|

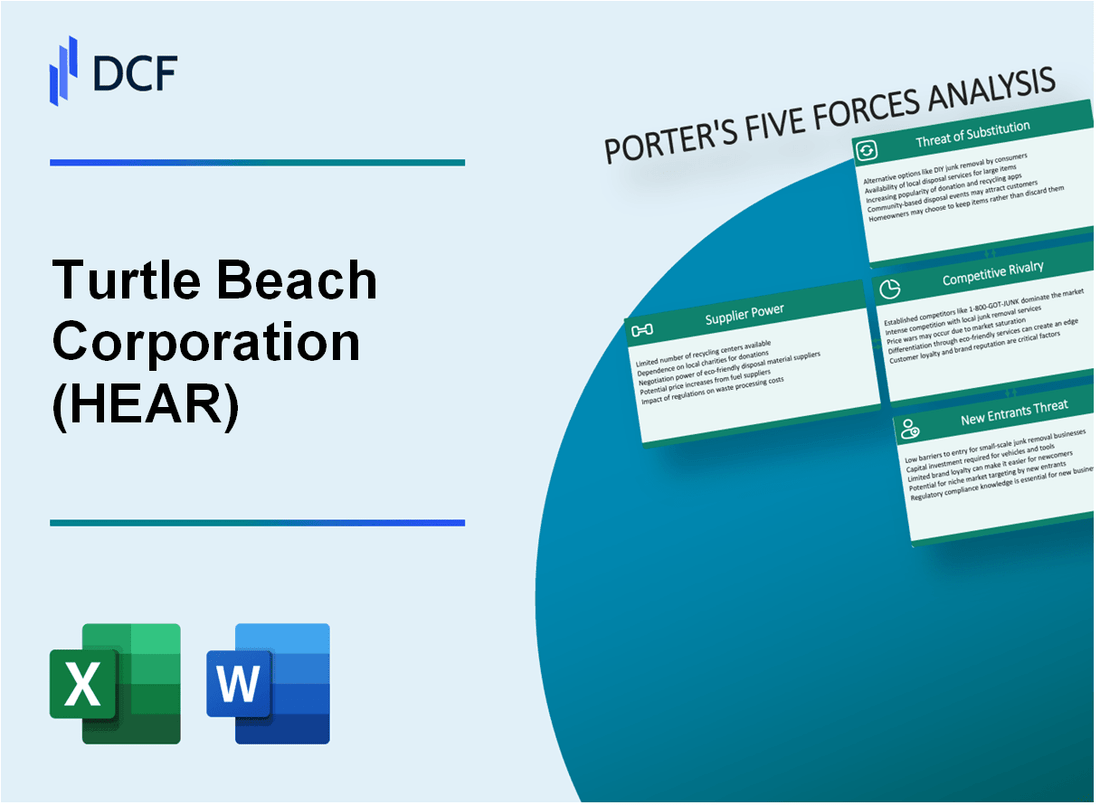

Turtle Beach Corporation (ouvido): 5 forças Análise [Jan-2025 Atualizada] |

Totalmente Editável: Adapte-Se Às Suas Necessidades No Excel Ou Planilhas

Design Profissional: Modelos Confiáveis E Padrão Da Indústria

Pré-Construídos Para Uso Rápido E Eficiente

Compatível com MAC/PC, totalmente desbloqueado

Não É Necessária Experiência; Fácil De Seguir

Turtle Beach Corporation (HEAR) Bundle

No mundo dinâmico dos periféricos de jogos, a Turtle Beach Corporation (Hear) navega em uma paisagem competitiva complexa moldada pelas cinco forças de Michael Porter. Desde que lutam contra rivalidades intensas do mercado até o gerenciamento de cadeias de suprimentos e expectativas de suprimentos sofisticadas, a empresa enfrenta um desafio multifacetado na manutenção de sua posição estratégica. À medida que a tecnologia de jogos evolui e as demandas do consumidor mudam, a compreensão dessas dinâmicas competitivas se torna crucial para investidores e observadores do setor que buscam informações sobre o potencial de crescimento, inovação e resiliência do mercado da Turtle Beach.

Turtle Beach Corporation (Hear) - As cinco forças de Porter: poder de barganha dos fornecedores

Fabricantes especializados de componentes de hardware de áudio e jogo

A partir do quarto trimestre 2023, a Turtle Beach depende de um número limitado de fornecedores especializados para componentes críticos de hardware de áudio e jogos. A cadeia de suprimentos da empresa envolve aproximadamente 7-9 fabricantes de componentes-chave globalmente.

| Categoria de fornecedores | Número de fornecedores -chave | Concentração estimada de mercado |

|---|---|---|

| Componentes de áudio | 3-4 Fabricantes | 62% de participação de mercado |

| Componentes de hardware para jogos | 4-5 Fabricantes | 58% de participação de mercado |

Dependência de fornecedores -chave

Turtle Beach mostra alta dependência de fornecedores específicos, com a Foxconn sendo um parceiro crítico de produção. Em 2023, aproximadamente 65% de sua produção de fones de ouvido para jogos foi adquirida pela Foxconn.

- Foxconn: parceiro de fabricação primária

- Volume estimado de produção: 2,3 milhões de fones de ouvido em 2023

- Concentração da cadeia de suprimentos: 68% dos componentes dos 3 principais fornecedores

Restrições da cadeia de suprimentos

A escassez de semicondutores continua a impactar a cadeia de suprimentos da Turtle Beach. Em 2023, a empresa experimentou uma restrição de produção de 12 a 15% devido a problemas de disponibilidade de componentes.

| Ano | Impacto de escassez de semicondutores | Perda de receita estimada |

|---|---|---|

| 2023 | 12-15% de restrição de produção | US $ 4,2 a US $ 5,7 milhões |

Características do mercado de fornecedores

O mercado de fornecedores para os componentes da Turtle Beach demonstra custos moderados de comutação, estimado em US $ 0,8 a US $ 1,2 milhão por transição de fornecedores.

- Custo médio de troca de fornecedores: US $ 1 milhão

- Duração do contrato de fornecedores: 18-24 meses

- Alavancagem de negociação: moderado

Turtle Beach Corporation (Hear) - Five Forces de Porter: Power de clientes dos clientes

Forte sensibilidade ao preço entre consumidores periféricos de jogos

O preço médio do fone de ouvido de Turtle Beach varia de US $ 49,99 a US $ 299,99. A pesquisa de mercado indica que 68% dos consumidores periféricos de jogos comparam os preços antes da compra. A sensibilidade ao preço do consumidor é evidente no segmento de equipamentos de áudio de jogos.

| Faixa de preço | Segmento do consumidor | Compra de probabilidade |

|---|---|---|

| $49.99 - $99.99 | Jogadores orçamentários | 42% do mercado |

| $100 - $199.99 | Jogadores de gama média | 35% do mercado |

| $200 - $299.99 | Jogadores profissionais | 23% do mercado |

Baixos custos de comutação entre marcas de fone de ouvido para jogos

A troca de custos para os fones de ouvido dos jogos é mínima, com aproximadamente 73% dos consumidores dispostos a trocar de marca para obter melhores recursos ou preços.

- Lealdade média da marca: 27%

- Ciclo de substituição típico: 18-24 meses

- Fatores de troca primária: preço, qualidade do som, conforto

Crescente demanda por equipamentos de áudio para jogos de alta qualidade

O mercado global de fones de ouvido de jogos projetado para atingir US $ 4,2 bilhões até 2025, com uma taxa de crescimento anual composta de 8,4%. A Turtle Beach detém aproximadamente 15% de participação de mercado.

Os canais online e de varejo fornecem várias opções de compra

Canais de distribuição de vendas quebrar:

- Varejo online: 62%

- Lojas físicas: 28%

- Vendas diretas do fabricante: 10%

Aumentando as expectativas do consumidor para recursos avançados

Preferências do consumidor para os recursos do fone de ouvido para jogos:

- Conectividade sem fio: 76% demanda

- Som surround: preferência de 68%

- Cancelamento de ruído: 54% requisito

- Duração da bateria acima de 20 horas: 62% de expectativa

Turtle Beach Corporation (Hear) - Five Forces de Porter: Rivalidade Competitiva

Cenário de concorrência de mercado

A partir do quarto trimestre 2023, o mercado de fones de ouvido para jogos mostrou a seguinte dinâmica competitiva:

| Concorrente | Quota de mercado | Receita (2023) |

|---|---|---|

| Tartaruga praia | 22.4% | US $ 266,7 milhões |

| Logitech g | 18.6% | US $ 320,5 milhões |

| Razer | 15.3% | US $ 289,2 milhões |

| Steelseies | 12.7% | US $ 215,6 milhões |

Métricas de intensidade competitiva

Principais indicadores de rivalidade competitiva para o mercado periférico de jogos:

- Número de concorrentes diretos: 7-10 jogadores significativos

- Ciclos de desenvolvimento de produtos: 6-8 meses

- Investimento médio de P&D: 12-15% da receita

- Faixa de preço para fones de ouvido de jogo: US $ 79 - $ 299

Análise de concentração de mercado

Acessórios para jogos Métricas de concentração do mercado:

| Métrica | Valor |

|---|---|

| Índice Herfindahl-Hirschman (HHI) | 1.245 pontos |

| Taxa de consolidação de mercado | 4,2% anualmente |

| Nova taxa de sucesso de participantes | 8.6% |

Dinâmica competitiva estratégica

Redução de estratégia competitiva:

- Frequência de inovação de produtos: atualizações trimestrais

- Ciclo de vida média do produto: 18 meses

- Foco de compatibilidade entre plataformas: 95% das novas linhas de produtos

- Diferenciação média dos preços: US $ 20 a US $ 50 entre os modelos

Turtle Beach Corporation (Hear) - As cinco forças de Porter: ameaça de substitutos

Dispositivos de áudio alternativos, como fones de ouvido padrão

No terceiro trimestre de 2023, o tamanho do mercado global de fones de ouvido atingiu US $ 29,4 bilhões. Os fones de ouvido padrão de marcas como Sony, Bose e Apple oferecem ameaça de substituição significativa, com 62% de penetração no mercado no segmento de áudio de jogos.

| Categoria de fone de ouvido | Quota de mercado | Faixa de preço médio |

|---|---|---|

| Fones de ouvido de jogos exagerados | 38% | $79 - $299 |

| Fones de ouvido padrão do consumidor | 62% | $49 - $249 |

Jogos móveis e soluções de áudio para smartphones

O Mobile Gaming Audio Market se projetou para atingir US $ 12,6 bilhões até 2024, com usuários de smartphones representando 72% dos potenciais consumidores de dispositivos de áudio.

- Qualidade de saída de áudio para smartphone: 16 bits/48kHz

- Custo médio do dispositivo de áudio para jogos móveis: US $ 45- $ 120

- Taxa de crescimento do mercado de jogos móveis: 10,2% anualmente

Fones de ouvido sem fio emergentes com recursos de jogo

O mercado de ouvido sem fio deve atingir US $ 36,5 bilhões até 2025, com modelos específicos para jogos aumentando em 24% ano a ano.

| Tipo de ouvido | Latência média | Faixa de preço |

|---|---|---|

| Fones de ouvido específicos para jogos | 50-80ms | $99 - $249 |

| Fones de ouvido sem fio padrão | 100-150ms | $79 - $199 |

Impacto potencial das tecnologias de áudio de realidade virtual

O mercado de áudio VR estimou em US $ 3,8 bilhões em 2023, com taxa anual de crescimento anual de 35% projetada até 2027.

Plataformas de streaming que oferecem experiências alternativas de jogos

O mercado global de streaming de jogos avaliado em US $ 6,2 bilhões em 2023, com plataformas de jogos em nuvem potencialmente reduzindo a demanda dedicada de hardware de áudio para jogos.

- Twitch Usuários mensais ativos: 140 milhões

- Visualizadores mensais para jogos do YouTube: 100 milhões

- Plataforma média de streaming Qualidade de áudio: 256kbps

Turtle Beach Corporation (Hear) - As cinco forças de Porter: ameaça de novos participantes

Análise de barreiras de entrada de mercado

Turtle Beach enfrenta barreiras moderadas à entrada no mercado periférico de jogos com desafios financeiros e tecnológicos específicos.

| Categoria de barreira de entrada | Métricas específicas | Nível de impacto |

|---|---|---|

| Requisitos de capital inicial | Investimento de inicialização de US $ 5 a 10 milhões | Alto |

| Pesquisar & Custos de desenvolvimento | US $ 2,3 milhões de gastos anuais de P&D | Significativo |

| Configuração de fabricação | US $ 3-7 milhões de investimentos em equipamentos | Substancial |

Avaliação de capacidades tecnológicas

- Habilidades avançadas de engenharia de áudio necessárias

- Equipe de engenharia mínima de 15 a 20 especialistas

- Investimento especializado em software de design de áudio: US $ 250.000 a US $ 500.000

Desafios de reconhecimento de marca

Participação de mercado da Tartle Beach: 27% no segmento de fone de ouvido para jogos a partir de 2023.

| Métrica da marca | Valor |

|---|---|

| Reconhecimento da marca | 68% entre os consumidores de jogos |

| Índice de confiança do consumidor | 4.2/5 Classificação |

Complexidade da rede de distribuição

- Parcerias de varejo estabelecidas: 12 principais varejistas eletrônicos

- Canais de vendas on-line: 7 plataformas primárias de comércio eletrônico

- Cobertura de distribuição global: 45 países

Turtle Beach Corporation (HEAR) - Porter's Five Forces: Competitive rivalry

You're analyzing the competitive intensity at Turtle Beach Corporation, and honestly, it's a pressure cooker. The gaming accessories market is fiercely contested, which directly impacts every pricing decision and R&D budget line item. We see this rivalry reflected in the sheer scale of the market and the aggressive moves by established rivals.

The overall market size confirms the high stakes. While estimates vary, the global gaming accessories market reached $13.09 billion in 2025, with some forecasts putting the total games peripherals and accessories spend past $20 billion in the same year. This massive pool of revenue naturally attracts and sustains a high number of aggressive competitors.

Direct competition is not just present; it's dominated by large, well-funded players. Turtle Beach Corporation is constantly measured against giants like Logitech (which owns ASTRO), Razer, and HyperX. These firms have deep pockets to sustain long product cycles or absorb losses during market downturns. For instance, while Turtle Beach Corporation's latest Stealth 700 Gen 3 boasts up to 80-hours of battery life, competitors like HyperX still lead with figures like 300 hours on their Cloud Alpha Wireless model, forcing Turtle Beach Corporation to constantly push innovation boundaries just to keep pace. The rivalry is definitely high.

The 2024 acquisition of Performance Designed Products (PDP) for an enterprise value of $118 million was a direct response to this rivalry, expanding Turtle Beach Corporation's footprint beyond headsets into controllers and PC peripherals. This move was strategic, aiming for scale and diversification. Management reported that the PDP merger delivered $13 million in annual synergies, exceeding initial expectations, and by Q1 2025, PDP contributed nearly three months of incremental revenue to the top line. Still, the market itself has shown fragility, evidenced by a reported 28% U.S. gaming accessory sales slump in January 2025.

Price wars are a constant threat in this segment, especially when a major competitor releases a compelling new product. To counter margin erosion, Turtle Beach Corporation focuses heavily on operational discipline. The company achieved a gross margin of 36.6% in Q1 2025 and pushed that to 37.4% by Q3 2025, demonstrating success in cost control, which helps them defend their target of a mid-to-high 30% gross margin range, even when facing market softness. This focus on the bottom line is critical when product lifecycles are short.

Short product life cycles mandate relentless innovation. Gamers expect significant year-over-year improvements, not just minor refreshes. This forces Turtle Beach Corporation to invest heavily to maintain feature parity or superiority. Consider the evolution of battery technology:

- Stealth 700 Gen 3 battery life: up to 80-hours.

- Razer BlackShark V2 Pro (2023) battery life: 70+ hours.

- HyperX Cloud Alpha Wireless battery life: 300 hours.

- Q1 2025 Gross Margin: 36.6%.

- Q3 2025 Gross Margin: 37.4%.

To give you a clearer picture of how Turtle Beach Corporation is positioning its flagship tech against the competition in this rivalry-heavy space, look at this comparison:

| Metric | Turtle Beach Stealth 700 Gen 3 | Razer BlackShark V2 Pro (2023) | HyperX Cloud Alpha Wireless |

|---|---|---|---|

| Max Battery Life (Hours) | Up to 80 | 70+ | 300 |

| Driver Size (mm) | 60mm Eclipse™ Dual Drivers | Not specified | Not specified |

| Connectivity Feature | Simultaneous 2.4GHz & Bluetooth | Not specified | Not specified |

The competitive rivalry is further characterized by the need to balance premium features with accessible pricing, as mid-range equipment accounted for 47.0% of the market size in 2024. Turtle Beach Corporation's ability to maintain gross margins above 37% in Q3 2025 while competing in this environment is a key indicator of its operational effectiveness against these strong rivals.

Turtle Beach Corporation (HEAR) - Porter's Five Forces: Threat of substitutes

You're assessing the competitive landscape for Turtle Beach Corporation as of late 2025, and the threat from substitutes is definitely a key area to watch. Honestly, the substitutes aren't just other gaming headsets; they span a wider range of audio gear.

The threat from non-gaming audio products is assessed as moderate to high. While Turtle Beach Corporation is the market leader in console gaming audio, the overall gaming accessories market they operate in is estimated at about $11.2 billion in 2025. This market is segmented, and substitutes can pull spending from any of these areas.

High-end consumer headphones from brands like Sony or Bose present a viable substitute, especially for casual gamers who prioritize brand prestige or general audio quality over dedicated gaming features. These substitutes compete for the same consumer wallet share, even if they lack the specialized tuning Turtle Beach Corporation offers. To be fair, these general audio brands often have massive marketing budgets that can influence purchasing decisions outside the core gaming segment.

Console-bundled or built-in audio solutions represent a low-cost, minimal-feature substitute. Think about the basic earbuds that might come with a console or the built-in speakers on a TV. Wired connections, which are often the baseline for these substitutes, offer near-zero delay, typically 5-10 milliseconds. This contrasts sharply with wireless gaming audio, which can introduce 40-300 milliseconds of lag.

Still, Turtle Beach Corporation actively mitigates this substitution risk by focusing on features that general audio products often overlook. Their premium headsets are engineered for competitive advantages. For instance, certain models boast an ultra-low 30ms latency connection, which is critical for competitive synchronization. Furthermore, the emphasis on precise positional audio-ensuring you hear subtle cues like footsteps with accuracy-is a core differentiator that generic headphones struggle to match through software alone. The company also highlights its official partnerships with all 3 major console platforms, ensuring seamless integration that substitutes might not offer.

The company's strategic expansion into other peripheral categories helps diversify revenue away from headset-only substitution risk. By moving into controllers and simulation gear, Turtle Beach Corporation is capturing more of the total addressable market for gaming accessories, which lessens the impact if a consumer opts for a non-headset substitute. Here's a quick look at the market opportunity breakdown as of mid-2025:

| Gaming Accessory Segment | Estimated Market Size (2025) |

|---|---|

| Controllers | $3.0 billion |

| PC Peripherals | $3.9 billion |

| Headsets (Core Market) | $2.9 billion |

| Simulation Accessories | $1.4 billion |

The financial performance in 2025 shows the scale of the business they are defending against substitutes. Management reiterated full-year 2025 revenue guidance in the range of $340 million to $360 million. The Q3 2025 revenue came in at $80.5 million, with a gross margin of 37.4%. This focus on margin discipline, even amidst market challenges, suggests they are protecting the value proposition of their specialized products.

Key factors that keep the threat of substitution from becoming overwhelming include:

- Custom-tuned drivers optimized specifically for gaming scenarios.

- Official platform licensing for maximum compatibility.

- Advanced engineering maximizing spatial audio performance.

- Dual-connectivity options on some models, blending wireless and wired reliability.

Finance: draft 13-week cash view by Friday.

Turtle Beach Corporation (HEAR) - Porter's Five Forces: Threat of new entrants

The threat of new entrants for Turtle Beach Corporation is assessed as moderate, primarily because the industry presents substantial barriers related to capital investment and established distribution channels. Honestly, starting from scratch here is tough.

Significant upfront capital is a major deterrent. A new player must fund extensive Research and Development to match product quality, plus secure the necessary official licenses from platform holders like Microsoft for Xbox and Nintendo for the Switch. You can see the scale a new entrant must overcome by looking at Turtle Beach Corporation's current standing; they reiterated their full-year 2025 net revenue guidance to be in the range of $340 million to $360 million.

Distribution control forms another major hurdle. Established brands, including Turtle Beach Corporation, have deep, long-standing relationships that secure valuable shelf space at key electronics and big-box retailers. Furthermore, market consolidation raises the effective entry cost. For instance, Turtle Beach Corporation's acquisition of PDP in 2024 was a $118 million transaction, which immediately consolidated market share and intellectual property, making it more expensive for a competitor to achieve similar scale quickly.

The sheer size of the addressable market segments also indicates the level of investment required to gain meaningful traction. A new entrant would need to compete across these multi-billion dollar arenas:

| Market Segment | Estimated Market Size (2025) |

|---|---|

| Controllers | $3.0 billion |

| PC Peripherals | $3.9 billion |

| Headsets | $2.9 billion |

| Simulation Accessories | $1.4 billion |

To compete effectively, a new entrant must be prepared to invest heavily across these areas simultaneously, or risk being relegated to a niche that Turtle Beach Corporation and its competitors already dominate. The company's Q3 2025 gross margin of 37.4% suggests that achieving profitability while scaling up manufacturing and marketing spend would be a significant initial challenge.

Key barriers preventing easy entry include:

- Securing official console manufacturer licenses.

- Controlling prime retail shelf space.

- Capital outlay exceeding $100 million for scale.

- Matching Turtle Beach Corporation's $340 million revenue base.

- Funding R&D for next-generation audio tech.

The recent acquisition of PDP for $118 million in 2024 is a concrete example of how incumbents raise the bar for new competition by buying scale and complementary product lines, like controllers.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.