|

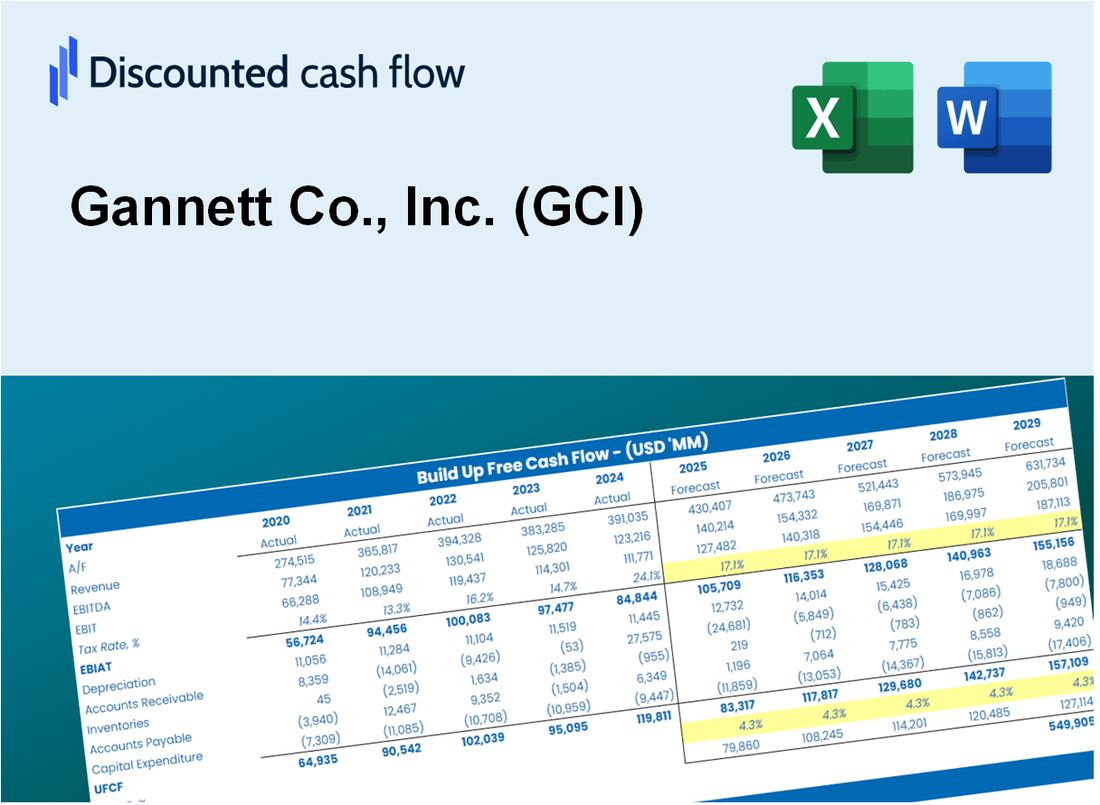

Gannett Co., Inc. (GCI) DCF -Bewertung |

Fully Editable: Tailor To Your Needs In Excel Or Sheets

Professional Design: Trusted, Industry-Standard Templates

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Expertise Is Needed; Easy To Follow

Gannett Co., Inc. (GCI) Bundle

Mit unserem GCI-DCF-Taschenrechner, der für die Genauigkeit entwickelt wurde, können Sie die Bewertung von Gannett Co., Inc. mithilfe aktueller Finanzdaten bewerten und vollständige Flexibilität bieten, um alle Schlüsselparameter für erweiterte Projektionen zu ändern.

What You Will Get

- Comprehensive GCI Financials: Access historical and projected data for precise valuation.

- Customizable Inputs: Adjust WACC, tax rates, revenue growth, and capital expenditures as needed.

- Dynamic Calculations: Intrinsic value and NPV are computed automatically.

- Scenario Analysis: Evaluate various scenarios to assess Gannett’s future performance.

- User-Friendly Design: Designed for professionals while remaining easy to use for beginners.

Key Features

- 🔍 Real-Life GCI Financials: Pre-filled historical and projected data for Gannett Co., Inc. (GCI).

- ✏️ Fully Customizable Inputs: Adjust all critical parameters (yellow cells) like WACC, growth %, and tax rates.

- 📊 Professional DCF Valuation: Built-in formulas calculate Gannett’s intrinsic value using the Discounted Cash Flow method.

- ⚡ Instant Results: Visualize Gannett’s valuation instantly after making changes.

- Scenario Analysis: Test and compare outcomes for various financial assumptions side-by-side.

How It Works

- 1. Download the Model: Obtain and open the Excel template containing Gannett Co., Inc.'s (GCI) financial data.

- 2. Adjust Key Inputs: Modify essential parameters such as revenue growth, discount rate, and capital investments.

- 3. Analyze Results Live: The DCF model automatically computes the intrinsic value and net present value (NPV).

- 4. Explore Different Scenarios: Evaluate various projections to understand different valuation possibilities.

- 5. Make Informed Decisions: Share comprehensive valuation findings to enhance your strategic choices.

Why Choose This Calculator for Gannett Co., Inc. (GCI)?

- Designed for Experts: A sophisticated tool utilized by financial analysts, CFOs, and industry consultants.

- Accurate Financial Data: Gannett’s historical and projected financial figures are preloaded for precision.

- Flexible Scenario Analysis: Effortlessly test various forecasts and assumptions.

- Comprehensive Outputs: Instantly calculates intrinsic value, NPV, and essential metrics.

- User-Friendly: Detailed step-by-step guidance ensures a smooth experience.

Who Should Use This Product?

- Individual Investors: Make informed decisions about buying or selling Gannett Co., Inc. (GCI) stock.

- Financial Analysts: Streamline valuation processes with ready-to-use financial models for Gannett Co., Inc. (GCI).

- Consultants: Deliver professional valuation insights on Gannett Co., Inc. (GCI) to clients quickly and accurately.

- Business Owners: Understand how media companies like Gannett Co., Inc. (GCI) are valued to guide your own strategy.

- Finance Students: Learn valuation techniques using real-world data and scenarios related to Gannett Co., Inc. (GCI).

What the Template Contains

- Pre-Filled DCF Model: Gannett Co., Inc. (GCI)’s financial data preloaded for immediate use.

- WACC Calculator: Detailed calculations for Weighted Average Cost of Capital.

- Financial Ratios: Evaluate Gannett Co., Inc. (GCI)’s profitability, leverage, and efficiency.

- Editable Inputs: Change assumptions such as growth, margins, and CAPEX to fit your scenarios.

- Financial Statements: Annual and quarterly reports to support detailed analysis.

- Interactive Dashboard: Easily visualize key valuation metrics and results.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.