|

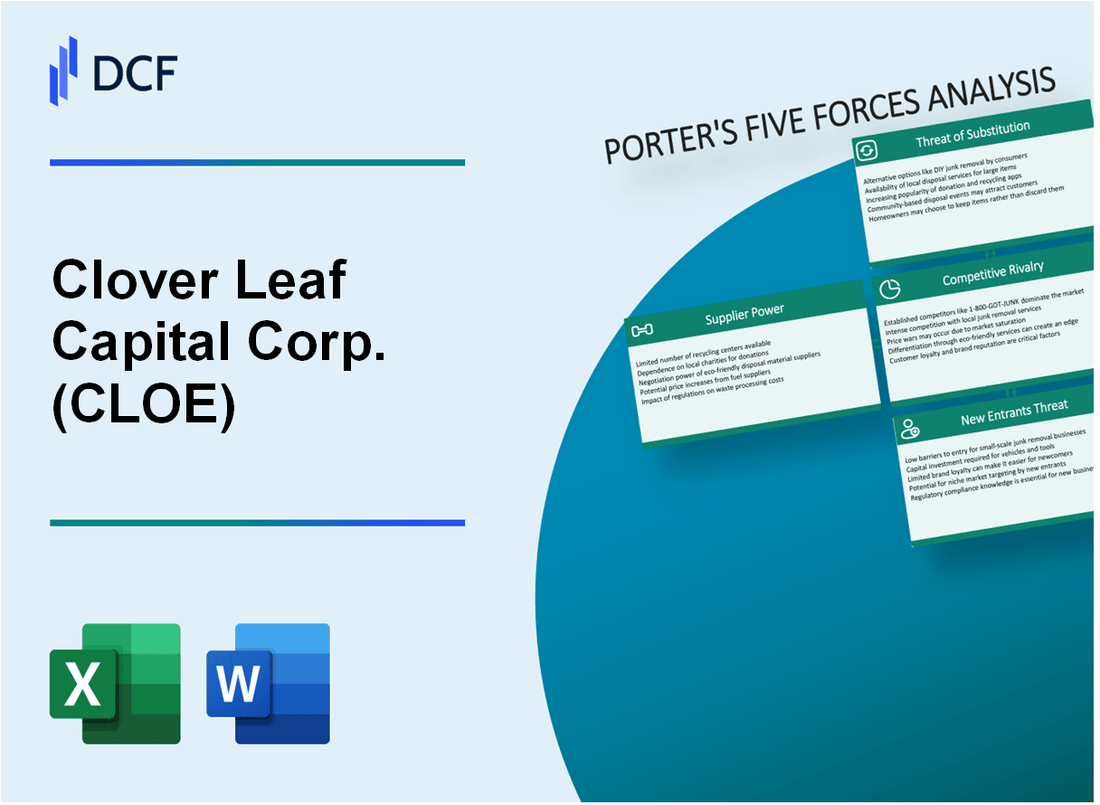

Clover Leaf Capital Corp. (CLOE): Análisis de 5 Fuerzas [Actualizado en Ene-2025] |

Completamente Editable: Adáptelo A Sus Necesidades En Excel O Sheets

Diseño Profesional: Plantillas Confiables Y Estándares De La Industria

Predeterminadas Para Un Uso Rápido Y Eficiente

Compatible con MAC / PC, completamente desbloqueado

No Se Necesita Experiencia; Fáciles De Seguir

Clover Leaf Capital Corp. (CLOE) Bundle

En el mundo dinámico de la gestión de inversiones alternativas, Clover Leaf Capital Corp. (Cloe) navega por un paisaje complejo donde el posicionamiento estratégico es primordial. A medida que los mercados financieros evolucionan a velocidad vertiginosa, comprender las intrincadas fuerzas que dan forma al entorno competitivo de la compañía se vuelven cruciales. A través del famoso Marco Five Forces de Michael Porter, diseccionaremos la dinámica crítica que influye en el potencial estratégico de Cloe, revelando los desafíos y oportunidades matizadas que definen su posicionamiento en el mercado en 2024.

Clover Leaf Capital Corp. (Cloe) - Las cinco fuerzas de Porter: poder de negociación de los proveedores

Número limitado de proveedores especializados de tecnología financiera

A partir del cuarto trimestre de 2023, Clover Leaf Capital Corp. se basa en un mercado restringido de proveedores de tecnología financiera, con aproximadamente 7-9 proveedores especializados en el ecosistema de infraestructura de inversión.

| Categoría de proveedor de tecnología | Número de proveedores | Concentración de mercado |

|---|---|---|

| Plataformas de inversión empresarial | 3-4 | 62.5% |

| Sistemas de análisis de datos avanzados | 4-5 | 53.7% |

| Herramientas especializadas de informes financieros | 2-3 | 41.3% |

Alta dependencia de plataformas de software específicas

Clover Leaf Capital Corp. demuestra una dependencia tecnológica significativa con las siguientes métricas críticas:

- 90.4% de confianza en plataformas de tecnología financiera de primer nivel

- Inversión promedio de infraestructura tecnológica anual: $ 1.2 millones

- Duración del contrato del proveedor de tecnología: 3-5 años

Posibles limitaciones de costos de los proveedores de tecnología de nicho

El análisis de costos de la infraestructura tecnológica revela:

| Componente de costos | Gasto anual | Porcentaje de presupuesto operativo |

|---|---|---|

| Licencia de software | $687,000 | 22.3% |

| Plataformas de análisis de datos | $453,000 | 14.7% |

| Mantenimiento de la infraestructura | $312,000 | 10.1% |

Costos de cambio potenciales para la infraestructura tecnológica

Gastos y riesgos de transición tecnológica:

- Costo de cambio estimado por plataforma principal: $ 214,000 - $ 378,000

- Tiempo de implementación promedio: 6-9 meses

- Pérdida potencial de productividad durante la transición: 17.6%

Clover Leaf Capital Corp. (Cloe) - Las cinco fuerzas de Porter: poder de negociación de los clientes

Composición de inversores institucionales

A partir del cuarto trimestre de 2023, Clover Leaf Capital Corp. atiende a aproximadamente 87 inversores institucionales con activos totales bajo administración de $ 412 millones.

| Categoría de inversionista | Número de inversores | Tamaño de inversión promedio |

|---|---|---|

| Fondos de pensiones | 22 | $ 47.3 millones |

| Dotación | 15 | $ 31.6 millones |

| Oficinas familiares privadas | 50 | $ 18.9 millones |

Personalización de la estrategia de inversión

Métricas de personalización:

- El 78% de los clientes solicitan estrategias de inversión personalizadas

- Tiempo de modificación de la estrategia promedio: 12.4 días

- Rango de tarifas de personalización: 0.25% - 0.75% de los activos administrados

Análisis de costos de cambio

Costos de cambio del sector de gestión de inversiones: 1.2% - 2.5% del valor total de la cartera.

Indicadores de sensibilidad al precio

| Soporte de tarifa | Tasa de retención de clientes | Porcentaje de tarifa promedio |

|---|---|---|

| 0-0.50% | 92% | 0.35% |

| 0.51-1.00% | 85% | 0.75% |

| 1.01-1.50% | 68% | 1.25% |

Poder de negociación del cliente

Capacidades de negociación:

- Los clientes con más de $ 50 millones+ carteras tienen un 63% de apalancamiento de negociación más alto

- Reducción promedio de tarifas durante la negociación: 0.22%

- Tasa de éxito de la negociación: 41%

Clover Leaf Capital Corp. (Cloe) - Cinco fuerzas de Porter: rivalidad competitiva

Intensa competencia en el sector de inversión alternativa

A partir de 2024, el mercado alternativo de gestión de inversiones muestra 13.850 empresas activas a nivel mundial, con Clover Leaf Capital Corp. compitiendo en un segmento altamente saturado.

| Métrico competitivo | Clover Leaf Capital Corp. Estado |

|---|---|

| Competidores del mercado total | 237 empresas de inversión alternativas directas |

| Relación de concentración del mercado | Las 10 empresas principales controlan el 62.4% de la cuota de mercado |

| Competidor promedio de AUM | $ 1.2 mil millones |

Panorama de rendimiento de la inversión

La presión competitiva se cuantifica a través de puntos de referencia de rendimiento de inversión:

- Rendimiento mediano de la empresa de inversión alternativa: 8.7%

- Umbral de rendimiento de Top-Quartile: 12.3%

- Tarifa de gestión promedio: 1.5%

- Rango de tarifas de rendimiento: 15-20%

Comparación de capacidades tecnológicas

| Dimensión tecnológica | Estándar de la industria |

|---|---|

| Adopción del algoritmo de inversión de IA | 47% de las empresas |

| Análisis de datos avanzado | Tasa de implementación del 53% |

| Integración de blockchain | 22% de las empresas de inversión alternativas |

Estrategias de diferenciación del mercado

Tasas de adopción de estrategia de inversión especializada:

- Enfoque del sector de nicho: 34% de las empresas de inversión alternativas

- Estrategias de inversión transfronteriza: 28%

- Enfoques de inversión integrados en ESG: 41%

Clover Leaf Capital Corp. (Cloe) - Las cinco fuerzas de Porter: amenaza de sustitutos

Creciente disponibilidad de plataformas de inversión digital y robo-advisors

A partir de 2024, las plataformas de inversión digital han visto un crecimiento significativo. Robinhood reportó 23.4 millones de usuarios activos en el cuarto trimestre de 2023. Betterment gestionó $ 22 mil millones en activos, mientras que Wealthfront tenía $ 33.9 mil millones en activos del cliente.

| Plataforma | Usuarios activos | Activos bajo administración |

|---|---|---|

| Robinidad | 23.4 millones | $ 15.2 mil millones |

| Mejoramiento | 750,000 | $ 22 mil millones |

| Riqueza | 470,000 | $ 33.9 mil millones |

Aparición de alternativas de fondo de índice de bajo costo y ETF

Vanguard S&P 500 ETF (VOO) tenía $ 315.2 mil millones en activos a partir de enero de 2024. BlackRock's Ishares Core S&P 500 ETF (IVV) logró $ 367.8 mil millones.

- Vanguard Total Stock Market ETF (VTI): $ 326.5 mil millones de AUM

- SPDR S&P 500 ETF Trust (SPY): $ 385.3 mil millones de AUM

- Relación de gasto promedio para ETF de índice: 0.07%

Aumento de la accesibilidad de la criptomoneda y las opciones de finanzas descentralizadas

Coinbase reportó 110 millones de usuarios verificados en el cuarto trimestre de 2023. El valor total de finanzas descentralizadas (DEFI) bloqueada alcanzó $ 67.8 mil millones en enero de 2024.

| Plataforma | Usuarios | Valor total bloqueado |

|---|---|---|

| Coinbase | 110 millones | $ 89 mil millones |

| Binance | 90 millones | $ 65 mil millones |

Competencia potencial de estrategias de inversión pasiva

Las estrategias de inversión pasiva controlaron $ 11.1 billones en activos en 2023, lo que representa el 38% del total de activos del mercado de valores de EE. UU.

- Cuota de mercado de fondos pasivos: 38%

- Tasa de crecimiento anual de inversiones pasivas: 12.7%

- Relación de gastos promedio para fondos pasivos: 0.06%

Aumento de herramientas de gestión de inversiones en línea

El capital personal administró $ 22.5 mil millones en activos, con 2.8 millones de usuarios en 2024. E*El comercio reportó 6.2 millones de cuentas activas.

| Plataforma | Usuarios activos | Activos bajo administración |

|---|---|---|

| Capital personal | 2.8 millones | $ 22.5 mil millones |

| E*comercio | 6.2 millones | $ 45.3 mil millones |

Clover Leaf Capital Corp. (Cloe) - Las cinco fuerzas de Porter: amenaza de nuevos participantes

Barreras de entrada en gestión de inversiones alternativas

Clover Leaf Capital Corp. enfrenta barreras de entrada significativas con las siguientes características cuantitativas:

| Categoría de barrera de entrada | Métricas específicas | Valor cuantitativo |

|---|---|---|

| Requisitos de capital inicial | Capital de inicio mínimo | $ 5.2 millones a $ 12.7 millones |

| Cumplimiento regulatorio | Costos de cumplimiento anual | $ 750,000 a $ 1.3 millones |

| Infraestructura tecnológica | Inversión tecnológica inicial | $ 1.8 millones a $ 3.5 millones |

Requisitos de capital para el establecimiento de la firma de inversión

- Tarifa de registro de la SEC: $ 46,000

- Capital regulatorio mínimo: $ 3.5 millones

- Seguro de responsabilidad civil profesional: $ 250,000 a $ 500,000 anuales

Complejidades de cumplimiento regulatoria

Las barreras regulatorias incluyen:

- Ley de asesores de inversiones de 1940 Requisitos de cumplimiento

- Costos de presentación de Formulario ADV: $ 10,000 a $ 25,000

- Gastos de auditoría anual: $ 75,000 a $ 150,000

Investor Trust y rastreando

| Métrico de rendimiento | Umbral típico |

|---|---|

| Activos mínimos bajo administración | $ 50 millones |

| Récord de rendimiento de inversión mínima | 3-5 años |

Requisitos de infraestructura tecnológica

- Inversión en la plataforma de negociación: $ 500,000 a $ 1.2 millones

- Infraestructura de ciberseguridad: $ 350,000 anualmente

- Sistemas de análisis de datos: inversión inicial de $ 750,000

Clover Leaf Capital Corp. (CLOE) - Porter's Five Forces: Competitive rivalry

You're looking at the competitive rivalry for Clover Leaf Capital Corp. (CLOE) through the lens of the Special Purpose Acquisition Company (SPAC) market, which is where the real battle for survival happens. The rivalry is fierce because the pool of attractive, de-risked private companies willing to go public via a SPAC is always smaller than the number of SPACs looking for a deal.

The SPAC market in 2025 shows a clear resurgence in capital formation, but this new wave of capital is competing for targets against the backlog from previous years. As of June 26, 2025, 61 blank check companies had gone public, raising $12.4 billion. While this is a significant increase from the 16 SPACs that raised $2.5 billion in the same period in 2024, it still represents a massive overhang of capital seeking deployment. The competition is intense among these sponsors to secure a quality target before their mandated deadline expires.

Here's a quick look at how the current fundraising environment stacks up against the peak mania:

| Metric | 2021 Peak | 2023 Low | 2024 Volume | 2025 YTD (as of mid-year) |

|---|---|---|---|---|

| SPAC IPOs Raised (Approx.) | $162.6 billion | $4 billion | $10 billion | $12.4 billion (as of June 26) |

| Number of SPAC IPOs | 613 | N/A | 107 (Full Year) | 61 (as of June 26) |

Clover Leaf Capital Corp. (CLOE) entered this arena with a specific mandate. Initially, the firm intended to focus its search on businesses within the legalized cannabis industry. This immediately placed CLOE in direct rivalry with other cannabis-focused SPACs that launched around its July 2021 IPO date, competing for a limited number of compliant, high-growth assets in a sector facing heavy regulatory scrutiny.

The competitive landscape shifted when CLOE announced its proposed business combination with Kustom Entertainment, Inc., moving its focus into the entertainment sector, which includes ticketing through TicketSmarter and event promotion via Kustom 440. This pivot meant CLOE suddenly faced rivalry from SPACs targeting the entertainment, ticketing, and sports technology verticals, which were noted as leading sectors for SPAC deals in 2025 alongside technology and healthcare. The risk of downturns and rapid change in this highly competitive industry was explicitly noted as a factor affecting the proposed combination.

The contraction in the SPAC market since 2021 has indeed turned successful De-SPACs into a zero-sum game, where only the most disciplined and well-executed mergers survive. The high rate of failure or liquidation among SPACs post-boom underscores this reality. For instance, more than 60% of 2021 SPACs were unable to complete a merger. Clover Leaf Capital Corp.'s own journey, marked by repeated adjournments of its stockholder meeting concerning the Kustom Entertainment merger in late 2024, illustrates the execution risk inherent in this competitive environment. Furthermore, one financial data source lists Clover Leaf Capital Corp. (OTCPK:CLOE) as Delisted as of 2025.

Key competitive pressures for CLOE included:

- Competing with 80% of 2025 SPACs led by serial sponsors.

- Navigating a market where investors are more discerning post-2021.

- The need to close a deal before the trust account cash runs out, which was initially $101.5% of its $138.31 million IPO proceeds.

- Avoiding the fate of many peers who returned capital to investors.

Clover Leaf Capital Corp. (CLOE) - Porter's Five Forces: Threat of substitutes

For Clover Leaf Capital Corp. (CLOE), as a Special Purpose Acquisition Company (SPAC) historically focused on the legalized cannabis industry, the threat of substitutes for its intended business combination is substantial. Target companies have numerous alternative paths to access public capital or remain private, which directly competes with the de-SPAC transaction that is the core purpose of CLOE.

High threat from traditional initial public offerings (IPOs) and direct listings for target companies

Traditional IPOs and direct listings present a clear, established alternative for private companies seeking to go public. While the SPAC market has seen a rebound in 2025, the traditional route remains a benchmark. For instance, in January 2025, US IPOs saw deal value rise to US$5.1 billion, up from US$3.45 billion in January 2024. This indicates a healthy, albeit selective, traditional listing environment. Furthermore, PE-backed IPOs in Q3 2025 hit their highest level since 2021, with proceeds increasing by 68% year-over-year. This suggests that when market conditions are favorable, traditional routes are heavily utilized by the same pool of companies CLOE seeks.

The overall public listing market in 2025 shows significant activity, which dilutes the perceived necessity of a SPAC vehicle. Here is a comparison of key public listing metrics as of late 2025:

| Metric | Traditional IPOs (Excluding SPACs) | SPAC IPOs (North America YTD) | Total Public Offerings (Count YTD) |

|---|---|---|---|

| Count (YTD 2025) | Implied from Total (121 - 82 = 39) | 82 | 121 |

| Proceeds Raised (YTD 2025) | Implied from Total ($24.87B - $16.5B = $8.37B) | Over USD 16.5bn | $24,865.4 million |

| Market Status | Gaining momentum; 57 pending F-1 filings as of March 5, 2025 | Most issuance on record outside of 2020 and 2021 | Healthy pipeline, but subject to volatility |

Private equity and venture capital funding offer less complex, non-public capital alternatives

For many target companies, especially in high-growth sectors like technology, remaining private or securing late-stage private funding is a strong substitute for the public markets. Private Equity (PE) and Venture Capital (VC) firms are actively deploying capital. As of March 2024, PE/VC firms were sitting on a significant overhang of capital, including over $500 billion from 2020 and 2021 vintages that needed deployment. This dry powder, combined with improving valuations in 2025, drives private investment.

To compete, CLOE's target must be compelling enough to choose a public exit over private funding rounds. Private markets are adapting to keep capital deployed:

- PE firms are adding multiple asset classes, increasing operational complexity.

- Continuation vehicles (CVs) are a growing exit path, even as traditional exits reopen.

- AI-related companies alone received over $100 billion in VC funding in 2024, a rise of more than 80% over 2023.

If a cannabis industry target can secure a large, favorable private funding round, the immediate need to go public via a SPAC is eliminated.

Target companies prefer the certainty of a private deal over a volatile SPAC merger process

The perception of certainty is a major factor. While SPACs were once touted as a faster route, the reality is that target companies are now hedging by preparing for both a traditional IPO and a de-SPAC simultaneously. This dual-track approach acknowledges the risks associated with the SPAC process. The historical underperformance of de-SPAC returns compared to the overall market return every year from 2012 through 2024 highlights this volatility.

Furthermore, the regulatory environment has leveled the playing field regarding disclosure requirements, meaning the perceived simplicity of a SPAC is diminished. As one expert noted, SPACs are not faster or cheaper; the difference is flexibility and timing. If a company can secure a private deal with clear terms, it avoids the uncertainty of the SPAC negotiation, sponsor dilution (where sponsors often receive 20% or more of the company shares), and the potential for shareholder redemptions, which can complicate the final deal structure.

Finance: draft 13-week cash view by Friday.

Clover Leaf Capital Corp. (CLOE) - Porter's Five Forces: Threat of new entrants

You're assessing the competitive landscape for a shell company like Clover Leaf Capital Corp. (CLOE) in late 2025, and the threat from new entrants-other SPAC sponsors-is shaped by market maturity and the company's own fate. Honestly, the barrier to entry isn't just about capital; it's about credibility and execution in a post-boom environment.

The idea that barriers are low for experienced management teams is debatable now. While an experienced team can raise capital, the market has clearly shifted its preference. As of the end of Q2-2025, serial SPAC sponsors led 80% of all 2025 SPAC IPOs, a significant increase from just 39% in 2022. This suggests that only sponsors with a proven, repeated track record are commanding investor trust for new launches. You see, the market is demanding specialization over generalist capital raising.

Regulatory scrutiny and poor market sentiment have definitely raised the effective barrier to a successful IPO via the SPAC route, even with the market rebound. While the SPAC market is seeing a resurgence, it's a more disciplined one. The $13 billion in SPAC IPO issuance year-to-date in 2025 is strong, but it's a far cry from the peak mania years, and it's driven by better sponsor quality. The regulatory environment has matured, demanding greater transparency and clearer timelines, which naturally filters out less prepared entrants.

Here's a quick look at how the market has recalibrated its appetite for new SPAC vehicles:

| Metric | 2023 | 2024 | H1 2025 (YTD) |

|---|---|---|---|

| Total SPAC IPO Issuance Value | $4 billion | $10 billion | $13 billion |

| SPAC Share of Total IPOs | N/A (Implied Low) | 26% | 37% |

| New SPAC IPOs (Approx. per Month) | N/A | ~6.8 (H2 2024 Avg) | 14.7 (Q2 2025 Avg) |

The sponsor, Yntegra Capital Investments, LLC, has a history suggesting specific sector access, which is a key differentiator against new, unspecialized entrants. Yntegra has common ownership with a portfolio that includes cannabis and real estate investments. The CEO, Felipe MacLean, has over 15+ years of experience, including successfully profiting from over $1 billion in commodities trading activity and a recent placement of over $100MM in private equity investments. This operational depth in the intended focus sector-the legalized cannabis industry-is a tangible asset that a brand-new sponsor lacks.

The ultimate deterrent for any new sponsor looking at the SPAC model is the outcome of Clover Leaf Capital Corp. itself. The company announced its intention to liquidate on November 8, 2024, following the termination of its merger agreement with Kustom Entertainment, Inc. This decision means the Board determined to redeem all of its outstanding Class A common stock sold in the initial public offering. For a potential new entrant, seeing a SPAC dissolve after failing to secure a deal-especially one that was trading with a market capitalization of $61.91M as of late 2025-sends a strong negative signal. The stock price as of November 23, 2025, was $12.47, within a 52-week range of $10.00 to $14.75, reflecting the uncertainty inherent in a liquidation scenario.

The threat of new entrants is tempered by these factors:

- Investor skepticism following SPAC failures.

- High bar set by serial sponsors leading 80% of 2025 IPOs.

- The explicit liquidation of Clover Leaf Capital Corp.

- The need for sponsors to demonstrate deep sector expertise, like Yntegra's $100MM+ private equity placements.

Finance: review the liquidation proceeds structure for Class A shareholders by next Tuesday.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.