|

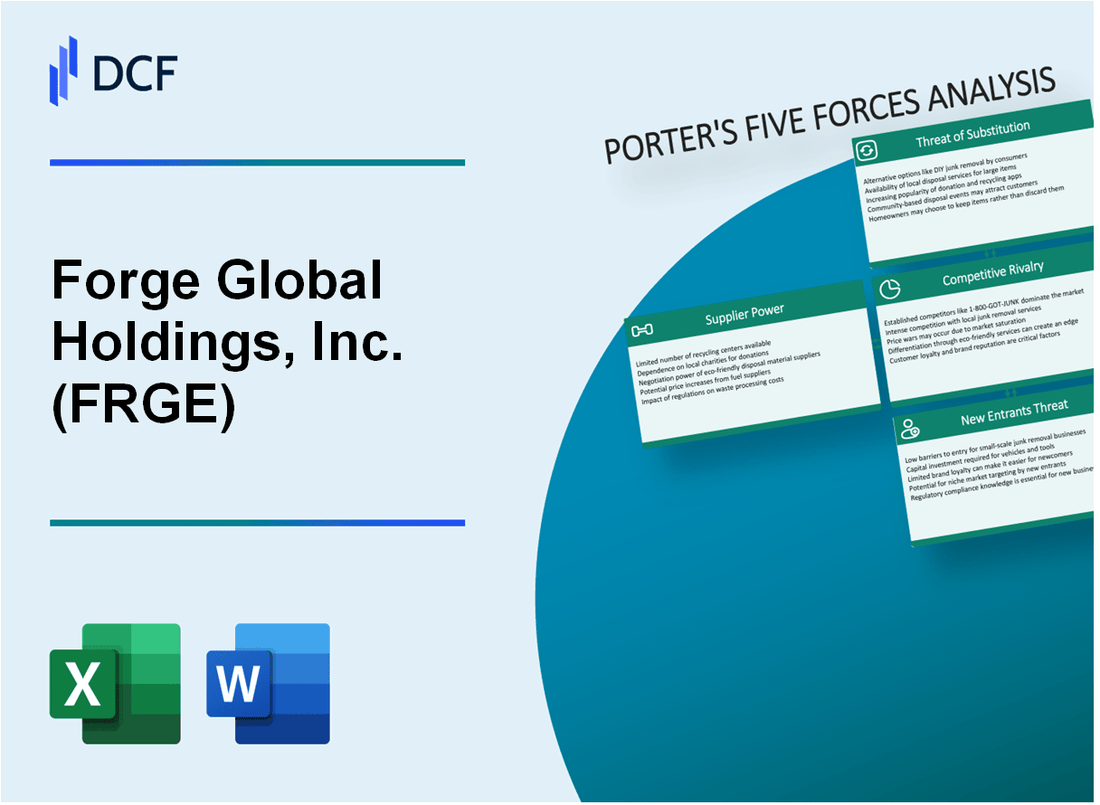

Forge Global Holdings, Inc. (FRGE): 5 forças Análise [Jan-2025 Atualizada] |

Totalmente Editável: Adapte-Se Às Suas Necessidades No Excel Ou Planilhas

Design Profissional: Modelos Confiáveis E Padrão Da Indústria

Pré-Construídos Para Uso Rápido E Eficiente

Compatível com MAC/PC, totalmente desbloqueado

Não É Necessária Experiência; Fácil De Seguir

Forge Global Holdings, Inc. (FRGE) Bundle

No cenário dinâmico dos mercados de valores mobiliários privados, a Forge Global Holdings, Inc. (FRGE) navega em um complexo ecossistema de forças competitivas que moldam seu posicionamento estratégico. À medida que as plataformas digitais revolucionam as transações do mercado privado, entender a intrincada dinâmica do poder do fornecedor, relacionamentos com clientes, concorrência de mercado, substitutos em potencial e barreiras à entrada se torna crucial para investidores e analistas do setor que buscam decodificar a vantagem competitiva da empresa e o potencial de crescimento futuro.

Forge Global Holdings, Inc. (FRGE) - As cinco forças de Porter: poder de barganha dos fornecedores

Número limitado de fornecedores de tecnologia e infraestrutura especializados

A Forge Global Holdings se baseia em um conjunto restrito de fornecedores de tecnologia especializados. A partir do quarto trimestre de 2023, apenas três principais fornecedores de infraestrutura em nuvem dominam o mercado:

| Provedor | Quota de mercado | Receita anual |

|---|---|---|

| Amazon Web Services | 32% | US $ 80,1 bilhões |

| Microsoft Azure | 23% | US $ 62,5 bilhões |

| Google Cloud | 10% | US $ 23,4 bilhões |

Altos custos de comutação para a infraestrutura tecnológica central

A troca de provedores de infraestrutura envolve implicações financeiras significativas:

- Custos de migração estimados em US $ 1,2 milhão a US $ 3,5 milhões

- Riscos de interrupção potencial de serviço

- Pessoal de reciclagem: US $ 250.000 - $ 500.000

- Despesas de transferência de dados: US $ 150.000 - US $ 750.000

Dependência de fornecedores de computação em nuvem e gerenciamento de dados importantes

Métricas de dependência de infraestrutura da Forge Global:

| Categoria de fornecedores | Nível de dependência | Gasto anual |

|---|---|---|

| Infraestrutura em nuvem | Alto | US $ 12,3 milhões |

| Gerenciamento de dados | Médio | US $ 5,7 milhões |

| Serviços de segurança cibernética | Crítico | US $ 3,2 milhões |

Cenários de bloqueio de fornecedores em potencial para serviços críticos de plataforma

Riscos de bloqueio de fornecedores para forge global:

- Duração do contrato: Compromissos de 3-5 anos

- Complexidade de integração: 18 a 24 meses de transição típica período de transição

- Pena de desempenho para rescisão precoce do contrato: 15-25% do valor total do contrato

Forge Global Holdings, Inc. (FRGE) - As cinco forças de Porter: poder de barganha dos clientes

Análise de base de clientes diversificada

A Forge Global Holdings, Inc. relatou 153.000 usuários registrados a partir do terceiro trimestre de 2023, com investidores institucionais representando 62% do volume total de transações.

| Categoria de cliente | Porcentagem de base de usuários | Volume de transação |

|---|---|---|

| Investidores institucionais | 62% | US $ 4,2 bilhões |

| Investidores de varejo | 38% | US $ 2,6 bilhões |

Custos de troca de clientes

Os custos de troca de mercado de valores mobiliários privados estimados em 3-5% do valor da transação, com a complexidade da integração da plataforma sendo um fator-chave.

- Tempo médio de integração da plataforma: 2-3 semanas

- Despesa de migração técnica: US $ 15.000 a US $ 25.000

- Complexidade de transferência de dados: médio

Fatores de sensibilidade ao preço

As taxas de transação da Forge Global variam de 0,5% a 2,5%, em comparação com as estruturas de taxas de 1,0% a 3,0% dos concorrentes.

| Intervalo de taxas | Tamanho da transação | Vantagem comparativa |

|---|---|---|

| 0.5% - 2.5% | US $ 100.000 - US $ 10 milhões | -15% em comparação com a média de mercado |

Transparência da transação de mercado

A Forge Global processou US $ 6,8 bilhões em transações de mercado privado em 2023, com 87% das transações concluídas digitalmente.

- Porcentagem de transação digital: 87%

- Tamanho médio da transação: $ 425.000

- Tempo de conclusão da transação: 3-5 dias úteis

Forge Global Holdings, Inc. (FRGE) - As cinco forças de Porter: rivalidade competitiva

Concorrência intensa de plataformas de valores mobiliários privados

A Forge Global Holdings compete diretamente com os seguintes mercados de valores mobiliários privados:

| Concorrente | Foco no mercado | Volume anual de transações |

|---|---|---|

| Equityzen | Empresas de tecnologia pré-IPO | US $ 2,3 bilhões (2023) |

| SharesPost | Empresas apoiadas por empreendimentos | US $ 1,8 bilhão (2023) |

| Forge global | Diversas valores mobiliários privados | US $ 5,6 bilhões (2023) |

Tendências de consolidação no mercado de valores mobiliários privados

Métricas de consolidação de mercado:

- Fusões do mercado de valores mobiliários privados: 3 transações significativas em 2023

- Índice de Concentração de Mercado: 0,68 (Índice Herfindahl-Hirschman)

- Tamanho médio da transação: US $ 12,4 milhões por negociação

Diferenciação através do volume de tecnologia e transação

| Métrica de tecnologia | Forge desempenho global |

|---|---|

| Velocidade de negociação da plataforma | 0,3 segundos por transação |

| Investidores únicos anuais | 78,500 |

| Liquidez total da plataforma | US $ 7,2 bilhões |

Requisitos de inovação contínuos

Métricas de investimento em inovação:

- Gastos de P&D: US $ 24,6 milhões (2023)

- Patentes de tecnologia arquivadas: 12

- Novos recursos de plataforma lançados: 7

Forge Global Holdings, Inc. (FRGE) - As cinco forças de Porter: ameaça de substitutos

Canais de investimento tradicionais como capital de risco

A Venture Capital Investments totalizou US $ 170,6 bilhões em 2022, com plataformas de investimento alternativas competindo diretamente com as ofertas de mercado privado da Forge Global.

| Categoria de investimento de capital de risco | Valor total do investimento (2022) |

|---|---|

| Investimentos em estágio inicial | US $ 74,5 bilhões |

| Investimentos em estágio final | US $ 96,1 bilhões |

Alternativas do mercado público para investimento

Os mercados de capital público oferecem opções de substituição significativas com capitalização total de mercado total de US $ 95,3 trilhões em 2023.

- Índice S&P 500 Valor de mercado total: US $ 38,2 trilhões

- Capitalização total de mercado da NASDAQ: US $ 19,7 trilhões

- NYSE TOTAL CAPITAÇÃO DE MERCADO: US $ 30,5 trilhões

Plataformas emergentes de blockchain e tokenização

O mercado global de blockchain se projetou para atingir US $ 469 bilhões até 2030, apresentando oportunidades substanciais de substituição de investimento.

| Plataforma blockchain | Valor total da transação (2023) |

|---|---|

| Ethereum | US $ 1,7 trilhão |

| Binance Smart Chain | US $ 1,2 trilhão |

Mecanismos potenciais de criptomoeda e investimento em ativos digitais

A capitalização de mercado da criptomoeda atingiu US $ 1,67 trilhão em janeiro de 2024, oferecendo alternativas de investimento direto.

- Bitcoin Market Cap: US $ 832 bilhões

- Cap de mercado Ethereum: US $ 276 bilhões

- Stablecoin Market Cap: US $ 142 bilhões

Forge Global Holdings, Inc. (FRGE) - As cinco forças de Porter: ameaça de novos participantes

Requisitos significativos de infraestrutura tecnológica

A Forge Global requer US $ 12,5 milhões para investimentos anuais em infraestrutura tecnológica. Os custos de desenvolvimento da plataforma variam entre US $ 3-5 milhões para a configuração inicial. A infraestrutura de computação em nuvem e segurança cibernética representa 40% do gasto total da tecnologia.

| Componente de infraestrutura | Custo anual | Porcentagem do orçamento de tecnologia total |

|---|---|---|

| Serviços em nuvem | US $ 4,2 milhões | 33.6% |

| Sistemas de segurança cibernética | US $ 1,8 milhão | 14.4% |

| Desenvolvimento da plataforma de negociação | US $ 3,5 milhões | 28% |

Complexidades de conformidade regulatória

Os custos de conformidade para plataformas de negociação de valores mobiliários têm uma média de US $ 2,7 milhões anualmente. Os requisitos regulatórios incluem:

- Taxas de registro da SEC: US $ 500.000

- Custos anuais de auditoria de conformidade: US $ 750.000

- Despesas de consulta legal: US $ 450.000

Investimento inicial de capital

Os novos participantes exigem investimento mínimo de capital de US $ 25 a 30 milhões para estabelecer uma plataforma competitiva de negociação de valores mobiliários privados. O financiamento de capital de risco para plataformas semelhantes em média de US $ 18,6 milhões em 2023.

Mecanismos de segurança e confiança

A infraestrutura de segurança avançada exige investimento de US $ 3,2 milhões. As tecnologias de blockchain e criptografia representam componentes críticos.

| Componente de segurança | Investimento anual |

|---|---|

| Criptografia avançada | US $ 1,1 milhão |

| Integração de blockchain | US $ 1,5 milhão |

Proteção de efeitos de rede

A rede existente da Forge Global inclui 550.000 usuários registrados. O volume de transações da plataforma atingiu US $ 4,3 bilhões em 2023, criando barreiras significativas para novos participantes do mercado.

- Taxa de crescimento da base de usuários: 22% anualmente

- Aumento do volume da transação: 35% ano a ano

- Conexões institucionais únicas: 180+ instituições financeiras

Forge Global Holdings, Inc. (FRGE) - Porter's Five Forces: Competitive rivalry

The competitive rivalry within the private securities marketplace remains high, directly impacting Forge Global Holdings, Inc.'s operational results. You see this pressure reflected in the financials. For the first half of 2025 (H1 2025), Forge Global reported an Adjusted EBITDA loss of $14.3 million, against total revenues less transaction-based expenses of $52.7 million.

Direct competition from established Alternative Trading Systems (ATS) platforms like Nasdaq Private Market and StartEngine Secondary is a major factor. Nasdaq Private Market (NPM) facilitated over $6 billion in transaction value across its company-structured liquidity programs in 2024, and its private share market returned 3% in 2024. StartEngine reported year-to-date revenue of $92 million for 2025, supported by a community of over 2.1 million individuals and $1.5 billion invested on its platform.

Competition is also significant from other secondary marketplace platforms, such as EquityZen. EquityZen reported that its deal volume almost doubled from the first half of 2024 to the first half of 2025. In Q2 2025, the average discount for deals on that platform decreased to 13% from 28% in Q1 2025, suggesting shifting valuation dynamics that Forge Global must navigate.

The intensity of this rivalry contributes to consolidation risk, which materialized in late 2025. Forge Global confirmed in October 2025 that it was engaged in discussions regarding a potential sale with multiple parties, following unsolicited inbound indications of interest. This followed a significant drop in market valuation, with the market capitalization falling to approximately $250 million as of October 2025, down from an approximate $2 billion valuation at its 2021 SPAC merger. Ultimately, Charles Schwab acquired Forge Global in a $660 Million Deal on November 6, 2025.

Competition in this opaque market hinges on proprietary data assets and network effects. Forge Global ranks 1st amongst 26 active competitors, having raised a total of $250 million in funding across 6 rounds. As of December 31, 2024, the company employed 300 individuals.

Key comparative metrics in this competitive environment include:

| Metric | Forge Global Holdings (H1 2025) | Nasdaq Private Market (2024) | StartEngine (YTD 2025) |

| Trading/Transaction Value | $1.4 billion (Trading Volume) | Over $6 billion (Tender Offer Value) | $1.5 billion (Total Invested) |

| Revenue/Proceeds | $52.7 million (Revenue) | N/A | $92 million (Revenue) |

| Community/Employee Base | 300 (Employees, Dec 2024) | N/A | Over 2.1 million (Community) |

| Adjusted EBITDA Result | Loss of $14.3 million | N/A | Profitable (Implied by Revenue/Growth) |

The competitive landscape is further defined by the following factors impacting market share:

- - Trading volume reached $1.4 billion in H1 2025.

- - EquityZen Q2 2025 average discount was 13%.

- - Forge Global insider ownership stood at 50.22%.

- - Forge Global H1 2025 Net Loss was $28.6 million.

- - StartEngine hosted 75 Regulation A offerings as of March 31, 2025.

Forge Global Holdings, Inc. (FRGE) - Porter's Five Forces: Threat of substitutes

You're looking at the competitive landscape for Forge Global Holdings, Inc. (FRGE), and the threat of substitutes-other ways for private market participants to get liquidity or for companies to stay private-is definitely a key area to watch. Honestly, the landscape is shifting fast.

High threat from internal company liquidity programs and tender offers.

Forge Global Holdings, Inc. itself provides infrastructure for tender offers, which are a direct substitute for a secondary market transaction. A tender offer is a formal invitation to shareholders to sell shares back to the issuer or a third party at a specified price within a set time frame. These offers typically run for a set period, generally requiring at least 20 business days. The company leadership maintains full control over who buys shares, the price, and the volume, which can be a substitute for a broad secondary market for some shareholders.

The sheer amount of capital available privately also keeps companies from needing public markets or external secondary platforms. Financial sponsors, for instance, held about $2.6T in uncommitted capital as of mid-2025.

Here's a quick comparison of the liquidity mechanisms:

| Liquidity Mechanism | Key Feature | Typical Duration/Minimum |

| Forge Tender Offer | Single event, fixed share price | Set duration, often 20 business days minimum |

| Forge Customized Program | Ongoing opportunity, market-based price | Pre-set blackout dates, demand-based liquidity |

| M&A Exit | Acquisition by a larger entity | Example: Google's $32B acquisition of Wiz in Q1 2025 |

Threat from Initial Public Offerings (IPOs) is low; companies stay private longer (14 years median age).

The trend of companies staying private longer directly reduces the pool of potential public market transactions that Forge Global Holdings, Inc. might otherwise facilitate through its secondary market infrastructure. The median age of a company at the time of IPO now stands at 14 years. This is significantly up from the median age of 6 years in the 1980s. This extended private tenure means more years where liquidity needs must be met outside of a public offering, but it also means that when an IPO does happen, the company is more mature.

The shift is stark when you look at the historical context:

- Median age at IPO (1980s): 6 years

- Median age at IPO (1999): 5 years

- Median age at IPO (2024): 13.5 years

- Median age at IPO (2025 data point): 14 years

The revenue for companies going public has also increased, nearly doubling over the past two decades from $110 million in 2005 to $218 million.

Emerging threat from tokenized platforms like Jarsy offering fractional shares for as little as $10.

New technology platforms are directly challenging the traditional model of accessing private equity. Tokenized platforms, such as Jarsy, are an emerging substitute by democratizing access to these assets. Jarsy, for example, allows investors to buy fractional shares of premier private companies with minimums as low as $10. This platform, which raised $5 million in pre-seed funding, uses a 1:1 asset-backed token model, removing technical barriers for new investors while offering blockchain transparency. This low barrier to entry directly competes with platforms that might require higher minimums for similar secondary market access.

Alternative financing platforms like Secfi substitute the need to sell shares for option exercise.

For employees holding stock options, financing solutions offer a substitute for selling shares to cover exercise costs or for immediate cash needs. Secfi provides equity planning and financing services, helping over 40,000 startup employees manage equity worth nearly $45 billion in value to date. Secfi's financing model substitutes a full sale by offering cash while the user retains ownership, charging a 5% platform fee plus an Advance Rate and Equity Share on the exit value. This directly substitutes the need for a shareholder to sell their entire stake on a secondary market just to fund an option exercise or meet a tax bill.

Here are the key financial aspects of this substitute:

- Secfi employees helped: Over 40,000

- Total value of equity planned: Nearly $45 billion

- Secfi financing fee structure: 5% platform fee + Advance Rate + Equity Share

- Secfi total funding raised: $7 million across 4 rounds, with a latest debt round of $150 million in May 2021

Forge Global Holdings, Inc. (FRGE) - Porter's Five Forces: Threat of new entrants

You're looking at the barriers to entry for a new player trying to replicate what Forge Global Holdings, Inc. does in the private capital markets. Honestly, the threat from new entrants is decidedly low, primarily because the regulatory moat around this business is incredibly deep and expensive to cross.

The first major hurdle is regulatory compliance. Any new entity aiming to operate a marketplace for unregistered securities must secure registration as a broker-dealer and operate an Alternative Trading System (ATS) under the watchful eye of the Financial Industry Regulatory Authority (FINRA). This isn't a simple online filing; it requires substantial ongoing financial commitment. For instance, as of 2025, FINRA member firms with gross revenue exceeding $50 million up to $100 million face a Gross Income Assessment rate of 0.0738%. If a new entrant scales quickly, they immediately face these recurring regulatory overheads designed to cover FINRA's supervision and examination costs. Plus, every registered person incurs a Personnel Assessment fee, which is a direct, recurring cost of doing business.

Next, consider the capital investment needed just to build a compliant, scalable trading and custody technology stack. Forge Global Holdings, Inc. reported total Assets Under Custody of $17.6 billion as of March 31, 2025. Building the infrastructure to securely handle that volume, manage settlement, and provide data services requires millions in upfront and ongoing technology expenditure. The market itself values this established infrastructure highly; Charles Schwab agreed to acquire Forge Global Holdings, Inc. for $45 per share in cash, valuing the entire firm at $660 million. That valuation reflects the cost of the existing, proven technology and compliance framework, which a startup must match or exceed.

The established network effects act as a significant barrier, too. Network effects mean the platform becomes more valuable as more participants join. Forge Global Holdings, Inc. has a history of transactions that new entrants lack. In the first quarter of 2025, Forge reported a total trading volume of $692.4 million. This volume is a direct result of their established network of buyers and sellers. A new platform starts at zero liquidity, which is a massive disadvantage when dealing with illiquid private shares.

Finally, trust is the currency of private markets, and Forge Global Holdings, Inc. has spent years building it. New entrants face difficulty attracting the necessary volume of buyers and sellers without a proven track record of regulatory adherence and successful trade execution. The fact that Forge Global Holdings, Inc. was deemed an attractive acquisition target by a major financial institution like Charles Schwab, with a market capitalization around $609.83 million as of November 2025, signals a high level of validated trust and operational maturity that takes years to replicate.

Here's a quick look at the scale Forge Global Holdings, Inc. operates at, which sets the bar for any potential competitor:

| Metric | Value (as of late 2025) | Context |

|---|---|---|

| Acquisition Valuation | $660 million | Implied value of established platform and trust |

| Total Assets Under Custody | $17.6 billion | As of March 31, 2025 |

| Q1 2025 Trading Volume | $692.4 million | Demonstrates existing market liquidity |

| Market Capitalization | $609.83 million | As of November 2025 |

| FINRA Gross Income Assessment Rate (Revenue $50M-$100M) | 0.0738% | Example of an ongoing regulatory cost for established firms in 2025 |

The barriers to entry are structural, not just competitive. You're not just fighting another startup; you're fighting the regulatory framework and the established trust capital.

The key deterrents for new entrants include:

- Extremely high regulatory barriers, requiring FINRA broker-dealer and ATS registration.

- High capital investment required for building a scalable, compliant trading and custody technology stack.

- Significant barrier from established network effects and Forge Global Holdings, Inc.'s extensive private company data history.

- New entrants face difficulty building trust and attracting the necessary volume of buyers and sellers.

If onboarding takes 14+ days for a new platform to clear regulatory hurdles, churn risk rises for early adopters.

Finance: draft 13-week cash view by Friday.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.