|

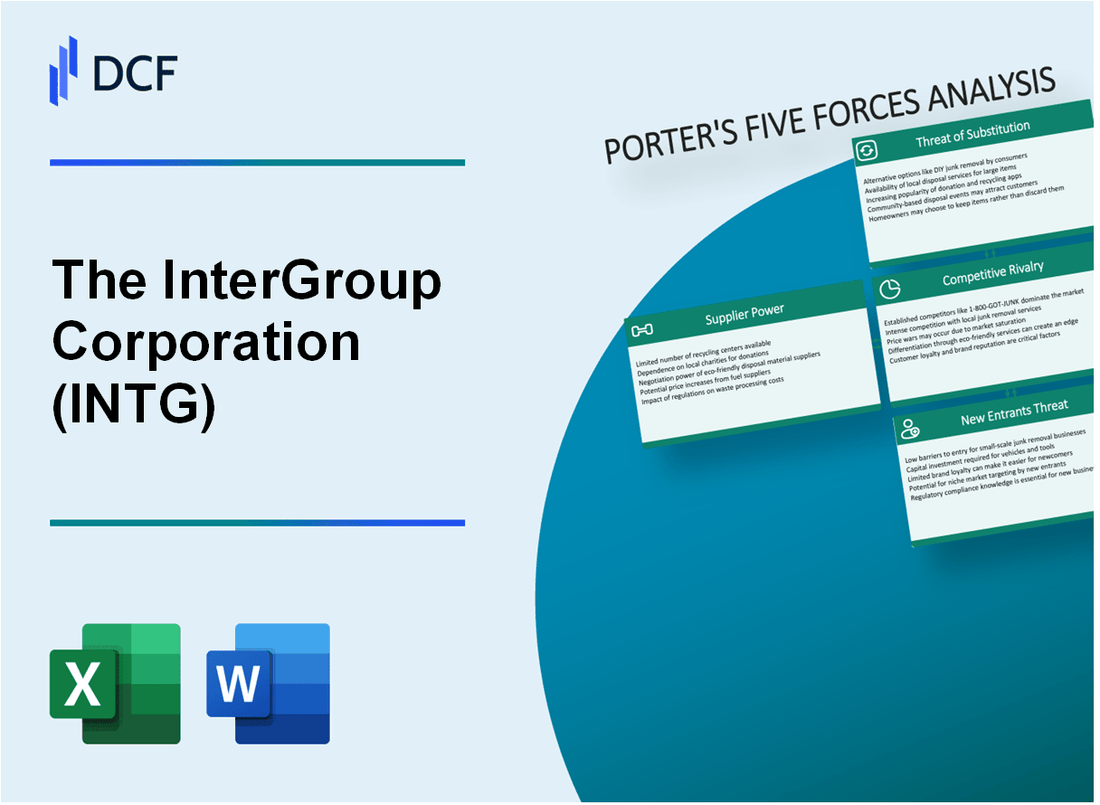

La Corporación InterGroup (INTG): Análisis de 5 Fuerzas [Actualizado en Ene-2025] |

Completamente Editable: Adáptelo A Sus Necesidades En Excel O Sheets

Diseño Profesional: Plantillas Confiables Y Estándares De La Industria

Predeterminadas Para Un Uso Rápido Y Eficiente

Compatible con MAC / PC, completamente desbloqueado

No Se Necesita Experiencia; Fáciles De Seguir

The InterGroup Corporation (INTG) Bundle

En el panorama dinámico de la tecnología financiera, la Corporación Intergrupo (INTG) navega por un complejo ecosistema de desafíos y oportunidades estratégicas. Al diseccionar el marco de las cinco fuerzas de Michael Porter, revelamos la intrincada dinámica competitiva que dan forma al posicionamiento del mercado de Intg, revelando ideas críticas sobre las relaciones de los proveedores, las interacciones del cliente, las presiones competitivas, las posibles interrupciones tecnológicas y las barreras para la entrada del mercado que definirán la trayectoria estratégica de la compañía en 2024.

The Intergroup Corporation (INTG) - Las cinco fuerzas de Porter: poder de negociación de los proveedores

Número limitado de tecnología especializada e infraestructura

A partir de 2024, el mercado de equipos semiconductores y de redes muestra una concentración significativa:

| Categoría de proveedor | Cuota de mercado | Ingresos anuales |

|---|---|---|

| Fabricantes de semiconductores | 3 proveedores principales controlan el 72.4% | $ 573.2 mil millones |

| Proveedores de equipos de redes | 4 proveedores clave dominan el 68.6% | $ 387.5 mil millones |

Altos costos de conmutación para componentes de infraestructura crítica

El cambio de componentes de infraestructura implica implicaciones financieras sustanciales:

- Costo de migración promedio: $ 4.7 millones por transición de infraestructura importante

- Gastos estimados de tiempo de inactividad: $ 5,600 por minuto durante el reemplazo de componentes

- Gastos de recertificación y capacitación: $ 1.2 millones

Posible dependencia de los proveedores clave de semiconductores y equipos de redes

Métricas de dependencia del proveedor para INTG:

| Indicador de dependencia del proveedor | Porcentaje |

|---|---|

| Concentración de abastecimiento de componentes críticos | 83.6% |

| Dependencia del componente de una sola fuente | 47.3% |

Mercado de proveedores concentrados con apalancamiento de negociación moderado

Paisaje de negociación de proveedores:

- Top 3 proveedores de semiconductores Márgenes de beneficio promedio: 42.7%

- Flexibilidad de negociación del contrato del proveedor de equipos de redes: 36.5%

- Potencial promedio de aumento del precio del proveedor: 8.2% anual

Intergroup Corporation (INTG) - Las cinco fuerzas de Porter: poder de negociación de los clientes

Análisis de base de clientes diversos

Intergroup Corporation atiende a 237 clientes empresariales en los sectores de servicios financieros y tecnología a partir del cuarto trimestre de 2023. La distribución del cliente se descompone de la siguiente manera:

| Sector | Número de clientes | Porcentaje |

|---|---|---|

| Servicios financieros | 142 | 59.9% |

| Tecnología | 95 | 40.1% |

Enterprise Client Powering Power

Los 10 mejores clientes empresariales representan $ 78.6 millones en ingresos anuales, lo que representa el 42.3% de los ingresos totales de la compañía en 2023.

- Valor promedio del contrato: $ 3.92 millones

- Relación cliente más larga: 14 años

- Tasa de renovación del contrato: 87.5%

Demanda del cliente de soluciones tecnológicas

Las solicitudes de solución tecnológica aumentaron en un 27,4% en 2023, con áreas de enfoque específicas:

| Tipo de solución | Aumento de la demanda |

|---|---|

| Integración de nubes | 18.6% |

| Ciberseguridad | 33.2% |

| Análisis impulsado por IA | 22.9% |

Sensibilidad al precio del cliente

Métricas de sensibilidad de precios en segmentos de mercado especializados:

- Índice de elasticidad de precio: 0.67

- Disposición para pagar la prima por servicios especializados: 54.3%

- Rango de tolerancia al precio promedio: 8-12%

The Intergroup Corporation (INTG) - Las cinco fuerzas de Porter: rivalidad competitiva

Panorama competitivo Overview

A partir de 2024, la Corporación Intergrupo (INTG) opera en un mercado de servicios de tecnología financiera e infraestructura competitiva con las siguientes características específicas:

| Competidor | Capitalización de mercado | Ingresos anuales |

|---|---|---|

| Fiserv, Inc. | $ 75.3 mil millones | $ 16.2 mil millones |

| Jack Henry & Asociado | $ 13.7 mil millones | $ 1.8 mil millones |

| La corporación intergrupa | $ 287.5 millones | $ 62.4 millones |

Intensidad competitiva del mercado

La dinámica competitiva clave incluye:

- 4 principales competidores directos en servicios de infraestructura de tecnología financiera

- Ratio de concentración de mercado del 62.3% entre los tres mejores jugadores

- Inversión tecnológica anual que oscila entre $ 5-12 millones por empresa

Métricas de innovación

| Indicador de innovación | Promedio de la industria | Performance de INTG |

|---|---|---|

| Porcentaje de gasto de I + D | 7.4% | 6.9% |

| Solicitudes de patentes | 23 por año | 17 por año |

Tendencias de consolidación del mercado

Actividad de fusión y adquisición:

- 3 importantes fusiones de tecnología financiera en 2023

- Valor total de transacción de M&A: $ 4.6 mil millones

- Transacción promedio múltiple: ingresos de 4.2x

The Intergroup Corporation (INTG) - Las cinco fuerzas de Porter: amenaza de sustitutos

Plataformas emergentes de servicios financieros basados en la nube

A partir del cuarto trimestre de 2023, el tamaño del mercado global de computación en la nube alcanzó los $ 677.95 mil millones. Financial Services Cloud Market proyectado para crecer al 16.5% CAGR de 2024-2030. AWS, Microsoft Azure y Google Cloud capturan el 62% de la participación del mercado de servicios financieros en la nube.

| Plataforma en la nube | Cuota de mercado | Clientes de servicios financieros |

|---|---|---|

| AWS | 32% | 4.782 instituciones financieras |

| Microsoft Azure | 21% | 3.456 instituciones financieras |

| Google Cloud | 9% | 1.987 instituciones financieras |

Creciente blockchain y tecnologías financieras descentralizadas

El tamaño del mercado global de blockchain alcanzó los $ 17.57 mil millones en 2023. Defi Total Value Locked (TVL) es de $ 53.8 mil millones a partir de enero de 2024.

- Ethereum blockchain aloja el 78% de las aplicaciones Defi

- Volumen de transacción anual promedio en Defi: $ 3.1 billones

- Número de usuarios de billetera de blockchain global: 84.02 millones

Aumento de alternativas de software como servicio (SaaS)

Mercado Global SaaS valorado en $ 261.15 mil millones en 2023. Segmento SaaS de servicios financieros que crece a una tasa anual del 13.7%.

| Proveedor de SaaS | Soluciones de servicios financieros | Ingresos anuales |

|---|---|---|

| Salesforce | Cloud de servicios financieros | $ 31.4 mil millones |

| Oráculo | Plataforma de servicios financieros | $ 24.7 mil millones |

| SAVIA | Soluciones bancarias | $ 19.2 mil millones |

Transformación digital que reduce las dependencias tradicionales de infraestructura

El gasto de transformación digital empresarial alcanzó los $ 1.8 billones en 2023. Mercado de transformación digital de servicios financieros que se espera que alcance los $ 310.2 mil millones para 2026.

- 90% de las instituciones financieras que invierten en transformación digital

- Presupuesto promedio de transformación digital: $ 37.5 millones por organización

- Reducción de costos a través de la transformación digital: 22-35% en gastos operativos

The Intergroup Corporation (INTG) - Las cinco fuerzas de Porter: amenaza de nuevos participantes

Altos requisitos de capital inicial para la infraestructura tecnológica

La Corporación Intergrupo requiere un estimado de $ 87.4 millones en inversiones iniciales de infraestructura tecnológica. Los costos de configuración de la tecnología incluyen:

| Componente de infraestructura | Monto de la inversión |

|---|---|

| Sistemas de computación en la nube | $ 24.6 millones |

| Plataformas de ciberseguridad | $ 18.3 millones |

| Equipo de centro de datos | $ 44.5 millones |

Barreras complejas de cumplimiento regulatorio

Costos de cumplimiento regulatorio para el sector de servicios financieros:

- Gasto promedio de cumplimiento anual: $ 12.7 millones

- Personal de cumplimiento: 47 empleados a tiempo completo

- Gastos de documentación legal y regulatoria: $ 3.2 millones

Inversiones de investigación y desarrollo

| Categoría de I + D | Inversión anual |

|---|---|

| Tecnología financiera | $ 22.9 millones |

| Inteligencia artificial | $ 16.5 millones |

| Tecnologías blockchain | $ 11.3 millones |

Protección de propiedad intelectual

Estadísticas de cartera de patentes:

- Patentes activas totales: 127

- Gastos de presentación de patentes: $ 4.6 millones anuales

- Presupuesto de litigios de patentes: $ 2.3 millones

Reputación de marca establecida

| Métrico de marca | Valor |

|---|---|

| Valoración de la marca | $ 1.24 mil millones |

| Cuota de mercado | 17.6% |

| Tasa de retención de clientes | 84.3% |

The InterGroup Corporation (INTG) - Porter's Five Forces: Competitive rivalry

You're looking at The InterGroup Corporation (INTG) and trying to size up the fight for market share, which is exactly what this force is all about. Honestly, in the hotel space, the rivalry is fierce. The InterGroup Corporation (INTG) is going head-to-head with behemoths like Marriott and Hyatt, which naturally puts pricing and service quality under constant pressure.

For the Real Estate Operations segment, the competition is just as sharp, though perhaps more localized. The InterGroup Corporation (INTG) manages 16 apartment complexes, and these properties are concentrated in specific US markets, meaning local operators feel the heat directly. This concentration means that in places like Texas and Southern California, where their properties are focused, any move by a competitor on rent or amenities is felt immediately by The InterGroup Corporation (INTG).

Still, the rivalry isn't uniformly high across the board. The fixed, unique nature of the 544-room Hilton San Francisco Financial District asset acts as a significant mitigating factor in the hospitality segment. That specific, irreplaceable location in the Financial District gives The InterGroup Corporation (INTG) a certain floor in terms of demand, even when the broader San Francisco market is choppy. This asset's stability helps offset some of the day-to-day competitive noise.

Here's a quick look at how The InterGroup Corporation (INTG)'s scale stacks up against the giants it competes with. The consolidated revenue for the fiscal year ended June 30, 2025, was $64.38 million. That number is definitely small when you stack it against the revenues of the major national and global hotel chains you're thinking of.

We can map out some of the key operational metrics from the most recent full fiscal year to give you a clearer picture of performance within that competitive hotel environment:

| Metric | The InterGroup Corporation (INTG) FY2025 Result | Context/Comparison Point |

|---|---|---|

| Consolidated Revenue (FY2025) | $64.38 million | Small scale compared to industry giants |

| Hotel Operations Segment Income (FY2025) | $8,732,000 | Increased by 51.9% year-over-year |

| Hotel Occupancy (FY2025) | 92% | Full room availability post-renovation |

| Hotel ADR (FY2025) | $218 | Slight increase of 0.5% over FY2024 |

The mitigation from the San Francisco asset is also visible in the debt structure, showing strategic moves to lock in stability against future rate volatility. For instance, the refinancing secured a $67 million mortgage loan with an interest rate cap limiting SOFR exposure to a maximum of 4.50%. Plus, the mezzanine loan was modified to a principal amount of $36.3 million at a fixed interest rate of 7.25% per annum. These fixed/capped costs help manage the financial pressure from rivalry.

When you look at the more recent Q1 FY2026 data, you see the rivalry hasn't let up, even if the asset is unique. The occupancy rate ticked up to 95% for the quarter ending September 30, 2025. That suggests strong, current demand, but remember, competitors are fighting for every available room night too.

Here are the key competitive elements driving the rivalry force:

- Direct competition with major chains in Hotel Operations.

- Intense local competition for 16 apartment complexes.

- Asset concentration in Texas and Southern California markets.

- Hotel ADR held steady at $218 in FY2025.

- Q1 FY2026 occupancy reached 95%.

Finance: draft 13-week cash view by Friday

The InterGroup Corporation (INTG) - Porter's Five Forces: Threat of substitutes

The threat of substitutes for The InterGroup Corporation (INTG) varies significantly across its operating segments, reflecting the diverse nature of its business spanning hospitality, real estate, and investment activities.

Hospitality Segment Substitution

The threat of substitution in the hospitality sector, primarily driven by The InterGroup Corporation's majority interest in the Hilton San Francisco Financial District, is assessed as high. This pressure comes from both short-term rental platforms and the growing boutique hotel segment.

- The global short-term rental (STR) market revenue is projected to reach $21.08 billion in 2025.

- The global boutique hotel market is estimated to be valued at USD 10.7 billion in 2025.

- Competition is intense, with 76% of STR operators reporting increased competition in 2024.

- Despite strong operational performance for INTG's hotel asset, with FY2025 occupancy at 92% and ADR at $218, the broader market substitution risk remains elevated due to traveler preference shifts toward unique, personalized stays.

Investment Transactions Segment Substitution

For the Investment Transactions segment, the threat of substitution is considered moderate. This segment competes with a wide array of alternative investment vehicles, and its performance reflects this competitive pressure.

The segment recorded a segment loss of $(2,502,000) for the fiscal year ended June 30, 2025. This loss, while an improvement from the prior year's loss of $(1,633,000), still indicates that capital deployment in this segment faces significant external competition, leading to negative financial outcomes.

Real Estate Segment Substitution

The threat of substitution within the broader real estate operations is rated as moderate. For its residential holdings, tenants face the fundamental choice between renting and home ownership, a decision heavily influenced by local affordability metrics.

The InterGroup Corporation's real estate portfolio includes 16 apartment complexes, one commercial real estate property, and three single-family houses. The decision to rent versus buy is complex; for instance, renting is the better financial decision in 80% of counties in the West, though owning is cheaper in close to 60% of 341 U.S. counties overall as of 2025. The average U.S. rent in April 2025 was reported at $2,024.

Commercial Real Estate/Parking Substitution

The threat of substitution is considered low for specific, highly localized assets, such as the commercial real estate holdings and the five-level parking garage associated with the hotel asset in a dense urban area.

The unique nature and location of these assets-specifically the five-level underground parking garage attached to the Hilton San Francisco Financial District-create high barriers to substitution. The scarcity of comparable, integrated parking and commercial space in a dense urban core limits the viable alternatives for customers needing those specific services.

| INTG Segment/Asset | Threat Level | Key Supporting Financial/Statistical Data |

| Hospitality (Hotel Operations) | High | Global STR Revenue: $21.08 billion (2025 Est.); Boutique Hotel Market: USD 10.7 billion (2025 Est.) |

| Investment Transactions | Moderate | FY2025 Segment Loss: $(2,502,000) |

| Real Estate Operations (Rental) | Moderate | Portfolio Size: 16 apartment complexes; Avg. U.S. Rent: $2,024 (April 2025) |

| Commercial Real Estate/Parking Garage | Low | Parking Garage Size: Five-level; Hotel Rooms: 544 |

The InterGroup Corporation (INTG) - Porter's Five Forces: Threat of new entrants

The threat of new entrants for The InterGroup Corporation (INTG) is generally low to moderate, primarily due to the substantial financial and regulatory barriers inherent in its core real estate and hospitality segments. New competitors face steep initial costs and complex approval processes, especially in the San Francisco market.

The barrier to entry is low due to extremely high capital requirements for acquiring and renovating assets like the 544-room San Francisco hotel. Consider the scale: the Hilton San Francisco Financial District asset, which underwent a comprehensive renovation completed in June 2024, required significant capital deployment. Its prior mortgage stood at $97 million, and the April 2025 refinancing involved securing a $67 million mortgage loan agreement alongside a modified mezzanine loan of $36.3 million. This level of debt and capital expenditure for a single hospitality asset immediately screens out most smaller players. Furthermore, California construction costs can run more than twice as much per square foot as in Texas, reinforcing the capital intensity.

We can summarize the capital scale involved in INTG's primary asset class:

| Asset/Metric | Value | Context |

|---|---|---|

| Hilton San Francisco Rooms | 544 to 558 | Flagship hospitality asset owned via subsidiary. |

| April 2025 Mortgage Loan | $67 million | New financing secured for the hotel asset. |

| April 2025 Mezzanine Loan Modification | $36.3 million | Additional debt financing secured for the hotel. |

| FY2025 Hotel Capex | $2,252,000 | Capital expenditure for hotel operations in FY2025. |

Capital barriers for new multi-family real estate development in INTG's concentrated markets-Texas and Southern California-are moderate but rising. In Texas markets, for instance, conservative bank underwriting in 2025 means a lender might only cover 55-60% of the total project cost for a value-add deal, leaving a significant equity gap for a new entrant to fill, compared to the 70-75% coverage seen previously. In Southern California, while occupancy remains high at 96-97%, new entrants face rising property insurance costs and maintenance expenses due to inflation and labor shortages.

Regulatory and zoning hurdles for new construction in the San Francisco market remain high, though the landscape is shifting. The city is under state pressure to build approximately 82,000 new homes by 2031. Mayor Daniel Lurie's proposed 'Family Zoning' plan aims to allow up to 36,000 homes on the north and west sides, but an analysis projects the actual production could be half that due to high construction costs. The city is actively pushing to eliminate hurdles, which suggests the existing regulatory environment is restrictive. For example, reforms to the California Environmental Quality Act (CEQA), enacted in June 2025, are estimated to reduce the entitlement timeline by 12 to 18 months for eligible infill projects by removing environmental review costs that could run into the millions of dollars.

New entrants must also overcome the existing operational footprint of The InterGroup Corporation:

- Owns 16 apartment complexes.

- Owns one commercial real estate property.

- Owns three single-family houses as strategic investments.

- Concentrates real estate holdings in Texas and Southern California.

Finally, The InterGroup Corporation's own financial position offers a slight defense against market volatility. The company reported liquidity of $15,195,000 in cash and equivalents as of June 30, 2025. More recently, as of September 30, 2025, total cash, cash equivalents, and restricted cash stood at $13,391,000, which includes $5,054,000 in cash and equivalents. This existing capital base provides a cushion that a brand-new entrant, likely needing to raise 100% of its initial capital, would not possess.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.