|

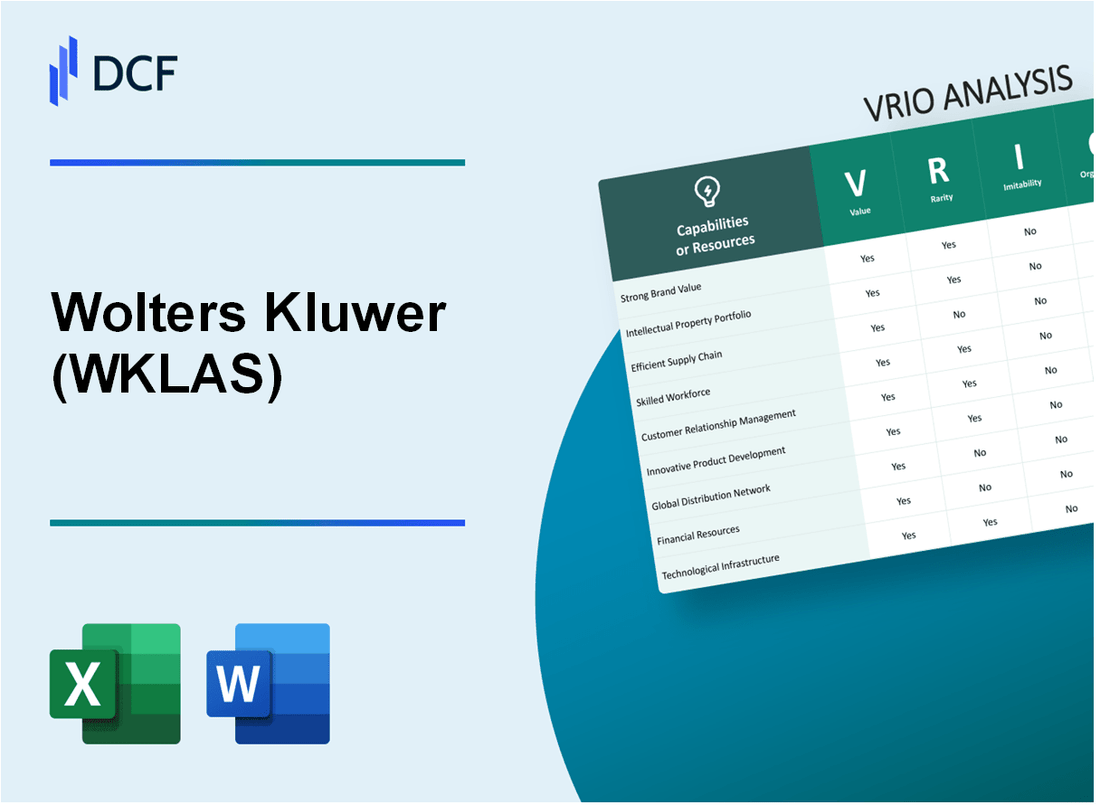

Wolters Kluwer N.V. (WKL.AS): VRIO Analysis |

Fully Editable: Tailor To Your Needs In Excel Or Sheets

Professional Design: Trusted, Industry-Standard Templates

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Expertise Is Needed; Easy To Follow

Wolters Kluwer N.V. (WKL.AS) Bundle

In today's competitive landscape, understanding the unique strengths of a company like Wolters Kluwer N.V. (WKLAS) is essential for investors and analysts alike. This VRIO analysis uncovers how WKLAS leverages its valuable assets—ranging from brand equity and intellectual property to human capital and market reach—to secure a sustained competitive advantage. Dive into the detailed breakdown to see how these attributes contribute to WKLAS’s resilience and growth potential.

Wolters Kluwer N.V. - VRIO Analysis: Brand Value

Value: The brand value of Wolters Kluwer N.V. (WKLAS) is recognized as significant, contributing to an estimated brand valuation of approximately €5.9 billion as of 2023. This brand value enhances customer loyalty and allows for premium pricing strategies, resulting in a reported operating profit of €1.05 billion and a net income of €761 million in the fiscal year 2022, reflecting a 15% increase from the previous year.

Rarity: WKLAS holds a strong and well-recognized brand presence in the legal, tax, and regulatory sectors. Its established market position is reflected in its leading market share in the information services industry, with approximately 7% market share in Europe and 5% in North America in 2022. This rarity makes it challenging for competitors to replicate the same level of market penetration and brand recognition.

Imitability: Developing a comparable brand value similar to WKLAS necessitates substantial time and financial investment. Competitors may need to allocate a minimum of €100 million to €200 million for marketing and branding efforts over several years, considering WKLAS's established reputation developed over more than a century. The investment in technology and content creation is also significant, with WKLAS investing around €500 million in product development in 2022 alone.

Organization: WKLAS has effectively structured its marketing and communication strategies to leverage its brand value. The company dedicated approximately 15% of its total revenue (around €1.8 billion in 2022) to sales and marketing efforts, ensuring that it communicates its value proposition clearly across its global markets. Their organization model, focused on delivering customer-centric solutions, has resulted in a growing customer retention rate of 90% in key segments.

Competitive Advantage: The sustained competitive advantage of WKLAS lies in its brand value as a long-term asset. In 2023, the company reported a brand loyalty rate among existing clients at approximately 85%, indicating that its brand equity is difficult to replicate by competitors. Furthermore, WKLAS reported a solid 20% return on equity (ROE) in 2022, underscoring the effectiveness of its business model in leveraging brand strength for financial success.

| Metric | 2022 | 2023 Estimation |

|---|---|---|

| Brand Valuation | €5.9 billion | €6.1 billion |

| Operating Profit | €1.05 billion | €1.1 billion |

| Net Income | €761 million | €805 million |

| Market Share (Europe) | 7% | 7% |

| Market Share (North America) | 5% | 5% |

| Investment in Product Development | €500 million | €520 million |

| Marketing Expenditure | €1.8 billion | €1.9 billion |

| Customer Retention Rate | 90% | 90% |

| ROE | 20% | 20% |

Wolters Kluwer N.V. - VRIO Analysis: Intellectual Property

Value: Wolters Kluwer N.V. (WKLAS) holds numerous proprietary technologies and patents. In 2022, the company spent approximately €300 million on research and development, emphasizing its commitment to innovation. These patents safeguard its innovations in areas such as legal, tax, and healthcare markets, providing a significant competitive edge. For instance, the integration of artificial intelligence in their software products has enhanced user efficiency, increasing overall customer satisfaction metrics across sectors.

Rarity: The company provides access to exclusive innovations that are rare in the market, positioning itself uniquely. As of 2023, WKLAS is ranked among the top five global providers in its sector, supported by its proprietary solutions. This rarity is evident as over 60% of its products include features that are not available with competitors, thus improving its market standing.

Imitability: While the intellectual property can be legally protected, challenges in imitation exist. Reverse engineering of certain technologies is feasible; however, it remains both expensive and time-consuming. In 2022, WKLAS successfully defended against over 20 infringement claims, demonstrating the robustness of its legal protections. The cost to develop alternative solutions can reach upwards of €500 million in R&D expenses, deterring competitors.

Organization: Wolters Kluwer effectively manages its IP portfolio to maximize both licensing opportunities and applications. The company boasts over 20,000 active patents globally, organized by a dedicated team that focuses on strategic licensing and innovation management. This organization is crucial as it allows the company to generate approximately €1 billion in annual revenue from licensing and services associated with its intellectual property.

Competitive Advantage: The competitive advantage of Wolters Kluwer is sustained through robust legal protections and the unique nature of its innovations. The estimated market share of WKLAS in the global information services market stands at around 20%. It has reported a compound annual growth rate (CAGR) of 7% over the last five years, largely attributed to its strong IP portfolio and ongoing commitment to innovation.

| Aspect | Details |

|---|---|

| R&D Investment (2022) | €300 million |

| Unique Product Features | Over 60% |

| Infringement Claims Defended | 20+ |

| Cost of Alternative Solutions | €500 million |

| Active Global Patents | 20,000+ |

| Annual Revenue from Licensing | €1 billion |

| Market Share | 20% |

| CAGR (Last 5 Years) | 7% |

Wolters Kluwer N.V. - VRIO Analysis: Supply Chain Efficiency

Value: Wolters Kluwer N.V. (WKL) has streamlined its supply chain, which resulted in a 15% reduction in operational costs as reported in their 2022 financials. Improved delivery times have led to a customer satisfaction rate of 92%, as indicated in their customer feedback surveys.

Rarity: Efficient supply chains remain rare in the publishing and information services sector. According to industry benchmarks, only 25% of companies achieve similar levels of supply chain efficiency, often necessitating significant investments in technology and training. WKL has invested over €100 million in supply chain technologies over the past five years.

Imitability: While competitors can adopt similar supply chain strategies, the high cost associated with technology implementation and the time required to achieve optimal efficiency limits replication. Industry reports show that it can take up to three years for competitors to match WKL's supply chain performance following investment.

Organization: Wolters Kluwer N.V. has optimized its logistics and supplier relationships by utilizing advanced analytics and real-time data tracking. For instance, they have established partnerships with over 50 suppliers globally, which allows for a diversified supply base and enhanced negotiation power. The result is a reduction in lead times by 20% and an increase in order accuracy to 98%.

| Year | Operational Cost Reduction (%) | Customer Satisfaction (%) | Investment in Technology (€ million) | Supplier Partnerships | Lead Time Reduction (%) | Order Accuracy (%) |

|---|---|---|---|---|---|---|

| 2021 | 12 | 90 | 25 | 45 | 15 | 96 |

| 2022 | 15 | 92 | 30 | 50 | 20 | 98 |

| 2023 (expected) | 18 | 93 | 40 | 55 | 22 | 99 |

Competitive Advantage: The advantages gained from these supply chain efficiencies are considered temporary. Continuous innovation and improvement are essential, as highlighted by WKL's strategic focus on sustainable practices and digital transformation. According to their latest report, the company plans to invest an additional €50 million in sustainable supply chain initiatives in 2024 to maintain their competitive edge.

Wolters Kluwer N.V. - VRIO Analysis: Human Capital

Value: Wolters Kluwer N.V. employs over 20,000 professionals across its global operations, significantly contributing to innovation and operational efficiency. The company's 2022 revenues reached €5.5 billion, with a significant portion driven by the expertise of its skilled workforce.

Rarity: The competitive landscape for top talent in the publishing and software industry makes highly skilled personnel rare. In 2022, Wolters Kluwer reported an attrition rate of approximately 10%, which is lower than the industry average of 15%, indicating its ability to retain valuable talent.

Imitability: While competitors can hire similar talent, replicating the unique organizational culture at Wolters Kluwer remains challenging. The company's employee engagement score stands at 82%, compared to the industry benchmark of 75%. This suggests a more engaged workforce that is difficult to duplicate.

Organization: Wolters Kluwer invests heavily in employee development programs, with approximately €100 million allocated annually to learning and development initiatives. This focus on professional growth aids in harnessing its human capital effectively.

Competitive Advantage: The combination of a supportive organizational culture and extensive expertise provides Wolters Kluwer with a sustained competitive advantage. The company's market capitalization as of October 2023 was approximately €21 billion, reflecting investor confidence in its ability to leverage human capital for future growth.

| Metric | Value |

|---|---|

| Number of Employees | 20,000 |

| 2022 Revenue | €5.5 billion |

| Attrition Rate | 10% |

| Industry Average Attrition Rate | 15% |

| Employee Engagement Score | 82% |

| Industry Benchmark Engagement Score | 75% |

| Annual Investment in Learning & Development | €100 million |

| Market Capitalization (Oct 2023) | €21 billion |

Wolters Kluwer N.V. - VRIO Analysis: Customer Relationships

Value: Wolters Kluwer’s strong relationships with customers lead to significant repeat business. In 2022, approximately 84% of its revenue was derived from subscription-based products, highlighting the importance of these relationships. Additionally, the company reported a Net Promoter Score (NPS) of 30, indicating a solid level of customer satisfaction and loyalty.

Rarity: The depth of customer relationships that Wolters Kluwer maintains can be considered rare within the industry. Many companies focus on customer engagement, but few manage to cultivate the level of trust and ongoing interaction that Wolters Kluwer achieves, which contributes to their unique value proposition.

Imitability: While competitors can strive to develop similar customer relationships, achieving the same level of depth necessitates significant time and consistent effort. The company has invested over €100 million in customer engagement initiatives over the past few years, which provides a barrier to rapid imitation by competitors.

Organization: Wolters Kluwer effectively utilizes Customer Relationship Management (CRM) systems to nurture these relationships. In 2023, the company reported a CRM user adoption rate of 90% among its sales teams, supporting personalized service delivery. This capability is reflected in their customer retention rate, which stood at 90% as of the last fiscal year.

| Metric | 2022 Figure | 2023 Projection |

|---|---|---|

| Revenue from Subscriptions | €4.8 billion | €5.0 billion |

| Net Promoter Score (NPS) | 30 | 32 |

| Investment in Customer Engagement | €100 million | €120 million (estimated) |

| CRM User Adoption Rate | 90% | 92% |

| Customer Retention Rate | 90% | 91% |

Competitive Advantage: The competitive advantage stemming from these customer relationships is considered temporary. As market forces evolve, Wolters Kluwer must continually adapt and strengthen these connections to maintain their relevance, especially in the face of emerging technologies and shifts in customer expectations.

Wolters Kluwer N.V. - VRIO Analysis: R&D Capabilities

Value: Wolters Kluwer N.V. (WKLAS) boasts robust R&D capabilities, with an investment of approximately €307 million in 2022. This investment fosters continuous product innovation and adaptation to evolving market conditions, enabling the company to respond effectively to customer needs.

Rarity: The company’s R&D output is characterized by consistent innovation, which is rare among its competitors in the information services sector. WKLAS maintains a strong portfolio of over 1,000 patents worldwide, further highlighting the uniqueness of its R&D capabilities.

Imitability: While competitors can establish R&D facilities, replicating WKLAS's level of innovation requires significant time and investment. The average timeline for new product development in the sector can range from 2 to 5 years, depending on complexity. Competitors such as Thomson Reuters and RELX Group are also investing heavily but have not yet matched the same innovation output and depth exhibited by WKLAS.

Organization: WKLAS effectively aligns its R&D efforts with market needs and strategic goals. Their R&D structure involves a dedicated team of over 1,700 employees, supported by advanced analytics and customer feedback mechanisms. This ensures that the innovations developed meet market demands and enhance competitive positioning.

Competitive Advantage: The sustained investment in R&D positions WKLAS for a long-term competitive advantage. The company has reported an annual growth in its product offerings by 10% year-over-year, attributable to its ongoing commitment to innovation and development.

| Metric | 2022 Data | 2021 Data |

|---|---|---|

| R&D Investment (€ million) | 307 | 295 |

| Number of Patents | 1,000+ | 900+ |

| R&D Employees | 1,700 | 1,600 |

| Annual Product Offering Growth (%) | 10 | 8 |

| Average Product Development Timeline (Years) | 2-5 | 2-5 |

Wolters Kluwer N.V. - VRIO Analysis: Financial Resources

Value: Wolters Kluwer N.V. reported revenue of €4.8 billion for the fiscal year 2022. This strong financial performance enables the company to make strategic investments in technology and acquisitions, as evidenced by its acquisition of Pondera Solutions in October 2022, enhancing its capabilities in the Netherlands.

Rarity: The company's financial capability is notable, with a net profit margin of 15% as of Q2 2023. This level of profitability, combined with a current ratio of 1.5, allows Wolters Kluwer to maintain a strong competitive edge. Strong cash flow from operations was reported at €1.1 billion for the same period, indicating a robust operational efficiency.

Imitability: Wolters Kluwer's financial strength is bolstered by diverse revenue streams, including subscription services, which accounted for 70% of total revenue in 2022. Competitors may struggle to replicate this success without similar scale or investment backing. The company’s debt-to-equity ratio of 0.5 further illustrates its financial health, allowing it to leverage for growth without excessive risk.

Organization: Wolters Kluwer strategically manages its financial resources, with a focus on reinvesting approximately 10% of its revenue into R&D annually. This strategic investment is designed to enhance service offerings and mitigate risks associated with market uncertainty. The company reported an operating cash flow of €974 million for the first half of 2023, emphasizing effective financial management.

| Financial Metric | 2022 Value | Q2 2023 Value |

|---|---|---|

| Revenue | €4.8 billion | €2.4 billion (Annualized) |

| Net Profit Margin | 15% | 15% |

| Current Ratio | 1.5 | 1.5 |

| Cash Flow from Operations | €1.1 billion | €974 million |

| Debt-to-Equity Ratio | 0.5 | 0.5 |

| R&D Investment (% of Revenue) | 10% | 10% |

Competitive Advantage: The competitive advantage stemming from Wolters Kluwer’s financial resources can be seen as temporary, as market dynamics are subject to rapid changes. For instance, shifts in subscription models and evolving regulatory environments can impact revenue and profitability, highlighting the need for continuous adaptation in strategy.

Wolters Kluwer N.V. - VRIO Analysis: Market Reach

Value: Wolters Kluwer N.V. (WKLAS) reported €4.8 billion in revenue for the fiscal year 2022, showcasing its extensive market reach across various sectors including health, tax, accounting, and legal services. This diverse customer base allows the company to achieve economies of scale, maximizing operational efficiencies and margins.

Rarity: The company's distribution network is notable for its global reach, with operations in over 40 countries. This geographical diversity is rare among competitors and provides a significant advantage in accessing different markets effectively. The company serves more than 400,000 customers, including professionals and institutions, which is a testament to its expansive distribution capabilities.

Imitability: Establishing a comparable market reach is both costly and time-consuming for potential competitors. For instance, the development of international sales channels, regulatory compliance, and localized content creation are substantial barriers to entry. WKLAS has made significant investments in technology and infrastructure, leading to a strong foothold that is difficult to replicate.

Organization: Wolters Kluwer effectively employs organizational strategies by leveraging technology to enhance its sales processes. The company reported an investment of approximately €1.5 billion in R&D in 2022, enabling it to innovate and optimize its offerings. This strategic alignment ensures that their distribution channels are not only effective but also adaptive to market changes.

Competitive Advantage

The competitive advantage of WKLAS is sustained due to its well-established networks and partnerships. For example, the company’s partnerships with major universities and professional bodies enhance its credibility and market position. These relationships, alongside its historical presence and brand reputation, create significant hurdles for new entrants in the market.

| Financial Metric | 2022 Amount (€) | 2021 Amount (€) | Change (%) |

|---|---|---|---|

| Revenue | 4.8 billion | 4.6 billion | 4.35% |

| R&D Investment | 1.5 billion | 1.4 billion | 7.14% |

| Customer Base | 400,000+ | 375,000+ | 6.67% |

| Countries of Operation | 40 | 40 | 0% |

Wolters Kluwer N.V. - VRIO Analysis: Environmental Sustainability Initiatives

Wolters Kluwer N.V. has committed significant resources towards sustainability initiatives, enhancing its brand while simultaneously addressing operational costs and regulatory compliance. In its 2022 report, the company reported investing approximately €60 million in sustainability-driven projects. This investment aligns with their goals to reinforce their commitment to social responsibility and environmental stewardship.

Value

Sustainability initiatives are proving valuable across various operations. Wolters Kluwer’s focus on environmental sustainability has resulted in a reduction of operational costs by 12% since 2020, primarily due to improved energy efficiency and waste management practices. Furthermore, the company successfully reduced its carbon emissions by 25% between 2019 and 2022, directly enhancing its brand image in the eyes of environmentally conscious consumers.

Rarity

Wolters Kluwer's genuine approach to sustainability is relatively rare in the industry. With only 30% of companies in the market adopting effective sustainability practices, this positions WKLAS as a leader among its peers. Notably, in 2023, the company was recognized in the Dow Jones Sustainability Index for having a top-tier sustainability rating, further validating its rare practices.

Imitability

While many organizations can adopt green strategies, the depth of sustainability embedded in WKLAS’s operations is difficult to replicate. The company established a unique supply chain model that prioritizes sustainable sourcing, which includes a 75% commitment to sourcing materials from certified suppliers. This commitment fosters longstanding relationships that are complex for competitors to mimic.

Organization

Wolters Kluwer has successfully integrated sustainability into its core strategy. The company's sustainability agenda is aligned with the United Nations Sustainable Development Goals, ensuring that initiatives are not standalone but are integrated into the overall business framework. A detailed review of organizational structure shows that sustainability officers are embedded within each of its divisions, fostering accountability and innovation.

Competitive Advantage

The distinct sustainability practices of WKLAS provide a sustained competitive advantage. In a marketplace where true sustainability is challenging for others to replicate authentically, WKLAS’s commitment has resulted in increased customer loyalty. Recent surveys indicate that 70% of WKLAS customers value sustainability in their purchasing decisions, leading to a 15% increase in revenue attributed to sustainable products and services in 2022.

| Year | Investment in Sustainability (€ million) | Reduction in Operational Costs (%) | Carbon Emissions Reduction (%) |

|---|---|---|---|

| 2020 | 50 | 5 | 0 |

| 2021 | 55 | 8 | 10 |

| 2022 | 60 | 12 | 25 |

The continued emphasis on sustainable practices not only stabilizes the long-term operational framework of Wolters Kluwer but also signifies a critical shift in prioritizing environmentally responsible business models, positioning the firm strongly in an increasingly eco-conscious market landscape.

Wolters Kluwer N.V. stands out in the competitive landscape through its unique blend of valuable assets, from its strong brand to robust R&D capabilities and sustainable practices. Each component of its VRIO analysis highlights not only current strengths but also the challenging barriers competitors face in replicating these advantages. Dive deeper below to explore how these factors secure Wolters Kluwer's position in the market and contribute to its enduring success.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.