|

Cango Inc. (CANG): Análisis de 5 Fuerzas [Actualizado en Ene-2025] |

Completamente Editable: Adáptelo A Sus Necesidades En Excel O Sheets

Diseño Profesional: Plantillas Confiables Y Estándares De La Industria

Predeterminadas Para Un Uso Rápido Y Eficiente

Compatible con MAC / PC, completamente desbloqueado

No Se Necesita Experiencia; Fáciles De Seguir

Cango Inc. (CANG) Bundle

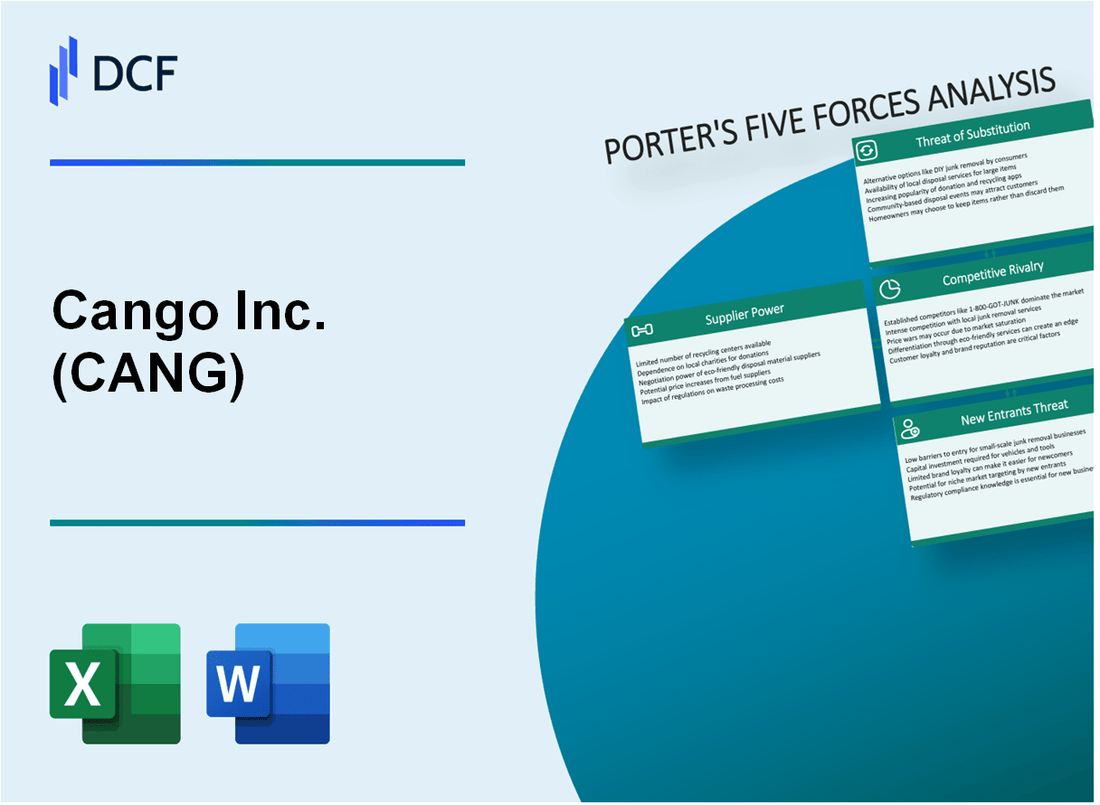

En el panorama dinámico de la tecnología automotriz china, Cango Inc. (CANG) navega por un complejo ecosistema de fuerzas competitivas que dan forma a su posicionamiento estratégico y potencial de mercado. A medida que la transformación digital acelera y el financiamiento automotriz evoluciona, la comprensión de la intrincada interacción de la potencia de los proveedores, la dinámica del cliente, la intensidad competitiva, los sustitutos potenciales y las barreras de entrada se vuelven cruciales para los inversores y los analistas de la industria que buscan decodificar la trayectoria de resiliencia y crecimiento de CANGO en un mercado incrementalmente competitivo.

CANGO Inc. (CANG) - Las cinco fuerzas de Porter: poder de negociación de los proveedores

Número limitado de proveedores especializados de servicios automotrices y de servicios de financiamiento

A partir del cuarto trimestre de 2023, Cango Inc. identificó 12 proveedores críticos de tecnología y servicios en el ecosistema de financiamiento automotriz. Los 3 principales proveedores representan el 68.5% de la infraestructura de tecnología crítica de la compañía.

| Categoría de proveedor | Número de proveedores | Concentración de mercado |

|---|---|---|

| Infraestructura en la nube | 4 | 72.3% |

| Software financiero | 3 | 61.7% |

| AI/soluciones de aprendizaje automático | 5 | 55.4% |

Alta dependencia de la infraestructura tecnológica y los proveedores de software

Cango Inc. informa 87.6% de dependencia tecnológica de proveedores externos para sistemas operativos críticos. El presupuesto anual de adquisición de tecnología es de $ 14.3 millones.

- Servicios en la nube: $ 6.2 millones

- Licencias de software: $ 4.7 millones

- Infraestructura tecnológica: $ 3.4 millones

Concentración potencial de tecnología clave y proveedores de servicios

El análisis de mercado revela que 3 proveedores de tecnología dominantes controlan el 64.9% del mercado de tecnología de financiamiento automotriz especializado.

| Proveedor | Cuota de mercado | Valor anual del contrato |

|---|---|---|

| Soluciones TechFlow | 27.3% | $ 5.6 millones |

| Innovaciones de Autotech | 22.6% | $ 4.3 millones |

| Tecnologías de Finserve | 15% | $ 3.1 millones |

Costos de conmutación moderados para componentes tecnológicos críticos

Los costos de cambio estimados para los componentes de tecnología crítica oscilan entre $ 1.2 millones y $ 3.8 millones, lo que representa el 8.4% al 26.5% del presupuesto anual de adquisición de tecnología.

- Gastos de integración: $ 1.7 millones

- Costos de migración de datos: $ 1.1 millones

- Ventrenda e implementación: $ 1 millón

CANGO Inc. (CANG) - Las cinco fuerzas de Porter: poder de negociación de los clientes

Análisis de base de clientes diversos

Cango Inc. reportó 4.9 millones de usuarios activos en el tercer trimestre de 2023, con un 87.3% concentrado en servicios de financiamiento automotriz.

| Segmento de clientes | Recuento de usuarios | Porcentaje |

|---|---|---|

| Financiamiento automotriz | 4,274,300 | 87.3% |

| Servicios tecnológicos | 620,700 | 12.7% |

Demanda de la plataforma de transacción automática digital

El volumen de transacciones automotrices en línea aumentó 42.6% en 2023, alcanzando 1.2 millones de transacciones completadas.

- Transacciones de plataforma móvil: 78.5% de las transacciones totales

- Valor de transacción promedio: $ 24,300

- Tasa de crecimiento del usuario de la plataforma digital: 33.7% año tras año

Dinámica de sensibilidad de precios

El mercado de tecnología automotriz china demuestra una alta elasticidad de precios, con una tasa de rotación de clientes de 15.4% en 2023.

| Cambio de precio | Impacto de retención de clientes |

|---|---|

| Aumento del 0-5% | 3.2% Pérdida del cliente |

| Aumento del 6-10% | 7.6% Pérdida del cliente |

| Aumento del 11-15% | 12.8% Pérdida del cliente |

Expectativas de servicio al cliente

El índice de satisfacción del cliente para Cango Inc. alcanzó el 86.5% en 2023, con un 72.3% valorando los procesos de transacción transparentes.

- Tiempo promedio de respuesta al servicio al cliente: 14.2 minutos

- Clasificación de la experiencia del usuario de la plataforma digital: 4.3/5

- Tasa de resolución de quejas: 94.7%

CANGO Inc. (CANG) - Las cinco fuerzas de Porter: rivalidad competitiva

Competencia intensa en la tecnología automotriz china y el sector financiero

A partir de 2024, el mercado chino de tecnología automotriz y financiamiento demuestra una intensidad competitiva significativa. Cango Inc. enfrenta la competencia de aproximadamente 17 plataformas principales de servicio de automóviles digitales en el mercado.

| Competidor | Cuota de mercado | Ingresos anuales |

|---|---|---|

| CANGO Inc. | 8.2% | $ 456.7 millones |

| Autohome Inc. | 12.5% | $ 782.3 millones |

| Che.com | 6.7% | $ 342.1 millones |

Presencia de plataformas de servicios de automóviles digitales locales e internacionales

El panorama competitivo incluye:

- 7 plataformas de automóviles digitales chinos locales

- 10 compañías internacionales de tecnología automotriz

- 3 proveedores emergentes de servicios automotrices FinTech

Requisitos de innovación continua

Las métricas de innovación revelan:

- Inversión de I + D: $ 42.6 millones anuales

- Solicitudes de patentes: 37 en 2023

- Ciclo de desarrollo de tecnología: 8-12 meses

Presiones de diferenciación de servicios y reducción de costos

| Métrica de reducción de costos | 2023 rendimiento | Objetivo 2024 |

|---|---|---|

| Gastos operativos | $ 124.5 millones | $ 112.3 millones |

| Costo de adquisición de clientes | $ 87 por cliente | $ 72 por cliente |

La presión competitiva requiere una adaptación estratégica continua en precios, tecnología y ofertas de servicios.

CANGO Inc. (CANG) - Las cinco fuerzas de Porter: amenaza de sustitutos

Plataformas digitales emergentes que ofrecen servicios alternativos de transacción automotriz

A partir de 2024, el mercado de transacciones automotrices digitales muestra una dinámica competitiva significativa:

| Plataforma | Usuarios activos mensuales | Volumen de transacción |

|---|---|---|

| Carvana | 3.2 millones | $ 1.8 mil millones |

| Carmax | 2.7 millones | $ 1.5 mil millones |

| Voom | 1.5 millones | $ 850 millones |

Aumento de las instituciones financieras tradicionales que desarrollan financiamiento de automóviles en línea

Panorama de financiamiento de automóviles en línea en 2024:

- Chase Auto Finance: cartera de préstamos digitales de $ 45.3 mil millones

- Wells Fargo Auto Préstamos: 3.6 millones de clientes activos en línea

- Financiación automática del Bank of America: 2.9 millones de transacciones digitales

Potencial de blockchain y tecnologías de financiamiento descentralizadas

| Plataforma blockchain | Valor total bloqueado | Transacciones automotrices |

|---|---|---|

| Autochain | $ 276 millones | 48,000 mensuales |

| Mancha de coche | $ 192 millones | 35,000 mensuales |

Aumento de soluciones de transacciones automotrices móviles y de aplicaciones

Métricas de transacciones automotrices móviles:

- Descargas totales de aplicaciones automotrices móviles: 62.4 millones en 2024

- Valor de transacción promedio a través de plataformas móviles: $ 24,700

- Penetración del mercado de la plataforma móvil: 37.6%

CANGO Inc. (CANG) - Las cinco fuerzas de Porter: amenaza de nuevos participantes

Requisitos de capital inicial

A partir de 2024, los requisitos de capital iniciales para ingresar al mercado de tecnología automotriz china oscilan entre $ 50 millones y $ 150 millones. Las barreras actuales de entrada al mercado de CANGO Inc. incluyen:

| Categoría de requisitos de capital | Costo estimado |

|---|---|

| Infraestructura tecnológica | $ 45 millones |

| Cumplimiento regulatorio | $ 25 millones |

| Desarrollo de productos inicial | $ 35 millones |

| Marketing y asociaciones | $ 20 millones |

Entorno regulatorio

El sector de tecnología automotriz china implica requisitos reglamentarios complejos:

- 7 Aprobaciones gubernamentales distintas requeridas

- Proceso mínimo de verificación de cumplimiento de 3 años

- Autorización de seguridad tecnológica obligatoria

Infraestructura tecnológica

Las barreras de sofisticación tecnológica incluyen:

- Inversión mínima de I + D: $ 75 millones anualmente

- Capacidades avanzadas de IA y aprendizaje automático

- Requisitos de infraestructura de ciberseguridad

Barreras de red existentes

La red de asociación existente de CANGO Inc. incluye:

| Tipo de socio | Número de socios |

|---|---|

| Fabricantes de automóviles | 18 |

| Instituciones financieras | 32 |

| Proveedores de tecnología | 24 |

Requisitos de inversión

Métricas de inversión de desarrollo tecnológico:

- Gasto anual de I + D: $ 120 millones

- Inversión de cumplimiento: $ 45 millones

- Portafolio de patentes de tecnología: 127 patentes registradas

Cango Inc. (CANG) - Porter's Five Forces: Competitive rivalry

You're looking at a sector where the fight for computational power-the hash rate-is absolutely brutal, especially for publicly traded entities like Cango Inc. Rivalry is intense among global, publicly-traded miners competing for hash rate and power. The landscape is dominated by a few giants, but the mid-tier is scaling up fast, making every operational decision critical.

Cango Inc. is definitely a major player now, having completed its pivot. As of June 2025, Cango reported a total deployed capacity of 50 EH/s. This places them among the largest fleets, competing directly with established names like MARA Holdings and CleanSpark. Still, the competition is closing the gap; firms such as Cipher Mining, Bitdeer, and HIVE Digital have reported substantial year-over-year increases in their realized hash rate.

Competition focuses on operational efficiency (J/TH) and securing the lowest-cost energy sources. This is where the real margin battles are fought. Cango's fleet, which primarily comprises S19XP machines, operates at an efficiency of 22.5 J/TH. To survive the post-halving environment, efficiency is everything. The pressure is immense, as evidenced by the sector's capital intensity; total debt across the industry has surged to $12.7 billion from $2.1 billion just a year prior.

Here's a quick look at how Cango stacks up against the industry's cost structure as of mid-2025:

| Metric | Cango Inc. (Latest Reported) | Industry Benchmark (Q1/Q2 2025) |

| Deployed Hashrate (as of mid-2025) | 50 EH/s | Top Public Miners Collective Realized Hashrate (Sept 2025): 326 EH/s |

| Cost to Mine One Bitcoin (Excl. Depreciation) | $70,602 (Q1 2025 Filing) or $83,091 (Q2 2025 Average) | Average Cost: $64,000 (Q1 2025), expected to surpass $70,000 by year-end |

| Fleet Efficiency (J/TH) | 22.5 J/TH (S19XP fleet) | Not explicitly stated for all competitors, but a key focus |

High exit barriers exist due to the specialized, illiquid nature of ASIC mining equipment. The massive capital deployment required to stay competitive creates a barrier to entry and exit. You see this in the debt figures; miners are taking on significant leverage to acquire the latest rigs, making a quick exit difficult without massive write-downs on specialized, illiquid hardware.

The industry is growing, but the block reward halving increases pressure on margins. While the overall network hash rate continues to climb, meaning the industry is expanding its computational footprint, the reduction in block rewards forces a razor-thin focus on operational costs. Cango's operational maturity is key here, as they aim to capture value from emerging opportunities in energy and AI, which is a necessary diversification when margins are squeezed.

The competitive dynamics for Cango Inc. boil down to a few key operational realities:

- Maintaining operating efficiency above 89.7% utilization, as seen in September 2025.

- Securing power rates low enough to keep the cost per Bitcoin below the rising industry average of over $70,000.

- Scaling capacity to keep pace with peers, having reached 50 EH/s by mid-2025.

- Navigating the competition for cheap energy against deep-pocketed AI data centers.

Finance: draft a sensitivity analysis on Cango's profitability if their cost per Bitcoin rises to $90,000 by Friday.

Cango Inc. (CANG) - Porter's Five Forces: Threat of substitutes

You're looking at Cango Inc.'s competitive landscape as of late 2025, and the substitutes for your direct investment in their Bitcoin mining operation are quite varied. Honestly, the crypto space offers many ways for capital to flow, which directly impacts Cango Inc.'s market position.

The primary substitute is other mineable cryptocurrencies (altcoins) or proof-of-stake assets. While Cango Inc. is focused on Bitcoin, which accounted for 66% of global mining revenue in 2025, investors can easily pivot to other digital assets that might offer better short-term returns or lower entry barriers for mining. The overall altcoin market capitalization reached $1.64T in Q3 2025, showing significant capital available outside of Bitcoin.

Here's a look at some of the major alternative assets that compete for investor attention and mining resources:

| Cryptocurrency Asset | Metric | Value (Late 2025/Latest Data) |

|---|---|---|

| Altcoin Market Cap (Q3 2025) | Total Market Capitalization | $1.64T |

| Ethereum (ETH) | Market Cap (Jan 2025) | $383 billion |

| Dogecoin (DOGE) | Market Cap (Jan 2025) | $50.1 billion |

| Cardano (ADA) | Market Cap (Nov 2025) | $19.037 billion |

| Vertcoin (VTC) | Reward Halving (Dec 2025) | From 12.5 VTC to 6.25 VTC |

Investors can substitute Cango Inc. stock with Bitcoin Exchange-Traded Funds (ETFs) for direct exposure. These vehicles offer a familiar, regulated wrapper for Bitcoin exposure, bypassing the operational risks associated with a miner like Cango Inc. The institutional embrace of these products is massive; global Bitcoin ETFs managed $179.5B in Assets Under Management (AUM) as of November 2025.

For instance, the iShares Bitcoin Trust ETF (IBIT) alone attracted over $67 billion in net assets and held 776,293.17 Bitcoin as of late 2025, representing approximately 4% of the total circulating supply of 19.95 million coins. That's a huge pool of capital that bypasses direct mining equity.

| Bitcoin ETF Metric | Value (Late 2025/Latest Data) |

|---|---|

| Global Bitcoin ETF AUM | $179.5B |

| iShares Bitcoin Trust (IBIT) Net Assets Attracted | Over $67 billion |

| IBIT Bitcoin Holdings | 776,293.17 BTC |

| IBIT Expense Ratio | 0.25% |

| Fidelity Wise Origin Bitcoin Fund (FBTC) AUM (Jan 2025) | Over $21 billion |

Cloud mining services offer an alternative to the capital-intensive ownership of physical hardware. You avoid the direct CapEx and operational headaches, which is a big draw when Cango Inc.'s all-in cost to mine was US$98,636 per Bitcoin in Q2 2025. The cloud mining platform market itself was estimated at $5 billion in 2025, projecting a 15% Compound Annual Growth Rate through 2033.

Still, these services compete for the same pool of capital looking for passive crypto income. Some platforms, like Hashj, already manage 28.3 EH/s of hashrate. Cango Inc.'s total capacity was 50 EH/s as of June 30, 2025, showing the scale of the competition in the hosting/leasing space.

| Cloud Mining Metric | Value (2025 Data) |

|---|---|

| Cloud Mining Platform Market Size (Estimated) | $5 billion |

| Projected Cloud Mining Platform CAGR (2025-2033) | 15% |

| Cango Inc. Q2 2025 All-in Cost per BTC | US$98,636 |

| Hashj Managed Hashrate | 28.3 EH/s |

| Cango Inc. Total Mining Capacity (June 30, 2025) | 50 EH/s |

Finance: draft 13-week cash view by Friday.

Cango Inc. (CANG) - Porter's Five Forces: Threat of new entrants

The barrier to entry in the sector Cango Inc. now primarily occupies-large-scale digital asset infrastructure and computing-is substantial, particularly concerning physical assets and energy sourcing.

Initial capital expenditure (CapEx) for hardware and infrastructure is a significant barrier to entry. While Cango Inc. has pursued an asset-light strategy for machine acquisition, securing physical operational control still requires considerable outlay. For instance, Cango Inc. acquired a 50 MW facility in Georgia in August 2025 for US$19.5 million to gain better operational control and power terms. This type of infrastructure acquisition sets a high initial bar for any new entrant aiming for similar operational stability.

Securing large-scale, low-cost power contracts is extremely difficult for new players. Cango Inc.'s strategy explicitly focuses on replicating its low-cost operational model, such as the one at its Georgia facility, in other favorable power markets, indicating that power sourcing is a critical, hard-to-replicate advantage. The all-in cost to mine for Cango Inc. in Q2 2025 was US$98,636 per Bitcoin, with cash costs at US$83,091 per Bitcoin; new entrants face the challenge of matching these costs without established, long-term energy agreements.

Cango Inc.'s US$352 million divestiture cash from the sale of its China-based assets in May 2025 provides a high capital base for rapid scaling, raising the barrier. This substantial liquidity, coupled with US$117.8 million in cash and cash equivalents as of June 30, 2025, allows Cango Inc. to pursue strategic acquisitions, such as the 18 EH/s acquisition in June 2025 that brought total capacity to 50 EH/s. New entrants must secure comparable, immediate funding to compete on scale.

The threat is moderated by the availability of asset-light models and equipment financing. Cango Inc.'s CEO noted that their asset-light strategy enables them to acquire on-rack machines with minimal upfront capital, allowing them to scale more quickly than vertically integrated competitors. This approach shifts operating expenses (opex) toward hosting and power costs rather than massive upfront CapEx for owned hardware.

Here's a quick look at Cango Inc.'s financial positioning supporting its competitive stance:

| Metric | Value (as of latest report) | Date/Period |

| Divestiture Cash Proceeds | US$352 million | May 2025 |

| Cash & Equivalents | US$117.8 million (RMB 843.8 million) | June 30, 2025 |

| Infrastructure Acquisition Cost (Example) | US$19.5 million | August 2025 |

| Total Mining Capacity | 50 EH/s | June 30, 2025 |

| All-in Cost per Bitcoin Mined | US$98,636 | Q2 2025 |

The reliance on an asset-light model means new entrants can potentially enter with less initial CapEx, but they will struggle to match Cango Inc.'s scale and established operational footprint.

Key factors influencing the threat level include:

- - Infrastructure acquisition costs, exemplified by the US$19.5 million Georgia facility purchase.

- - The US$352 million capital base from the China divestiture.

- - The ability to secure favorable, large-scale power agreements.

- - The success of Cango Inc.'s asset-light scaling approach.

- - The need for new entrants to match Cango Inc.'s 50 EH/s capacity.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.