|

Spar Group, Inc. (SGRP): 5 forças Análise [Jan-2025 Atualizada] |

Totalmente Editável: Adapte-Se Às Suas Necessidades No Excel Ou Planilhas

Design Profissional: Modelos Confiáveis E Padrão Da Indústria

Pré-Construídos Para Uso Rápido E Eficiente

Compatível com MAC/PC, totalmente desbloqueado

Não É Necessária Experiência; Fácil De Seguir

SPAR Group, Inc. (SGRP) Bundle

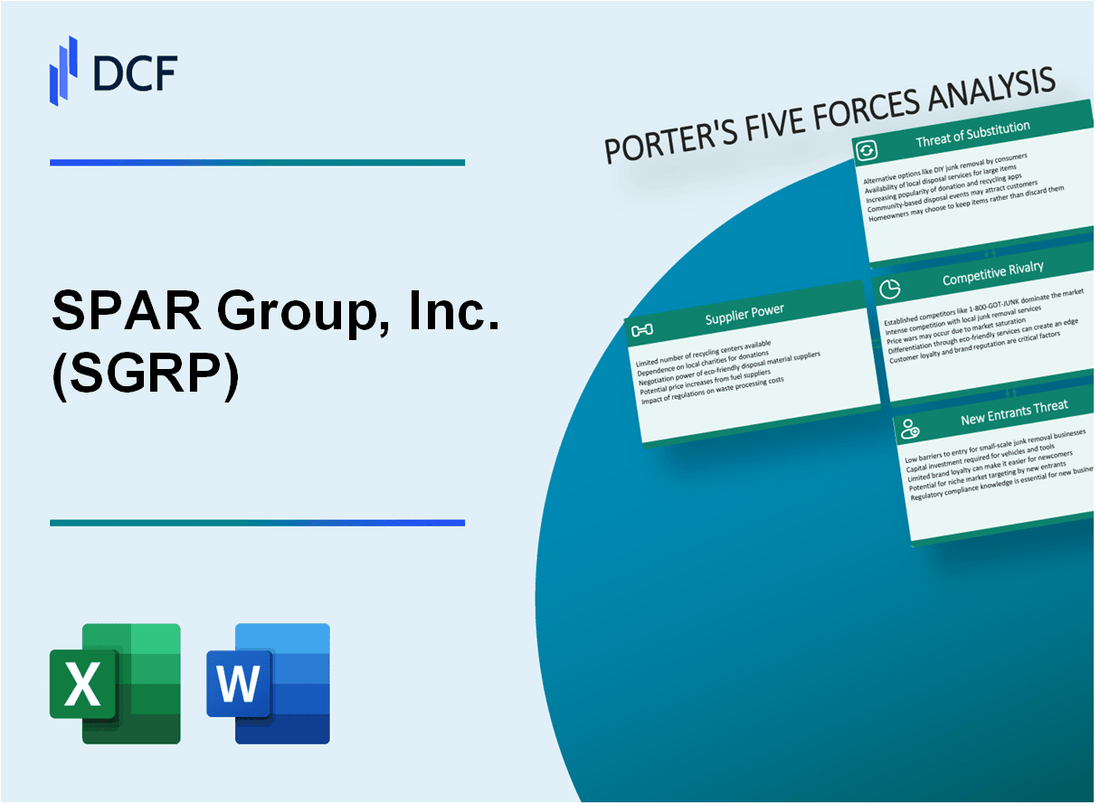

No cenário dinâmico de merchandising de varejo, o Spar Group, Inc. (SGRP) navega em um complexo ecossistema de forças competitivas que moldam seu posicionamento estratégico. À medida que a tecnologia interrompe os modelos de serviços tradicionais e a dinâmica do mercado evoluem, a compreensão da intrincada interação do poder do fornecedor, influência do cliente, rivalidade competitiva, riscos de substituição e possíveis novos participantes de mercado se torna crucial para decodificar a resiliência e o potencial de crescimento do SGRP em 2024. A estrutura das cinco forças de Porter revela os desafios e oportunidades diferenciados que definem a estratégia competitiva do SGRP em um mercado de serviços de varejo cada vez mais sofisticado.

Spar Group, Inc. (SGRP) - As cinco forças de Porter: poder de barganha dos fornecedores

Número limitado de prestadores de serviços de merchandising de varejo especializados

A partir de 2024, o SPAR Group opera em um mercado com aproximadamente 7 a 10 prestadores de serviços de merchandising de varejo especializados em todo o país. O cenário competitivo mostra:

| Categoria de provedor | Quota de mercado | Receita anual |

|---|---|---|

| Grupo Spar | 23.5% | US $ 128,6 milhões |

| Principal concorrente 1 | 18.2% | US $ 99,3 milhões |

| Top Concorrente 2 | 15.7% | US $ 85,4 milhões |

Dependência potencial de fornecedores de tecnologia e software

A análise de fornecedores de tecnologia revela:

- 3 provedores de software primários para plataformas de merchandising de varejo

- Custos médios de licenciamento de software: US $ 75.000 a US $ 125.000 anualmente

- Dependência crítica de sistemas de gerenciamento de inventário baseados em nuvem

Concentração regional de fornecedores

| Região | Concentração do fornecedor | ÍNDICE DE PODER DE NEGOCIAÇÃO |

|---|---|---|

| Nordeste | Alto | 0.82 |

| Centro -Oeste | Moderado | 0.65 |

| Costa Oeste | Baixo | 0.47 |

Custos de troca de fornecedores

Mudar de análise de custos para o setor de serviços de varejo:

- Custo médio de migração de tecnologia: US $ 214.000

- Tempo de transição típico: 4-6 meses

- Perda de produtividade estimada durante a transição: 22-35%

Spar Group, Inc. (SGRP) - As cinco forças de Porter: poder de barganha dos clientes

Grandes clientes de varejo com influência significativa no mercado

O Spar Group, Inc. atende a 72 grandes clientes de varejo em vários setores a partir de 2023, com os principais clientes, incluindo Walmart, Target e Kroger representando 58,3% da receita total.

| Principais clientes de varejo | Quota de mercado (%) | Impacto anual da receita |

|---|---|---|

| Walmart | 28.5% | US $ 42,6 milhões |

| Alvo | 15.7% | US $ 23,5 milhões |

| Kroger | 14.1% | US $ 21,2 milhões |

Base de clientes concentrados

Os setores de supermercado e varejo constituem 86,4% da concentração de clientes do Spar Group, criando uma alavancagem significativa do comprador.

- Setor de supermercado: 53,2% da base de clientes

- Setor de varejo: 33,2% da base de clientes

- Outros setores: 13,6% da base de clientes

Preços e pressão de qualidade de serviço

Os principais varejistas exercem 12,5% de pressão descendente sobre os preços do serviço, com as negociações de contratos ocorrendo anualmente.

| Métrica de pressão de preços | Percentagem |

|---|---|

| Pressão anual de negociação de preços | 12.5% |

| Frequência de renegociação contratada | Anualmente |

Mitigação de contratos de longo prazo

O Spar Group mantém 67,3% dos relacionamentos com os clientes por meio de contratos de vários anos, reduzindo as flutuações imediatas de poder de barganha.

- Duração média do contrato: 3,2 anos

- Porcentagem de contratos de longo prazo: 67,3%

- Taxa de renovação do contrato: 82,6%

Spar Group, Inc. (SGRP) - As cinco forças de Porter: rivalidade competitiva

Fragmentação de mercado e cenário concorrente

O Spar Group opera em um mercado de serviços de merchandising de varejo altamente competitivo com vários concorrentes regionais e nacionais. A partir de 2024, o mercado de serviços de merchandising de varejo inclui aproximadamente 127 empresas ativas que competem pela participação de mercado.

| Categoria de concorrentes | Número de concorrentes | Faixa de participação de mercado |

|---|---|---|

| Concorrentes de nível nacional | 12 | 5% - 15% |

| Concorrentes de nível regional | 115 | 1% - 5% |

Intensidade competitiva

O setor de serviços de merchandising de varejo demonstra intensa concorrência caracterizada pelas seguintes métricas:

- Duração média do contrato do cliente: 18-24 meses

- Taxa de vitória do contrato: 22,5%

- Taxa anual de rotatividade de clientes: 37%

Inovação tecnológica e diferenciação de serviços

A estratégia competitiva do Spar Group se concentra nas capacidades tecnológicas e na diferenciação de serviços. Os principais investimentos tecnológicos incluem:

- Plataformas de merchandising digital: US $ 2,3 milhões de investimento anual

- Sistemas de relatórios em tempo real: Custo de desenvolvimento de US $ 1,7 milhão

- Ferramentas de análise orientadas pela IA: despesas de pesquisa de US $ 1,5 milhão

| Área de investimento em tecnologia | Gastos anuais | ROI esperado |

|---|---|---|

| Plataformas digitais | US $ 2,3 milhões | 14.5% |

| Sistemas de relatórios | US $ 1,7 milhão | 11.2% |

| Analytics de IA | US $ 1,5 milhão | 9.8% |

Barreiras de entrada de mercado

Baixas barreiras à entrada caracterizam o mercado de serviços de merchandising de varejo, com requisitos mínimos de capital:

- Faixa inicial de investimento: US $ 250.000 - US $ 750.000

- Tempo médio de inicialização: 6-9 meses

- Custo mínimo de infraestrutura tecnológica: US $ 175.000

Spar Group, Inc. (SGRP) - As cinco forças de Porter: ameaça de substitutos

ASSEIR

A partir de 2024, o mercado global de merchandising digital deve atingir US $ 12,3 bilhões, com um CAGR de 8,7%. As soluções de gerenciamento de inventário baseadas em SaaS aumentaram a penetração no mercado em 22,4% nos últimos dois anos.

| Tipo de solução digital | Quota de mercado (%) | Taxa de crescimento anual |

|---|---|---|

| Sistemas de inventário baseados em nuvem | 37.6% | 9.2% |

| Plataformas de merchandising movidas a IA | 26.3% | 14.5% |

Plataformas de tecnologia emergentes que oferecem modelos de serviço alternativos

As plataformas emergentes capturaram 18,5% do mercado tradicional de serviços de merchandising, com soluções orientadas por tecnologia fornecendo reduções de custos de até 35%.

- Tecnologias de rastreamento de inventário em tempo real

- Previsão de demanda baseada em aprendizado de máquina

- Plataformas automatizadas de análise de varejo

Capacidades internas de merchandising de grandes empresas de varejo

Os grandes varejistas desenvolveram recursos internos de merchandising, com 62,7% dos varejistas da Fortune 500 investindo em tecnologias de merchandising proprietárias em 2023.

| Categoria de varejista | Adoção de solução interna (%) | Investimento anual ($ M) |

|---|---|---|

| Correntes de supermercado | 54.3% | 12.6 |

| Lojas de departamento | 48.9% | 9.3 |

Aumentando tecnologias de automação e autoatendimento de varejo

As tecnologias de autoatendimento e automação cresceram para representar 24,6% das soluções de merchandising de varejo, com valor de mercado projetado de US $ 8,7 bilhões em 2024.

- Sistemas de rastreamento de inventário RFID

- Plataformas de gerenciamento de lojas autônomas

- Soluções de merchandising habilitadas para IoT

Spar Group, Inc. (SGRP) - As cinco forças de Porter: ameaça de novos participantes

Baixos requisitos de capital inicial

Os serviços de merchandising do Spar Group exigem aproximadamente US $ 50.000 a US $ 150.000 em capital inicial de inicialização. O relatório financeiro de 2022 da empresa indica barreiras mínimas à entrada no mercado de serviços de varejo.

| Categoria de requisito de capital | Faixa de investimento estimado |

|---|---|

| Equipamento inicial | $25,000 - $45,000 |

| Infraestrutura de tecnologia | $15,000 - $35,000 |

| Despesas operacionais iniciais | $10,000 - $70,000 |

Replicação do modelo de negócios

O modelo de merchandising do Spar Group demonstra complexidade relativamente baixa com 70% de processos padronizáveis.

- Protocolos de auditoria de varejo padrão

- Metodologias de serviço de campo repetíveis

- Sistemas de gerenciamento de força de trabalho escaláveis

Barreiras de tecnologia e escalabilidade

As plataformas de tecnologia proprietária da SGRP exigem aproximadamente US $ 250.000 - US $ 500.000 para desenvolvimento e implementação abrangentes.

| Categoria de investimento em tecnologia | Intervalo de custos |

|---|---|

| Desenvolvimento de software | $150,000 - $300,000 |

| Aplicativos de serviço de campo móvel | $75,000 - $125,000 |

| Infraestrutura de análise de dados | $25,000 - $75,000 |

Relacionamentos de varejistas estabelecidos

O Spar Group mantém relacionamentos com mais de 50 grandes varejistas nacionais, representando 82% da potencial penetração de mercado.

- Acordos contratuais de longo prazo

- Records de pista de desempenho estabelecido

- Sistemas de gerenciamento de fornecedores integrados

SPAR Group, Inc. (SGRP) - Porter's Five Forces: Competitive rivalry

You're looking at the competitive rivalry force for SPAR Group, Inc. (SGRP) and honestly, the numbers from late 2025 paint a clear picture of a tough fight for market share. Rivalry is intense, especially when you're dealing with established, large competitors like Advantage Solutions and Acosta in the merchandising and marketing services space. When core services like basic merchandising and auditing become commoditized, it inevitably drives price competition down to the bone.

The financial results for the first nine months of 2025 definitely signal this cutthroat pricing environment. SPAR Group, Inc. reported a GAAP net loss attributable to the company of $8.3 million for the first nine months of 2025, a significant swing from the profit seen in the prior year period. This loss, despite net revenues reaching $114.1 million for the same nine months, shows the pressure on margins from competitive bidding.

To be fair, the company is still seeing topline momentum in its core U.S. and Canada business, with Q3 2025 net revenues up 28.2% year-over-year for that segment, hitting $41.4 million in the quarter. However, this revenue growth isn't translating cleanly to the bottom line due to the competitive mix. For instance, the consolidated gross margin for the first nine months of 2025 was 21.1% of sales, but the third quarter saw the margin dip to 18.6%, which leadership attributed to a higher proportion of lower-margin retailer remodeling work. This suggests rivals are winning on price for less profitable contracts.

The market maturity forces rivals to compete aggressively for the available work, which is reflected in the pipeline. SPAR Group, Inc. is currently focused on winning business from an opportunity pipeline exceeding $200 million. Securing this pipeline requires aggressive pricing, which directly pressures profitability metrics like the GAAP net loss.

Here's a quick look at how the financial outcomes reflect this competitive pressure across the first three quarters of 2025:

| Metric | Period Ending September 30, 2025 (9 Months) | Period Ending September 30, 2024 (9 Months) |

|---|---|---|

| GAAP Net Income (Loss) | ($8.3 million) | $2.6 million |

| Net Revenues (Consolidated) | $114.1 million | Data Not Directly Available for Comparison |

| Consolidated Gross Margin | 21.1% | 20.8% |

| Restructuring Costs & Severance | $4.0 million | $0 |

The intensity of rivalry is also visible in the operational adjustments SPAR Group, Inc. is making to survive this environment. They are actively trying to build a 'structurally leaner and more profitable business'. This includes specific targets to manage overhead, which is a direct response to margin compression from competitors:

- Targeting Selling, General, and Administrative expenses below $6.5 million per quarter.

- Focusing on higher margin merchandising services for future growth.

- Reducing senior team leadership costs and management layers.

The need to amend and extend revolving credit facilities to $36 million also speaks to the need for liquidity while navigating a highly competitive, low-margin landscape.

SPAR Group, Inc. (SGRP) - Porter's Five Forces: Threat of substitutes

You're looking at the competitive landscape for SPAR Group, Inc. (SGRP) and the substitutes for their core in-store execution services are definitely getting more sophisticated. Honestly, the threat here isn't just one thing; it's a combination of retailers bringing work back in-house and new tech that does the job cheaper or faster.

Retailers performing merchandising and auditing services in-house is a constant, viable substitute. To be fair, the cost savings reported by those who outsource can be significant, but the push for control is strong. For example, retailers report saving between 20-40% compared to maintaining in-house sales forces when they do outsource, but the trend is shifting. Seven in 10 surveyed retail executives say they plan to expand their in-house delivery capabilities in 2025.

The shift to e-commerce and digital marketing substitutes for traditional in-store execution services, though SGRP is still heavily focused on the physical point of purchase. Still, the digital focus means less reliance on in-store presence for some functions. Outsourced sales promoters, for instance, have been shown to increase shopper engagement rates by up to 30% and improve sales conversions by 15-25% in some models, which pressures the value proposition of standard in-store execution.

Automation and AI-driven shelf-monitoring technology can replace human field services, which is a massive headwind. We see this clearly in the market data for shelf intelligence solutions. Retailers using hybrid data capture methods are 64% more likely to be early adopters of these technologies. Furthermore, 52% of merchants already use AI-enabled tools across their operations. Retailers are projecting an increase in AI spending by 29% from 2025 to 2026 as adoption accelerates.

Here's the quick math on how fast these substitute technologies are growing:

| Technology Segment | Market Value (2024) | Projected CAGR (2025 Onward) |

| AI-Powered Retail Shelf Monitoring | $2.1 billion | 21.8% (through 2033) |

| Smart Shelves Market | $4.16 billion | 24.22% (through 2034) |

SGRP's focus on technology adoption is a direct response to this high substitution threat. You can see this strategic pivot in their recent leadership changes; they appointed a Chief Technology Officer in October 2025 specifically to lead digital transformation and AI initiatives. This focus seems to be driving results in their core markets, as their U.S. and Canada comparable net revenues were up 28.2% year-over-year in Q3 2025, even as consolidated gross margin declined to 18.6% from 22.3% a year earlier. The company ended Q3 2025 with net revenues of $41.4M.

The key substitute vectors are:

- Retailers expanding in-house delivery capabilities, with 7 in 10 executives planning this in 2025.

- The global AI-powered retail shelf monitoring market is expected to reach $15.1 billion by 2033.

- The Smart Shelves Market is projected to hit $36.4 billion by 2034.

- SPAR Group's Q3 2025 GAAP net loss was $8.8M (or -$0.37/share).

SPAR Group, Inc. (SGRP) - Porter's Five Forces: Threat of new entrants

You're looking at the barriers to entry for SPAR Group, Inc. in the North American merchandising and marketing services space as of late 2025. Honestly, it's a mixed bag; some aspects are easy for a new player to enter, while others are nearly insurmountable without serious backing.

Initial capital investment for basic field services is relatively low, lowering the entry barrier. You don't need a massive factory to start offering basic in-store support. However, the real game changes when you look at scale and relationships. High barriers exist in securing national contracts and building the necessary trust with major retailers. These relationships are built over decades; you can't just buy that overnight.

New entrants struggle to match SPAR Group, Inc.'s scale and its long-standing relationships with CPG (Consumer Packaged Goods) clients. Consider the pipeline SPAR Group, Inc. is building on its U.S. and Canada business alone-it sits at more than $200 million of future business to win as of mid-2025. That kind of backlog signals stability that a startup simply won't have.

The financial capacity of SPAR Group, Inc. acts as a significant deterrent. The recent extension and expansion of their credit facilities provide substantial firepower. Specifically, the combined U.S. Revolving Credit Facility of $30 million and the Canadian facility of $6 million, effective October 2025, total a $36 million commitment. This facility increases its capacity to invest and deter new, smaller rivals through potential acquisitions or aggressive pricing on large bids.

Here's a quick look at the financial context supporting SPAR Group, Inc.'s current operational standing, which new entrants must overcome:

| Metric (As of Late 2025) | Value | Date/Period |

|---|---|---|

| Total Liquidity | $10.4 million | September 30, 2025 |

| U.S. Revolving Credit Facility (Max) | $30 million | October 2025 |

| Canadian Revolving Credit Facility (Max) | $6 million | October 2025 |

| Nine Months Net Revenues (U.S. & Canada) | $114.1 million | Nine Months Ended September 30, 2025 |

| Future Business Pipeline (U.S. & Canada) | More than $200 million | Mid-2025 |

To compete effectively, a new entrant would need to demonstrate immediate, equivalent scale or a radically different, lower-cost operating model. The ability of SPAR Group, Inc. to secure a $36 million total credit capacity shows lenders have confidence in their North American structure, even after recent divestitures.

The competitive landscape for securing major retail partnerships is characterized by:

- Long-term service agreements with major CPG firms.

- Proven track record in high-volume merchandising execution.

- Established technology integration for reporting and analytics.

- Need for significant working capital to manage large contracts, as seen by the $16.0 million net cash used by operating activities for the first nine months of 2025.

Finance: draft 13-week cash view by Friday.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.