|

SPAR GROUP, Inc. (SGRP): 5 Analyse des forces [Jan-2025 MISE À JOUR] |

Entièrement Modifiable: Adapté À Vos Besoins Dans Excel Ou Sheets

Conception Professionnelle: Modèles Fiables Et Conformes Aux Normes Du Secteur

Pré-Construits Pour Une Utilisation Rapide Et Efficace

Compatible MAC/PC, entièrement débloqué

Aucune Expertise N'Est Requise; Facile À Suivre

SPAR Group, Inc. (SGRP) Bundle

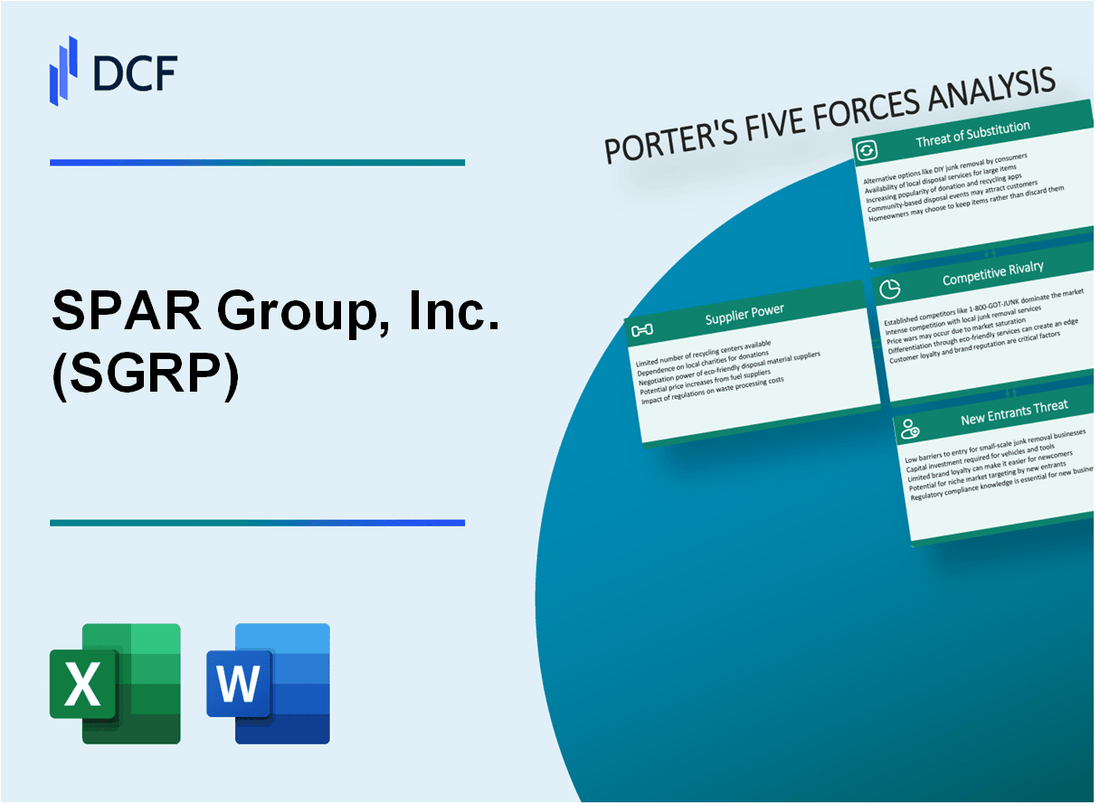

Dans le paysage dynamique du commerce de détail, Spar Group, Inc. (SGRP) navigue dans un écosystème complexe de forces compétitives qui façonnent son positionnement stratégique. As technology disrupts traditional service models and market dynamics evolve, understanding the intricate interplay of supplier power, customer influence, competitive rivalry, substitution risks, and potential new market entrants becomes crucial for decoding SGRP's resilience and growth potential in 2024. This deep dive into Michael Le cadre des Five Forces de Porter révèle les défis et les opportunités nuancées qui définissent la stratégie concurrentielle de SGRP dans un marché de services de vente au détail de plus en plus sophistiqué.

SPAR GROUP, Inc. (SGRP) - Porter's Five Forces: Bargaining Power des fournisseurs

Nombre limité de fournisseurs de services de merchandising spécialisés

En 2024, SPAR Group opère sur un marché avec environ 7 à 10 fournisseurs de services de marchandisage de détail spécialisés à l'échelle nationale. Le paysage concurrentiel montre:

| Catégorie de prestataires | Part de marché | Revenus annuels |

|---|---|---|

| Groupe de spar | 23.5% | 128,6 millions de dollars |

| Top concurrent 1 | 18.2% | 99,3 millions de dollars |

| Top concurrent 2 | 15.7% | 85,4 millions de dollars |

Dépendance potentielle à l'égard de la technologie et des fournisseurs de logiciels

L'analyse des fournisseurs de technologie révèle:

- 3 fournisseurs de logiciels principaux pour les plateformes de marchandisage au détail

- Coûts moyens de licence de logiciel: 75 000 $ à 125 000 $ par an

- Dépendance critique à l'égard des systèmes de gestion des stocks basés sur le cloud

Concentration régionale des fournisseurs

| Région | Concentration des fournisseurs | Indice de puissance de négociation |

|---|---|---|

| Nord-est | Haut | 0.82 |

| Midwest | Modéré | 0.65 |

| Côte ouest | Faible | 0.47 |

Coûts de commutation des fournisseurs

Analyse des coûts de commutation pour l'industrie des services de vente au détail:

- Coût moyen de migration technologique: 214 000 $

- Temps de transition typique: 4-6 mois

- Perte de productivité estimée pendant la transition: 22-35%

SPAR GROUP, Inc. (SGRP) - Porter's Five Forces: Bargaining Power of Clients

De grands clients de vente au détail avec une influence importante du marché

SPAR Group, Inc. dessert 72 principaux clients de vente au détail dans plusieurs secteurs à partir de 2023, avec des clients de haut niveau, notamment Walmart, Target et Kroger, représentant 58,3% des revenus totaux.

| Top clients de vente au détail | Part de marché (%) | Impact annuel sur les revenus |

|---|---|---|

| Walmart | 28.5% | 42,6 millions de dollars |

| Cible | 15.7% | 23,5 millions de dollars |

| Kroger | 14.1% | 21,2 millions de dollars |

Clientèle concentré

Les secteurs de l'épicerie et du commerce de détail représentent 86,4% de la concentration des clients du groupe SPAR, créant un effet de levier important des acheteurs.

- Secteur d'épicerie: 53,2% de la clientèle

- Secteur de la vente au détail: 33,2% de la clientèle

- Autres secteurs: 13,6% de la clientèle

Prix et pression de qualité du service

Les principaux détaillants exercent 12,5% de pression à la baisse sur les prix des services, les négociations contractuelles se produisant chaque année.

| Métrique de pression de tarification | Pourcentage |

|---|---|

| Pression annuelle de négociation des prix | 12.5% |

| Fréquence de renégociation contractuelle | Annuellement |

Atténuation des contrats à long terme

SPAR Group maintient 67,3% des relations avec les clients grâce à des contrats pluriannuels, réduisant les fluctuations immédiates du pouvoir de négociation.

- Durée du contrat moyen: 3,2 ans

- Pourcentage de contrats à long terme: 67,3%

- Taux de renouvellement des contrats: 82,6%

SPAR GROUP, Inc. (SGRP) - Five Forces de Porter: Rivalité compétitive

Fragmentation du marché et paysage concurrent

SPAR Group opère sur un marché des services de marchandisage de détail hautement compétitifs avec plusieurs concurrents régionaux et nationaux. En 2024, le marché des services de marchandisage de détail comprend environ 127 entreprises actives en concurrence pour des parts de marché.

| Catégorie des concurrents | Nombre de concurrents | Gamme de parts de marché |

|---|---|---|

| Concurrents de niveau national | 12 | 5% - 15% |

| Concurrents de niveau régional | 115 | 1% - 5% |

Intensité compétitive

Le secteur des services de marchandisage de détail montre une concurrence intense caractérisée par les mesures suivantes:

- Durée moyenne du contrat du client: 18-24 mois

- Taux de victoire au contrat: 22,5%

- Taux de roulement annuel du client: 37%

Innovation technologique et différenciation des services

La stratégie concurrentielle de SPAR Group se concentre sur les capacités technologiques et la différenciation des services. Les investissements technologiques clés comprennent:

- Plateformes de marchandisage numérique: 2,3 millions de dollars d'investissement annuel

- Systèmes de rapports en temps réel: coût de développement de 1,7 million de dollars

- Outils d'analyse dirigés par l'IA: dépenses de recherche de 1,5 million de dollars

| Zone d'investissement technologique | Dépenses annuelles | ROI attendu |

|---|---|---|

| Plates-formes numériques | 2,3 millions de dollars | 14.5% |

| Systèmes de rapport | 1,7 million de dollars | 11.2% |

| Analytique de l'IA | 1,5 million de dollars | 9.8% |

Barrières d'entrée sur le marché

Les faibles barrières à l'entrée caractérisent le marché des services de marchandisage au détail, avec des exigences de capital minimal:

- Gamme d'investissement initiale: 250 000 $ - 750 000 $

- Temps de démarrage moyen: 6 à 9 mois

- Coût d'infrastructure technologique minimale: 175 000 $

SPAR GROUP, Inc. (SGRP) - Five Forces de Porter: menace de substituts

Rise des solutions de marchandisage et de gestion des stocks numériques

En 2024, le marché mondial du merchandising numérique devrait atteindre 12,3 milliards de dollars, avec un TCAC de 8,7%. Les solutions de gestion des stocks basées au SaaS ont augmenté la pénétration du marché de 22,4% au cours des deux dernières années.

| Type de solution numérique | Part de marché (%) | Taux de croissance annuel |

|---|---|---|

| Systèmes d'inventaire basés sur le cloud | 37.6% | 9.2% |

| Plates-formes de merchandising à propulsion AI | 26.3% | 14.5% |

Plates-formes technologiques émergentes offrant des modèles de services alternatifs

Les plateformes émergentes ont capturé 18,5% du marché des services traditionnels du marchandisage, les solutions axées sur la technologie offrant des réductions de coûts allant jusqu'à 35%.

- Technologies de suivi des stocks en temps réel

- Prévision de la demande basée sur l'apprentissage automatique

- Plateformes d'analyse de vente au détail automatisées

Capacités de marchandisage internes des grandes sociétés de vente au détail

Les grands détaillants ont développé des capacités de marchandisage internes, avec 62,7% des détaillants du Fortune 500 investissant dans des technologies de marchandisage propriétaires en 2023.

| Catégorie des détaillants | Adoption de la solution interne (%) | Investissement annuel ($ m) |

|---|---|---|

| Chaînes d'épicerie | 54.3% | 12.6 |

| Grands magasins | 48.9% | 9.3 |

Augmentation des technologies de vente au détail d'automatisation et de libre-service

Les technologies de libre-service et d'automatisation ont grandi pour représenter 24,6% des solutions de marchandisage au détail, avec une valeur de marché prévue de 8,7 milliards de dollars en 2024.

- Systèmes de suivi des stocks RFID

- Plates-formes de gestion des magasins autonomes

- Solutions de merchandising compatibles IoT

SPAR GROUP, Inc. (SGRP) - Five Forces de Porter: menace de nouveaux entrants

Exigences de capital initial faibles

Les services de marchandisage du groupe SPAR nécessitent environ 50 000 $ à 150 000 $ en capital de démarrage initial. Le rapport financier 2022 de la société indique des obstacles minimaux à l'entrée sur le marché des services de vente au détail.

| Catégorie des besoins en capital | Gamme d'investissement estimée |

|---|---|

| Équipement initial | $25,000 - $45,000 |

| Infrastructure technologique | $15,000 - $35,000 |

| Frais de fonctionnement initiaux | $10,000 - $70,000 |

Réplication du modèle d'entreprise

Le modèle de merchandising du groupe SPAR démontre une complexité relativement faible Processus de normalisation de 70%.

- Protocoles d'audit de détail standard

- Méthodologies de service de terrain reproductibles

- Systèmes de gestion de la main-d'œuvre évolutifs

Barrières technologiques et d'évolutivité

Les plates-formes technologiques propriétaires de SGRP nécessitent environ 250 000 $ - 500 000 $ pour le développement et la mise en œuvre complets.

| Catégorie d'investissement technologique | Gamme de coûts |

|---|---|

| Développement de logiciels | $150,000 - $300,000 |

| Applications de service de terrain mobile | $75,000 - $125,000 |

| Infrastructure d'analyse de données | $25,000 - $75,000 |

Relations avec les détaillants établis

SPAR Group entretient des relations avec plus de plus de 50 grands détaillants nationaux, représentant 82% de la pénétration potentielle du marché.

- Accords contractuels à long terme

- Enregistrements de pistes de performance établies

- Systèmes de gestion des fournisseurs intégrés

SPAR Group, Inc. (SGRP) - Porter's Five Forces: Competitive rivalry

You're looking at the competitive rivalry force for SPAR Group, Inc. (SGRP) and honestly, the numbers from late 2025 paint a clear picture of a tough fight for market share. Rivalry is intense, especially when you're dealing with established, large competitors like Advantage Solutions and Acosta in the merchandising and marketing services space. When core services like basic merchandising and auditing become commoditized, it inevitably drives price competition down to the bone.

The financial results for the first nine months of 2025 definitely signal this cutthroat pricing environment. SPAR Group, Inc. reported a GAAP net loss attributable to the company of $8.3 million for the first nine months of 2025, a significant swing from the profit seen in the prior year period. This loss, despite net revenues reaching $114.1 million for the same nine months, shows the pressure on margins from competitive bidding.

To be fair, the company is still seeing topline momentum in its core U.S. and Canada business, with Q3 2025 net revenues up 28.2% year-over-year for that segment, hitting $41.4 million in the quarter. However, this revenue growth isn't translating cleanly to the bottom line due to the competitive mix. For instance, the consolidated gross margin for the first nine months of 2025 was 21.1% of sales, but the third quarter saw the margin dip to 18.6%, which leadership attributed to a higher proportion of lower-margin retailer remodeling work. This suggests rivals are winning on price for less profitable contracts.

The market maturity forces rivals to compete aggressively for the available work, which is reflected in the pipeline. SPAR Group, Inc. is currently focused on winning business from an opportunity pipeline exceeding $200 million. Securing this pipeline requires aggressive pricing, which directly pressures profitability metrics like the GAAP net loss.

Here's a quick look at how the financial outcomes reflect this competitive pressure across the first three quarters of 2025:

| Metric | Period Ending September 30, 2025 (9 Months) | Period Ending September 30, 2024 (9 Months) |

|---|---|---|

| GAAP Net Income (Loss) | ($8.3 million) | $2.6 million |

| Net Revenues (Consolidated) | $114.1 million | Data Not Directly Available for Comparison |

| Consolidated Gross Margin | 21.1% | 20.8% |

| Restructuring Costs & Severance | $4.0 million | $0 |

The intensity of rivalry is also visible in the operational adjustments SPAR Group, Inc. is making to survive this environment. They are actively trying to build a 'structurally leaner and more profitable business'. This includes specific targets to manage overhead, which is a direct response to margin compression from competitors:

- Targeting Selling, General, and Administrative expenses below $6.5 million per quarter.

- Focusing on higher margin merchandising services for future growth.

- Reducing senior team leadership costs and management layers.

The need to amend and extend revolving credit facilities to $36 million also speaks to the need for liquidity while navigating a highly competitive, low-margin landscape.

SPAR Group, Inc. (SGRP) - Porter's Five Forces: Threat of substitutes

You're looking at the competitive landscape for SPAR Group, Inc. (SGRP) and the substitutes for their core in-store execution services are definitely getting more sophisticated. Honestly, the threat here isn't just one thing; it's a combination of retailers bringing work back in-house and new tech that does the job cheaper or faster.

Retailers performing merchandising and auditing services in-house is a constant, viable substitute. To be fair, the cost savings reported by those who outsource can be significant, but the push for control is strong. For example, retailers report saving between 20-40% compared to maintaining in-house sales forces when they do outsource, but the trend is shifting. Seven in 10 surveyed retail executives say they plan to expand their in-house delivery capabilities in 2025.

The shift to e-commerce and digital marketing substitutes for traditional in-store execution services, though SGRP is still heavily focused on the physical point of purchase. Still, the digital focus means less reliance on in-store presence for some functions. Outsourced sales promoters, for instance, have been shown to increase shopper engagement rates by up to 30% and improve sales conversions by 15-25% in some models, which pressures the value proposition of standard in-store execution.

Automation and AI-driven shelf-monitoring technology can replace human field services, which is a massive headwind. We see this clearly in the market data for shelf intelligence solutions. Retailers using hybrid data capture methods are 64% more likely to be early adopters of these technologies. Furthermore, 52% of merchants already use AI-enabled tools across their operations. Retailers are projecting an increase in AI spending by 29% from 2025 to 2026 as adoption accelerates.

Here's the quick math on how fast these substitute technologies are growing:

| Technology Segment | Market Value (2024) | Projected CAGR (2025 Onward) |

| AI-Powered Retail Shelf Monitoring | $2.1 billion | 21.8% (through 2033) |

| Smart Shelves Market | $4.16 billion | 24.22% (through 2034) |

SGRP's focus on technology adoption is a direct response to this high substitution threat. You can see this strategic pivot in their recent leadership changes; they appointed a Chief Technology Officer in October 2025 specifically to lead digital transformation and AI initiatives. This focus seems to be driving results in their core markets, as their U.S. and Canada comparable net revenues were up 28.2% year-over-year in Q3 2025, even as consolidated gross margin declined to 18.6% from 22.3% a year earlier. The company ended Q3 2025 with net revenues of $41.4M.

The key substitute vectors are:

- Retailers expanding in-house delivery capabilities, with 7 in 10 executives planning this in 2025.

- The global AI-powered retail shelf monitoring market is expected to reach $15.1 billion by 2033.

- The Smart Shelves Market is projected to hit $36.4 billion by 2034.

- SPAR Group's Q3 2025 GAAP net loss was $8.8M (or -$0.37/share).

SPAR Group, Inc. (SGRP) - Porter's Five Forces: Threat of new entrants

You're looking at the barriers to entry for SPAR Group, Inc. in the North American merchandising and marketing services space as of late 2025. Honestly, it's a mixed bag; some aspects are easy for a new player to enter, while others are nearly insurmountable without serious backing.

Initial capital investment for basic field services is relatively low, lowering the entry barrier. You don't need a massive factory to start offering basic in-store support. However, the real game changes when you look at scale and relationships. High barriers exist in securing national contracts and building the necessary trust with major retailers. These relationships are built over decades; you can't just buy that overnight.

New entrants struggle to match SPAR Group, Inc.'s scale and its long-standing relationships with CPG (Consumer Packaged Goods) clients. Consider the pipeline SPAR Group, Inc. is building on its U.S. and Canada business alone-it sits at more than $200 million of future business to win as of mid-2025. That kind of backlog signals stability that a startup simply won't have.

The financial capacity of SPAR Group, Inc. acts as a significant deterrent. The recent extension and expansion of their credit facilities provide substantial firepower. Specifically, the combined U.S. Revolving Credit Facility of $30 million and the Canadian facility of $6 million, effective October 2025, total a $36 million commitment. This facility increases its capacity to invest and deter new, smaller rivals through potential acquisitions or aggressive pricing on large bids.

Here's a quick look at the financial context supporting SPAR Group, Inc.'s current operational standing, which new entrants must overcome:

| Metric (As of Late 2025) | Value | Date/Period |

|---|---|---|

| Total Liquidity | $10.4 million | September 30, 2025 |

| U.S. Revolving Credit Facility (Max) | $30 million | October 2025 |

| Canadian Revolving Credit Facility (Max) | $6 million | October 2025 |

| Nine Months Net Revenues (U.S. & Canada) | $114.1 million | Nine Months Ended September 30, 2025 |

| Future Business Pipeline (U.S. & Canada) | More than $200 million | Mid-2025 |

To compete effectively, a new entrant would need to demonstrate immediate, equivalent scale or a radically different, lower-cost operating model. The ability of SPAR Group, Inc. to secure a $36 million total credit capacity shows lenders have confidence in their North American structure, even after recent divestitures.

The competitive landscape for securing major retail partnerships is characterized by:

- Long-term service agreements with major CPG firms.

- Proven track record in high-volume merchandising execution.

- Established technology integration for reporting and analytics.

- Need for significant working capital to manage large contracts, as seen by the $16.0 million net cash used by operating activities for the first nine months of 2025.

Finance: draft 13-week cash view by Friday.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.