|

Forge Global Holdings, Inc. (FRGE): Análisis de 5 Fuerzas [Actualizado en Ene-2025] |

Completamente Editable: Adáptelo A Sus Necesidades En Excel O Sheets

Diseño Profesional: Plantillas Confiables Y Estándares De La Industria

Predeterminadas Para Un Uso Rápido Y Eficiente

Compatible con MAC / PC, completamente desbloqueado

No Se Necesita Experiencia; Fáciles De Seguir

Forge Global Holdings, Inc. (FRGE) Bundle

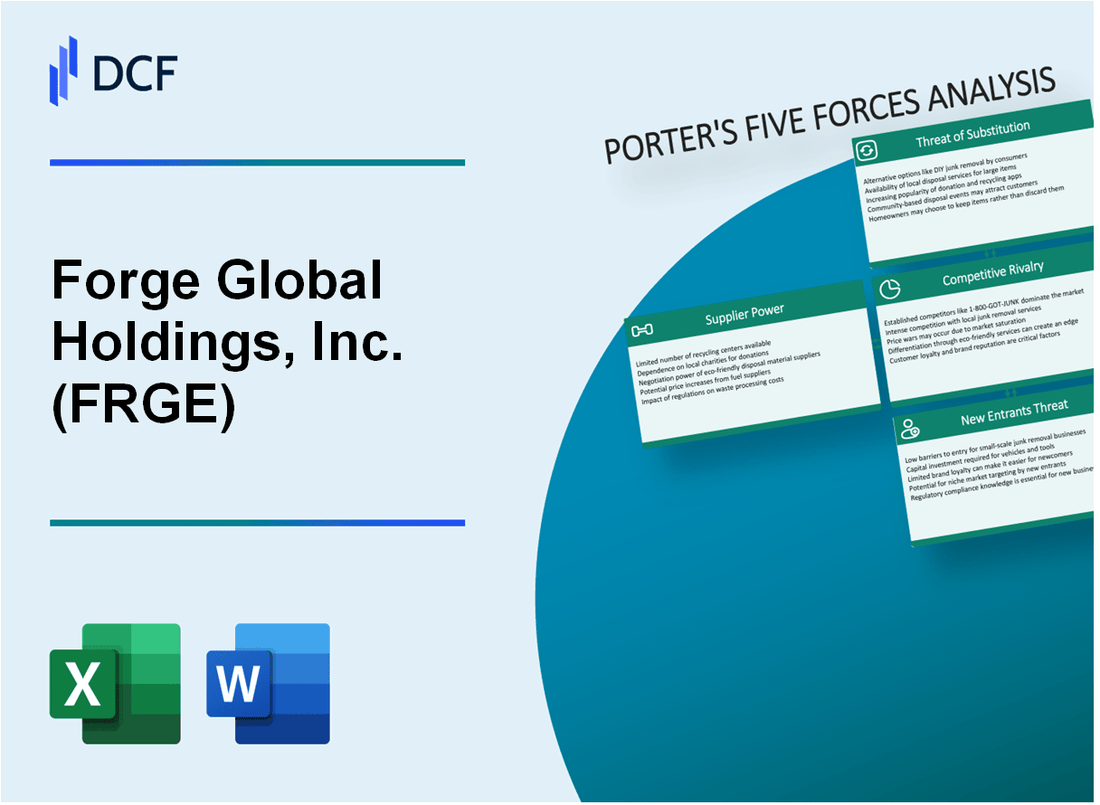

En el panorama dinámico de los mercados de valores privados, Forge Global Holdings, Inc. (FRGE) navega por un ecosistema complejo de fuerzas competitivas que dan forma a su posicionamiento estratégico. A medida que las plataformas digitales revolucionan las transacciones del mercado privado, comprender la intrincada dinámica del poder de los proveedores, las relaciones con los clientes, la competencia del mercado, los posibles sustitutos y las barreras de entrada se vuelven cruciales para los inversores y los analistas de la industria que buscan decodificar la ventaja competitiva de la compañía y el potencial de crecimiento futuro.

Forge Global Holdings, Inc. (FRGE) - Las cinco fuerzas de Porter: poder de negociación de los proveedores

Número limitado de tecnología especializada e infraestructura

Forge Global Holdings se basa en un grupo restringido de proveedores de tecnología especializados. A partir del cuarto trimestre de 2023, solo 3 proveedores principales de infraestructura en la nube dominan el mercado:

| Proveedor | Cuota de mercado | Ingresos anuales |

|---|---|---|

| Servicios web de Amazon | 32% | $ 80.1 mil millones |

| Microsoft Azure | 23% | $ 62.5 mil millones |

| Google Cloud | 10% | $ 23.4 mil millones |

Altos costos de conmutación para la infraestructura tecnológica central

El cambio de proveedores de infraestructura implica implicaciones financieras significativas:

- Los costos de migración estimados en $ 1.2 millones a $ 3.5 millones

- Riesgos potenciales de interrupción del servicio

- Personal de reentrenamiento: $ 250,000 - $ 500,000

- Gastos de transferencia de datos: $ 150,000 - $ 750,000

Dependencia de los proveedores clave de computación en la nube y gestión de datos

Métricas de dependencia de infraestructura de Forge Global:

| Categoría de proveedor | Nivel de dependencia | Gasto anual |

|---|---|---|

| Infraestructura en la nube | Alto | $ 12.3 millones |

| Gestión de datos | Medio | $ 5.7 millones |

| Servicios de ciberseguridad | Crítico | $ 3.2 millones |

Escenarios potenciales de bloqueo del proveedor para servicios de plataforma crítica

Riesgos de bloqueo de proveedores para Forge Global:

- Duración del contrato: Compromisos de 3-5 años

- Complejidad de integración: 18-24 meses Período de transición típico

- Mancaje de desempeño por terminación temprana del contrato: 15-25% del valor total del contrato

Forge Global Holdings, Inc. (FRGE) - Las cinco fuerzas de Porter: poder de negociación de los clientes

Análisis diverso de la base de clientes

Forge Global Holdings, Inc. reportó 153,000 usuarios registrados a partir del tercer trimestre de 2023, con inversores institucionales que representan el 62% del volumen total de transacciones.

| Categoría de cliente | Porcentaje de la base de usuarios | Volumen de transacción |

|---|---|---|

| Inversores institucionales | 62% | $ 4.2 mil millones |

| Inversores minoristas | 38% | $ 2.6 mil millones |

Costos de cambio de cliente

Costos de cambio de mercado de valores privados estimados en 3-5% del valor de transacción, con la complejidad de integración de la plataforma un factor clave.

- Tiempo de integración de plataforma promedio: 2-3 semanas

- Gastos de migración técnica: $ 15,000- $ 25,000

- Complejidad de transferencia de datos: medio

Factores de sensibilidad a los precios

Las tarifas de transacción de Forge Global varían de 0.5% a 2.5%, en comparación con las estructuras de tarifas de 1.0% a 3.0% de los competidores.

| Rango de tarifas | Tamaño de transacción | Ventaja comparativa |

|---|---|---|

| 0.5% - 2.5% | $ 100,000 - $ 10 millones | -15% en comparación con el promedio del mercado |

Transparencia de la transacción del mercado

Forge Global procesó $ 6.8 mil millones en transacciones de mercado privado en 2023, con el 87% de las transacciones completadas digitalmente.

- Porcentaje de transacción digital: 87%

- Tamaño promedio de la transacción: $ 425,000

- Tiempo de finalización de la transacción: 3-5 días hábiles

Forge Global Holdings, Inc. (FRGE) - Cinco fuerzas de Porter: rivalidad competitiva

Competencia intensa de plataformas de valores privados

Forge Global Holdings compite directamente con los siguientes mercados de valores privados:

| Competidor | Enfoque del mercado | Volumen de transacción anual |

|---|---|---|

| Equityzen | Empresas de tecnología previa a la OPI | $ 2.3 mil millones (2023) |

| Sharepost | Empresas respaldadas por la empresa | $ 1.8 mil millones (2023) |

| Forge Global | Diversos valores privados | $ 5.6 mil millones (2023) |

Tendencias de consolidación en el mercado de valores privados

Métricas de consolidación del mercado:

- Fusiones del mercado de valores privados: 3 transacciones significativas en 2023

- Índice de concentración de mercado: 0.68 (Herfindahl-Hirschman Índice)

- Tamaño promedio de la transacción: $ 12.4 millones por operación

Diferenciación a través de la tecnología y el volumen de transacciones

| Métrica de tecnología | Forge Global Performance |

|---|---|

| Velocidad de comercio de plataforma | 0.3 segundos por transacción |

| Inversores únicos anuales | 78,500 |

| Liquidez de la plataforma total | $ 7.2 mil millones |

Requisitos de innovación continua

Métricas de inversión de innovación:

- Gasto de I + D: $ 24.6 millones (2023)

- Patentes de tecnología presentadas: 12

- Nuevas características de plataforma lanzadas: 7

Forge Global Holdings, Inc. (FRGE) - Las cinco fuerzas de Porter: amenaza de sustitutos

Canales de inversión tradicionales como el capital de riesgo

Venture Capital Investments totalizaron $ 170.6 mil millones en 2022, con plataformas de inversión alternativas que compiten directamente con las ofertas del mercado privado de Forge Global.

| Categoría de inversión de capital de riesgo | Monto total de la inversión (2022) |

|---|---|

| Inversiones en etapa inicial | $ 74.5 mil millones |

| Inversiones en etapa tardía | $ 96.1 mil millones |

Alternativas de mercado público para la inversión

Los mercados de capital público ofrecen opciones de sustitución significativas con una capitalización de mercado global total de $ 95.3 billones a partir de 2023.

- S&P 500 Índice Valor de mercado total: $ 38.2 billones

- Capitalización total de mercado de NASDAQ: $ 19.7 billones

- Capitalización total de mercado de NYSE: $ 30.5 billones

Plataformas emergentes de blockchain y tokenización

Global Blockchain Market proyectado para alcanzar los $ 469 mil millones para 2030, presentando oportunidades sustanciales de sustitución de inversiones.

| Plataforma blockchain | Valor de transacción total (2023) |

|---|---|

| Ethereum | $ 1.7 billones |

| Binance Smart Chain | $ 1.2 billones |

Posibles criptomonedas y mecanismos de inversión de activos digitales

La capitalización del mercado de criptomonedas alcanzó los $ 1.67 billones en enero de 2024, ofreciendo alternativas de inversión directa.

- Bitcoin Market Cap: $ 832 mil millones

- Ethereum Market Cap: $ 276 mil millones

- Cape de mercado de Stablecoin: $ 142 mil millones

Forge Global Holdings, Inc. (FRGE) - Las cinco fuerzas de Porter: amenaza de nuevos participantes

Requisitos significativos de infraestructura tecnológica

Forge Global requiere una inversión anual de $ 12.5 millones en infraestructura tecnológica. Los costos de desarrollo de la plataforma oscilan entre $ 3-5 millones para la configuración inicial. La infraestructura de computación en la nube y ciberseguridad representa el 40% del gasto total de tecnología.

| Componente de infraestructura | Costo anual | Porcentaje del presupuesto tecnológico total |

|---|---|---|

| Servicios en la nube | $ 4.2 millones | 33.6% |

| Sistemas de ciberseguridad | $ 1.8 millones | 14.4% |

| Desarrollo de la plataforma de negociación | $ 3.5 millones | 28% |

Complejidades de cumplimiento regulatoria

Los costos de cumplimiento para las plataformas de negociación de valores promedian $ 2.7 millones anuales. Los requisitos reglamentarios incluyen:

- Tarifas de registro de la SEC: $ 500,000

- Costos de auditoría de cumplimiento anual: $ 750,000

- Gastos de consulta legal: $ 450,000

Inversión de capital inicial

Los nuevos participantes requieren una inversión de capital mínima de $ 25-30 millones para establecer una plataforma de negociación de valores privados competitivos. La financiación de capital de riesgo para plataformas similares promedió $ 18.6 millones en 2023.

Mecanismos de seguridad y confianza

La infraestructura de seguridad avanzada exige una inversión de $ 3.2 millones. Las tecnologías de blockchain y de cifrado representan componentes críticos.

| Componente de seguridad | Inversión anual |

|---|---|

| Cifrado avanzado | $ 1.1 millones |

| Integración de blockchain | $ 1.5 millones |

Protección de efectos de red

La red existente de Forge Global incluye 550,000 usuarios registrados. El volumen de transacciones de la plataforma alcanzó los $ 4.3 mil millones en 2023, creando barreras significativas para los nuevos participantes del mercado.

- Tasa de crecimiento de la base de usuarios: 22% anual

- Aumento del volumen de transacción: 35% año tras año

- Conexiones institucionales únicas: más de 180 instituciones financieras

Forge Global Holdings, Inc. (FRGE) - Porter's Five Forces: Competitive rivalry

The competitive rivalry within the private securities marketplace remains high, directly impacting Forge Global Holdings, Inc.'s operational results. You see this pressure reflected in the financials. For the first half of 2025 (H1 2025), Forge Global reported an Adjusted EBITDA loss of $14.3 million, against total revenues less transaction-based expenses of $52.7 million.

Direct competition from established Alternative Trading Systems (ATS) platforms like Nasdaq Private Market and StartEngine Secondary is a major factor. Nasdaq Private Market (NPM) facilitated over $6 billion in transaction value across its company-structured liquidity programs in 2024, and its private share market returned 3% in 2024. StartEngine reported year-to-date revenue of $92 million for 2025, supported by a community of over 2.1 million individuals and $1.5 billion invested on its platform.

Competition is also significant from other secondary marketplace platforms, such as EquityZen. EquityZen reported that its deal volume almost doubled from the first half of 2024 to the first half of 2025. In Q2 2025, the average discount for deals on that platform decreased to 13% from 28% in Q1 2025, suggesting shifting valuation dynamics that Forge Global must navigate.

The intensity of this rivalry contributes to consolidation risk, which materialized in late 2025. Forge Global confirmed in October 2025 that it was engaged in discussions regarding a potential sale with multiple parties, following unsolicited inbound indications of interest. This followed a significant drop in market valuation, with the market capitalization falling to approximately $250 million as of October 2025, down from an approximate $2 billion valuation at its 2021 SPAC merger. Ultimately, Charles Schwab acquired Forge Global in a $660 Million Deal on November 6, 2025.

Competition in this opaque market hinges on proprietary data assets and network effects. Forge Global ranks 1st amongst 26 active competitors, having raised a total of $250 million in funding across 6 rounds. As of December 31, 2024, the company employed 300 individuals.

Key comparative metrics in this competitive environment include:

| Metric | Forge Global Holdings (H1 2025) | Nasdaq Private Market (2024) | StartEngine (YTD 2025) |

| Trading/Transaction Value | $1.4 billion (Trading Volume) | Over $6 billion (Tender Offer Value) | $1.5 billion (Total Invested) |

| Revenue/Proceeds | $52.7 million (Revenue) | N/A | $92 million (Revenue) |

| Community/Employee Base | 300 (Employees, Dec 2024) | N/A | Over 2.1 million (Community) |

| Adjusted EBITDA Result | Loss of $14.3 million | N/A | Profitable (Implied by Revenue/Growth) |

The competitive landscape is further defined by the following factors impacting market share:

- - Trading volume reached $1.4 billion in H1 2025.

- - EquityZen Q2 2025 average discount was 13%.

- - Forge Global insider ownership stood at 50.22%.

- - Forge Global H1 2025 Net Loss was $28.6 million.

- - StartEngine hosted 75 Regulation A offerings as of March 31, 2025.

Forge Global Holdings, Inc. (FRGE) - Porter's Five Forces: Threat of substitutes

You're looking at the competitive landscape for Forge Global Holdings, Inc. (FRGE), and the threat of substitutes-other ways for private market participants to get liquidity or for companies to stay private-is definitely a key area to watch. Honestly, the landscape is shifting fast.

High threat from internal company liquidity programs and tender offers.

Forge Global Holdings, Inc. itself provides infrastructure for tender offers, which are a direct substitute for a secondary market transaction. A tender offer is a formal invitation to shareholders to sell shares back to the issuer or a third party at a specified price within a set time frame. These offers typically run for a set period, generally requiring at least 20 business days. The company leadership maintains full control over who buys shares, the price, and the volume, which can be a substitute for a broad secondary market for some shareholders.

The sheer amount of capital available privately also keeps companies from needing public markets or external secondary platforms. Financial sponsors, for instance, held about $2.6T in uncommitted capital as of mid-2025.

Here's a quick comparison of the liquidity mechanisms:

| Liquidity Mechanism | Key Feature | Typical Duration/Minimum |

| Forge Tender Offer | Single event, fixed share price | Set duration, often 20 business days minimum |

| Forge Customized Program | Ongoing opportunity, market-based price | Pre-set blackout dates, demand-based liquidity |

| M&A Exit | Acquisition by a larger entity | Example: Google's $32B acquisition of Wiz in Q1 2025 |

Threat from Initial Public Offerings (IPOs) is low; companies stay private longer (14 years median age).

The trend of companies staying private longer directly reduces the pool of potential public market transactions that Forge Global Holdings, Inc. might otherwise facilitate through its secondary market infrastructure. The median age of a company at the time of IPO now stands at 14 years. This is significantly up from the median age of 6 years in the 1980s. This extended private tenure means more years where liquidity needs must be met outside of a public offering, but it also means that when an IPO does happen, the company is more mature.

The shift is stark when you look at the historical context:

- Median age at IPO (1980s): 6 years

- Median age at IPO (1999): 5 years

- Median age at IPO (2024): 13.5 years

- Median age at IPO (2025 data point): 14 years

The revenue for companies going public has also increased, nearly doubling over the past two decades from $110 million in 2005 to $218 million.

Emerging threat from tokenized platforms like Jarsy offering fractional shares for as little as $10.

New technology platforms are directly challenging the traditional model of accessing private equity. Tokenized platforms, such as Jarsy, are an emerging substitute by democratizing access to these assets. Jarsy, for example, allows investors to buy fractional shares of premier private companies with minimums as low as $10. This platform, which raised $5 million in pre-seed funding, uses a 1:1 asset-backed token model, removing technical barriers for new investors while offering blockchain transparency. This low barrier to entry directly competes with platforms that might require higher minimums for similar secondary market access.

Alternative financing platforms like Secfi substitute the need to sell shares for option exercise.

For employees holding stock options, financing solutions offer a substitute for selling shares to cover exercise costs or for immediate cash needs. Secfi provides equity planning and financing services, helping over 40,000 startup employees manage equity worth nearly $45 billion in value to date. Secfi's financing model substitutes a full sale by offering cash while the user retains ownership, charging a 5% platform fee plus an Advance Rate and Equity Share on the exit value. This directly substitutes the need for a shareholder to sell their entire stake on a secondary market just to fund an option exercise or meet a tax bill.

Here are the key financial aspects of this substitute:

- Secfi employees helped: Over 40,000

- Total value of equity planned: Nearly $45 billion

- Secfi financing fee structure: 5% platform fee + Advance Rate + Equity Share

- Secfi total funding raised: $7 million across 4 rounds, with a latest debt round of $150 million in May 2021

Forge Global Holdings, Inc. (FRGE) - Porter's Five Forces: Threat of new entrants

You're looking at the barriers to entry for a new player trying to replicate what Forge Global Holdings, Inc. does in the private capital markets. Honestly, the threat from new entrants is decidedly low, primarily because the regulatory moat around this business is incredibly deep and expensive to cross.

The first major hurdle is regulatory compliance. Any new entity aiming to operate a marketplace for unregistered securities must secure registration as a broker-dealer and operate an Alternative Trading System (ATS) under the watchful eye of the Financial Industry Regulatory Authority (FINRA). This isn't a simple online filing; it requires substantial ongoing financial commitment. For instance, as of 2025, FINRA member firms with gross revenue exceeding $50 million up to $100 million face a Gross Income Assessment rate of 0.0738%. If a new entrant scales quickly, they immediately face these recurring regulatory overheads designed to cover FINRA's supervision and examination costs. Plus, every registered person incurs a Personnel Assessment fee, which is a direct, recurring cost of doing business.

Next, consider the capital investment needed just to build a compliant, scalable trading and custody technology stack. Forge Global Holdings, Inc. reported total Assets Under Custody of $17.6 billion as of March 31, 2025. Building the infrastructure to securely handle that volume, manage settlement, and provide data services requires millions in upfront and ongoing technology expenditure. The market itself values this established infrastructure highly; Charles Schwab agreed to acquire Forge Global Holdings, Inc. for $45 per share in cash, valuing the entire firm at $660 million. That valuation reflects the cost of the existing, proven technology and compliance framework, which a startup must match or exceed.

The established network effects act as a significant barrier, too. Network effects mean the platform becomes more valuable as more participants join. Forge Global Holdings, Inc. has a history of transactions that new entrants lack. In the first quarter of 2025, Forge reported a total trading volume of $692.4 million. This volume is a direct result of their established network of buyers and sellers. A new platform starts at zero liquidity, which is a massive disadvantage when dealing with illiquid private shares.

Finally, trust is the currency of private markets, and Forge Global Holdings, Inc. has spent years building it. New entrants face difficulty attracting the necessary volume of buyers and sellers without a proven track record of regulatory adherence and successful trade execution. The fact that Forge Global Holdings, Inc. was deemed an attractive acquisition target by a major financial institution like Charles Schwab, with a market capitalization around $609.83 million as of November 2025, signals a high level of validated trust and operational maturity that takes years to replicate.

Here's a quick look at the scale Forge Global Holdings, Inc. operates at, which sets the bar for any potential competitor:

| Metric | Value (as of late 2025) | Context |

|---|---|---|

| Acquisition Valuation | $660 million | Implied value of established platform and trust |

| Total Assets Under Custody | $17.6 billion | As of March 31, 2025 |

| Q1 2025 Trading Volume | $692.4 million | Demonstrates existing market liquidity |

| Market Capitalization | $609.83 million | As of November 2025 |

| FINRA Gross Income Assessment Rate (Revenue $50M-$100M) | 0.0738% | Example of an ongoing regulatory cost for established firms in 2025 |

The barriers to entry are structural, not just competitive. You're not just fighting another startup; you're fighting the regulatory framework and the established trust capital.

The key deterrents for new entrants include:

- Extremely high regulatory barriers, requiring FINRA broker-dealer and ATS registration.

- High capital investment required for building a scalable, compliant trading and custody technology stack.

- Significant barrier from established network effects and Forge Global Holdings, Inc.'s extensive private company data history.

- New entrants face difficulty building trust and attracting the necessary volume of buyers and sellers.

If onboarding takes 14+ days for a new platform to clear regulatory hurdles, churn risk rises for early adopters.

Finance: draft 13-week cash view by Friday.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.