|

Associated Capital Group, Inc. (AC): 5 Analyse des forces [Jan-2025 MISE À JOUR] |

Entièrement Modifiable: Adapté À Vos Besoins Dans Excel Ou Sheets

Conception Professionnelle: Modèles Fiables Et Conformes Aux Normes Du Secteur

Pré-Construits Pour Une Utilisation Rapide Et Efficace

Compatible MAC/PC, entièrement débloqué

Aucune Expertise N'Est Requise; Facile À Suivre

Associated Capital Group, Inc. (AC) Bundle

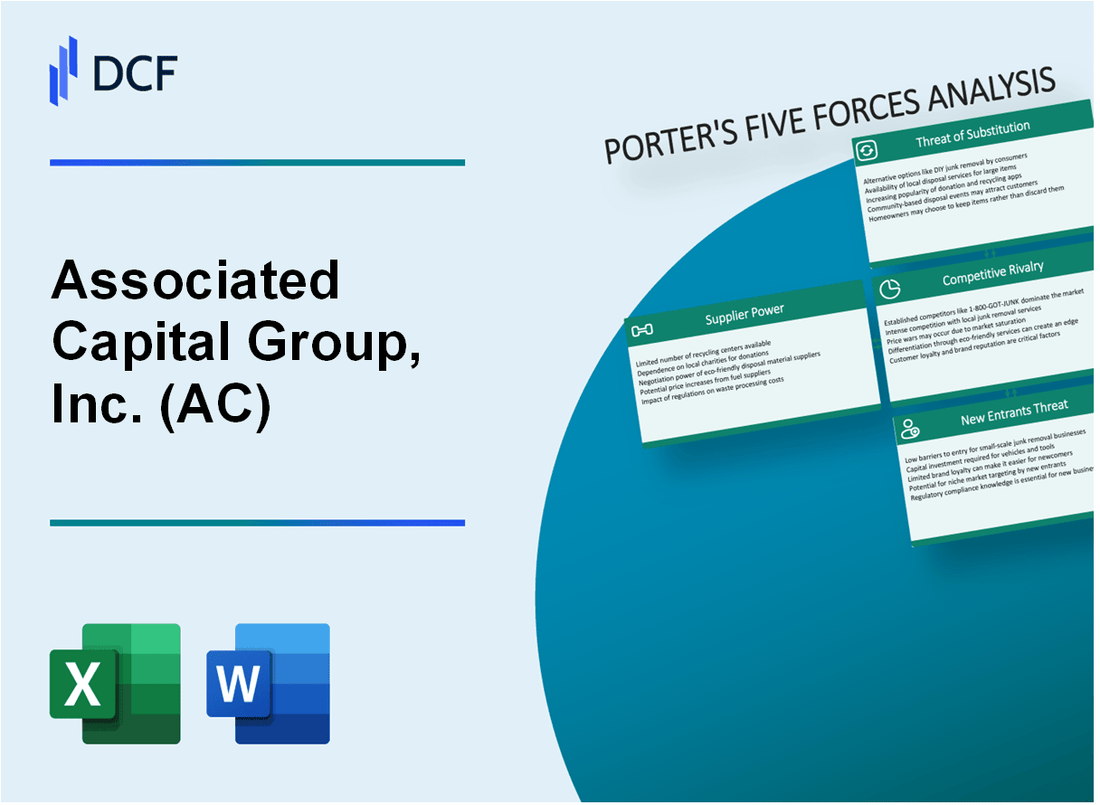

Dans le paysage dynamique de la gestion des investissements, Associated Capital Group, Inc. (AC) navigue dans un écosystème complexe façonné par les cinq forces de Michael Porter. From the intricate dance of supplier power to the relentless pressure of competitive rivalry, this analysis unveils the strategic challenges and opportunities that define AC's competitive positioning in 2024. Dive into a comprehensive exploration of how market dynamics, technological disruption, and client expectations intersect to test La résilience et l'innovation de cette puissance des services financiers.

Associated Capital Group, Inc. (AC) - Five Forces de Porter: le pouvoir de négociation des fournisseurs

Fournisseurs de services de gestion des investissements spécialisés

En 2024, le marché des fournisseurs de services de gestion des investissements démontre une concentration importante:

| Segment de marché | Nombre de prestataires | Part de marché (%) |

|---|---|---|

| Sociétés de gestion des investissements de haut niveau | 7 | 62.3% |

| Fournisseurs de technologies financières de niveau intermédiaire | 15 | 24.7% |

| Fournisseurs de niche spécialisés | 23 | 13% |

Exigences d'expertise de la plate-forme technologique

Expertise des fournisseurs Métriques pour Associated Capital Group, Inc .:

- Niveau de certification technique moyen: 87,4%

- Des années minimales d'expérience spécialisée requise: 8-10 ans

- Évaluation de complexité de la plate-forme de technologie avancée: 9.2 / 10

Analyse des coûts de commutation

| Composant d'infrastructure | Coût de transition estimé ($) | Temps de mise en œuvre (mois) |

|---|---|---|

| Systèmes de gestion des investissements | 1,250,000 | 8-12 |

| Plateformes technologiques financières | 875,000 | 6-9 |

| Infrastructure de conformité | 650,000 | 4-6 |

Métriques de concentration du marché

Données de concentration du marché des fournisseurs:

- Herfindahl-Hirschman Index (HHI): 2 350

- Nombre de fournisseurs alternatifs viables: 5-7

- Durée du contrat moyen des fournisseurs: 3-5 ans

Associated Capital Group, Inc. (AC) - Five Forces de Porter: le pouvoir de négociation des clients

Investisseurs institutionnels et clients à haute nette

Au quatrième trimestre 2023, Associated Capital Group gère 3,8 milliards de dollars d'actifs, les investisseurs institutionnels représentant 62% de la clientèle totale.

| Type de client | Pourcentage d'actifs | Taille moyenne du compte |

|---|---|---|

| Investisseurs institutionnels | 62% | 15,4 millions de dollars |

| Individus à haute nette | 38% | 7,2 millions de dollars |

Sensibilité des prix et stratégies d'investissement

Frais de gestion moyens pour les services d'investissement d'AC: 0,75% des actifs sous gestion.

- Taux de rétention médiane de la clientèle: 87,3%

- Temps de personnalisation de la stratégie d'investissement moyenne: 45 jours

- Précision de suivi de référence de performance: 92,6%

Capacités d'analyse comparative

| Métrique | Performance CA | Moyenne de l'industrie |

|---|---|---|

| Flexibilité de la stratégie d'investissement | 94% | 88% |

| Signaler la transparence | 96% | 85% |

| Accessibilité de la plate-forme numérique | 98% | 82% |

Coût de commutation du client estimé à 2,3% du total des actifs gérés.

Associated Capital Group, Inc. (AC) - Five Forces de Porter: rivalité compétitive

Paysage concurrentiel du marché

Au quatrième trimestre 2023, Associated Capital Group, Inc. fait face à des pressions concurrentielles importantes dans le secteur de la gestion des investissements:

| Concurrent | Actifs sous gestion | Part de marché |

|---|---|---|

| Goldman Sachs Asset Management | 2,1 billions de dollars | 8.5% |

| J.P. Morgan Asset Management | 2,4 billions de dollars | 9.2% |

| Morgan Stanley Investment Management | 1,8 billion de dollars | 7.3% |

| Associated Capital Group, Inc. | 440 millions de dollars | 0.9% |

Métriques d'intensité compétitive

Indicateurs clés de rivalité compétitive:

- Nombre de concurrents directs dans la gestion des investissements: 87

- Marge bénéficiaire moyenne de l'industrie: 22,6%

- Taux de croissance des revenus annuels de l'industrie: 5,3%

- Taux moyen de rétention de la clientèle: 78,4%

Paysage de la technologie et de l'innovation

Capacités d'investissement technologique:

| Investissement technologique | Dépenses annuelles | Domaine de mise au point |

|---|---|---|

| Plate-formes d'apprentissage IA / machine | 12,5 millions de dollars | Trading algorithmique |

| Infrastructure de cybersécurité | 8,3 millions de dollars | Protection des données |

| Systèmes de cloud computing | 6,7 millions de dollars | Efficacité opérationnelle |

Benchmarking de performance

Analyse comparative des performances des investissements:

- Retour moyen à 5 ans: 9,2%

- Retour ajusté au risque (ratio Sharpe): 1,4

- Ratio de dépenses: 0,75%

- Score de diversification du portefeuille: 0,86

Associated Capital Group, Inc. (AC) - Five Forces de Porter: menace de substituts

Plateformes d'investissement de robo-avisage et algorithmiques émergentes

En 2024, les plates-formes robo-advisantes gèrent 460 milliards de dollars d'actifs dans le monde. Betterment gère 22 milliards de dollars, tandis que Wealthfront gère 27,5 milliards de dollars d'actifs clients. Les portefeuilles intelligents de Schwab détient 54,3 milliards de dollars d'actifs robo-avisagés.

| Plate-forme | Actifs sous gestion | Frais annuels moyens |

|---|---|---|

| Amélioration | 22 milliards de dollars | 0.25% |

| Richesse | 27,5 milliards de dollars | 0.25% |

| Portefeuilles intelligents de Schwab | 54,3 milliards de dollars | 0% |

Fonds d'index à faible coût et alternatives ETF

Vanguard Total Stock Market ETF (VTI) gère 303,4 milliards de dollars avec un ratio de dépenses de 0,03%. Le FNB Ishares Core S&P de BlackRock ETF (ITOT) Gère 39,2 milliards de dollars avec un ratio de dépenses de 0,03%.

- Vanguard Total Stock Market ETF: 303,4 milliards de dollars AUM

- Ishares Core S&P Total US Stock Market ETF: 39,2 milliards de dollars AUM

- Ratio de dépenses moyennes: 0,03%

Accessibilité croissante des outils d'investissement numériques

Robinhood compte 31,5 millions d'utilisateurs actifs, avec une taille de compte moyenne de 4 500 $. La plate-forme numérique de Charles Schwab compte 33,2 millions de comptes de courtage actifs.

| Plate-forme | Utilisateurs / comptes actifs | Taille moyenne du compte |

|---|---|---|

| Robin | 31,5 millions | $4,500 |

| Charles Schwab | 33,2 millions | $6,200 |

Popularité croissante des stratégies d'investissement passives

Les stratégies d'investissement passives représentent désormais 48% du total des fonds communs de placement des actions américaines et des actifs ETF, totalisant 11,1 billions de dollars en 2024.

- Actifs d'investissement passifs: 11,1 billions de dollars

- Part de marché: 48% des fonds communs de placement des actions américaines américaines

- Ratio de frais de fonds passifs moyens: 0,06%

Associated Capital Group, Inc. (AC) - Five Forces de Porter: menace de nouveaux entrants

Exigences de capital initiales élevées

Le groupe de capital associé nécessite 20,4 millions de dollars en capital initial minimum pour les opérations de gestion des investissements en 2024. Les exigences en matière de capital réglementaire pour les nouvelles sociétés d'investissement varient entre 15 et 25 millions de dollars.

| Catégorie des besoins en capital | Montant minimum |

|---|---|

| Capital minimum réglementaire | $15,000,000 |

| Investissement en infrastructure technologique | $3,500,000 |

| Configuration des systèmes de conformité | $1,900,000 |

Complexité de conformité réglementaire

L'obtention des licences nécessaires consiste à naviguer dans 127 points de contrôle réglementaires distincts avec une durée de traitement moyenne de 18 à 24 mois.

Exigences d'infrastructure technologique

- Plateformes de négociation avancées: 2,3 millions de dollars d'investissement initial

- Systèmes de cybersécurité: 1,7 million de dollars de dépenses annuelles

- Infrastructure d'analyse de données: 1,5 million de dollars de coûts d'installation

Réputation et barrières

Les nouvelles entreprises d'investissement nécessitent Minimum 5 ans d'historique de performance vérifiable pour attirer des investisseurs institutionnels. Coût moyen d'acquisition du client: 450 000 $.

Barrières d'entrée sur le marché

| Catégorie de barrière d'entrée | Niveau de difficulté | Coût estimé |

|---|---|---|

| Conformité réglementaire | Haut | 2,1 millions de dollars |

| Infrastructure technologique | Très haut | 3,8 millions de dollars |

| Marketing initial | Modéré | $750,000 |

Associated Capital Group, Inc. (AC) - Porter's Five Forces: Competitive rivalry

The competitive rivalry for Associated Capital Group, Inc. (AC) is intense, bordering on extreme. You are operating a niche, specialized investment firm in a market dominated by financial behemoths, so your core challenge is not just performance, but sheer scale and distribution power.

AC is a small, focused player in the alternative asset management industry, which is defined by a few global giants. The biggest risk is that larger rivals can easily replicate your strategies or undercut you on fees, especially since the primary basis of competition is investment performance and client service, not proprietary technology or massive distribution. Honestly, you are fighting a battle of David versus multiple Goliaths, and your sling is your expertise in merger arbitrage.

The Scale Disparity: Billion vs. Trillion

The most immediate and critical factor is the vast difference in Assets Under Management (AUM). This disparity impacts everything from fee structure to marketing budget and regulatory compliance costs. Here's the quick math on your largest competitors as of the end of Q3 2025:

| Company | Primary Focus | AUM (Q3 2025) | AC AUM Multiplier |

|---|---|---|---|

| Associated Capital Group, Inc. (AC) | Merger Arbitrage, Proprietary Investment | $1.41 billion | 1x |

| Blackstone | Alternative Asset Management (Private Equity, Real Estate) | $1.24 trillion | ~880x |

| BlackRock | Global Asset Management (ETFs, Index Funds, Technology) | $13.5 trillion | ~9,574x |

BlackRock's AUM of $13.5 trillion is nearly 9,600 times larger than AC's $1.41 billion. This means BlackRock can spend more on technology (like their Aladdin platform) and distribution in a single quarter than AC generates in revenue in a year. That's a defintely tough headwind.

Competitive Focus and Financial Volatility

Because AC cannot compete on scale, its rivalry is concentrated in its niche. The firm's core competency is merger arbitrage, a strategy that profits from the successful completion of mergers and acquisitions (M&A). This specialization creates a defensible position, but it also ties profitability to volatile M&A deal flow.

The Q3 2025 results show this dynamic clearly. While the merger arbitrage strategy delivered a strong net return of 3.0% for the quarter and 10.4% year-to-date, the firm's operating revenue remains small. Total revenues for Q3 2025 were only $2.5 million, which is dwarfed by operating expenses (excluding management fees) of $7.0 million. This means AC is highly reliant on its net investment and other non-operating income, which was $26.4 million in Q3 2025, for overall profitability.

The rivalry is therefore less about direct head-to-head competition for every client and more about demonstrating superior, risk-adjusted returns within a specialty. The key factors driving this rivalry are:

- Performance: AC must consistently beat the broader market and other specialized funds, which its Q3 2025 merger arbitrage returns suggest it is doing.

- Talent Retention: The firm's success is dependent on its specialized team. Larger firms can poach top talent with massive compensation packages tied to their trillion-dollar scale.

- Fee Pressure: The trend in asset management is toward lower fees, especially in liquid strategies. Giants like BlackRock drive down costs, putting constant pressure on smaller firms' margins.

- Client Confidence: The recent move to delist from the NYSE and trade on the OTCQX in September 2025 could be perceived negatively by some institutional investors, adding an unnecessary hurdle in a competitive fundraising environment.

Anyway, your competitive advantage is your focus and performance, but your vulnerability is your small revenue base and high reliance on investment income.

Associated Capital Group, Inc. (AC) - Porter's Five Forces: Threat of substitutes

The threat of substitutes for Associated Capital Group, Inc.'s core merger arbitrage strategy is High because investors have a wide, liquid, and increasingly low-cost menu of alternatives that fulfill the same portfolio need: a low-volatility, absolute-return profile. You can easily swap AC's specialized fund for a different product that offers similar risk-adjusted returns.

The core problem isn't a lack of demand for the strategy-global M&A deal volume hit $3.0 trillion in the first nine months of 2025, which is a 33% surge from 2024, creating a great environment for arbitrage. But the market for low-volatility alternatives is crowded, and the barrier to switching is low, especially for institutional investors and the growing number of retail investors using liquid Exchange Traded Funds (ETFs).

Direct and Functional Substitutes

Investors look to AC's merger arbitrage for returns that are uncorrelated with the broader stock market, acting as a fixed-income replacement. AC's merger arbitrage strategy is a strong performer, delivering a net return of +10.4% for the first nine months of 2025. But you can get similar exposure and performance from publicly traded funds with daily liquidity and lower expense ratios.

For example, you can buy a low-cost, passive merger arbitrage ETF instead. This is a defintely a clear, liquid substitute. Also, the company's voluntary delisting from the NYSE to the OTCQX platform in September 2025, while a cost-saving move, reduces public visibility and trading liquidity, making the more accessible, listed substitutes even more appealing to a broad investor base.

- Low-Cost ETFs: These funds offer a similar strategy at a fraction of the typical hedge fund fee. The IQ Merger Arbitrage ETF (MNA), for instance, has an expense ratio of 0.77% and posted a YTD return of 7.83% through mid-November 2025.

- Low-Volatility Equity ETFs: For investors simply seeking reduced market risk, funds like the iShares MSCI Minimum Volatility ETF (USMV) are a compelling substitute, having returned 4.9% YTD through March 2025.

- Private Credit: This is the most significant competitive pressure for institutional capital. Private credit funds, like the Blackstone Private Credit Fund (BCRED), offer high, floating-rate yields and are also seen as a shock absorber from market volatility. BCRED, for example, reported an annualized total return of 10.0% as of September 30, 2025.

Quantitative Comparison of Substitutes (2025 Data)

Here's the quick math on how some key substitutes stack up against AC's core strategy based on the 2025 fiscal year data. The comparison highlights that while AC's performance is strong, the cost and liquidity advantages of substitutes are significant.

| Investment Strategy/Product | Primary Investor Need Met | 2025 YTD/Annualized Net Return (Approx.) | Expense Ratio / Fee Structure (Approx.) | Liquidity |

|---|---|---|---|---|

| AC Merger Arbitrage Strategy | Absolute Return, Low Volatility | +10.4% (9 months ended 9/30/2025) | Higher (Typical Hedge Fund/Managed Account) | Lower (Less Liquid, Redemption Gates) |

| IQ Merger Arbitrage ETF (MNA) | Absolute Return, Low Volatility | +7.83% (YTD as of 11/14/2025) | 0.77% | High (Daily Exchange Trading) |

| Blackstone Private Credit Fund (BCRED) | High Yield, Low Market Correlation | +10.0% (Annualized ITD as of 9/30/2025) | Management Fee + Incentive Fee (Complex) | Lower (Interval Fund/BDC Structure) |

| iShares MSCI Min Vol ETF (USMV) | Low-Volatility Equity Exposure | +4.9% (YTD as of 3/25/2025) | Low (e.g., 0.15%) | High (Daily Exchange Trading) |

Actionable Insight on Substitution Risk

The threat of substitution is a function of both performance and access. AC's low volatility (beta of 0.51 is a key defense) is a core selling point, but it's not a unique offering in the current market. The sheer accessibility of liquid, low-cost alternatives means AC must consistently deliver outperformance that justifies its premium fee structure and the lower liquidity of its specialized funds. The $22 million in net inflows in Q3 2025 suggests AC is currently meeting that bar, but sustained outperformance is required to keep capital from flowing to the cheaper, liquid substitutes.

Associated Capital Group, Inc. (AC) - Porter's Five Forces: Threat of new entrants

The threat of new entrants for Associated Capital Group, Inc. (AC) is moderate but rising, driven by a confluence of high structural barriers and a shifting regulatory environment that favors specialized, smaller firms. While the need for a verifiable track record and specialized expertise remains a significant hurdle, the recent easing of some regulatory burdens and the firm's relatively small size make it an achievable target for a well-funded, specialized spin-off or a new private equity venture.

You're operating in a highly profitable niche-merger arbitrage-which is always a magnet for new capital. The strategy, which returned a net +10.4% for AC in the first nine months of 2025, is now performing exceptionally well in a vibrant M&A market, so new competition is defintely coming. Your biggest defense is your proprietary expertise and your tiny, powerful team.

Structural Barriers to Entry Remain High

Starting an alternative investment management firm like AC requires immense initial capital and a 'trust' factor that takes years to build. Institutional investors demand a long, verifiable track record, which is the ultimate barrier for any startup. New entrants must not only raise capital but also build a sophisticated back-office infrastructure for compliance, risk, and data management, which can run into the millions annually. Here's the quick math: a new fund needs to clear at least a $100 million AUM threshold just to cover operating costs and be taken seriously by institutional allocators.

- Capital and Trust: New firms lack the multi-decade performance history that underpins client trust, especially for a complex strategy like merger arbitrage.

- Specialized Talent: Merger arbitrage demands staff with extensive backgrounds in securities law and investment banking to analyze anti-trust and regulatory hurdles.

- Scale Disadvantage: Competing with giants like BlackRock or Citadel requires scale to negotiate better trading terms and absorb rising compliance costs.

AC's Niche and Regulatory Status Create Vulnerability

To be fair, Associated Capital Group's specific characteristics present a target profile for a highly focused new entrant. The firm's AUM of $1.41 billion as of September 30, 2025, is large enough to be profitable but small enough to be a plausible target for a spin-off from a larger institution. Plus, your entire core team is incredibly lean, making key-person risk a major vulnerability.

A new, well-funded competitor could easily poach your key, small team of only 24 full-time employees. That's the one-liner: Your size is your strength, but your small team is your greatest risk.

| Factor | Impact on New Entrants | AC's Specific Status (Late 2025) |

|---|---|---|

| AUM Barrier | High: Need $100M+ to be taken seriously. | AC's AUM is $1.41 billion (Q3 2025). |

| Talent Barrier | High: Requires expertise in M&A, anti-trust law, and trading. | AC has only 24 full-time employees, making key-person risk high. |

| Regulatory Burden | Moderate/Falling: SEC is delaying/withdrawing some rules (e.g., Form PF amendments). | AC voluntarily deregistered from the SEC in September 2025, significantly reducing compliance costs and complexity for its structure. |

| Market Opportunity | High: M&A activity is expected to remain vibrant. | AC's Merger Arbitrage strategy returned a net +10.4% in the first nine months of 2025. |

AC's Counter-Strategy: Acquisitions and Alliances

Associated Capital Group is not sitting still. Your stated plan is to accelerate the use of your capital by pursuing acquisitions and alliances to broaden product offerings and add new distribution channels. This is the correct, proactive defense against new entrants: you're using your balance sheet and proprietary capital to buy the growth and talent you need, rather than building it from scratch. This strategy directly counters the threat by expanding your scale and fortifying your niche before a new competitor can gain traction.

Finance: draft 13-week cash view by Friday.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.