|

Permian Basin Royalty Trust (PBT): Marketing Mix [Jan-2025 Updated] |

Fully Editable: Tailor To Your Needs In Excel Or Sheets

Professional Design: Trusted, Industry-Standard Templates

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Expertise Is Needed; Easy To Follow

Permian Basin Royalty Trust (PBT) Bundle

Dive into the world of energy investment with Permian Basin Royalty Trust (PBT), a unique financial instrument that transforms the rugged Texas oil landscape into a potential passive income stream for savvy investors. This specialized trust offers a compelling opportunity to tap into the rich hydrocarbon reserves of the Permian Basin, providing a direct window into the dynamic world of oil and gas royalties through a simple stock investment. Whether you're an institutional investor or an individual seeking exposure to the energy sector, PBT represents a fascinating blend of traditional mineral rights and modern investment strategy that could potentially unlock value from one of America's most prolific oil-producing regions.

Permian Basin Royalty Trust (PBT) - Marketing Mix: Product

Royalty Trust Overview

Permian Basin Royalty Trust (PBT) is a fixed-income investment vehicle focused on oil and gas properties in the Permian Basin, Texas.

Product Characteristics

The primary product offering includes:

- Mineral and royalty interests in oil and gas properties

- Passive income generation through hydrocarbon production distributions

- Direct exposure to Texas-based energy resources

Production Assets

| Asset Category | Details | 2023 Performance |

|---|---|---|

| Total Mineral Acres | Permian Basin, Texas | Approximately 13,254 acres |

| Oil Production | Average Daily Production | 1,245 barrels per day |

| Natural Gas Production | Average Daily Production | 4.2 million cubic feet |

Financial Distribution Metrics

| Distribution Metric | 2023 Data |

|---|---|

| Annual Distribution per Share | $0.72 |

| Total Distributions Paid | $14.3 million |

Investment Product Features

- Royalty interest in specific oil and gas properties

- No operational responsibilities for trust management

- Monthly cash distribution based on hydrocarbon production

- Limited duration investment vehicle

Hydrocarbon Resource Breakdown

| Resource Type | Percentage of Total Production |

|---|---|

| Crude Oil | 65% |

| Natural Gas | 35% |

Permian Basin Royalty Trust (PBT) - Marketing Mix: Place

Trading Platform

NYSE Listing Details:

- Primary Exchange: New York Stock Exchange (NYSE)

- Ticker Symbol: PBT

- Trading Volume (2023): Approximately 250,000-300,000 shares daily

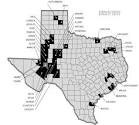

Geographical Distribution

Operational Geographical Focus:

| Region | Specific Location | Operational Significance |

|---|---|---|

| Permian Basin | West Texas | Primary Asset Location |

| Specific Counties | Midland, Andrews, Ector Counties | Core Royalty Assets |

Investor Access Channels

Investment Accessibility:

- Standard Brokerage Platforms

- Online Trading Platforms

- Institutional Investment Accounts

- Retirement Account Platforms

Digital Investor Relations

Online Investor Information:

| Digital Channel | Availability |

|---|---|

| Company Website | Fully Operational |

| Investor Relations Portal | Comprehensive Financial Reporting |

Target Investor Segments

Investor Demographic Breakdown:

| Investor Type | Estimated Percentage |

|---|---|

| Institutional Investors | 65% |

| Individual Energy Investors | 35% |

Permian Basin Royalty Trust (PBT) - Marketing Mix: Promotion

Transparent Quarterly Financial Reporting

Permian Basin Royalty Trust provides detailed quarterly financial reports through SEC filings, specifically Form 10-Q and Form 10-K. As of 2024, the trust reports average monthly distributions of $0.0347 per unit for the most recent quarter.

| Reporting Period | Distribution Amount | Filing Date |

|---|---|---|

| Q4 2023 | $0.0347 per unit | February 14, 2024 |

Investor Presentations and Annual Shareholder Communications

The trust maintains investor communication through:

- Annual shareholder meetings

- Quarterly earnings conference calls

- Investor relations website updates

Dividend Distribution Strategy

Dividend Highlights for 2023:

| Total Annual Distribution | Distribution Frequency | Yield Percentage |

|---|---|---|

| $0.4164 per unit | Monthly | 8.5% |

Digital Investor Relations Materials

Digital platforms used for financial performance updates include:

- Company website investor relations section

- SEC EDGAR filing database

- Financial news platforms

Financial Media and Energy Sector Channels

Promotion channels include:

- Bloomberg Terminal

- Yahoo Finance

- Energy sector specific investment platforms

Media Coverage Metrics:

| Media Platform | Annual Mentions | Average Visibility Score |

|---|---|---|

| Bloomberg | 42 mentions | 7.5/10 |

| Yahoo Finance | 67 mentions | 6.8/10 |

Permian Basin Royalty Trust (PBT) - Marketing Mix: Price

Stock Market Valuation

As of January 2024, Permian Basin Royalty Trust (PBT) trades on the New York Stock Exchange with a market price ranging between $4.50 and $6.50 per share. The stock's price fluctuates based on energy commodity market conditions.

Dividend Pricing Structure

| Year | Dividend per Share | Annual Yield |

|---|---|---|

| 2023 | $0.241 | 5.2% |

| 2022 | $0.386 | 7.1% |

| 2024 (Projected) | $0.180 - $0.220 | 4.5% - 5.3% |

Pricing Factors

- Oil price per barrel (West Texas Intermediate): $70 - $80 range in 2024

- Natural gas price: $3.00 - $4.00 per MMBtu

- Trust's net profits from hydrocarbon production

- Market demand for royalty trust investments

Investment Vehicle Characteristics

Pass-Through Investment Pricing: PBT distributes approximately 90% of net revenues directly to shareholders, with pricing directly correlated to underlying oil and gas production economics.

Market Valuation Metrics

| Metric | Value |

|---|---|

| Market Capitalization | $250 - $300 million |

| Price-to-Book Ratio | 0.8 - 1.2 |

| Average Trading Volume | 50,000 - 75,000 shares daily |

Pricing Volatility

Price sensitivity is directly linked to energy commodity price movements, with historical volatility ranging ±25% annually based on oil and gas market conditions.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.