|

UCB SA (UCB.BR): BCG Matrix |

Fully Editable: Tailor To Your Needs In Excel Or Sheets

Professional Design: Trusted, Industry-Standard Templates

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Expertise Is Needed; Easy To Follow

UCB SA (UCB.BR) Bundle

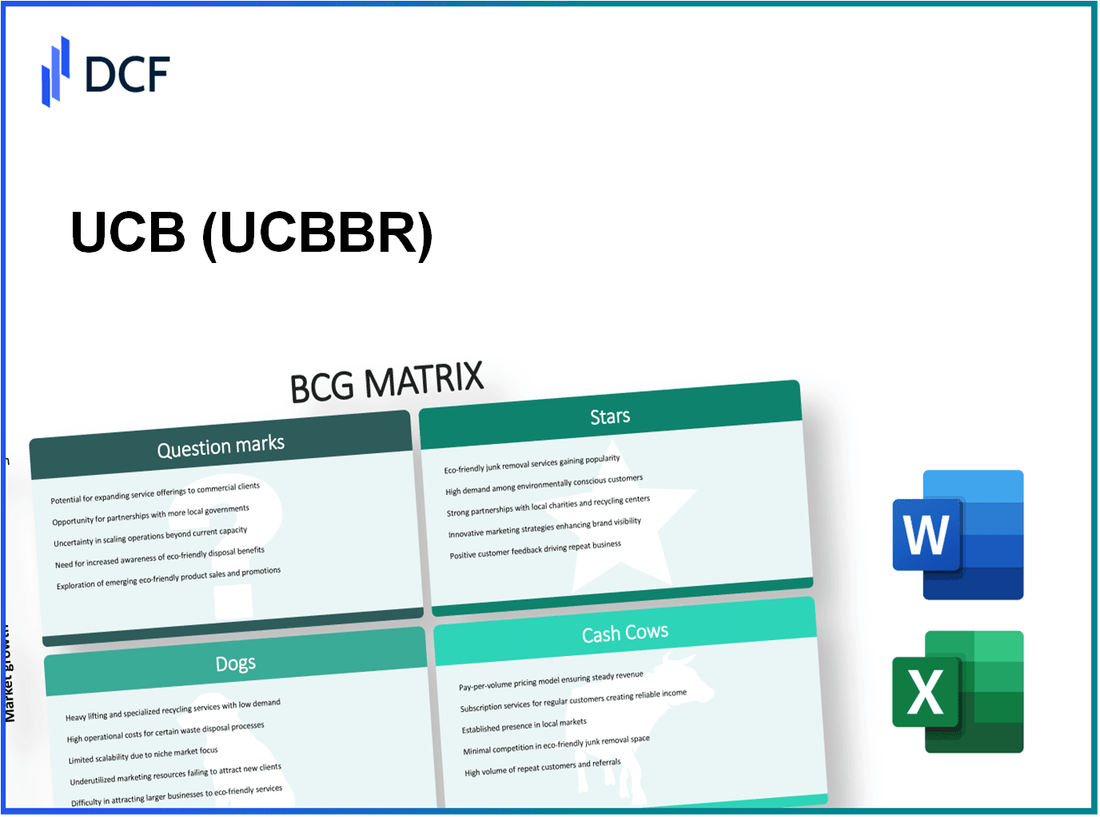

The Boston Consulting Group (BCG) Matrix serves as a vital tool for assessing the strategic positioning of companies like UCB SA within the dynamic pharmaceutical landscape. By categorizing its portfolio into Stars, Cash Cows, Dogs, and Question Marks, we can gain insight into where UCB is thriving and where it faces challenges. Dive into this analysis to explore the pivotal areas driving innovation and revenue, as well as the segments that may require a reevaluation of strategy.

Background of UCB SA

UCB SA is a global biopharmaceutical company headquartered in Brussels, Belgium. Founded in 1928, UCB has evolved significantly, focusing on discovering and developing innovative treatments for severe diseases, particularly in neurology and immunology. The company's mission revolves around creating value for patients through science.

UCB operates in over 40 countries, with a strong presence in Europe and North America. The company allocates a substantial part of its revenue towards research and development, which constituted approximately 28% of the total sales in 2022. This commitment underscores its dedication to pioneering new therapies that address unmet medical needs.

As of 2023, UCB's portfolio includes well-known products like Vimpat (used for epilepsy) and cimzia (for autoimmune conditions). In 2022, UCB reported a revenue of around €5.4 billion, primarily driven by the success of these key drugs. The company has also made strides in expanding its pipeline, focusing on therapies for conditions such as Alzheimer’s disease, further enhancing its reputation as a player in the biopharmaceutical sector.

UCB has embraced digital transformation and innovative technology to optimize its operations and improve patient outcomes. Through collaborations and partnerships, including academic institutions and other biopharmaceutical companies, UCB aims to accelerate the development of its drug candidates.

In addition to its strong financial performance, UCB is recognized for its sustainability efforts. The company has set ambitious targets to reduce its carbon footprint and enhance transparency across its supply chain, aligning itself with global sustainability goals.

UCB SA - BCG Matrix: Stars

UCB SA is strategically positioned with key products classified as Stars, characterized by high market share in rapidly growing markets. The following sections highlight the various aspects that contribute to UCB's Stars within the BCG Matrix framework.

Emerging Biotechnology Innovations

UCB has made significant strides in biotechnology, with a focused investment in innovative treatments for various diseases. In 2022, UCB reported a total revenue of approximately €5.5 billion, driven largely by its biotechnology products. Notably, UCB's blockbuster drug, Cimzia (certolizumab pegol), generated sales of about €1.13 billion in 2022, reflecting a growth of 10% from the previous year.

Expanding Market for Neurology Treatments

The global market for neurology treatments is projected to grow significantly. According to a report by Fortune Business Insights, the neurology market is expected to reach €34.6 billion by 2027, growing at a CAGR of 7.4% from 2020 to 2027. UCB's emphasis on neurology, including its anti-epileptic drug, Briviact (brivaracetam), positions the company to capture a substantial share of this expanding market. In 2022, Briviact sales reached approximately €415 million, indicating a robust demand in a high-growth sector.

Robust R&D Pipeline

UCB maintains a strong research and development pipeline, investing about €1.4 billion in R&D in 2022, which represents over 25% of its total revenue. The company focuses on several key therapeutic areas, including neurology and immunology, which are expected to bolster future growth. UCB has over 20 drug candidates in clinical development, including promising therapies for conditions like Parkinson's disease and Crohn's disease.

Strong Brand Recognition in Immunology

UCB is recognized as a leader in immunology, with its flagship product, antibody-based therapy, becoming a cornerstone of its portfolio. The company has captured approximately 8% market share in the global immunology market, which is valued at around €78 billion in 2022. UCB's other immunology product, Evenity (romosozumab), also contributed significantly, with sales of approximately €782 million in 2022, highlighting its strong position in the growing market for autoimmune therapies.

| Product | 2022 Sales (€ Million) | Growth Rate (%) | Market Share (%) |

|---|---|---|---|

| Cimzia | 1,130 | 10 | 12 |

| Briviact | 415 | 15 | 5 |

| Evenity | 782 | 20 | 8 |

In summary, UCB SA’s Stars exhibit strong financial performance, high market share, and robust growth potential in rapidly advancing therapeutic areas. The company’s commitment to innovation and strategic investments ensures its competitive position in the biotechnology landscape.

UCB SA - BCG Matrix: Cash Cows

UCB SA has established several strong positions in the pharmaceutical market, particularly in the areas of epilepsy and immunology. The following sections will delve into the cash cow segments that contribute significantly to UCB's financial health.

Established Epilepsy Treatments

UCB's established epilepsy treatment, Keppra, has been a consistent revenue generator. As of the latest financial reports, Keppra contributes approximately €1.5 billion in annual sales. The product has a market share exceeding 25% in the epilepsy drug segment within Europe, evidencing its robust position in a mature market.

With low promotional costs and high profit margins, Keppra remains a significant cash cow. It benefits from established physician familiarity and a strong patient base, leading to ongoing sales stability.

Leading Immunology Products

UCB's immunology product, Cimzia, further reinforces the cash cow status. Cimzia has generated revenue of approximately €1.1 billion for UCB in the last fiscal year, holding a market share of around 18% in the global anti-TNF market. The product's performance is particularly noted in treating rheumatoid arthritis and Crohn's disease, where competition is lower, and brand loyalty is high.

Investment in Cimzia's supporting infrastructure has led to improvements in distribution efficiency, further enhancing its profitable cash flow. The predictability of cash generation allows UCB to allocate resources to other areas of growth.

Sustainable Revenue from Mature Markets

UCB's overall strategy focuses on sustainable revenue streams from its mature product lines. The company's total revenue from cash cows is approximately €2.6 billion, representing over 65% of UCB’s total revenue. This significant contribution allows the company to fund research developments and address corporate expenses while providing stability against market fluctuations.

In terms of profitability, UCB's cash cow products maintain an average operating margin of 40%, which is considerably above the industry average of 25%. This highlights the efficiency and cash generation capabilities of UCB’s established products.

| Product | Annual Revenue (€ Million) | Market Share (%) | Average Operating Margin (%) |

|---|---|---|---|

| Keppra | 1,500 | 25 | 40 |

| Cimzia | 1,100 | 18 | 40 |

| Total Cash Cow Revenue | 2,600 | 65 | 40 |

UCB's ability to leverage these cash cows demonstrates its strength in maintaining a solid foundation within the pharmaceutical industry. With efficient operations and established products, UCB is well-positioned to maximize its cash flow while exploring opportunities in burgeoning markets.

UCB SA - BCG Matrix: Dogs

UCB SA, a global biopharmaceutical company based in Belgium, has faced challenges with certain product lines that fall into the 'Dogs' category of the BCG Matrix. These products are characterized by low market share and low growth in their respective markets.

Declining sales in outdated drug lines

Several of UCB’s older drug lines have shown significant declines in sales. For instance, the revenue from Keppra, an anti-epileptic drug, has decreased from approximately €1.3 billion in 2017 to around €1 billion in 2021. This represents a CAGR decline of about 5.9%.

Non-core business segments

UCB's non-core business segments have contributed to the 'Dogs' designation. The revenue from non-core operations has decreased by 15% year-over-year, accounting for less than 5% of UCB's total annual revenue of €5.5 billion in 2022. This reliance on peripheral segments has resulted in a significant drag on resources.

Products with high competition and low differentiation

UCB operates in highly competitive markets, particularly in therapeutic areas like neurology and immunology. For instance, the competitive landscape for cognitive drugs has led to a decrease in market share for UCB’s flagship products. The market for anti-epileptics alone is projected to grow at a CAGR of just 1.8%, while UCB’s market share has dwindled to below 10%.

| Product Line | 2017 Revenue (€ million) | 2021 Revenue (€ million) | Decline (%) |

|---|---|---|---|

| Keppra | 1,300 | 1,000 | 23.1 |

| Non-core business revenue | 650 | 550 | 15.4 |

| Anti-epileptics market share | 12 | 9 | 25.0 |

Products categorized as Dogs frequently do not contribute positively to the cash flow of UCB. For instance, the overall contribution margin from these products has nearly reached a break-even point, consuming resources that could be better allocated to more promising segments.

With the current market dynamics and the slow growth in these mature segments, UCB SA faces a challenging landscape. The strategic focus may need to shift away from these Dogs to enhance overall operational efficiency and concentrate on more lucrative opportunities.

UCB SA - BCG Matrix: Question Marks

UCB SA has identified several areas within its portfolio that fall into the Question Marks category, reflecting high growth potential but currently low market share. Here's a detailed analysis of these ventures.

Early-stage gene therapy ventures

UCB is actively involved in gene therapy with a focus on rare diseases. As of 2023, the global gene therapy market is projected to reach $6.8 billion by 2027, growing at a compound annual growth rate (CAGR) of 27.5%. UCB's investments in this area include programs that are still in clinical trials, such as their collaboration on therapies targeting neurological disorders.

Investments in digital health platforms

UCB has been investing in digital health initiatives, recognizing the demand for improved patient engagement through technology. The global digital health market was valued at approximately $175 billion in 2021 and is expected to grow to $660 billion by 2027, representing a CAGR of 25%. UCB's recent initiatives include partnerships with digital health firms to enhance treatment adherence and data sharing.

Initiatives in emerging geographic markets

Emerging markets present significant growth opportunities for UCB, particularly in Asia and Latin America. The pharmaceutical market in Asia alone is expected to exceed $300 billion by 2025, driven by increasing healthcare access and rising incomes. UCB's focus on expanding in these regions includes investments totaling approximately $50 million aimed at establishing a foothold and increasing market penetration.

Partnerships with biotech startups

UCB has forged several partnerships with biotech startups to bolster its innovation pipeline. In 2023, UCB announced a strategic alliance with a biotech company focusing on immunology, with an initial investment of $30 million. The aim is to co-develop new treatments that could enhance UCB's product offerings in a market expected to grow by 15% annually over the next five years.

| Segment | Market Size (2021) | Projected Market Size (2027) | CAGR (%) | UCB Investment ($ Million) |

|---|---|---|---|---|

| Gene Therapy | $1.2 billion | $6.8 billion | 27.5 | $20 |

| Digital Health | $175 billion | $660 billion | 25 | $10 |

| Emerging Markets | $300 billion | $500 billion | 10 | $50 |

| Biotech Partnerships | N/A | N/A | N/A | $30 |

Understanding UCB SA's positioning within the Boston Consulting Group Matrix provides clear insights into its future potential; while the strength of its Stars indicates a promising trajectory, its Cash Cows assure steady revenue, even as it navigates the challenges of Dogs and evaluates the uncertain prospects of Question Marks. This strategic mix underscores the company's adaptive approach in a rapidly evolving biotech landscape.

[right_small]Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.