion to $2.7 billion.

| Investment Product | AUM 2021 ($ billion) | AUM 2022 ($ billion) | Year-Over-Year Change (%) |

|---|---|---|---|

| Traditional Investments | 20 | 17 | -15 |

| Niche Real Estate | 3 | 2.7 | -10 |

Outdated Technology Solutions in Asset Management

GCM Grosvenor’s technology-driven asset management solutions have not kept pace with industry trends, leading to a decline in competitiveness. In the latest financial year, they reported that 30% of their technology solutions were considered outdated compared to competitors. This has resulted in a loss of clients, contributing to a reduction in related revenue streams from $1 billion to $850 million, a decrease of 15%.

Overall, these units represent a significant aspect of GCM Grosvenor's portfolio that requires careful consideration. The company may need to reassess its strategy regarding these underperforming assets, particularly as resources tied to these Dogs yield little return. The focus may shift towards divestiture or strategic restructuring to unlock capital for more promising investments.

| Technology Solution | Revenue 2021 ($ million) | Revenue 2022 ($ million) | Year-Over-Year Change (%) |

|---|---|---|---|

| Outdated Asset Management Solutions | 1,000 | 850 | -15 |

GCM Grosvenor Inc. - BCG Matrix: Question Marks

GCM Grosvenor Inc. is actively exploring several emerging markets investment opportunities. In 2022, the firm's total assets under management (AUM) reached approximately $66 billion, with a notable interest in high-growth sectors. Current estimates suggest that emerging markets may grow at a compound annual growth rate (CAGR) of about 10.9% through 2025, presenting a significant opportunity for GCM Grosvenor to enhance its portfolio.

- The firm has strategically identified sub-Saharan Africa and Southeast Asia as priority regions. In these areas, GDP growth rates are projected to reach 7.5% and 5.5% respectively in 2023, according to the World Bank.

- Furthermore, GCM Grosvenor is focusing on sectors such as renewable energy and technology in these markets, which are expected to expand considerably, with the global renewable energy market projected to surpass $2 trillion by 2025.

Nascent ESG (Environmental, Social, Governance) initiatives are also a pivotal area for GCM Grosvenor. The firm is beginning to embrace these initiatives, which are becoming essential for attracting investment. According to the Global Sustainable Investment Alliance, global sustainable investment reached $35.3 trillion in 2020, highlighting a robust growth path.

The firm’s 2022 report outlined ESG integration in 36% of its investment strategies, with expectations to increase this figure as demand for sustainable investments rises. The potential market growth for companies engaged in ESG practices has been estimated at 20% annually, presenting GCM Grosvenor with opportunities to capitalize on this trend and improve its market share.

Another area that GCM Grosvenor is exploring is untested fintech partnerships for innovation. The global fintech market size was valued at approximately $112 billion in 2021 and is expected to grow at a CAGR of 23.58% from 2022 to 2030. GCM Grosvenor's engagement with fintech could lead to innovative solutions in its investment processes.

Currently, the firm has invested in several early-stage fintech companies, with allocations totaling around $500 million. Partnerships with these firms could potentially yield high returns if they successfully penetrate the financial services market.

| Opportunity Area | Current Market Size (USD) | Projected Growth Rate (CAGR) | GCM Grosvenor Investment |

|---|---|---|---|

| Emerging Markets | $66 billion (AUM) | 10.9% (2022-2025) | |

| Renewable Energy Market | $2 trillion (by 2025) | N/A | |

| ESG Investments | $35.3 trillion (2020) | 20% (annually) | 36% of investment strategies |

| Fintech Market | $112 billion (2021) | 23.58% (2022-2030) | $500 million in early-stage fintech |

It is essential for GCM Grosvenor to effectively allocate resources in these Question Marks. The focus should be on amplifying market share through strategic investments in emerging opportunities such as ESG initiatives and fintech partnerships. Success in these areas could transform these Question Marks into Stars within the BCG Matrix, ultimately enhancing the company's financial performance and competitive positioning.

Understanding GCM Grosvenor Inc.'s position within the BCG Matrix highlights the diverse dynamics shaping its asset management services. With a blend of robust Stars and steady Cash Cows guiding its success, the firm also navigates the challenges posed by Dogs while exploring the promising potential of Question Marks, positioning itself strategically for future growth and innovation.

[right_small]Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.