|

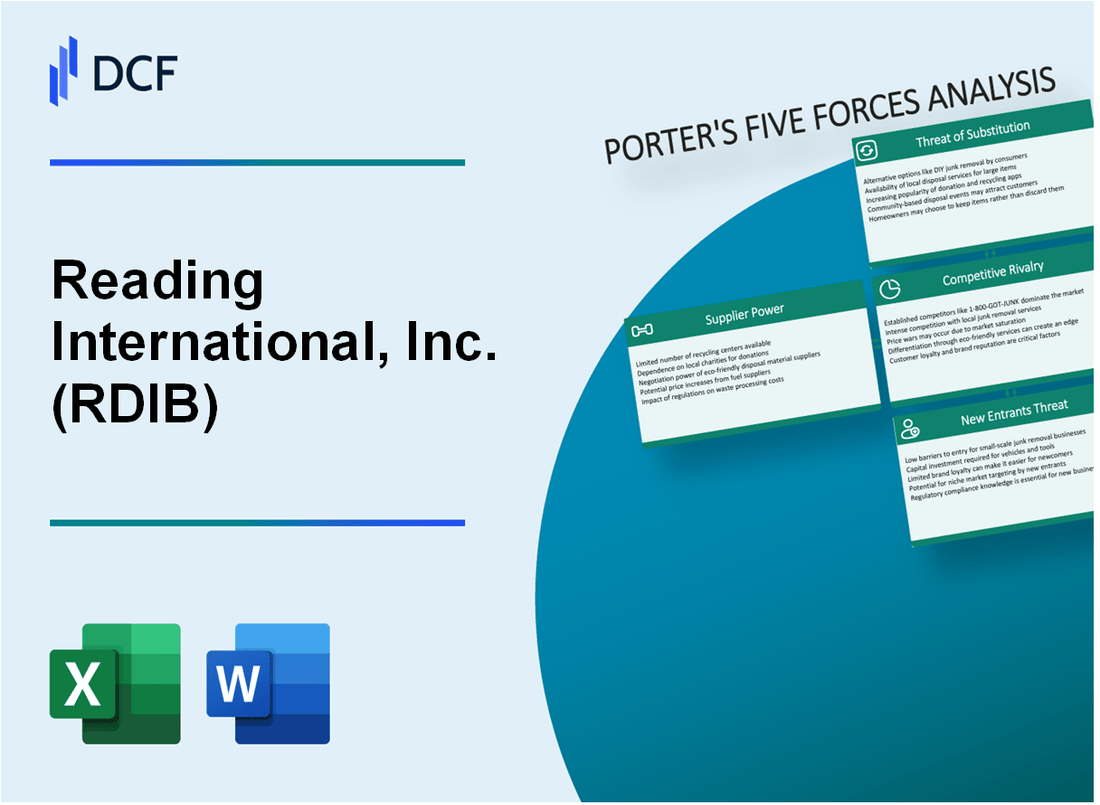

Reading International, Inc. (RDIB): 5 forças Análise [Jan-2025 Atualizada] |

Totalmente Editável: Adapte-Se Às Suas Necessidades No Excel Ou Planilhas

Design Profissional: Modelos Confiáveis E Padrão Da Indústria

Pré-Construídos Para Uso Rápido E Eficiente

Compatível com MAC/PC, totalmente desbloqueado

Não É Necessária Experiência; Fácil De Seguir

Reading International, Inc. (RDIB) Bundle

No cenário dinâmico de entretenimento e imóveis, a Reading International, Inc. (RDIB) navega em uma complexa rede de forças de mercado que moldam seu posicionamento estratégico. À medida que a empresa enfrenta os desafios da interrupção digital, pressões competitivas e expectativas em evolução dos clientes, a compreensão das cinco forças de Michael Porter fornece uma lente crítica ao ecossistema competitivo da empresa. Desde a intrincada dinâmica das relações de fornecedores até o terreno em mudança das preferências dos clientes, essa análise revela as complexidades estratégicas que definem a resiliência de negócios da RDIB e o potencial de crescimento em 2024.

Reading International, Inc. (RDIB) - As cinco forças de Porter: poder de barganha dos fornecedores

Paisagem de fornecedores de equipamentos de cinema especializada

A partir de 2024, a Reading International, Inc. enfrenta um mercado de fornecedores concentrado com alternativas limitadas para equipamentos especializados em cinema.

| Categoria de equipamento | Número de fornecedores especializados | Concentração média da cadeia de suprimentos |

|---|---|---|

| Sistemas de projeção digital | 3-4 Fabricantes globais | 87% de controle de mercado |

| Sistemas de som de cinema | 2-3 fornecedores especializados | 79% de domínio do mercado |

| Assentos de teatro | 5-6 fabricantes especializados | 65% de participação de mercado |

Requisitos de investimento de capital

A infraestrutura de teatro especializada exige investimentos substanciais de capital.

- Custo do sistema de projeção digital: US $ 75.000 - US $ 150.000 por tela

- Investimento avançado do sistema de som: US $ 50.000 - US $ 100.000 por teatro

- Assentos especializados em teatro: US $ 30.000 - US $ 60.000 por teatro

Dependências de tecnologia e materiais de construção

A Reading International demonstra dependência moderada de fornecedores específicos de tecnologia e materiais de construção.

| Categoria de fornecedores | Valor anual de compras | Concentração do fornecedor |

|---|---|---|

| Provedores de tecnologia de cinema | US $ 2,3 milhões | 92% dos 3 principais fornecedores |

| Materiais de construção | US $ 1,7 milhão | 85% dos 4 principais fornecedores |

Estratégia de integração vertical

A Reading International explora estratégias de integração vertical para mitigar a alavancagem do fornecedor.

- Capacidade atual de fabricação interna: 15% das necessidades do equipamento

- Investimento de integração vertical planejada: US $ 3,5 milhões

- Redução de dependência do fornecedor projetado: 25% até 2025

Reading International, Inc. (RDIB) - As cinco forças de Porter: poder de barganha dos clientes

Análise de base de clientes diversificada

A Reading International, Inc. relatou receitas totais de US $ 112,3 milhões no terceiro trimestre de 2023, com receitas de segmento de cinema em US $ 38,2 milhões e receitas imobiliárias em US $ 74,1 milhões.

| Segmento de mercado | Porcentagem do cliente | Contribuição da receita |

|---|---|---|

| Cinema | 34% | US $ 38,2 milhões |

| Imobiliária | 66% | US $ 74,1 milhões |

Dinâmica de sensibilidade ao preço

Os preços médios dos ingressos para o cinema para os cinemas do RDIB variam entre US $ 12,50 e US $ 15,75, com uma média de US $ 14,20 por ingresso.

- Elasticidade do preço do ingresso de cinema: 0.6

- Atendimento médio de cinema por local: 85.000 anualmente

- Taxa de ocupação de aluguel imobiliário: 92,3%

Custos de troca de clientes

A troca de custos para os clientes de cinema estimados em US $ 25 a US $ 35 por seleção alternativa do local.

| Segmento de mercado | Custo de troca | Taxa de retenção de clientes |

|---|---|---|

| Cinema | $25-$35 | 78.5% |

| Imobiliária | $500-$1,200 | 85.7% |

Expectativas do cliente

Pontuações de satisfação do cliente: Experiências de cinema 7.8/10, Desenvolvimentos imobiliários 8.2/10.

- Disponibilidade de tela de cinema premium: 45% do total de telas

- Classificação média de qualidade do desenvolvimento imobiliário imobiliário: 8.5/10

Reading International, Inc. (RDIB) - As cinco forças de Porter: rivalidade competitiva

Concorrência do mercado de exposições de cinema

A partir de 2024, Reading International enfrenta uma pressão competitiva significativa no mercado de exposições de cinema:

| Concorrente | Quota de mercado | Número de telas |

|---|---|---|

| Teatros da AMC | 23.4% | 8,326 |

| Cinemas reais | 19.7% | 7,258 |

| Cinemark | 17.2% | 4,434 |

| Reading International | 3.6% | 372 |

Cenário do mercado de desenvolvimento imobiliário

Cenário competitivo nos mercados de desenvolvimento imobiliário:

- Valor de mercado total de desenvolvimento imobiliário comercial: US $ 1,2 trilhão

- Portfólio imobiliário da Reading International: US $ 487,3 milhões

- Principais mercados geográficos: Estados Unidos, Austrália

Exposição de cinema Pressões competitivas

| Métrica competitiva | Valor |

|---|---|

| Preço médio do ingresso | $9.57 |

| Receita anual do mercado de cinema | US $ 8,8 bilhões |

| Competição de serviço de streaming | 47,8% de impacto no mercado |

Métricas de inovação e diferenciação

- Investimento anual de P&D: US $ 2,1 milhões

- Despesas de atualização da tecnologia: US $ 1,4 milhão

- Taxa de conversão de cinema digital: 98%

Reading International, Inc. (RDIB) - As cinco forças de Porter: ameaça de substitutos

Plataformas de streaming desafiando a experiência tradicional de cinema

A Netflix registrou 260,8 milhões de assinantes pagos globalmente a partir do quarto trimestre de 2023. O Amazon Prime Video tem 200 milhões de assinantes. A receita global de streaming atingiu US $ 82,8 bilhões em 2023.

| Plataforma de streaming | Assinantes globais | Receita anual |

|---|---|---|

| Netflix | 260,8 milhões | US $ 29,7 bilhões |

| Amazon Prime Video | 200 milhões | US $ 35,2 bilhões |

Opções alternativas de entretenimento

O mercado do sistema de entretenimento doméstico avaliado em US $ 231,5 bilhões em 2023.

- Mercado de console de jogos: US $ 196,8 bilhões

- Entretenimento de realidade virtual: US $ 42,5 bilhões

- Mercado de TV inteligente: US $ 139,8 bilhões

Plataformas imobiliárias digitais

Tamanho do mercado da plataforma imobiliária on -line: US $ 453,2 bilhões em 2023.

| Plataforma | Transações anuais | Quota de mercado |

|---|---|---|

| Zillow | US $ 41,6 bilhões | 22.3% |

| Redfin | US $ 26,3 bilhões | 14.7% |

Entretenimento digital sob demanda

Mercado global de entretenimento digital: US $ 304,6 bilhões em 2023.

- Jogos móveis: US $ 124,2 bilhões

- Esports: US $ 1,8 bilhão

- Mercado de podcast: US $ 23,5 bilhões

Reading International, Inc. (RDIB) - As cinco forças de Porter: ameaça de novos participantes

Requisitos de capital para o cinema e desenvolvimento imobiliário

A Reading International, Inc. relatou ativos totais de US $ 436,5 milhões em 31 de dezembro de 2022. Os custos iniciais de construção de teatro de cinema variam entre US $ 3 milhões e US $ 10 milhões por local, dependendo do mercado e tamanho.

| Categoria de investimento | Faixa de custo estimada |

|---|---|

| Construção de teatro de tela única | US $ 2,5 milhões - US $ 5 milhões |

| Construção de teatro multiplex | US $ 5 milhões - US $ 15 milhões |

| Investimento inicial de desenvolvimento imobiliário | US $ 10 milhões - US $ 50 milhões |

Barreiras ambientais regulatórias

Os setores de entretenimento e desenvolvimento de propriedades exigem extensa conformidade regulatória, incluindo:

- Permissões de zoneamento com média de US $ 50.000 - US $ 250.000

- Avaliações de impacto ambiental que custam US $ 75.000 - US $ 300.000

- Código de construção Investimentos de conformidade de US $ 100.000 - US $ 500.000

Barreira de entrada de reputação da marca

A capitalização de mercado da Reading International de US $ 124,7 milhões (em janeiro de 2024) representa uma barreira significativa no estabelecimento de marca.

Investimento inicial de infraestrutura

| Componente de infraestrutura | Faixa de investimento típica |

|---|---|

| Equipamento de teatro | US $ 500.000 - US $ 2 milhões |

| Infraestrutura de desenvolvimento de propriedades | US $ 3 milhões - US $ 20 milhões |

| Integração de tecnologia | $ 250.000 - US $ 1 milhão |

Reading International, Inc. (RDIB) - Porter's Five Forces: Competitive rivalry

The cinema segment of Reading International, Inc. faces a high degree of competitive rivalry. You see this pressure when looking at the larger US chains like AMC and Cinemark, plus the local competitors across Australia and New Zealand. This intense environment is reflected in the recent financial performance.

Reading International, Inc. holds a specific competitive position within this landscape. The company operates as the #3 cinema operator in New Zealand and the #4 operator in Australia. This positioning means Reading International, Inc. must compete for market share against established, often larger, players in both territories.

The cinema market itself is mature and undergoing consolidation. This maturity and consolidation pressure directly impacted recent operating results. For the quarter ended September 30, 2025, the global cinema operating income for Reading International, Inc. was $1.8 million. This figure represents a year-over-year decrease of 21% when compared to the $2.2 million in operating income reported for the third quarter of 2024. Furthermore, Q3 2025 global cinema revenues were $48.6 million, a 14% decrease compared to the same period in 2024.

Competition in the cinema space forces capital expenditure decisions. For example, competition drives necessary investments like the recliner seat and TITAN LUXE upgrades underway at the Bakersfield, CA location. These upgrades are a direct response to market expectations set by rivals.

Conversely, the rivalry within the Real Estate segment is noticeably lower. This is because Reading International, Inc. owns assets that are unique and maintain high occupancy. As of September 30, 2025, the combined Australian and New Zealand property portfolio had 58 third-party tenants and maintained a portfolio occupancy rate of 98%. This high occupancy suggests less direct competition for the space itself.

To combat rivalry and maximize revenue per patron in the competitive cinema environment, Reading International, Inc. focuses on ancillary revenue streams, showing where competitive efforts are concentrated:

- Food and Beverage Spend Per Patron (F&B SPP) for Q3 2025 in Australia reached AUD 8.05.

- F&B SPP for Q3 2025 in New Zealand was NZD 6.75.

- F&B SPP for Q3 2025 in the U.S. segment was $8.74.

Here's a quick look at the segment performance comparison for the quarter ended September 30, 2025, which illustrates the difference in competitive intensity:

| Segment | Q3 2025 Operating Income/(Loss) | Year-over-Year Change |

| Cinema (Global) | $1.8 million | Decreased by 21% |

| Real Estate (AU/NZ Tenants) | Not explicitly stated, but occupancy is 98% | Not explicitly stated |

The focus on operational efficiency, such as closing one underperforming U.S. cinema in April 2025, is also a direct result of competitive pressures forcing portfolio optimization. Reading International, Inc. currently operates 469 screens across 58 theatres in the U.S., Australia, and New Zealand.

Reading International, Inc. (RDIB) - Porter's Five Forces: Threat of substitutes

The threat of substitutes for Reading International, Inc.'s cinema operations remains very high, driven primarily by the convenience and growing content libraries of direct-to-consumer streaming platforms like Netflix and Disney+. This substitution pressure is exacerbated by the industry trend of significantly shorter theatrical windows, which erodes the exclusivity of the cinema experience by making new releases available for home viewing much faster.

For the core cinema business, this substitution pressure is evident in the lingering impact of industry-wide challenges; for instance, global Total Revenues in Q1 2025 were $40.2 million, down from $45.1 million in Q1 2024, partly due to lower cinema attendance. However, Reading International, Inc. counters this by focusing on premium offerings and maximizing ancillary revenue streams, which create a differentiated value proposition that streaming cannot easily replicate.

The company's success in driving per-person spending on concessions demonstrates a tangible countermeasure against the substitution threat. This focus on the in-theater experience is a direct attempt to make the visit a destination event rather than just a film viewing.

Here is a look at the record-setting Food & Beverage Sales Per Person (F&B SPP) achieved in 2025, which helps offset cinema weakness:

| Region | Period | F&B Sales Per Person (SPP) | Context |

|---|---|---|---|

| U.S. Cinema Division | Q2 2025 | $9.13 | Highest quarter ever for fully operating periods; highest among publicly traded competitors disclosing SPP |

| U.S. Cinema Division | Q3 2025 | $8.74 | Highest third quarter ever and second highest quarter ever |

| Australian Cinemas | Q2 2025 | A$8.26 | Highest second quarter ever |

| Australian Cinemas | Q3 2025 | AU$8.05 | Highest third quarter ever |

| New Zealand Cinema Division | Q2 2025 | NZ$7.14 | Record for the highest quarter ever |

| New Zealand Cinema Division | Q3 2025 | NZ$6.75 | Record for the highest third quarter ever |

Furthermore, Reading International, Inc.'s live theaters segment, which operates under the Orpheum and Minetta Lane names, faces its own substitution threat from major touring productions and smaller, independent local venues. Still, the real estate segment acts as a significant hedge against cinema volatility. The diversification strategy is clearly paying dividends when cinema attendance lags, such as from the lingering impacts of the 2023 Hollywood Strikes.

The financial insulation provided by the real estate holdings is substantial:

- Global Real Estate Operating Income rose by 79% in Q1 2025 compared to Q1 2024, reaching $1.6 million.

- This Q1 2025 result was the highest first quarter for the global Real Estate division since Q1 2018.

- The U.S. Real Estate Revenues of $1.6 million in Q1 2025 marked the highest first quarter on record for that metric.

- The Q2 2025 Real Estate Operating Income of $1.5 million increased by 56% from Q2 2024.

- The improved performance of the Live Theatre assets in NYC contributed to a 15% increase in Q2 2025 U.S. Real Estate Revenues.

The company is actively managing its asset base to optimize returns, including closing underperforming cinemas, such as one in San Diego on April 15, 2025, and monetizing property assets, like the sale of Wellington, New Zealand assets for NZ$38.0 million in Q1 2025. This dual focus-enhancing the cinema experience while monetizing and growing the real estate portfolio-is Reading International, Inc.'s primary defense against the high threat of substitutes.

Reading International, Inc. (RDIB) - Porter's Five Forces: Threat of new entrants

The threat of new entrants for Reading International, Inc. (RDIB) remains low to moderate, primarily because both its core segments-real estate development and cinema operation-demand substantial upfront capital and navigating complex regulatory environments presents a significant hurdle.

Entering the real estate development space requires significant investment capital, plus you have to deal with navigating complex local zoning laws. To give you a sense of the scale RDIB operates at, even after recent monetizations, the company's total gross debt stood at $172.6 million as of September 30, 2025, down from $202.7 million at the end of 2024. New players face the same high hurdle for securing large parcels and financing in prime locations.

RDIB owns a substantial portfolio of land and net rentable area in established markets, which acts as a major barrier to entry. While the total land portfolio figure you might be looking for isn't immediately available in the latest filings, we can look at the scale of their existing centers:

| Property Location | Land Area (sq ft) (As of Dec 31, 2023) | Net Rentable Area (SF) (As of Sep 30, 2025/Dec 31, 2023) | Recent Activity |

|---|---|---|---|

| Newmarket Village (Brisbane, AU) | 203,287 | Approx. 144,247 (As of Dec 31, 2023) | Extended long-term lease with anchor tenant in Q2 2025 |

| Cannon Park (Townsville, AU) | 408,372 | 132,731 (As of Dec 31, 2023) | Sold property assets in Q2 2025 for AU$32.0 million |

| The Belmont Common (Perth, AU) | 103,204 | 60,117 (As of Dec 31, 2023) | N/A |

Also, consider the cinema market. Entering this segment requires substantial capital just to modernize facilities with premium screens and sound systems to compete with established, upgraded venues. For instance, one of RDIB's U.S. cinemas is currently undergoing a major renovation that includes installing recliner seats and adding a TITAN LUXE auditorium. That kind of CapEx is a deterrent.

New entrants also face challenges securing first-run content from film distributors, who remain relatively concentrated. While RDIB is seeing strong demand, reporting global presales for 'Wicked: For Good' nearing $850,000, a new operator would have to prove its reliability to studios to get favorable terms on major releases.

Financing costs in 2025, despite some recent rate cuts, still make new, large-scale real estate projects difficult to pencil out profitably. Reading International, Inc. has been actively managing this, achieving a 15% reduction in its global debt balance from December 2024 to September 2025, which helped lower interest expenses by $2.6 million or 17% year-over-year. Still, the overall cost of capital is a real headwind for any newcomer trying to finance a massive development or cinema rollout right now.

- U.S. Cinema screen count reduced by 7.3% in Q3 2025 due to closures.

- Global cinema revenue decreased 14% in Q3 2025 versus Q3 2024.

- As of September 30, 2025, RDIB held $8.1 million in cash and cash equivalents.

- The company's total gross debt was $172.6 million as of September 30, 2025.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.