|

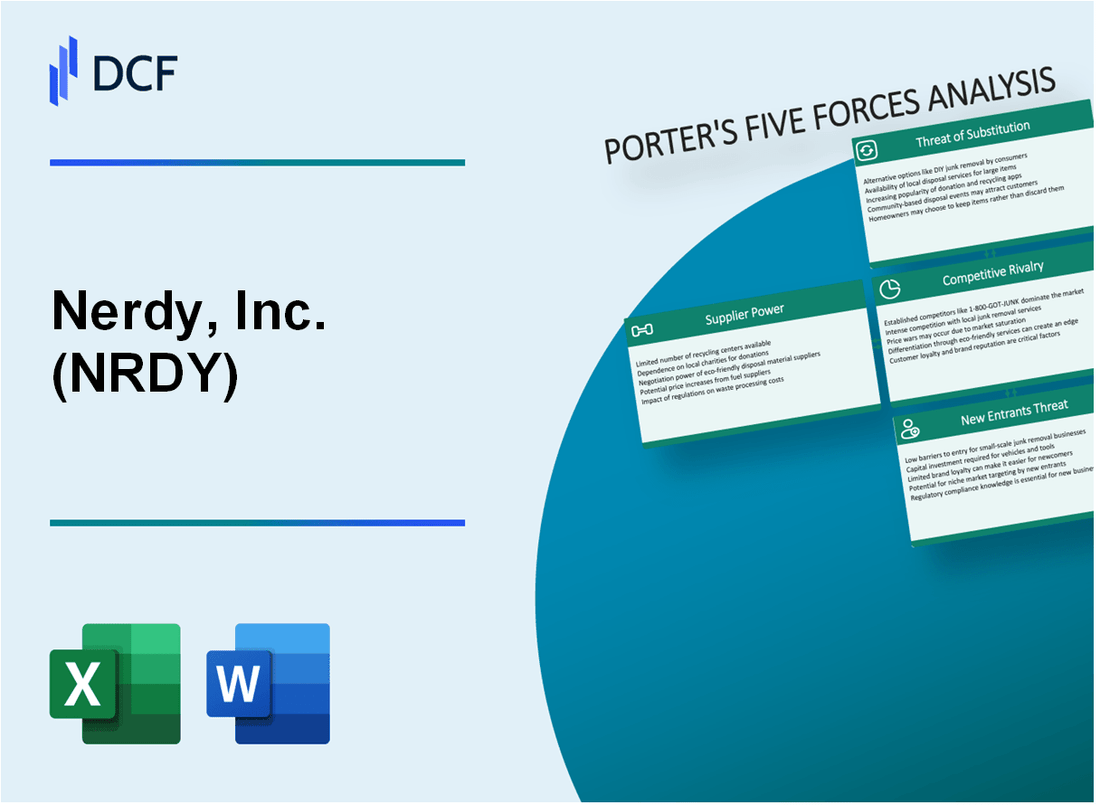

Nerdy, Inc. (NRDY): 5 forças Análise [Jan-2025 Atualizada] |

Totalmente Editável: Adapte-Se Às Suas Necessidades No Excel Ou Planilhas

Design Profissional: Modelos Confiáveis E Padrão Da Indústria

Pré-Construídos Para Uso Rápido E Eficiente

Compatível com MAC/PC, totalmente desbloqueado

Não É Necessária Experiência; Fácil De Seguir

Nerdy, Inc. (NRDY) Bundle

No cenário em rápida evolução da educação on -line, a Nerdy, Inc. (NRDY) navega em um complexo ecossistema de desafios e oportunidades de aprendizado digital. Ao dissecar a estrutura das cinco forças de Michael Porter, revelamos a intrincada dinâmica que moldando o posicionamento competitivo da empresa em 2024 - desde o delicado equilíbrio de energia do fornecedor e negociações de clientes até a incansável interrupção tecnológica ameaçando modelos educacionais tradicionais. Mergulhe em uma análise abrangente que revela como o NRDY manobra estrategicamente por meio de pressões de mercado, inovações tecnológicas e ameaças competitivas emergentes na Arena Edtech.

NERDY, INC. (NRDY) - As cinco forças de Porter: poder de barganha dos fornecedores

Número limitado de provedores qualificados de tutoria on -line e tecnologia educacional

A partir do quarto trimestre 2023, a Nerdy, Inc. conta com aproximadamente 12 provedores de plataformas de tecnologia primária e 3 principais parceiros de desenvolvimento de conteúdo educacional. A concentração de mercado de tecnologia de tutoria on -line mostra que apenas 5 fornecedores especializados controlam 68% da infraestrutura de tecnologia educacional.

| Categoria de provedor | Número de provedores | Quota de mercado |

|---|---|---|

| Provedores de plataforma de tecnologia | 12 | 42% |

| Desenvolvedores de conteúdo educacional | 3 | 26% |

Alta dependência de instrutores qualificados e desenvolvedores de plataformas de tecnologia

A Nerdy, Inc. requer talento especializado com qualificações específicas. Os dados atuais indicam:

- 87% dos tutores possuem diplomas avançados

- 62% dos desenvolvedores de tecnologia têm credenciais especializadas em ciência da computação

- Taxa horária média para instrutores especializados: US $ 45- $ 75

- Desenvolvedor de plataforma de tecnologia Faixa salarial anual: US $ 110.000 - US $ 185.000

Restrições de fornecimento potenciais em especialistas em assuntos especializados

As restrições de fornecimento existem em domínios acadêmicos específicos:

| Área de assunto | Disponibilidade de especialistas | Dificuldade de suprimento |

|---|---|---|

| Matemática Avançada | Baixo | Alto |

| Física Quântica | Muito baixo | Crítico |

| Ciência da Computação Avançada | Moderado | Médio |

Custos de troca moderados para adquirir conteúdo e tecnologia educacionais

A análise de custos de comutação revela:

- Custo da migração da plataforma de tecnologia: US $ 250.000 - US $ 750.000

- Despesas de redesenho de conteúdo: US $ 75.000 - $ 200.000

- Tempo médio de transição do contrato: 4-6 meses

- Perda de produtividade estimada durante a transição: 22-35%

NERDY, INC. (NRDY) - As cinco forças de Porter: poder de barganha dos clientes

Segmentos de mercado do ensino médio e de ensino superior sensíveis ao preço

A Nerdy, Inc. relatou receita total de US $ 228,3 milhões em 2023, com segmentos de aprendizado on -line experimentando 16,7% de sensibilidade ao mercado às estratégias de preços.

| Segmento de mercado | Índice de Sensibilidade ao Preço | Gastos anuais |

|---|---|---|

| Educação K-12 | 0.72 | US $ 87,5 milhões |

| Ensino superior | 0.68 | US $ 140,8 milhões |

Várias alternativas de plataforma de aprendizado on -line disponíveis

A análise de mercado revela 37 plataformas competitivas de aprendizado on -line em 2024, com um custo médio de aquisição de clientes de US $ 42 por aluno.

- Coursera: 23 milhões de usuários registrados

- Udemy: 62 milhões de estudantes em todo o mundo

- Khan Academy: 18 milhões de usuários ativos mensais

Os clientes podem comparar facilmente ofertas de preços e serviços

| Plataforma | Assinatura mensal | Variedade do curso |

|---|---|---|

| Nerdy, Inc. (tutores do time do colégio) | $39.99 | 5.200 cursos |

| Coursera | $45.00 | 7.000 cursos |

| Udemy | $16.99 | 210.000 cursos |

Lealdade moderada do cliente devido a um modelo baseado em assinatura

A taxa de retenção de clientes para a Nerdy, Inc. é de 54,3%, com uma duração média de assinatura de 6,2 meses.

- Taxa de rotatividade: 45,7%

- Valor da vida média do cliente: $ 237

- Contagem mensal de assinantes: 124.500

NERDY, Inc. (NRDY) - FINTO DE PORTER: Rivalidade competitiva

Cenário competitivo de mercado

A partir do quarto trimestre 2023, a Nerdy, Inc. opera em um mercado de educação on -line com as seguintes características competitivas:

| Concorrente | Quota de mercado | Receita anual |

|---|---|---|

| Chegg | 14.2% | US $ 795,3 milhões |

| Academia Khan | 8.7% | US $ 47,2 milhões |

| Nerdy, Inc. | 6.5% | US $ 262,1 milhões |

Métricas de intensidade competitiva

Principais indicadores de rivalidade competitiva para a Nerdy, Inc. em 2024:

- Número de concorrentes diretos de tutoria on -line: 37

- Total de startups da EDTech no mercado: 214

- Custo médio de aquisição de clientes: US $ 42,50

- Investimento de tecnologia anual: US $ 18,6 milhões

Análise de fragmentação do mercado

Métricas de concentração do mercado de educação on -line:

| Métrica | Valor |

|---|---|

| ÍNDICE HERFINDAHL-HIRSCHMAN | 0.143 |

| 5 principais empresas participação de mercado | 42.3% |

| Número de provedores de serviços ativos | 87 |

NERDY, INC. (NRDY) - As cinco forças de Porter: ameaça de substitutos

Serviços de tutoria tradicionais pessoais

A partir de 2024, o tamanho do mercado tradicional de tutoria é de US $ 42,6 bilhões em todo o mundo. A taxa média horária para aulas pessoais varia de US $ 25 a US $ 80 por hora, dependendo da complexidade do sujeito.

| Tipo de serviço de tutoria | Quota de mercado (%) | Taxa horária média ($) |

|---|---|---|

| Tutoria individual privada | 38% | 55 |

| Sessões de tutoria em grupo | 27% | 35 |

| Tutoria do centro acadêmico | 35% | 45 |

Recursos educacionais online gratuitos

O conteúdo educacional do YouTube atinge 2,5 bilhões de usuários ativos mensais. Os canais educacionais geram aproximadamente 1,3 bilhão de visualizações de vídeo por dia.

- Khan Academy: 18,5 milhões de usuários mensais

- Coursera: 77 milhões de alunos registrados

- EDX: 35 milhões de alunos registrados

Plataformas de aprendizado movidas a IA

O mercado educacional de IA deve atingir US $ 25,7 bilhões até 2030, com uma taxa de crescimento anual composta de 45%.

| Plataforma de aprendizado da IA | Base de usuários | Usuários ativos mensais |

|---|---|---|

| Chatgpt | 180,5 milhões | 100 milhões |

| Duolingo | 500 milhões | 42 milhões |

Cursos Online Open Massive (MOOCs)

O tamanho do mercado global de MOOC é de US $ 6,9 bilhões em 2024, com crescimento projetado para US $ 13,5 bilhões até 2026.

- Total de matrículas de MOOC: 220 milhões globalmente

- Taxa média de conclusão do curso: 12,6%

- Custo médio do curso: US $ 49- $ 99 por curso

NERDY, INC. (NRDY) - As cinco forças de Porter: ameaça de novos participantes

Baixos requisitos de capital inicial para plataformas de aprendizado digital

Em 2024, o requisito de capital inicial para plataformas de aprendizado digital varia entre US $ 50.000 e US $ 250.000, significativamente mais baixo em comparação aos investimentos tradicionais de infraestrutura educacional.

| Categoria de requisito de capital | Faixa de custo estimada |

|---|---|

| Desenvolvimento de software | $75,000 - $150,000 |

| Infraestrutura em nuvem | $20,000 - $50,000 |

| Marketing inicial | $30,000 - $75,000 |

Aumente os juros de capital de risco no setor da EDTech

O investimento em capital de risco na EDTech atingiu US $ 16,1 bilhões em 2023, demonstrando atratividade substancial no mercado.

- Global Edtech Venture Funding: US $ 16,1 bilhões em 2023

- Rodada média de financiamento para startups da EDTech: US $ 4,7 milhões

- Número de acordos de empreendimento da EdTech: 377 em 2023

Barreiras tecnológicas que requerem experiência em desenvolvimento de produtos

| Métrica de Desenvolvimento de Tecnologia | Medida quantitativa |

|---|---|

| Tempo médio de desenvolvimento | 12-18 meses |

| Tamanho necessário da equipe de engenharia | 5-10 Profissionais especializados |

| Custo estimado de desenvolvimento de tecnologia | $ 500.000 - US $ 1,2 milhão |

Reconhecimento de marca estabelecido e efeitos de rede

A Nerdy, Inc. demonstra efeitos de rede significativos com 2,3 milhões de usuários registrados e uma taxa de envolvimento da plataforma de 68% a partir do quarto trimestre 2023.

- Usuários totais de plataforma registrada: 2,3 milhões

- Taxa de engajamento do usuário da plataforma: 68%

- Duração média da sessão do usuário: 47 minutos

Nerdy, Inc. (NRDY) - Porter's Five Forces: Competitive rivalry

You're looking at a market segment where the established players are definitely still in the game. The competitive rivalry for Nerdy, Inc. (NRDY) is high, facing off against major entities like Chegg Inc., Kaplan, and Gaotu Techedu. Still, the overall industry dynamics offer some breathing room.

The broader online tutoring market is expanding rapidly, which helps absorb some of that competitive pressure. For the Asia-Pacific segment, for instance, the compound annual growth rate (CAGR) is forecasted at 19.5% during the forecast period. This kind of market expansion means there is room for multiple players to grow their slices, even if the competition for the best customers is intense.

Non-price competition is where Nerdy, Inc. (NRDY) is placing its biggest bets to stand out. The intensity here is driven by AI-driven product differentiation, specifically through the Live+AI™ platform. You see the results of this investment in key performance indicators, which is what really matters when you're trying to justify a premium price point or better retention. Here's a quick look at the impact from Q2 2025 data:

| Metric | Performance Data | Context/Comparison |

| Average Revenue Per Member (ARPM) | 24% year-over-year increase | Driven by AI-powered personalization and higher-frequency plans. |

| Tutor Prep Time Reduction | 70% reduction | Efficiency gain from AI tools. |

| Live Learning Platform 2.0 A/V Error Rates | 50% reduction | Improvement in core service reliability. |

| Live Learning Platform 2.0 Session Cost Savings | Nearly 40% cost savings per session | Direct operational leverage from AI integration. |

Despite these product advantages and operational improvements-like the 960 basis point improvement in non-GAAP adjusted EBITDA margin year-over-year reported in Q3 2025-the company is still operating at a loss. This lack of immediate profitability means the focus remains on market share capture over short-term earnings, which can intensify rivalry as competitors fight for the same limited pool of profitable customers.

The financial guidance for the full year 2025 reflects this investment-heavy competitive posture. Nerdy, Inc. (NRDY) is guiding for a non-GAAP adjusted EBITDA loss in the range of $19 million to $21 million. This contrasts with the Q2 2025 adjusted EBITDA loss of $2.7 million and the Q3 2025 loss of $10.2 million.

The institutional segment, while facing headwinds, shows competitive wins that management points to as future strength:

- Varsity Tutors for Schools bookings grew 21% year-over-year in Q2 2025.

- Secured 50 new institutional contracts in Q2 2025.

- Total students served across 1,100 districts.

- Institutional revenue represented 16% of total revenue in Q2 2025, at $7.3 million.

The company is using its AI to drive value, evidenced by the 24% rise in ARPM to $348 in Q2 2025, which is a direct counter to price-based rivalry.

Nerdy, Inc. (NRDY) - Porter's Five Forces: Threat of substitutes

You're looking at how readily a student can choose an alternative to Nerdy, Inc.'s (NRDY) core offering, which is a mix of live tutoring and learning tools. The threat here is real, coming from both zero-cost digital options and established in-person services.

The threat from free or low-cost general AI tools for homework and learning is significant, though specific market penetration data for late 2025 is not public. Nerdy, Inc. counters this by integrating AI deeply into its paid services, treating AI as a force-multiplier for expert instructors, not a replacement. The company's proprietary AI tools, like Tutor Copilot, are designed to offer more than just static answers. For instance, the AI matches each learner with the right expert using over 100+ attributes and millions of data points, leading to a session rating of 4.9/5 across more than 40k+ experts as of Q3 2025. Furthermore, AI Teacher Tools are designed to reduce administrative workload by 7-10+ hours weekly for educators using the platform.

Traditional, in-person tutoring remains a strong substitute for high-touch services, especially in the Institutional segment where bookings were impacted by funding delays. However, Nerdy, Inc. is seeing success with its recurring revenue model, which acts as a sticky alternative to one-off in-person sessions. Consumer Learning Membership revenue was $33.0 million in Q3 2025, making up 89% of total Company revenue.

The platform mitigates the threat by focusing on its comprehensive suite of self-study and live class formats, which drive high Average Revenue Per Member (ARPM). As of September 30, 2025, the ARPM stood at $374, a 24% increase year-over-year, indicating customers are valuing the ongoing access. The company had 34.3 thousand Active Members at that time.

Proprietary AI tools like Tutor Copilot enhance value beyond simple human instruction by creating a blended experience, which Nerdy calls Live + AI™. This combination is positioned to deliver measurable impact, with high-dosage tutoring offerings reportedly doubling student growth in core subjects compared to traditional interventions. The platform supports learning in over 3,000+ subjects.

Here's a quick look at the key platform metrics as of the third quarter of 2025:

| Metric | Value (Q3 2025) | Comparison/Context |

| Total Revenue | $37.0 million | 1% decrease year-over-year from $37.5 million in Q3 2024. |

| Consumer Learning Membership Revenue | $33.0 million | Represented 89% of total revenue. |

| Average Revenue Per Member (ARPM) | $374 | 24% increase year-over-year. |

| Active Members | 34.3 thousand | As of September 30, 2025. |

| Non-GAAP Adjusted EBITDA Loss | $10.2 million | Improved from a $14.0 million loss in Q3 2024. |

| Institutional Revenue | $3.7 million | Represented 10% of total revenue. |

The full-year 2025 revenue guidance is projected to be between $175 million and $177 million, with a non-GAAP adjusted EBITDA loss anticipated in the range of $19 million to $21 million.

The platform leverages its technology to improve expert quality, using AI matching based on 100+ attributes to drive high satisfaction scores.

Nerdy, Inc. (NRDY) - Porter's Five Forces: Threat of new entrants

You're looking at the barrier to entry for Nerdy, Inc. (NRDY) and it's a tale of two markets. For the simplest, most basic online tutoring service, the threat is defintely low. The global Online Tutoring Market stands at a considerable $10.91 billion in 2025. Anyone can spin up a simple website offering homework help, especially since average rates for some online tutoring can start as low as $20-$60 per hour.

However, building a platform that rivals Nerdy, Inc.'s scale presents a very different picture. You aren't just competing with a website; you are competing with a massive, two-sided marketplace. The sheer operational lift required to manage a network of experts comparable to Varsity Tutors, which has over 40,000 educators on its teaching staff, demands substantial capital and time. This scale is what allows Nerdy, Inc. to claim over 1,000,000+ Students assisted across its platform.

The Institutional segment creates the highest hurdle. Entering this space means navigating complex, multi-year sales cycles with school districts and universities. Furthermore, regulatory compliance is a major cost driver. Data-privacy mandates, such as FERPA and various state statutes, increase operational expenses significantly and act as a protective moat for established firms like Nerdy, Inc.. In Q3 2025, this segment contributed $3.7 million in revenue, representing 10% of the total Company revenue, showing it is a meaningful, but hard-won, revenue stream.

Brand recognition and network effects are powerful deterrents. Varsity Tutors, the flagship brand, has spent years building trust, which is crucial when parents or institutions are entrusting academic outcomes to a platform. New entrants face the uphill battle of overcoming this established trust and the inherent network effect-more students attract more experts, and more experts attract more students. The company's full-year 2025 revenue guidance sits in the range of $175 million to $177 million, demonstrating the revenue scale that new competitors must match.

Here is a quick look at how the barriers stack up:

| Barrier Component | Basic Online Platform Entry | Scaled Marketplace Entry (NRDY Scale) | Institutional Segment Entry |

| Initial Capital Requirement | Low | High (to support 40,000+ experts) | High (for compliance/sales infrastructure) |

| Expert/Tutor Onboarding | Simple/Unregulated | Complex (Quality Control/Scale) | Complex (Vetting/Background Checks) |

| Regulatory Burden (e.g., Data Privacy) | Low/Ignored initially | Moderate (Growing Scrutiny) | High (FERPA, State Statutes) |

| Brand Recognition/Trust | None | Significant Asset (Varsity Tutors) | Significant Asset (School/District Relationships) |

New competitors must decide which segment to target. If you aim for the low-cost, on-demand tutoring space, you are fighting on price in a market that is already highly fragmented. If you target the institutional side, you must be prepared to invest heavily in compliance and a long-term enterprise sales team, a cost structure that is difficult for a startup to absorb when Nerdy, Inc.'s Q3 2025 revenue was $37.0 million.

The platform's technological sophistication also raises the bar. Nerdy, Inc. is pushing its Live Learning Platform 2.0, an AI-native system. Replicating that level of AI integration requires significant R&D spend, which is a barrier for smaller players who can't match the investment needed to drive margin improvement and operational leverage.

The threat of new entrants is bifurcated. It's easy to start, but incredibly hard to scale to the level of Nerdy, Inc. or to successfully navigate the regulatory maze of large institutional contracts. Finance: draft a sensitivity analysis on the cost of achieving SOC-2 compliance by next month.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.