|

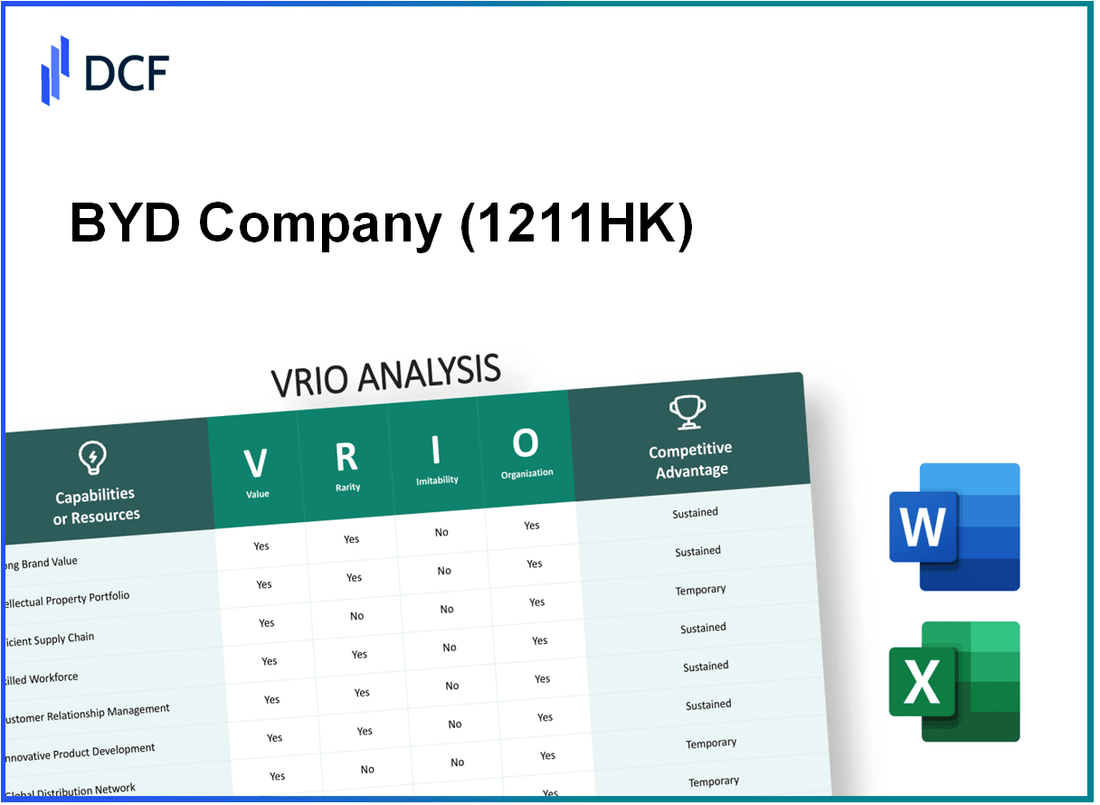

BYD Company Limited (1211.HK): VRIO Analysis |

Fully Editable: Tailor To Your Needs In Excel Or Sheets

Professional Design: Trusted, Industry-Standard Templates

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Expertise Is Needed; Easy To Follow

BYD Company Limited (1211.HK) Bundle

BYD Company Limited, a trailblazer in the electric vehicle and renewable energy sectors, leverages key resources and capabilities to secure its place as a market leader. Through a comprehensive VRIO analysis, we will explore how BYD's brand value, intellectual property, supply chain management, and other critical factors not only create competitive advantages but also position the company for sustained growth in a rapidly evolving industry. Dive in to uncover the distinctive elements that fuel BYD's innovative drive and operational excellence.

BYD Company Limited - VRIO Analysis: Brand Value

Value: As of 2022, BYD Company Limited's brand was valued at approximately $8.75 billion, contributing significantly to its revenue, which reached $42.3 billion in the same year. The company's ability to charge premium prices for its electric vehicles (EVs) has bolstered its financial performance. In the first half of 2023, BYD reported a net profit of $1.4 billion, showcasing its effective monetization of brand value.

Rarity: BYD is recognized as one of the largest manufacturers of electric vehicles globally, a position that is relatively rare in the automotive industry. The company held about 12% market share in the global electric vehicle market as of 2022, and its brand reputation as a pioneer in battery technology enhances its competitive edge.

Imitability: Establishing a brand like BYD with similar recognition would require significant time and investment. For instance, BYD has invested over $15 billion in R&D since 2015, primarily focused on battery technology and EV production. This substantial commitment to innovation and brand development positions BYD far ahead of many competitors.

Organization: BYD has strategically organized its operations to maximize brand leverage. The company employs a strong marketing strategy, including partnerships with local governments and participation in global auto shows. In 2022, BYD allocated approximately $1.2 billion to marketing and promotional activities to enhance brand engagement.

Competitive Advantage: BYD's brand value serves as a sustained competitive advantage. The firm’s strong market position is highlighted by a sales figure of 1.5 million electric vehicles sold in 2022, a year-on-year growth of 150%. The distinctiveness and difficulty in replicating its brand strength make it pivotal to the company's ongoing success.

| Metric | Value |

|---|---|

| Brand Value (2022) | $8.75 billion |

| Total Revenue (2022) | $42.3 billion |

| Net Profit (H1 2023) | $1.4 billion |

| Global Electric Vehicle Market Share (2022) | 12% |

| Investment in R&D (2015-2022) | $15 billion |

| Marketing Investment (2022) | $1.2 billion |

| Electric Vehicles Sold (2022) | 1.5 million |

| Year-on-Year Growth in Sales (2022) | 150% |

BYD Company Limited - VRIO Analysis: Intellectual Property

Intellectual Property is a key component of BYD Company Limited’s competitive strategy. The company's portfolio includes numerous patents and trademarks that provide significant value in the increasingly competitive automotive and renewable energy sectors.

Value

BYD holds over 12,000 patents, encompassing technologies for electric vehicles (EVs), batteries, and solar energy. These patents help shield innovative products and processes, positioning BYD favorably against competitors.

Rarity

BYD's focus on vertical integration, particularly in battery production, is underscored by its exclusive technologies. The company's solid-state battery technology, anticipated to hit the market by 2025, is a testament to the rarity of its intellectual properties.

Imitability

BYD's patents and trademarks are legally protected, making imitation difficult. For instance, BYD has successfully enforced 350 patents related to its electric drive system, demonstrating the legal barriers competitors face when trying to replicate their innovations.

Organization

BYD has established a dedicated intellectual property management team, tasked with overseeing the protection and commercialization of its patents. The company’s commitment is evident in its annual budget allocation of approximately 5% of revenue for R&D, which was over ¥22 billion (approximately $3.5 billion) in 2022.

Competitive Advantage

BYD's sustained competitive advantage is reinforced by its extensive legal protections and the high barriers to entry it creates for competitors. In 2022, BYD’s market share in the EV sector surged to 30% in China, largely due to its unique technologies.

| Parameter | Value |

|---|---|

| Total Patents Held | 12,000+ |

| Planned Solid-State Battery Launch | 2025 |

| Patents Enforced on Electric Drive System | 350 |

| R&D Budget as % of Revenue | 5% |

| R&D Spending (2022) | ¥22 billion ($3.5 billion) |

| Market Share in EV Sector (2022) | 30% |

BYD Company Limited - VRIO Analysis: Supply Chain Management

Value: Efficient supply chain management reduces costs and improves product availability, enhancing customer satisfaction. In 2022, BYD Company reported a gross profit margin of 18.4%, demonstrating its effectiveness in managing supply chain costs. The company's revenue reached ¥424.1 billion (approximately $62.7 billion), reflecting increased product availability driven by supply chain efficiency.

Rarity: While effective supply chain management is valuable, it is not particularly rare, as many companies strive for efficiency. The global automotive supply chain is becoming increasingly competitive, with major players like Tesla and Volkswagen also focusing on optimizing their supply chains. However, BYD benefits from its vertical integration strategy, controlling over 70% of its battery production, which provides some level of rarity in resource availability.

Imitability: Competitors can imitate best practices in supply chain management, though it requires time and investment. For instance, companies like NIO and Xpeng are investing heavily in their supply chain capabilities. The average cost to implement a modern supply chain system can range from $100,000 to $500,000, depending on the scale, which poses a barrier to rapid imitation.

Organization: The company is well-organized to optimize its supply chain operations through strategic partnerships and technology. BYD has established partnerships with lithium suppliers like Ganfeng Lithium Co., Ltd. to secure critical materials for battery production. In 2023, BYD signed a strategic agreement to ensure a consistent supply of lithium, showcasing a proactive organizational approach to supply chain management.

Competitive Advantage: Temporary, as while it provides current benefits, competitors can eventually replicate an efficient supply chain. BYD's supply chain efficiency contributed to its 33.2% increase in vehicle sales in Q1 2023 compared to the previous year. However, as new players enter the electrification market, such advantages are susceptible to erosion.

| Metric | 2022 Value | Q1 2023 Growth | Battery Production Control |

|---|---|---|---|

| Gross Profit Margin | 18.4% | N/A | 70%+ of its battery supply |

| Revenue | ¥424.1 billion (~$62.7 billion) | 33.2% Increase | N/A |

| Strategic Partnership with Ganfeng Lithium | N/A | N/A | Secures lithium supply |

| Average Cost for Supply Chain Implementation | $100,000 - $500,000 | N/A | N/A |

BYD Company Limited - VRIO Analysis: Technological Innovation

Value: Technological innovation is pivotal for BYD Company Limited, driving product development and operational efficiency. In 2022, BYD's revenue reached approximately ¥424.3 billion (around $62.7 billion), a significant year-over-year increase of 150%. This surge indicates the critical role of technology in enhancing product lines, such as electric vehicles (EVs).

Rarity: The company's commitment to research and development (R&D) is substantial, with BYD investing ¥16.3 billion (approximately $2.4 billion) in R&D in 2022, marking a 22.4% increase from 2021. This investment in cutting-edge technology, including battery production and electric drivetrains, is rare in the automotive industry, positioning BYD uniquely against competitors.

Imitability: The high costs associated with developing advanced technologies serve as a barrier to imitation. For example, BYD's proprietary Blade Battery technology has been a focus of innovation, with manufacturing costs reported to be lower than traditional lithium-ion batteries. Competitors face challenges in replicating this technology without significant capital and expertise, which can run into hundreds of millions of dollars.

Organization: BYD is structured to leverage its technological advancements effectively. The company has established multiple R&D centers globally, including in the United States, Europe, and Asia, employing over 30,000 R&D personnel. In 2022, BYD's total assets were valued at around ¥385.5 billion (approximately $56.8 billion), with a significant portion dedicated to technological growth.

Competitive Advantage: Sustained technological innovation provides BYD with a competitive edge. The company held a market share of approximately 29% in the Chinese EV market in early 2023, illustrating the effectiveness of its advancements in maintaining leadership amidst fierce competition.

| Year | Revenue (¥ Billion) | R&D Investment (¥ Billion) | Market Share (%) | Total Assets (¥ Billion) |

|---|---|---|---|---|

| 2020 | 156.5 | 8.0 | 5% | 307.8 |

| 2021 | 169.4 | 13.3 | 20% | 350.5 |

| 2022 | 424.3 | 16.3 | 29% | 385.5 |

| 2023 (Q1) | 115.6 | N/A | 30% | N/A |

BYD Company Limited - VRIO Analysis: Financial Resources

Value: BYD Company Limited reported a revenue of ¥191.92 billion (approximately $28.45 billion) for the fiscal year ending December 2022, showcasing its strong financial base that supports investment in growth opportunities such as electric vehicle production and battery technology. The company's net profit for the same period was ¥16.21 billion (about $2.36 billion).

Rarity: Many firms have access to financial resources, yet BYD stands out with a cash and cash equivalents balance of ¥56.61 billion (approximately $8.34 billion) as of the end of Q2 2023. This financial strength is not typical across the automotive and energy sector, especially among companies focused on electric vehicles.

Imitability: Accumulating similar financial resources requires not just time but also strategic management. BYD has invested heavily in R&D, totaling approximately ¥15.75 billion (about $2.30 billion) in 2022, thus achieving significant returns that are difficult for competitors to replicate quickly.

Organization: BYD's financial management is structured to support strategic objectives. For instance, the company reported an operating cash flow of ¥27.91 billion (around $4.07 billion) for the year ended December 2022, indicating effective cash flow management aligned with expansion and operational efficiency.

Competitive Advantage: While BYD's financial resources provide a competitive edge, this advantage is considered temporary. Companies like Tesla and Volkswagen are also increasing their investments in electric vehicles, which could match BYD's financial capabilities over time. As of Q3 2023, Tesla's market cap stands at approximately $695 billion, while BYD's is around $103 billion.

| Metric | 2022 (Fiscal Year) | Q2 2023 | Comparative Company |

|---|---|---|---|

| Revenue | ¥191.92 billion (~$28.45 billion) | N/A | Tesla: ~$81.46 billion |

| Net Profit | ¥16.21 billion (~$2.36 billion) | N/A | Tesla: ~$12.56 billion |

| Cash & Cash Equivalents | N/A | ¥56.61 billion (~$8.34 billion) | N/A |

| R&D Investment | ¥15.75 billion (~$2.30 billion) | N/A | N/A |

| Operating Cash Flow | ¥27.91 billion (~$4.07 billion) | N/A | N/A |

| Market Capitalization | ¥703.44 billion (~$103 billion) | N/A | Tesla: ~$695 billion |

BYD Company Limited - VRIO Analysis: Human Capital

Value: BYD Company Limited employs over 220,000 employees globally as of 2023. Its skilled workforce is pivotal in driving innovation in electric vehicle (EV) technology and battery production. The company's R&D spending reached approximately CNY 14.1 billion in 2022, reflecting its commitment to enhancing productivity and customer service excellence.

Rarity: In the automotive and EV industry, a highly skilled workforce can be considered rare. The demand for qualified engineers and technicians in the EV sector has surged, with reports indicating a projected shortage of about 300,000 EV-related workers by 2030 in China. BYD's ability to attract top talent is critical in maintaining its competitive edge.

Imitability: While competitors may attempt to poach talent, replicating BYD’s unique company culture is challenging. The firm has developed a specific expertise in vertical integration, particularly in battery production, which is not easily copied. For example, BYD produced over 100 GWh of batteries in 2022, showcasing its proprietary capabilities in this area.

Organization: BYD promotes talent through extensive development programs. In 2022, the company invested around CNY 3 billion in employee training and development initiatives. Its supportive culture is evident in its employee retention rate, which stands at approximately 90%.

Competitive Advantage: BYD’s unique company culture and accumulated expertise provide a sustained competitive advantage. The company ranked 4th globally in electric vehicle sales in 2022, with a market share of 12% in the EV sector. These metrics highlight the difficulty competitors face in replicating BYD’s success.

| Metric | Value |

|---|---|

| Number of Employees | 220,000 |

| R&D Spending (2022) | CNY 14.1 billion |

| EV-Related Worker Shortage (by 2030) | 300,000 |

| Battery Production (2022) | 100 GWh |

| Investment in Employee Development (2022) | CNY 3 billion |

| Employee Retention Rate | 90% |

| Global EV Sales Rank (2022) | 4th |

| Market Share in EV Sector (2022) | 12% |

BYD Company Limited - VRIO Analysis: Customer Relationships

Value: BYD Company Limited has established a robust network of customer relationships that significantly contributes to its revenue generation. In 2022, BYD reported a revenue of approximately RMB 424.5 billion (around $65.9 billion), indicating the effectiveness of its customer relationship management that fosters repeat business and brand advocacy.

Rarity: The capacity to maintain long-lasting customer relationships is rare among competitors in the automobile and battery industries. As of 2023, BYD has a customer base of over 1.5 million electric vehicle (EV) buyers, emphasizing the rarity of its sustained customer loyalty and engagement.

Imitability: Crafting strong customer relationships similar to BYD's requires substantial investment in time and resources. BYD's consistent quality in its products, evidenced by its 87% customer satisfaction score in the 2022 customer survey, highlights the challenges competitors face in replicating such relationships. The introduction of tailored services and proactive customer engagement strategies also adds to this complexity.

Organization: BYD employs sophisticated Customer Relationship Management (CRM) systems to gather and analyze customer feedback effectively. In 2023, the company utilized data analytics to enhance customer interactions and product offerings, contributing to an increase of 30% in customer engagement metrics year-over-year.

| Year | Revenue (RMB Billion) | Revenue (USD Billion) | Customer Base (Millions) | Customer Satisfaction (%) |

|---|---|---|---|---|

| 2022 | 424.5 | 65.9 | 1.5 | 87 |

| 2023 | Projected at 480 | Projected at 75 | 1.7 | 90 |

Competitive Advantage: BYD's deep-rooted customer loyalty and established relationships provide a sustained competitive advantage, making it challenging for competitors to disrupt. The company's strong brand positioning has resulted in a 40% market share in the Chinese EV market as of mid-2023, showcasing the effectiveness of its customer relationship strategies.

BYD Company Limited - VRIO Analysis: Distribution Network

Value: BYD Company Limited has established a broad and efficient distribution network across multiple regions, facilitating product availability and enhancing its sales potential. The company reported operating revenue of approximately RMB 152.5 billion in 2022, indicating robust market reach. The electric vehicle (EV) segment alone contributed over RMB 107 billion to this total.

Rarity: While BYD's distribution network is comprehensive, it is not particularly rare. Various competitors, such as Tesla and NIO, have also developed extensive distribution channels. For instance, Tesla operates over 1,000 locations worldwide, reflecting a similar level of market presence.

Imitability: Competitors can replicate BYD's distribution network; however, establishing a similar infrastructure requires significant logistical investments and partnerships. For example, BYD's extensive network includes over 1,200 dealers in China and strategic alliances with local suppliers, which can take years for competitors to develop.

Organization: BYD optimizes its distribution strategy through effective logistics management and strategic partnerships. The company’s logistic capabilities were highlighted in its 2022 annual report, where it noted a 20% reduction in delivery times year-over-year due to improved supply chain processes.

| Metric | 2022 Data | 2021 Data | Growth Rate |

|---|---|---|---|

| Operating Revenue (RMB) | 152.5 billion | 125.0 billion | 22% |

| EV Segment Revenue (RMB) | 107 billion | 82 billion | 30% |

| Number of Dealers (China) | 1,200 | 1,100 | 9% |

| Reduction in Delivery Times | 20% | N/A | N/A |

Competitive Advantage: BYD's competitive advantage in its distribution network is considered temporary. With sufficient time and resources, competitors can develop similar networks. The rapid expansion of companies like NIO, which has increased its dealer count by 15% in 2022, exemplifies this potential for imitation in the industry.

BYD Company Limited - VRIO Analysis: Corporate Social Responsibility (CSR) Approach

Value

BYD’s commitment to CSR enhances its brand reputation significantly. In 2022, BYD achieved a revenue of RMB 424.3 billion, reflecting a rise of 74.5% year-over-year, driven in part by its sustainable practices which have attracted 4.4 million customers in the electric vehicle segment. The company’s focus on environmentally friendly products resonates well with consumers, particularly in the electric vehicle market, where sales comprised approximately 70% of total revenue.

Rarity

BYD's integrated CSR strategy is relatively rare as it genuinely aligns with business objectives—unlike the more superficial efforts observed in many competitors. For instance, BYD is among the select few companies that have committed to a full lifecycle assessment of their products, which is evidenced by their stringent compliance with ISO 14001 environmental management standards. This places BYD ahead of many automotive manufacturers who may not prioritize sustainability to the same extent.

Imitability

While competitors can adopt CSR initiatives, BYD’s authentic integration into its corporate ethos is challenging to replicate. The company has invested over RMB 5 billion in renewable energy projects and has established over 25 solar power stations. This deep-rooted commitment to sustainability creates a unique corporate identity, difficult for others to imitate effectively in both scale and authenticity.

Organization

BYD has structured its organization to embed CSR into the core strategy. In the fiscal year 2022, the company allocated 12% of its gross revenue to sustainable development initiatives. The alignment of CSR with overall corporate goals is evident as the company reported a 120% increase in EV production capacity, to 1.5 million vehicles annually, promoting energy efficiency and lower emissions as core business values.

Competitive Advantage

The sustained competitive advantage BYD enjoys from its authentic CSR efforts is reflected in its brand trust and market position. In 2023, BYD was named the world’s largest electric vehicle manufacturer with a market share of 27%. This differentiation built through CSR initiatives has established BYD not only as a leader in EVs but has also cultivated a loyal customer base committed to sustainable practices.

| Metric | 2022 Value | Growth Rate |

|---|---|---|

| Revenue | RMB 424.3 billion | 74.5% |

| Electric Vehicles Sold | 4.4 million | - |

| Investment in Renewable Energy Projects | RMB 5 billion | - |

| Production Capacity | 1.5 million vehicles annually | 120% increase |

| Market Share in Electric Vehicles | 27% | - |

| Gross Revenue Allocated to CSR Initiatives | 12% | - |

BYD Company Limited exemplifies a robust business model through its strategic use of VRIO analysis, showcasing the strength of its brand value, unique intellectual properties, and a dedicated workforce, among other assets. Each element contributes to a competitive advantage that is difficult for rivals to replicate, ensuring BYD remains a formidable player in its industry. For a deeper dive into how these factors interplay within the market landscape and influence BYD's success, continue reading below.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.