|

Fathom Holdings Inc. (FTHM): 5 Analyse des forces [Jan-2025 MISE À JOUR] |

Entièrement Modifiable: Adapté À Vos Besoins Dans Excel Ou Sheets

Conception Professionnelle: Modèles Fiables Et Conformes Aux Normes Du Secteur

Pré-Construits Pour Une Utilisation Rapide Et Efficace

Compatible MAC/PC, entièrement débloqué

Aucune Expertise N'Est Requise; Facile À Suivre

Fathom Holdings Inc. (FTHM) Bundle

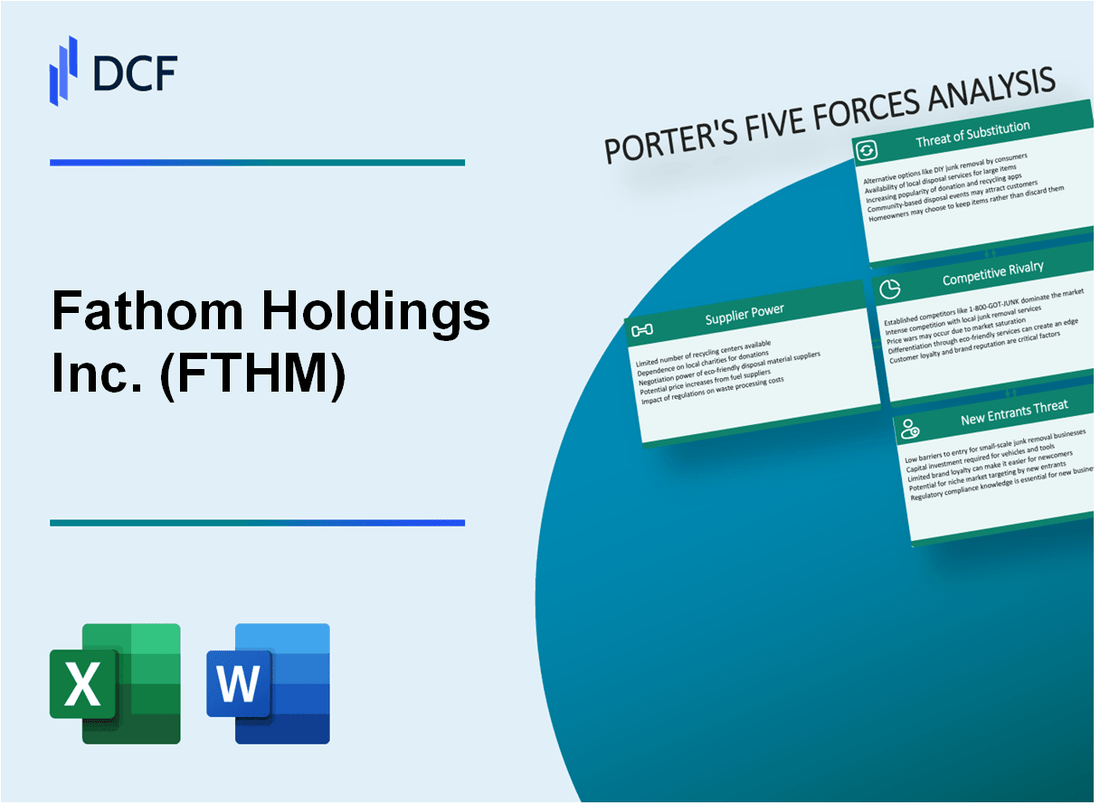

Dans le monde dynamique du marketing numérique immobilier, Fathom Holdings Inc. (FTHM) navigue dans un paysage complexe façonné par le cadre stratégique de Michael Porter. Alors que la technologie remodeler la façon dont les professionnels de l'immobilier se connectent, commercialisent et concluent des offres, la compréhension des forces concurrentielles devient cruciale. Cette analyse dévoile la dynamique complexe de 5 Forces critiques du marché qui définissent le positionnement stratégique du FTHM, révélant les défis et les opportunités dans un écosystème proptech en évolution rapide où l'innovation, les attentes des clients et les perturbations technologiques se croisent.

Fathom Holdings Inc. (FTHM) - Porter's Five Forces: Bargaining Power des fournisseurs

Paysage des fournisseurs de technologies et de logiciels

Depuis 2024, Fathom Holdings Inc. fait face à un marché des fournisseurs de technologies concentrés avec des alternatives limitées. Le secteur de la technologie de marketing numérique immobilier montre les caractéristiques de concentration des fournisseurs suivantes:

| Catégorie des fournisseurs | Nombre de prestataires | Concentration de parts de marché |

|---|---|---|

| Infrastructure cloud | 3-4 fournisseurs majeurs | 82,5% de concentration du marché |

| Plateformes logicielles immobilières | 5-6 fournisseurs spécialisés | 76,3% de concentration du marché |

| Services de gestion des données | 4-5 Solutions d'entreprise | 71,9% de concentration du marché |

Facteurs de dépendance technologique

Fathom Holdings démontre des dépendances critiques sur les fournisseurs de technologies spécialisées:

- Amazon Web Services (AWS) fournit 67,3% de l'infrastructure cloud

- Microsoft Azure couvre 22,5% des services cloud

- Google Cloud Platform représente 10,2% de l'infrastructure cloud restante

Analyse des coûts de commutation

Le changement de fournisseur technologique implique des implications financières importantes:

| Catégorie de coût de commutation | Plage de coûts estimés |

|---|---|

| Migration des données | $75,000 - $250,000 |

| Reconfiguration de la plate-forme | $45,000 - $150,000 |

| Formation et intégration | $30,000 - $85,000 |

Risques à augmentation des prix potentiels

La dynamique des prix des fournisseurs indique des escalades de coûts annuels potentiels:

- Le prix des infrastructures cloud augmente: 7,2% - 12,5% par an

- Plateformes de technologie immobilière spécialisée: 6,8% - 11,3% Ajustements annuels des prix

- Services de gestion des données: 5,5% - 9,7%.

Fathom Holdings Inc. (FTHM) - Porter's Five Forces: Bargaining Power of Clients

Faible coût de commutation pour les professionnels de l'immobilier

Fathom Holdings Inc. a déclaré 8 500 agents immobiliers dans son réseau au T3 2023, avec un coût d'abonnement mensuel moyen de 450 $ par agent. Coût de commutation de plate-forme de marketing numérique estimé à environ 2 à 3 semaines de temps de transition.

Analyse diversifiée de la clientèle

| Segment de clientèle | Nombre d'utilisateurs | Pénétration du marché |

|---|---|---|

| Agents indépendants | 6,200 | 72.9% |

| Petites maisons de courtage | 1,850 | 21.8% |

| Grands réseaux de courtage | 450 | 5.3% |

Métriques de sensibilité aux prix

Le prix moyen des services de marketing numérique dans le secteur immobilier varie de 300 $ à 750 $ par mois. Les prix de Fathom se positionnent à 450 $, représentant le taux du marché médian de 0,8x.

Demandes des clients pour des solutions

- Exigences de personnalisation: 68% des agents recherchent des outils de marketing personnalisés

- Priorité de rentabilité: 73% Comparez les prix sur toutes les plateformes

- Demande d'intégration technologique: 82% nécessitent une compatibilité CRM sans couture

Attentes du service technologique

Les attentes de la technologie client comprennent: 1,2 million de dollars d'investissement annuel dans l'innovation de la plate-forme, avec 41% du développement s'est concentré sur les outils de marketing axés sur l'IA.

Fathom Holdings Inc. (FTHM) - Five Forces de Porter: Rivalité compétitive

Paysage concurrentiel du marché

Depuis le quatrième trimestre 2023, Fathom Holdings Inc. opère sur un marché compétitif de technologies immobilières avec les principaux concurrents suivants:

| Concurrent | Segment de marché | Revenus annuels |

|---|---|---|

| EXP World Holdings | Technologie immobilière | 1,19 milliard de dollars (2022) |

| Groupe zillow | Plateforme immobilière | 3,3 milliards de dollars (2022) |

| Redfin Corporation | Brokerage immobilier numérique | 1,44 milliard de dollars (2022) |

Métriques d'intensité compétitive

L'analyse de la rivalité compétitive révèle:

- Taille totale du marché adressable: 78,6 milliards de dollars (secteur de la technologie immobilière)

- Nombre de concurrents directs: 12-15 joueurs importants

- Ratio de concentration du marché: fragmentation modérée

Compétition technologique

Les mesures d'investissement technologique du FTHM:

- Dépenses de R&D: 4,2 millions de dollars (2022)

- Applications de brevet technologique: 3 nouveaux dépôts en 2023

- Taille de l'équipe de développement de logiciels: 47 ingénieurs

Prix de la pression concurrentielle

Données de comparaison des prix:

| Service | Prix du FTHM | Moyenne de l'industrie |

|---|---|---|

| Commission de courtage | 1.5% | 2.5-3% |

| Frais de plate-forme technologique | 59,95 $ / mois | 79 $ - 99 $ / mois |

Dynamique des parts de marché

Analyse des parts de marché:

- Part de marché du FTHM: 1,2% du marché des technologies immobilières

- Croissance de la part de marché sur l'autre en glissement annuel: 0,3%

- Total des transactions traitées: 78 000 (2022)

Fathom Holdings Inc. (FTHM) - Five Forces de Porter: Menace de substituts

Méthodes de marketing traditionnelles comme alternatives

En 2024, les méthodes de marketing immobilier traditionnelles continuent de représenter des menaces de substitution importantes. Les dépenses publicitaires imprimées dans l'immobilier restent à 1,2 milliard de dollars par an. Le marketing de publipostage génère environ 780 millions de dollars de revenus de marketing immobilier.

Alternatives d'outil de marketing numérique

Les plates-formes de marketing numérique gratuites et à faible coût présentent des risques substituts substantiels:

| Plate-forme | Utilisateurs mensuels | Coût marketing |

|---|---|---|

| Toile | 60 millions | $0-$12.99 |

| Mailchimp | 14 millions | $0-$17 |

| Hootsuite | 18 millions | $49-$99 |

Capacités de marketing des médias sociaux

Les plateformes sociales offrent des alternatives marketing avec une portée significative:

- Facebook: 2,9 milliards d'utilisateurs actifs mensuels

- Instagram: 2 milliards d'utilisateurs actifs mensuels

- LinkedIn: 875 millions d'utilisateurs professionnels

- Tiktok: 1,5 milliard d'utilisateurs actifs mensuels

Solutions de marketing internes

Brokerages immobiliers développant des capacités de marketing interne:

| Type de courtage | Adoption du marketing interne |

|---|---|

| Écarts de courtage | 68% |

| Courtages moyens | 42% |

| Petites maisons de courtage | 23% |

Paysage de plate-forme de marketing numérique

Taille du marché des plates-formes de marketing numérique immobilier: 3,6 milliards de dollars en 2024, avec une croissance annuelle prévue de 12,5%.

Fathom Holdings Inc. (FTHM) - Five Forces de Porter: Menace de nouveaux entrants

Exigences de capital initial faibles pour les plateformes de marketing numérique

En 2024, les coûts de démarrage de la plate-forme de marketing numérique varient de 5 000 $ à 25 000 $, les solutions basées sur le cloud réduisant les investissements initiaux d'infrastructure.

| Type de plate-forme | Investissement initial | Coût d'exploitation mensuel moyen |

|---|---|---|

| Plateforme de marketing numérique de base | $7,500 | $1,200 |

| Solution de marketing immobilier avancée | $22,000 | $3,500 |

Accessibilité technologique croissante

Les coûts de cloud computing ont diminué de 33,4% entre 2020-2023, permettant une entrée de marché plus facile pour les plateformes numériques.

Potentiel pour les startups technologiques dans le marketing numérique immobilier

- Le financement de la startup proptech a atteint 12,8 milliards de dollars en 2023

- Le marché des technologies immobilières prévoyait une croissance à 16,8% du TCAC

- Les investissements en capital-risque dans les solutions immobilières numériques ont augmenté de 27% sur une année

Intérêt croissant des investisseurs

| Catégorie d'investissement | 2022 total ($ b) | 2023 total ($ b) | Pourcentage de croissance |

|---|---|---|---|

| Investissements proptech | 10.2 | 12.8 | 25.5% |

| Marketing numérique immobilier | 3.6 | 4.9 | 36.1% |

Défis dans le renforcement de la réputation de la marque

Le coût d'acquisition des clients dans le marketing immobilier numérique est en moyenne de 85 $ à 215 $ par avance qualifiée.

- Délai moyen pour établir la crédibilité du marché: 18-24 mois

- Le développement de la confiance des clients nécessite des mesures de performance cohérentes

- La reconnaissance de la marque nécessite un minimum d'investissement marketing annuel de 50 000 $

Fathom Holdings Inc. (FTHM) - Porter's Five Forces: Competitive rivalry

You're looking at Fathom Holdings Inc. in a market packed with established players and fast-moving tech disruptors. The competitive rivalry here is definitely intense; it's a fight for agent loyalty and market share in a low-margin business. Fathom Holdings Inc. is using its structure to punch above its weight, but the pressure from both legacy brokerages and other tech-enabled platforms is constant.

Fathom Holdings Inc.'s flat-fee model is highly disruptive, driving price competition. This model directly challenges the traditional commission split structure, forcing competitors to either lower their fees or offer significantly more value to retain their agents. This dynamic puts downward pressure on overall industry margins, but it's the core of Fathom Holdings Inc.'s strategy to attract agents looking for higher splits and lower overhead. The company's ability to grow its agent base despite this pressure shows the model is resonating.

The numbers from Q3 2025 clearly show Fathom Holdings Inc. is gaining ground in this competitive arena. Agent count grew 24.1% to 15,371 in Q3 2025, indicating market share gains. This isn't just about adding bodies; it's about bringing productive agents onto a platform that promises better economics. Also, Q3 2025 revenue surged 37.7% to $115.3 million, showing strong momentum against rivals. Honestly, that kind of top-line growth suggests their competitive positioning is working, at least in terms of recruitment and transaction volume.

To see how this growth stacks up operationally against the backdrop of rivalry, look at these key Q3 2025 metrics:

| Metric | Q3 2025 Value | Year-over-Year Change |

| Total Revenue | $115.3 million | 37.7% increase |

| Licensed Agents | 15,371 | 24.1% increase |

| Real Estate Transactions | 11,479 | 23.0% increase |

| Brokerage Revenue | $109.2 million | 39.0% increase |

| Adjusted EBITDA | $6,000 | Improvement from negative $1.4 million in Q3 2024 |

The rivalry is also being fought on the ancillary services front. Fathom Holdings Inc. is using its integrated platform to create stickiness, which is a smart move when agents can easily switch brokerages. The title segment, for instance, saw revenue climb 28.6% year-over-year, even as they invested heavily to expand. This focus on attachment rates-like the 70% mortgage attach rate at the recently acquired START Real Estate-is a direct competitive lever against rivals who only offer brokerage services.

Here are some specific competitive actions Fathom Holdings Inc. took in the recent period that fuel this rivalry:

- Acquired START Real Estate, adding approx. 70 agents.

- Expanded Verus Title into Arizona and Alabama, now in 34 states.

- Onboarded over 165 agents to the high-margin Elevate program.

- Reported a low agent turnover rate of just 1% per month.

- Secured a partnership with By Owner, accessing FSBO leads.

While the revenue growth is strong, the competition for profitability is still fierce. The adjusted EBITDA for the quarter was only $6,000, which, while positive for the second straight quarter, shows how much of that revenue growth is being reinvested or eaten up by costs associated with scaling and competition. The brokerage segment generated $1.6 million in adjusted EBITDA, but the title segment posted a loss of $191,000 due to growth expenses. Finance: draft the Q4 cash flow projection factoring in the planned IntelliAgent marketing spend by next Wednesday.

Fathom Holdings Inc. (FTHM) - Porter's Five Forces: Threat of substitutes

The threat of substitutes for Fathom Holdings Inc. centers on alternative methods sellers use to transact real estate, bypassing the traditional agent-centric model that Fathom Holdings Inc. supports. You need to see the hard numbers to gauge the actual pressure here.

For-Sale-By-Owner (FSBO) remains a viable, commission-free substitute for sellers. However, the data from late 2025 shows this threat is diminishing significantly. In 2025, only 5% of homeowners sold their homes on their own, which is an all-time low. Contrast that with the 91% of sellers who used a real estate agent, a record high. The financial incentive to go solo is often negated by the final sale price. In 2025, the median sale price for FSBO homes was $360,000, while agent-assisted homes commanded a median of $425,000. That price gap means FSBO sellers left approximately 28.6% to 28.9% of potential value on the table. Even with the shift in commission rules, 75% of FSBO sellers still ended up paying the buyer agent's commission, typically between 2.5% and 3%. Furthermore, 36% of those who start as FSBO eventually hire an agent due to roadblocks or paperwork issues.

iBuyers offer a fast, certain sale process that bypasses the agent model. While the iBuyer segment has seen volatility, with market share dropping to about 1% of the national market in 2022, the remaining players still present an alternative for speed. For instance, one major iBuyer reported a 4% revenue increase in the first quarter of 2025. The convenience factor is the primary draw, allowing sellers to skip staging and repairs, though offers are typically below full market value.

Fathom Holdings Inc.'s low-fee structure partially mitigates the cost incentive of substitution. Fathom Holdings Inc. operates on a 100% commission model, charging agents a flat fee per transaction instead of royalties or franchise fees. Effective January 1, 2024, the agent's annual fee was set at $700. The company also layers on a High-Value Property Fee structure to capture more value from larger transactions:

| Property Price Range | Additional Fee Amount |

|---|---|

| $600,000 to $999,999 | $200 |

| Above $1,000,000 | $250 per every $500,000 tier |

This structure, combined with strong top-line performance-Q3 2025 revenue hit $115.3 million, a 38% year-over-year increase-suggests the agent value proposition is strong enough to keep agents from defecting to commission-free models.

Ancillary services create a more holistic platform, making the agent more defintely sticky. Fathom Holdings Inc.'s focus on integrating these services directly counters the simplicity of a pure FSBO or iBuyer transaction by offering a one-stop shop. The growth in these areas shows traction:

- Title revenue in Q2 2025 reached $1.5 million, an 88% year-over-year increase.

- Mortgage segment revenue in Q2 2025 was $3.3 million.

- The Elevate concierge program had onboarded over 70 agents by Q2 2025, averaging eight closings per year per agent, with a goal of over 300 agents by year-end 2025.

- The agent network grew 24% in Q3 2025, supporting the overall transaction growth of 23% in that quarter.

Fathom Holdings Inc. (FTHM) - Porter's Five Forces: Threat of new entrants

When we look at the threat of new entrants for Fathom Holdings Inc. (FTHM), we see a dynamic where the very nature of their business model both lowers one barrier while simultaneously erecting others through technology and scale.

The cloud-based brokerage model, which Fathom Holdings Inc. champions, inherently presents a lower capital barrier to entry compared to the brick-and-mortar firms of the past. You don't need massive physical office footprints to support a national agent base anymore. This democratization of access means new, lean competitors can start up with less initial outlay for real estate. Still, the market is not wide open; the barrier shifts from physical assets to technological sophistication and agent density.

Building a competitive proprietary technology platform like Fathom Holdings Inc.'s intelliAgent is now a significant barrier to entry. This isn't just a CRM; it's the core operating system. The fact that Fathom Holdings Inc. is now licensing this technology, as seen with the agreement with Sovereign Realty Partners in Q2 2025, shows management views the platform itself as a competitive moat. New entrants must either spend heavily to replicate this integrated tech stack or rely on third-party, less-integrated solutions, which puts them at an immediate productivity disadvantage.

Fathom Holdings Inc.'s achieved scale creates a substantial barrier that new entrants will struggle to match quickly. As of September 30, 2025, Fathom Holdings Inc.'s network stood at approximately 15,371 agent licenses, representing a year-over-year growth of 24.1%. New competitors face the difficult task of recruiting and retaining that many agents in a competitive environment, especially when established players offer proven support systems.

The validation of the scalable, lower-overhead model is evident in the financial results. Achieving positive Adjusted EBITDA, as seen with $6,000 in Q3 2025, proves that once a certain scale is reached, the fixed-cost structure of the cloud-based operation can generate profit. This profitability, even if modest, signals to potential entrants that the model works, but also shows the high hurdle of reaching that inflection point.

Here's a quick look at the operational scale and financial validation points as of the end of Q3 2025:

| Metric | Q3 2025 Value | Context/Significance |

| Agent Licenses | 15,371 | Substantial scale barrier to overcome. |

| Adjusted EBITDA | $6,000 | Second consecutive quarter of positive profitability. |

| Total Revenue | $115.3 million | Reflects 37.7% year-over-year growth. |

| Real Estate Transactions | 11,479 | Represents a 23.0% year-over-year increase. |

The threat is further mitigated by the success of agent-centric programs that increase stickiness, which new entrants would need to immediately match:

- The Elevate program is scaling, with over 165 agents onboarded and another 45 in the pipeline as of Q3 2025.

- The company is actively expanding ancillary services, with Verus Title expanding into Arizona and Alabama.

- The brokerage segment's Adjusted EBITDA increased by 100% to $1.6 million for Q3 2025 compared to 2024.

Honestly, while the initial software investment is lower than building a national office chain, the required investment in proprietary tech like intelliAgent and the cost of acquiring agent density make the true barrier to entry quite high for any competitor aiming for Fathom Holdings Inc.'s level of operational efficiency.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.