|

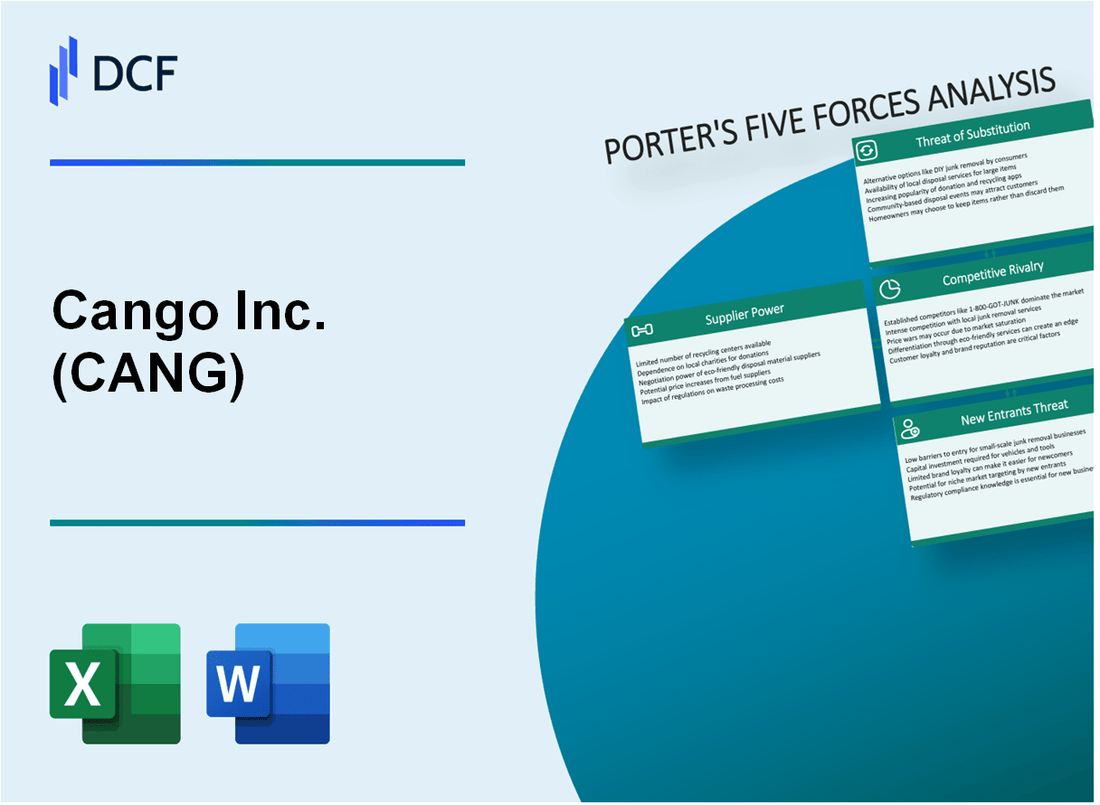

CANGO Inc. (CANG): 5 forças Análise [Jan-2025 Atualizada] |

Totalmente Editável: Adapte-Se Às Suas Necessidades No Excel Ou Planilhas

Design Profissional: Modelos Confiáveis E Padrão Da Indústria

Pré-Construídos Para Uso Rápido E Eficiente

Compatível com MAC/PC, totalmente desbloqueado

Não É Necessária Experiência; Fácil De Seguir

Cango Inc. (CANG) Bundle

No cenário dinâmico da tecnologia automotiva chinesa, a Cango Inc. (CANG) navega em um ecossistema complexo de forças competitivas que moldam seu posicionamento estratégico e potencial de mercado. À medida que a transformação digital acelera e o financiamento automotivo evolui, a compreensão da intrincada interação do poder do fornecedor, dinâmica do cliente, intensidade competitiva, substitutos em potencial e barreiras de entrada se torna crucial para investidores e analistas do setor que buscam decodificar a resiliência e a trajetória de crescimento de Cango.

CANGO INC. (CANG) - As cinco forças de Porter: poder de barganha dos fornecedores

Número limitado de fornecedores especializados de serviços de tecnologia e financiamento automotivos

A partir do quarto trimestre 2023, a CANGO Inc. identificou 12 fornecedores críticos de tecnologia e serviços no ecossistema de financiamento automotivo. Os três principais fornecedores representam 68,5% da infraestrutura de tecnologia crítica da empresa.

| Categoria de fornecedores | Número de provedores | Concentração de mercado |

|---|---|---|

| Infraestrutura em nuvem | 4 | 72.3% |

| Software financeiro | 3 | 61.7% |

| Soluções de AI/Machine Learning | 5 | 55.4% |

Alta dependência de infraestrutura de tecnologia e fornecedores de software

A Cango Inc. relata 87,6% dependência tecnológica de fornecedores externos para sistemas operacionais críticos. O orçamento anual de compras de tecnologia é de US $ 14,3 milhões.

- Serviços em nuvem: US $ 6,2 milhões

- Licenciamento de software: US $ 4,7 milhões

- Infraestrutura de tecnologia: US $ 3,4 milhões

Concentração potencial dos principais fornecedores de tecnologia e serviço

A análise de mercado revela 3 provedores de tecnologia dominantes controlam 64,9% do mercado de tecnologia de financiamento automotivo especializado.

| Fornecedor | Quota de mercado | Valor anual do contrato |

|---|---|---|

| Soluções TechFlow | 27.3% | US $ 5,6 milhões |

| Innovações de Autotech | 22.6% | US $ 4,3 milhões |

| Tecnologias FinServe | 15% | US $ 3,1 milhões |

Custos de troca moderados para componentes tecnológicos críticos

Os custos estimados de comutação para componentes críticos de tecnologia variam entre US $ 1,2 milhão e US $ 3,8 milhões, representando 8,4% a 26,5% do orçamento anual de compras de tecnologia.

- Despesas de integração: US $ 1,7 milhão

- Custos de migração de dados: US $ 1,1 milhão

- Reciclagem e implementação: US $ 1 milhão

CANGO INC. (CANG) - As cinco forças de Porter: poder de barganha dos clientes

Análise de base de clientes diversificada

A Cango Inc. relatou 4,9 milhões de usuários ativos no terceiro trimestre de 2023, com 87,3% concentrados em serviços de financiamento automotivo.

| Segmento de clientes | Contagem de usuários | Percentagem |

|---|---|---|

| Financiamento automotivo | 4,274,300 | 87.3% |

| Serviços de Tecnologia | 620,700 | 12.7% |

Demanda de plataforma de transação automática digital

O volume de transações automotivas on -line aumentou 42,6% em 2023, atingindo 1,2 milhão de transações concluídas.

- Transações de plataforma móvel: 78,5% do total de transações

- Valor médio da transação: US $ 24.300

- Taxa de crescimento do usuário da plataforma digital: 33,7% ano a ano

Dinâmica de sensibilidade ao preço

O mercado chinês de tecnologia automotiva demonstra uma alta elasticidade de preços, com uma taxa de rotatividade de clientes de 15,4% em 2023.

| Mudança de preço | Impacto de retenção de clientes |

|---|---|

| 0-5% de aumento | 3,2% de perda do cliente |

| Aumento de 6 a 10% | 7,6% de perda do cliente |

| Aumento de 11 a 15% | 12,8% de perda do cliente |

Expectativas de atendimento ao cliente

O índice de satisfação do cliente para a Cango Inc. atingiu 86,5% em 2023, com 72,3% avaliando processos de transação transparentes.

- Tempo médio de resposta ao atendimento ao cliente: 14,2 minutos

- Classificação de experiência do usuário da plataforma digital: 4.3/5

- Taxa de resolução de reclamação: 94,7%

CANGO INC. (CANG) - As cinco forças de Porter: rivalidade competitiva

Concorrência intensa no setor de tecnologia e financiamento automotivo chinês

A partir de 2024, o mercado chinês de tecnologia e financiamento automotivo demonstra intensidade competitiva significativa. A Cango Inc. enfrenta a concorrência de aproximadamente 17 principais plataformas de serviços de automóveis digitais do mercado.

| Concorrente | Quota de mercado | Receita anual |

|---|---|---|

| CANGO INC. | 8.2% | US $ 456,7 milhões |

| Autohome Inc. | 12.5% | US $ 782,3 milhões |

| Che.com | 6.7% | US $ 342,1 milhões |

Presença de plataformas locais e internacionais de serviço de automóveis digitais

O cenário competitivo inclui:

- 7 plataformas de automóveis digitais chinesas locais

- 10 empresas internacionais de tecnologia automotiva

- 3 provedores de serviços automotivos emergentes da FinTech

Requisitos de inovação contínuos

As métricas de inovação revelam:

- Investimento de P&D: US $ 42,6 milhões anualmente

- Pedidos de patente: 37 em 2023

- Ciclo de desenvolvimento de tecnologia: 8 a 12 meses

Diferenciação de serviço e pressões de redução de custos

| Métrica de redução de custos | 2023 desempenho | 2024 Target |

|---|---|---|

| Despesas operacionais | US $ 124,5 milhões | US $ 112,3 milhões |

| Custo de aquisição do cliente | US $ 87 por cliente | US $ 72 por cliente |

A pressão competitiva requer adaptação estratégica contínua nas ofertas de preços, tecnologia e serviços.

CANGO INC. (CANG) - As cinco forças de Porter: ameaça de substitutos

Plataformas digitais emergentes que oferecem serviços alternativos de transação automotiva

A partir de 2024, o mercado de transações automotivas digitais mostra dinâmica competitiva significativa:

| Plataforma | Usuários ativos mensais | Volume de transação |

|---|---|---|

| Carvana | 3,2 milhões | US $ 1,8 bilhão |

| Carmax | 2,7 milhões | US $ 1,5 bilhão |

| Vroom | 1,5 milhão | US $ 850 milhões |

Ascensão das instituições financeiras tradicionais que desenvolvem financiamento automático on -line

Cenário online de financiamento automático em 2024:

- Chase Auto Finance: US $ 45,3 bilhões portfólio de empréstimos digitais

- Empréstimos para automóveis da Wells Fargo: 3,6 milhões de clientes online ativos

- Financiamento automático do Bank of America: 2,9 milhões de transações digitais

Blockchain potencial e tecnologias de financiamento descentralizadas

| Plataforma blockchain | Valor total bloqueado | Transações automotivas |

|---|---|---|

| Autochain | US $ 276 milhões | 48.000 mensais |

| Carblockchain | US $ 192 milhões | 35.000 mensais |

Aumentando soluções de transação automotiva móvel e baseada em aplicativos

Métricas de transação automotiva móvel:

- Total Mobile Automotive App Downloads: 62,4 milhões em 2024

- Valor médio da transação através de plataformas móveis: US $ 24.700

- Penetração de mercado da plataforma móvel: 37,6%

CANGO INC. (CANG) - As cinco forças de Porter: ameaça de novos participantes

Requisitos de capital inicial

Em 2024, os requisitos de capital inicial para entrar no mercado de tecnologia automotiva chinesa variam entre US $ 50 milhões e US $ 150 milhões. As barreiras atuais de entrada de mercado da CANGO Inc. incluem:

| Categoria de requisito de capital | Custo estimado |

|---|---|

| Infraestrutura de tecnologia | US $ 45 milhões |

| Conformidade regulatória | US $ 25 milhões |

| Desenvolvimento inicial do produto | US $ 35 milhões |

| Marketing e parcerias | US $ 20 milhões |

Ambiente Regulatório

O setor de tecnologia automotiva chinesa envolve requisitos regulatórios complexos:

- 7 aprovações governamentais distintas necessárias

- Processo mínimo de verificação de conformidade de 3 anos

- Liberação de segurança tecnológica obrigatória

Infraestrutura tecnológica

As barreiras de sofisticação tecnológicas incluem:

- Investimento mínimo de P&D: US $ 75 milhões anualmente

- Recursos avançados de IA e aprendizado de máquina

- Requisitos de infraestrutura de segurança cibernética

Barreiras de rede existentes

A rede de parceria existente da CANGO Inc. inclui:

| Tipo de parceiro | Número de parceiros |

|---|---|

| Fabricantes automotivos | 18 |

| Instituições financeiras | 32 |

| Provedores de tecnologia | 24 |

Requisitos de investimento

Métricas de investimento em desenvolvimento tecnológico:

- Gastos anuais de P&D: US $ 120 milhões

- Investimento de conformidade: US $ 45 milhões

- Portfólio de patentes de tecnologia: 127 patentes registradas

Cango Inc. (CANG) - Porter's Five Forces: Competitive rivalry

You're looking at a sector where the fight for computational power-the hash rate-is absolutely brutal, especially for publicly traded entities like Cango Inc. Rivalry is intense among global, publicly-traded miners competing for hash rate and power. The landscape is dominated by a few giants, but the mid-tier is scaling up fast, making every operational decision critical.

Cango Inc. is definitely a major player now, having completed its pivot. As of June 2025, Cango reported a total deployed capacity of 50 EH/s. This places them among the largest fleets, competing directly with established names like MARA Holdings and CleanSpark. Still, the competition is closing the gap; firms such as Cipher Mining, Bitdeer, and HIVE Digital have reported substantial year-over-year increases in their realized hash rate.

Competition focuses on operational efficiency (J/TH) and securing the lowest-cost energy sources. This is where the real margin battles are fought. Cango's fleet, which primarily comprises S19XP machines, operates at an efficiency of 22.5 J/TH. To survive the post-halving environment, efficiency is everything. The pressure is immense, as evidenced by the sector's capital intensity; total debt across the industry has surged to $12.7 billion from $2.1 billion just a year prior.

Here's a quick look at how Cango stacks up against the industry's cost structure as of mid-2025:

| Metric | Cango Inc. (Latest Reported) | Industry Benchmark (Q1/Q2 2025) |

| Deployed Hashrate (as of mid-2025) | 50 EH/s | Top Public Miners Collective Realized Hashrate (Sept 2025): 326 EH/s |

| Cost to Mine One Bitcoin (Excl. Depreciation) | $70,602 (Q1 2025 Filing) or $83,091 (Q2 2025 Average) | Average Cost: $64,000 (Q1 2025), expected to surpass $70,000 by year-end |

| Fleet Efficiency (J/TH) | 22.5 J/TH (S19XP fleet) | Not explicitly stated for all competitors, but a key focus |

High exit barriers exist due to the specialized, illiquid nature of ASIC mining equipment. The massive capital deployment required to stay competitive creates a barrier to entry and exit. You see this in the debt figures; miners are taking on significant leverage to acquire the latest rigs, making a quick exit difficult without massive write-downs on specialized, illiquid hardware.

The industry is growing, but the block reward halving increases pressure on margins. While the overall network hash rate continues to climb, meaning the industry is expanding its computational footprint, the reduction in block rewards forces a razor-thin focus on operational costs. Cango's operational maturity is key here, as they aim to capture value from emerging opportunities in energy and AI, which is a necessary diversification when margins are squeezed.

The competitive dynamics for Cango Inc. boil down to a few key operational realities:

- Maintaining operating efficiency above 89.7% utilization, as seen in September 2025.

- Securing power rates low enough to keep the cost per Bitcoin below the rising industry average of over $70,000.

- Scaling capacity to keep pace with peers, having reached 50 EH/s by mid-2025.

- Navigating the competition for cheap energy against deep-pocketed AI data centers.

Finance: draft a sensitivity analysis on Cango's profitability if their cost per Bitcoin rises to $90,000 by Friday.

Cango Inc. (CANG) - Porter's Five Forces: Threat of substitutes

You're looking at Cango Inc.'s competitive landscape as of late 2025, and the substitutes for your direct investment in their Bitcoin mining operation are quite varied. Honestly, the crypto space offers many ways for capital to flow, which directly impacts Cango Inc.'s market position.

The primary substitute is other mineable cryptocurrencies (altcoins) or proof-of-stake assets. While Cango Inc. is focused on Bitcoin, which accounted for 66% of global mining revenue in 2025, investors can easily pivot to other digital assets that might offer better short-term returns or lower entry barriers for mining. The overall altcoin market capitalization reached $1.64T in Q3 2025, showing significant capital available outside of Bitcoin.

Here's a look at some of the major alternative assets that compete for investor attention and mining resources:

| Cryptocurrency Asset | Metric | Value (Late 2025/Latest Data) |

|---|---|---|

| Altcoin Market Cap (Q3 2025) | Total Market Capitalization | $1.64T |

| Ethereum (ETH) | Market Cap (Jan 2025) | $383 billion |

| Dogecoin (DOGE) | Market Cap (Jan 2025) | $50.1 billion |

| Cardano (ADA) | Market Cap (Nov 2025) | $19.037 billion |

| Vertcoin (VTC) | Reward Halving (Dec 2025) | From 12.5 VTC to 6.25 VTC |

Investors can substitute Cango Inc. stock with Bitcoin Exchange-Traded Funds (ETFs) for direct exposure. These vehicles offer a familiar, regulated wrapper for Bitcoin exposure, bypassing the operational risks associated with a miner like Cango Inc. The institutional embrace of these products is massive; global Bitcoin ETFs managed $179.5B in Assets Under Management (AUM) as of November 2025.

For instance, the iShares Bitcoin Trust ETF (IBIT) alone attracted over $67 billion in net assets and held 776,293.17 Bitcoin as of late 2025, representing approximately 4% of the total circulating supply of 19.95 million coins. That's a huge pool of capital that bypasses direct mining equity.

| Bitcoin ETF Metric | Value (Late 2025/Latest Data) |

|---|---|

| Global Bitcoin ETF AUM | $179.5B |

| iShares Bitcoin Trust (IBIT) Net Assets Attracted | Over $67 billion |

| IBIT Bitcoin Holdings | 776,293.17 BTC |

| IBIT Expense Ratio | 0.25% |

| Fidelity Wise Origin Bitcoin Fund (FBTC) AUM (Jan 2025) | Over $21 billion |

Cloud mining services offer an alternative to the capital-intensive ownership of physical hardware. You avoid the direct CapEx and operational headaches, which is a big draw when Cango Inc.'s all-in cost to mine was US$98,636 per Bitcoin in Q2 2025. The cloud mining platform market itself was estimated at $5 billion in 2025, projecting a 15% Compound Annual Growth Rate through 2033.

Still, these services compete for the same pool of capital looking for passive crypto income. Some platforms, like Hashj, already manage 28.3 EH/s of hashrate. Cango Inc.'s total capacity was 50 EH/s as of June 30, 2025, showing the scale of the competition in the hosting/leasing space.

| Cloud Mining Metric | Value (2025 Data) |

|---|---|

| Cloud Mining Platform Market Size (Estimated) | $5 billion |

| Projected Cloud Mining Platform CAGR (2025-2033) | 15% |

| Cango Inc. Q2 2025 All-in Cost per BTC | US$98,636 |

| Hashj Managed Hashrate | 28.3 EH/s |

| Cango Inc. Total Mining Capacity (June 30, 2025) | 50 EH/s |

Finance: draft 13-week cash view by Friday.

Cango Inc. (CANG) - Porter's Five Forces: Threat of new entrants

The barrier to entry in the sector Cango Inc. now primarily occupies-large-scale digital asset infrastructure and computing-is substantial, particularly concerning physical assets and energy sourcing.

Initial capital expenditure (CapEx) for hardware and infrastructure is a significant barrier to entry. While Cango Inc. has pursued an asset-light strategy for machine acquisition, securing physical operational control still requires considerable outlay. For instance, Cango Inc. acquired a 50 MW facility in Georgia in August 2025 for US$19.5 million to gain better operational control and power terms. This type of infrastructure acquisition sets a high initial bar for any new entrant aiming for similar operational stability.

Securing large-scale, low-cost power contracts is extremely difficult for new players. Cango Inc.'s strategy explicitly focuses on replicating its low-cost operational model, such as the one at its Georgia facility, in other favorable power markets, indicating that power sourcing is a critical, hard-to-replicate advantage. The all-in cost to mine for Cango Inc. in Q2 2025 was US$98,636 per Bitcoin, with cash costs at US$83,091 per Bitcoin; new entrants face the challenge of matching these costs without established, long-term energy agreements.

Cango Inc.'s US$352 million divestiture cash from the sale of its China-based assets in May 2025 provides a high capital base for rapid scaling, raising the barrier. This substantial liquidity, coupled with US$117.8 million in cash and cash equivalents as of June 30, 2025, allows Cango Inc. to pursue strategic acquisitions, such as the 18 EH/s acquisition in June 2025 that brought total capacity to 50 EH/s. New entrants must secure comparable, immediate funding to compete on scale.

The threat is moderated by the availability of asset-light models and equipment financing. Cango Inc.'s CEO noted that their asset-light strategy enables them to acquire on-rack machines with minimal upfront capital, allowing them to scale more quickly than vertically integrated competitors. This approach shifts operating expenses (opex) toward hosting and power costs rather than massive upfront CapEx for owned hardware.

Here's a quick look at Cango Inc.'s financial positioning supporting its competitive stance:

| Metric | Value (as of latest report) | Date/Period |

| Divestiture Cash Proceeds | US$352 million | May 2025 |

| Cash & Equivalents | US$117.8 million (RMB 843.8 million) | June 30, 2025 |

| Infrastructure Acquisition Cost (Example) | US$19.5 million | August 2025 |

| Total Mining Capacity | 50 EH/s | June 30, 2025 |

| All-in Cost per Bitcoin Mined | US$98,636 | Q2 2025 |

The reliance on an asset-light model means new entrants can potentially enter with less initial CapEx, but they will struggle to match Cango Inc.'s scale and established operational footprint.

Key factors influencing the threat level include:

- - Infrastructure acquisition costs, exemplified by the US$19.5 million Georgia facility purchase.

- - The US$352 million capital base from the China divestiture.

- - The ability to secure favorable, large-scale power agreements.

- - The success of Cango Inc.'s asset-light scaling approach.

- - The need for new entrants to match Cango Inc.'s 50 EH/s capacity.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.