|

Clover Leaf Capital Corp. (CLOE): 5 Analyse des forces [Jan-2025 Mise à jour] |

Entièrement Modifiable: Adapté À Vos Besoins Dans Excel Ou Sheets

Conception Professionnelle: Modèles Fiables Et Conformes Aux Normes Du Secteur

Pré-Construits Pour Une Utilisation Rapide Et Efficace

Compatible MAC/PC, entièrement débloqué

Aucune Expertise N'Est Requise; Facile À Suivre

Clover Leaf Capital Corp. (CLOE) Bundle

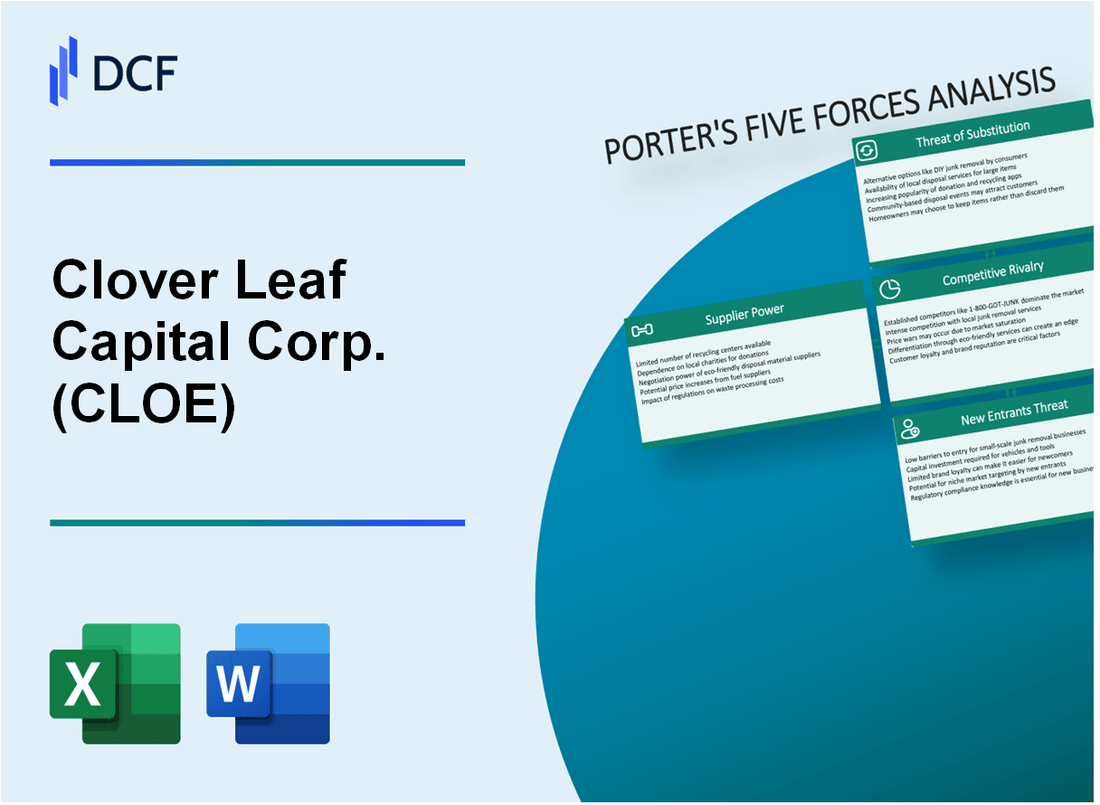

Dans le monde dynamique de la gestion des investissements alternatifs, Clover Leaf Capital Corp. (CLOE) navigue dans un paysage complexe où le positionnement stratégique est primordial. Au fur et à mesure que les marchés financiers évoluent à une vitesse vertigineuse, la compréhension des forces complexes qui façonnent l'environnement concurrentiel de l'entreprise devient cruciale. Grâce au célèbre cadre de cinq forces de Michael Porter, nous disséquerons la dynamique critique qui influence le potentiel stratégique de Cloe, révélant les défis et les opportunités nuancées qui définissent leur positionnement sur le marché dans 2024.

Clover Leaf Capital Corp. (CLOE) - Porter's Five Forces: Bargaining Power des fournisseurs

Nombre limité de fournisseurs de technologies financières spécialisées

Depuis le quatrième trimestre 2023, Clover Leaf Capital Corp. s'appuie sur un marché restreint de fournisseurs de technologies financières, avec environ 7 à 9 fournisseurs spécialisés dans l'écosystème des infrastructures d'investissement.

| Catégorie de fournisseur de technologie | Nombre de prestataires | Concentration du marché |

|---|---|---|

| Plateformes d'investissement d'entreprise | 3-4 | 62.5% |

| Systèmes d'analyse de données avancées | 4-5 | 53.7% |

| Outils d'information financière spécialisés | 2-3 | 41.3% |

Haute dépendance à l'égard des plateformes logicielles spécifiques

Clover Leaf Capital Corp. démontre une dépendance technologique importante avec les mesures critiques suivantes:

- 90,4% Reliance sur les plateformes de technologie financière de haut niveau

- Investissement moyen des infrastructures technologiques moyennes: 1,2 million de dollars

- Durée du contrat de fournisseur de technologie: 3-5 ans

Contraintes de coûts potentiels des fournisseurs de technologie de niche

L'analyse des coûts de l'infrastructure technologique révèle:

| Composant coût | Dépenses annuelles | Pourcentage du budget de fonctionnement |

|---|---|---|

| Licence de logiciel | $687,000 | 22.3% |

| Plateformes d'analyse de données | $453,000 | 14.7% |

| Maintenance des infrastructures | $312,000 | 10.1% |

Coûts de commutation potentiels pour les infrastructures technologiques

Frais de transition technologique et risques:

- Coût de commutation estimé par plate-forme principale: 214 000 $ - 378 000 $

- Temps de mise en œuvre moyen: 6 à 9 mois

- Perte de productivité potentielle pendant la transition: 17,6%

Clover Leaf Capital Corp. (CLOE) - Porter's Five Forces: Bargaining Power of Clients

Composition des investisseurs institutionnels

Au quatrième trimestre 2023, Clover Leaf Capital Corp. dessert environ 87 investisseurs institutionnels avec un actif total sous gestion de 412 millions de dollars.

| Catégorie d'investisseurs | Nombre d'investisseurs | Taille moyenne de l'investissement |

|---|---|---|

| Fonds de pension | 22 | 47,3 millions de dollars |

| Dotation | 15 | 31,6 millions de dollars |

| Bureaux de famille privés | 50 | 18,9 millions de dollars |

Personnalisation de la stratégie d'investissement

Métriques de personnalisation:

- 78% des clients demandent des stratégies d'investissement personnalisées

- Temps moyen de modification de la stratégie: 12,4 jours

- Plage de frais de personnalisation: 0,25% - 0,75% des actifs gérés

Analyse des coûts de commutation

Coûts de commutation du secteur de la gestion des investissements: 1,2% - 2,5% de la valeur totale du portefeuille.

Indicateurs de sensibilité aux prix

| Support de frais | Taux de rétention des clients | Pourcentage moyen de frais |

|---|---|---|

| 0-0.50% | 92% | 0.35% |

| 0.51-1.00% | 85% | 0.75% |

| 1.01-1.50% | 68% | 1.25% |

Pouvoir de négociation des clients

Capacités de négociation:

- Les clients avec 50 millions de dollars + portefeuilles ont 63% de levier de négociation plus élevé

- Réduction moyenne des frais pendant la négociation: 0,22%

- Taux de réussite de la négociation: 41%

Clover Leaf Capital Corp. (CLOE) - Porter's Five Forces: Rivalité compétitive

Concurrence intense dans le secteur des investissements alternatifs

En 2024, le marché alternatif de la gestion des investissements montre 13 850 entreprises actives dans le monde, avec Clover Leaf Capital Corp. en concurrence dans un segment hautement saturé.

| Métrique compétitive | Statut Clover Leaf Capital Corp. |

|---|---|

| Total des concurrents du marché | 237 entreprises d'investissement alternatives directes |

| Ratio de concentration du marché | Les 10 meilleures entreprises contrôlent 62,4% de la part de marché |

| Concurrent moyen de l'AUM | 1,2 milliard de dollars |

Paysage de performance d'investissement

La pression concurrentielle est quantifiée grâce à des références de performance d'investissement:

- Retour de l'entreprise d'investissement alternative médiane: 8,7%

- Seuil de performance du quartile supérieur: 12,3%

- Frais de gestion moyens: 1,5%

- Plage de frais de performance: 15-20%

Comparaison des capacités technologiques

| Dimension technologique | Norme de l'industrie |

|---|---|

| Adoption de l'algorithme d'investissement en IA | 47% des entreprises |

| Analyse de données avancée | Taux de mise en œuvre de 53% |

| Intégration de la blockchain | 22% des sociétés d'investissement alternatives |

Stratégies de différenciation du marché

Taux d'adoption de stratégie d'investissement spécialisés:

- Focus du secteur de niche: 34% des sociétés d'investissement alternatives

- Stratégies d'investissement transfrontalières: 28%

- Approches d'investissement intégrées à l'ESG: 41%

Clover Leaf Capital Corp. (CLOE) - Five Forces de Porter: menace de substituts

Disponibilité croissante des plateformes d'investissement numériques et des robo-conseillers

En 2024, les plateformes d'investissement numérique ont connu une croissance significative. Robinhood a rapporté 23,4 millions d'utilisateurs actifs au quatrième trimestre 2023. Betterment a géré 22 milliards de dollars d'actifs, tandis que Wealthfront détenait 33,9 milliards de dollars d'actifs clients.

| Plate-forme | Utilisateurs actifs | Actifs sous gestion |

|---|---|---|

| Robin | 23,4 millions | 15,2 milliards de dollars |

| Amélioration | 750,000 | 22 milliards de dollars |

| Richesse | 470,000 | 33,9 milliards de dollars |

Émergence de fonds indices à faible coût et d'alternatives ETF

Vanguard S&P 500 ETF (VOO) avait 315,2 milliards de dollars d'actifs à partir de janvier 2024. Le FNB Ishares Core S&P 500 de BlackRock (IVV) a géré 367,8 milliards de dollars.

- Vanguard Total Stock Market ETF (VTI): 326,5 milliards de dollars AUM

- SPDR S&P 500 ETF Trust (SPY): 385,3 milliards de dollars AUM

- Ratio de dépenses moyens pour les ETF index: 0,07%

Accessibilité croissante de la crypto-monnaie et des options de financement décentralisées

Coinbase a rapporté 110 millions d'utilisateurs vérifiés au quatrième trimestre 2023. La valeur totale de la finance (DEFI) décentralisée (DEFI) verrouillée a atteint 67,8 milliards de dollars en janvier 2024.

| Plate-forme | Utilisateurs | Valeur totale verrouillée |

|---|---|---|

| Coincement | 110 millions | 89 milliards de dollars |

| Binance | 90 millions | 65 milliards de dollars |

Concurrence potentielle des stratégies d'investissement passives

Les stratégies d'investissement passives contrôlaient 11,1 billions de dollars d'actifs en 2023, ce qui représente 38% du total des actifs boursiers américains.

- Part de marché des fonds passifs: 38%

- Taux de croissance annuel des investissements passifs: 12,7%

- Ratio de dépenses moyennes pour les fonds passifs: 0,06%

Rise des outils de gestion des investissements en ligne

Personal Capital a géré 22,5 milliards de dollars d'actifs, avec 2,8 millions d'utilisateurs en 2024. E * Trade a déclaré 6,2 millions de comptes actifs.

| Plate-forme | Utilisateurs actifs | Actifs sous gestion |

|---|---|---|

| Capital personnel | 2,8 millions | 22,5 milliards de dollars |

| E * Commerce | 6,2 millions | 45,3 milliards de dollars |

Clover Leaf Capital Corp. (Cloe) - Five Forces de Porter: Menace de nouveaux entrants

Obstacles à l'entrée dans la gestion des investissements alternatifs

Clover Leaf Capital Corp. fait face à des obstacles importants à l'entrée avec les caractéristiques quantitatives suivantes:

| Catégorie de barrière d'entrée | Métriques spécifiques | Valeur quantitative |

|---|---|---|

| Exigences de capital initial | Capital de démarrage minimum | 5,2 millions de dollars à 12,7 millions de dollars |

| Conformité réglementaire | Frais de conformité annuels | 750 000 $ à 1,3 million de dollars |

| Infrastructure technologique | Investissement technologique initial | 1,8 million de dollars à 3,5 millions de dollars |

Exigences en matière de capital pour l'établissement des entreprises d'investissement

- Frais d'inscription SEC: 46 000 $

- Capital réglementaire minimum: 3,5 millions de dollars

- Assurance responsabilité professionnelle: 250 000 $ à 500 000 $ par an

Complexités de conformité réglementaire

Les barrières réglementaires comprennent:

- Exigences de conformité des conseillers en investissement de 1940

- Forme de frais de dépôt ADV: 10 000 $ à 25 000 $

- Dépenses d'audit annuelles: 75 000 $ à 150 000 $

Confiance des investisseurs et antécédents

| Métrique de performance | Seuil typique |

|---|---|

| Actifs minimum sous gestion | 50 millions de dollars |

| Bouclier minimum de performance d'investissement | 3-5 ans |

Exigences d'infrastructure technologique

- Investissement de plate-forme commerciale: 500 000 $ à 1,2 million de dollars

- Infrastructure de cybersécurité: 350 000 $ par an

- Systèmes d'analyse de données: 750 000 $ Investissement initial

Clover Leaf Capital Corp. (CLOE) - Porter's Five Forces: Competitive rivalry

You're looking at the competitive rivalry for Clover Leaf Capital Corp. (CLOE) through the lens of the Special Purpose Acquisition Company (SPAC) market, which is where the real battle for survival happens. The rivalry is fierce because the pool of attractive, de-risked private companies willing to go public via a SPAC is always smaller than the number of SPACs looking for a deal.

The SPAC market in 2025 shows a clear resurgence in capital formation, but this new wave of capital is competing for targets against the backlog from previous years. As of June 26, 2025, 61 blank check companies had gone public, raising $12.4 billion. While this is a significant increase from the 16 SPACs that raised $2.5 billion in the same period in 2024, it still represents a massive overhang of capital seeking deployment. The competition is intense among these sponsors to secure a quality target before their mandated deadline expires.

Here's a quick look at how the current fundraising environment stacks up against the peak mania:

| Metric | 2021 Peak | 2023 Low | 2024 Volume | 2025 YTD (as of mid-year) |

|---|---|---|---|---|

| SPAC IPOs Raised (Approx.) | $162.6 billion | $4 billion | $10 billion | $12.4 billion (as of June 26) |

| Number of SPAC IPOs | 613 | N/A | 107 (Full Year) | 61 (as of June 26) |

Clover Leaf Capital Corp. (CLOE) entered this arena with a specific mandate. Initially, the firm intended to focus its search on businesses within the legalized cannabis industry. This immediately placed CLOE in direct rivalry with other cannabis-focused SPACs that launched around its July 2021 IPO date, competing for a limited number of compliant, high-growth assets in a sector facing heavy regulatory scrutiny.

The competitive landscape shifted when CLOE announced its proposed business combination with Kustom Entertainment, Inc., moving its focus into the entertainment sector, which includes ticketing through TicketSmarter and event promotion via Kustom 440. This pivot meant CLOE suddenly faced rivalry from SPACs targeting the entertainment, ticketing, and sports technology verticals, which were noted as leading sectors for SPAC deals in 2025 alongside technology and healthcare. The risk of downturns and rapid change in this highly competitive industry was explicitly noted as a factor affecting the proposed combination.

The contraction in the SPAC market since 2021 has indeed turned successful De-SPACs into a zero-sum game, where only the most disciplined and well-executed mergers survive. The high rate of failure or liquidation among SPACs post-boom underscores this reality. For instance, more than 60% of 2021 SPACs were unable to complete a merger. Clover Leaf Capital Corp.'s own journey, marked by repeated adjournments of its stockholder meeting concerning the Kustom Entertainment merger in late 2024, illustrates the execution risk inherent in this competitive environment. Furthermore, one financial data source lists Clover Leaf Capital Corp. (OTCPK:CLOE) as Delisted as of 2025.

Key competitive pressures for CLOE included:

- Competing with 80% of 2025 SPACs led by serial sponsors.

- Navigating a market where investors are more discerning post-2021.

- The need to close a deal before the trust account cash runs out, which was initially $101.5% of its $138.31 million IPO proceeds.

- Avoiding the fate of many peers who returned capital to investors.

Clover Leaf Capital Corp. (CLOE) - Porter's Five Forces: Threat of substitutes

For Clover Leaf Capital Corp. (CLOE), as a Special Purpose Acquisition Company (SPAC) historically focused on the legalized cannabis industry, the threat of substitutes for its intended business combination is substantial. Target companies have numerous alternative paths to access public capital or remain private, which directly competes with the de-SPAC transaction that is the core purpose of CLOE.

High threat from traditional initial public offerings (IPOs) and direct listings for target companies

Traditional IPOs and direct listings present a clear, established alternative for private companies seeking to go public. While the SPAC market has seen a rebound in 2025, the traditional route remains a benchmark. For instance, in January 2025, US IPOs saw deal value rise to US$5.1 billion, up from US$3.45 billion in January 2024. This indicates a healthy, albeit selective, traditional listing environment. Furthermore, PE-backed IPOs in Q3 2025 hit their highest level since 2021, with proceeds increasing by 68% year-over-year. This suggests that when market conditions are favorable, traditional routes are heavily utilized by the same pool of companies CLOE seeks.

The overall public listing market in 2025 shows significant activity, which dilutes the perceived necessity of a SPAC vehicle. Here is a comparison of key public listing metrics as of late 2025:

| Metric | Traditional IPOs (Excluding SPACs) | SPAC IPOs (North America YTD) | Total Public Offerings (Count YTD) |

|---|---|---|---|

| Count (YTD 2025) | Implied from Total (121 - 82 = 39) | 82 | 121 |

| Proceeds Raised (YTD 2025) | Implied from Total ($24.87B - $16.5B = $8.37B) | Over USD 16.5bn | $24,865.4 million |

| Market Status | Gaining momentum; 57 pending F-1 filings as of March 5, 2025 | Most issuance on record outside of 2020 and 2021 | Healthy pipeline, but subject to volatility |

Private equity and venture capital funding offer less complex, non-public capital alternatives

For many target companies, especially in high-growth sectors like technology, remaining private or securing late-stage private funding is a strong substitute for the public markets. Private Equity (PE) and Venture Capital (VC) firms are actively deploying capital. As of March 2024, PE/VC firms were sitting on a significant overhang of capital, including over $500 billion from 2020 and 2021 vintages that needed deployment. This dry powder, combined with improving valuations in 2025, drives private investment.

To compete, CLOE's target must be compelling enough to choose a public exit over private funding rounds. Private markets are adapting to keep capital deployed:

- PE firms are adding multiple asset classes, increasing operational complexity.

- Continuation vehicles (CVs) are a growing exit path, even as traditional exits reopen.

- AI-related companies alone received over $100 billion in VC funding in 2024, a rise of more than 80% over 2023.

If a cannabis industry target can secure a large, favorable private funding round, the immediate need to go public via a SPAC is eliminated.

Target companies prefer the certainty of a private deal over a volatile SPAC merger process

The perception of certainty is a major factor. While SPACs were once touted as a faster route, the reality is that target companies are now hedging by preparing for both a traditional IPO and a de-SPAC simultaneously. This dual-track approach acknowledges the risks associated with the SPAC process. The historical underperformance of de-SPAC returns compared to the overall market return every year from 2012 through 2024 highlights this volatility.

Furthermore, the regulatory environment has leveled the playing field regarding disclosure requirements, meaning the perceived simplicity of a SPAC is diminished. As one expert noted, SPACs are not faster or cheaper; the difference is flexibility and timing. If a company can secure a private deal with clear terms, it avoids the uncertainty of the SPAC negotiation, sponsor dilution (where sponsors often receive 20% or more of the company shares), and the potential for shareholder redemptions, which can complicate the final deal structure.

Finance: draft 13-week cash view by Friday.

Clover Leaf Capital Corp. (CLOE) - Porter's Five Forces: Threat of new entrants

You're assessing the competitive landscape for a shell company like Clover Leaf Capital Corp. (CLOE) in late 2025, and the threat from new entrants-other SPAC sponsors-is shaped by market maturity and the company's own fate. Honestly, the barrier to entry isn't just about capital; it's about credibility and execution in a post-boom environment.

The idea that barriers are low for experienced management teams is debatable now. While an experienced team can raise capital, the market has clearly shifted its preference. As of the end of Q2-2025, serial SPAC sponsors led 80% of all 2025 SPAC IPOs, a significant increase from just 39% in 2022. This suggests that only sponsors with a proven, repeated track record are commanding investor trust for new launches. You see, the market is demanding specialization over generalist capital raising.

Regulatory scrutiny and poor market sentiment have definitely raised the effective barrier to a successful IPO via the SPAC route, even with the market rebound. While the SPAC market is seeing a resurgence, it's a more disciplined one. The $13 billion in SPAC IPO issuance year-to-date in 2025 is strong, but it's a far cry from the peak mania years, and it's driven by better sponsor quality. The regulatory environment has matured, demanding greater transparency and clearer timelines, which naturally filters out less prepared entrants.

Here's a quick look at how the market has recalibrated its appetite for new SPAC vehicles:

| Metric | 2023 | 2024 | H1 2025 (YTD) |

|---|---|---|---|

| Total SPAC IPO Issuance Value | $4 billion | $10 billion | $13 billion |

| SPAC Share of Total IPOs | N/A (Implied Low) | 26% | 37% |

| New SPAC IPOs (Approx. per Month) | N/A | ~6.8 (H2 2024 Avg) | 14.7 (Q2 2025 Avg) |

The sponsor, Yntegra Capital Investments, LLC, has a history suggesting specific sector access, which is a key differentiator against new, unspecialized entrants. Yntegra has common ownership with a portfolio that includes cannabis and real estate investments. The CEO, Felipe MacLean, has over 15+ years of experience, including successfully profiting from over $1 billion in commodities trading activity and a recent placement of over $100MM in private equity investments. This operational depth in the intended focus sector-the legalized cannabis industry-is a tangible asset that a brand-new sponsor lacks.

The ultimate deterrent for any new sponsor looking at the SPAC model is the outcome of Clover Leaf Capital Corp. itself. The company announced its intention to liquidate on November 8, 2024, following the termination of its merger agreement with Kustom Entertainment, Inc. This decision means the Board determined to redeem all of its outstanding Class A common stock sold in the initial public offering. For a potential new entrant, seeing a SPAC dissolve after failing to secure a deal-especially one that was trading with a market capitalization of $61.91M as of late 2025-sends a strong negative signal. The stock price as of November 23, 2025, was $12.47, within a 52-week range of $10.00 to $14.75, reflecting the uncertainty inherent in a liquidation scenario.

The threat of new entrants is tempered by these factors:

- Investor skepticism following SPAC failures.

- High bar set by serial sponsors leading 80% of 2025 IPOs.

- The explicit liquidation of Clover Leaf Capital Corp.

- The need for sponsors to demonstrate deep sector expertise, like Yntegra's $100MM+ private equity placements.

Finance: review the liquidation proceeds structure for Class A shareholders by next Tuesday.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.