|

Rush Enterprises, Inc. (RushB): 5 Analyse des forces [Jan-2025 MISE À JOUR] |

Entièrement Modifiable: Adapté À Vos Besoins Dans Excel Ou Sheets

Conception Professionnelle: Modèles Fiables Et Conformes Aux Normes Du Secteur

Pré-Construits Pour Une Utilisation Rapide Et Efficace

Compatible MAC/PC, entièrement débloqué

Aucune Expertise N'Est Requise; Facile À Suivre

Rush Enterprises, Inc. (RUSHB) Bundle

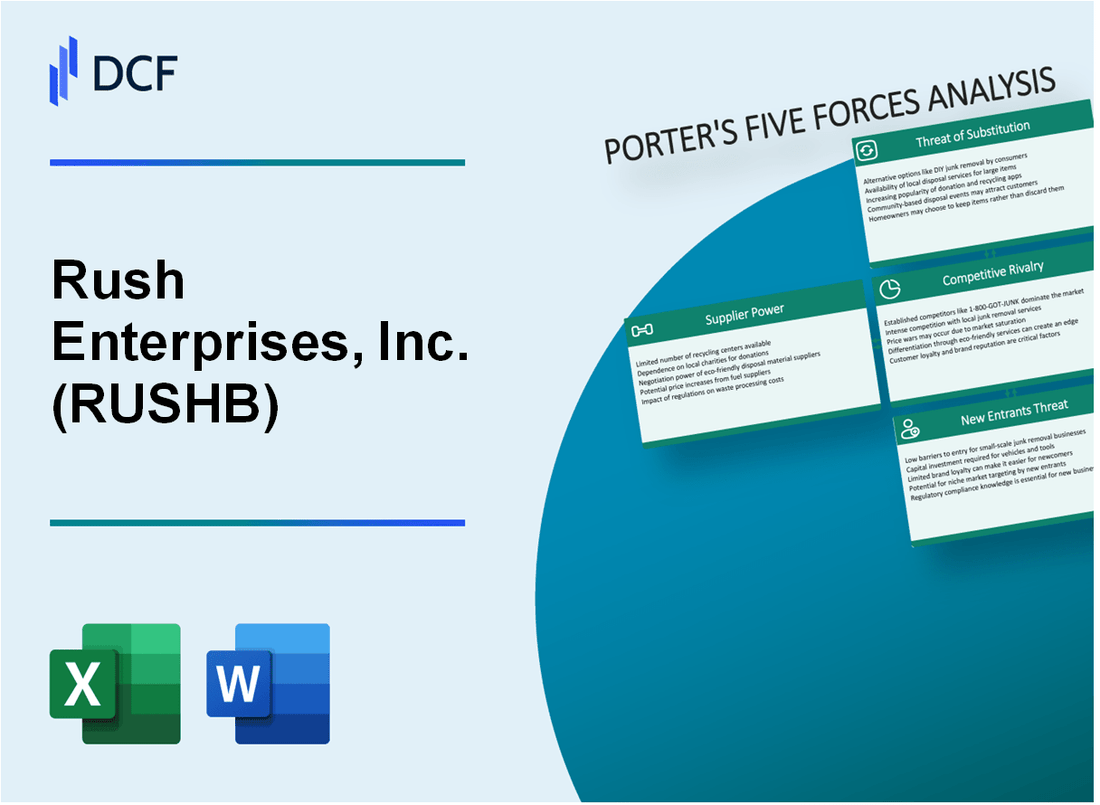

Plongez dans le paysage stratégique de Rush Enterprises, Inc. (RUSHB), où la dynamique complexe du pouvoir des fournisseurs, des relations avec les clients, de la concurrence du marché, des perturbations technologiques et des barrières de l'industrie convergent pour façonner un écosystème complexe de véhicules commerciaux. En tant qu'acteur de premier plan dans le sud-ouest des États-Unis, Rush Enterprises navigue sur un marché difficile défini par des fabricants limités, l'évolution des technologies de transport et des pressions concurrentielles intenses qui exigent une agilité stratégique et des offres de services innovantes.

Rush Enterprises, Inc. (RushB) - Five Forces de Porter: Poste de négociation des fournisseurs

Nombre limité de fabricants de camions et de véhicules commerciaux lourds

Depuis 2024, le marché de la fabrication de véhicules et de véhicules commerciaux en service lourd est dominé par quelques acteurs clés:

| Fabricant | Part de marché | Volume de production annuel |

|---|---|---|

| Peterbilt | 22.5% | 87 600 véhicules |

| Kenworth | 19.3% | 75 200 véhicules |

| Navistar | 16.7% | 65 000 véhicules |

Dépendance aux principaux fournisseurs

Rush Enterprises s'appuie de manière critique sur ces fabricants:

- Peterbilt (filiale PACCAR): fournit 38,6% de l'inventaire des camions de Rush

- Kenworth (filiale PACCAR): fournit 32,4% de l'inventaire des camions

- Navistar: contribue 18,9% des achats de véhicules commerciaux

Contrats d'approvisionnement à long terme

| Fournisseur | Durée du contrat | Structure de tarification |

|---|---|---|

| Peterbilt | 7 ans | Prix fixe avec un ajustement annuel de 2,5% |

| Kenworth | 5 ans | Remises basées sur le volume |

Impact du réseau de pièces et de services

Rush Enterprises maintient un réseau de services complet avec:

- 117 lieux de concessionnaires dans 13 États

- Plus de 1 200 techniciens de service certifié

- 284 millions de dollars investis dans l'inventaire des pièces (2023 Exercice)

Rush Enterprises, Inc. (RUSHB) - Five Forces de Porter: le pouvoir de négociation des clients

Composition de la clientèle

Rush Enterprises sert les clients dans trois secteurs principaux:

- Transport: 42% de la clientèle totale

- Construction: 33% de la clientèle totale

- Agriculture: 25% de la clientèle totale

Dynamique des prix du marché

| Segment de clientèle | Sensibilité moyenne aux prix | Effet de levier de négociation |

|---|---|---|

| Petites entreprises | Élevé (75% axé sur le prix) | Faible |

| Flottes moyennes | Modéré (52% sensible au prix) | Moyen |

| Grandes flottes commerciales | Bas (35% axé sur le prix) | Haut |

Métriques de fidélisation de la clientèle

Rush Enterprises maintient Taux de rétention de 68% Grâce à des offres de services complètes.

Stratégie de tarification de la flotte

Les grands clients commerciaux reçoivent des réductions de prix basées sur le volume allant de 12% à 22% en fonction du volume d'achat de l'équipement annuel.

Impact du forfait de service

- Maintenance complète: réduit les coûts de commutation des clients

- Support technique 24/7: augmente la dépendance des clients

- Options de financement personnalisées: améliore la fidélisation de la clientèle

Rush Enterprises, Inc. (RushB) - Five Forces de Porter: rivalité compétitive

Paysage de concurrence du marché

En 2024, Rush Enterprises fait face à une pression concurrentielle importante sur le marché des ventes de camions et d'équipements commerciaux. La société rivalise directement avec plusieurs réseaux de concessionnaires nationaux.

| Concurrent | Présence du marché | Revenus annuels (2023) |

|---|---|---|

| Loue de camion Penske | À l'échelle nationale | 8,4 milliards de dollars |

| PACCAR Inc. | Mondial | 26,9 milliards de dollars |

| Entreprises précipitées | Southwestern United States | 8,1 milliards de dollars |

Fragmentation du marché

Le marché des ventes de camions et d'équipements commerciaux démontre une fragmentation significative avec plusieurs acteurs régionaux et nationaux.

- Taille du marché des camions commerciaux totaux: 350 milliards de dollars

- Nombre de réseaux de concessionnaires régionaux: 47

- Indice de concentration du marché: 0,35 (modérément fragmenté)

Stratégies de différenciation compétitive

Rush Enterprises se distingue par des offres de services complètes:

- Réseau de services étendu: 114 emplacements à service complet

- Assistance du marché secondaire: Assistance technique 24/7

- Force du marché régional: 75% de part de marché dans le sud-ouest des États-Unis

Performance du marché régional

| Région | Part de marché | Contribution des revenus |

|---|---|---|

| Texas | 42% | 3,4 milliards de dollars |

| New Mexico | 22% | 1,8 milliard de dollars |

| Oklahoma | 11% | 0,9 milliard de dollars |

Rush Enterprises, Inc. (RushB) - Five Forces de Porter: menace de substituts

Modes de transport alternatifs

Selon les American Trucking Associations, le volume de fret ferroviaire en 2022 était de 1,81 billion de tonnes. Les volumes d'expédition intermodaux ont atteint 14,47 millions de conteneurs en 2022.

| Mode de transport | Part de marché (%) | Volume annuel |

|---|---|---|

| Camionnage | 72.5% | 11,84 milliards de tonnes |

| Rail | 16.2% | 1,81 billion de tonnes-miles |

| Intermodal | 11.3% | 14,47 millions de conteneurs |

Technologies de véhicules électriques et autonomes

Les ventes de véhicules commerciaux électriques en 2023 ont atteint 72 000 unités dans le monde. Les investissements en technologie des camions autonomes ont totalisé 2,3 milliards de dollars de financement de capital-risque en 2022.

- Le marché des camions électriques prévoyait une croissance à 36,2% du TCAC jusqu'en 2030

- Niveau 4 La technologie des camions autonomes devrait atteindre 15% de pénétration du marché d'ici 2030

Options de location et de location

La taille du marché de la location de camions commerciaux était de 56,4 milliards de dollars en 2022.

| Catégorie de location | Valeur marchande | Croissance annuelle |

|---|---|---|

| Location de camions commerciaux | 56,4 milliards de dollars | 8.7% |

| Location d'équipement | 39,2 milliards de dollars | 6.5% |

Plates-formes logistiques émergentes

Les plateformes de correspondance de fret numérique ont généré 3,6 milliards de dollars de revenus en 2022. L'investissement technologique dans les plateformes logistiques a atteint 12,4 milliards de dollars dans le monde.

- 87% des sociétés logistiques explorant la transformation numérique

- Les plateformes de logistique basées sur le cloud augmentent à 22,3% par an

Rush Enterprises, Inc. (RushB) - Five Forces de Porter: menace de nouveaux entrants

Exigences de capital élevé pour établir des réseaux de concessionnaires

Rush Enterprises nécessite un investissement initial estimé à 15 à 25 millions de dollars pour établir un seul réseau de concessionnaires de camions commerciaux. L'entreprise exploite 139 lieux de concessionnaires dans 13 États en 2023.

| Catégorie d'investissement | Plage de coûts estimés |

|---|---|

| Installation | 5-8 millions de dollars |

| Inventaire initial | 4 à 6 millions de dollars |

| Infrastructure de service | 3 à 5 millions de dollars |

| Fonds de roulement | 3 à 6 millions de dollars |

Relations établies avec les principaux fabricants de camions

Rush Enterprises maintient des partenariats à long terme avec les principaux fabricants:

- Peterbilt (relation de fabricant principal)

- Kenworth

- Camions DAF

Environnement réglementaire complexe dans les ventes de véhicules commerciaux

Les coûts de conformité réglementaire pour les nouveaux participants comprennent:

- Conformité aux émissions de l'EPA: 500 000 $ - 1,2 million de dollars par an

- Licence de véhicules commerciaux d'État: 75 000 $ - 150 000 $

- Exigences d'administration de la sécurité des transporteurs de moteur fédéral: 250 000 $ - 500 000 $ Configuration initiale

Investissement initial important dans les infrastructures et les installations de services

Rush Enterprises des services d'investissement dans l'investissement en panne:

| Composant d'infrastructure de service | Investissement moyen |

|---|---|

| Équipement de diagnostic | 1,2 à 1,8 million de dollars |

| Baies de réparation | 2 à 3 millions de dollars par emplacement |

| Formation des techniciens | 500 000 $ - 750 000 $ par an |

Rush Enterprises, Inc. (RUSHB) - Porter's Five Forces: Competitive rivalry

The competitive rivalry within the new truck sales arena for Rush Enterprises, Inc. is definitely high, driven by a tough operating environment as of late 2025. You see this pressure reflected in the broader market data; U.S. Class 8 retail truck sales for the third quarter of 2025 totaled 54,078 units, which was a 18.9% drop compared to the same period last year. Furthermore, ACT Research forecasts the full-year 2025 U.S. retail sales for new Class 8 trucks to land around 216,300 units, representing a 12.5% decrease from 2024 figures.

This environment naturally leads to intense price competition because industry supply is catching up to, and in some segments exceeding, weak demand. Carriers are feeling the pinch from depressed freight rates and overcapacity, which directly impacts their willingness to replace equipment. For instance, in October 2025, Class 8 production fell sharply to 17,367 units year-over-year, a clear signal that Original Equipment Manufacturers (OEMs) are slowing builds to manage excess inventories. This inventory overhang is also softening secondary markets; used truck resale values saw average retail prices fall 3.5% month-over-month in October 2025.

Still, Rush Enterprises, Inc. holds a significant scale advantage as the largest network of commercial vehicle dealerships in North America. This scale helps them navigate the sales contraction better than smaller players. In the third quarter of 2025, Rush sold 3,120 new Class 8 trucks in the U.S., which translated to a 5.8% market share for the quarter. This positioning allows Rush to maintain a relatively stronger footing even when the overall market is contracting, as their vocational demand remained more stable.

The competitive battleground is clearly shifting toward the aftermarket segment, where operational efficiency becomes the key differentiator. Rush's aftermarket products and services business remained resilient, contributing approximately 63.7% of the Company's total gross profit in Q3 2025. The absorption ratio, which measures how much fixed overhead is covered by aftermarket gross profit, stood at 129.3% for the third quarter of 2025, down slightly from 132.6% in Q3 2024. This metric shows how effectively Rush is using its service and parts operations to absorb fixed costs amid weak new truck sales. Aftermarket parts, service, and collision center revenues hit $642.7 million in the quarter, marking a 1.5% increase year-over-year.

Here are some key operational and market statistics from the third quarter of 2025 for Rush Enterprises, Inc.:

- U.S. Class 8 Truck Sales Volume: 3,120 units

- U.S. Class 8 Market Share (Q3 2025): 5.8%

- Absorption Ratio (Q3 2025): 129.3%

- Aftermarket Gross Profit Contribution: Approx. 63.7%

- Q3 2025 Aftermarket Revenue: $642.7 million

- Q3 2025 Total Revenue: $1.881 billion

To give you a clearer picture of the segment performance driving this rivalry dynamic, look at this breakdown:

| Segment Metric | Q3 2025 Value | Year-over-Year Change |

| New U.S. Class 8 Sales (Units) | 3,120 | Down 11.0% |

| U.S. Class 8 Market Share | 5.8% | Data not provided for YoY change in share |

| Aftermarket Revenue | $642.7 million | Up 1.5% |

| Rush Truck Leasing Revenue | $93.3 million | Up 4.7% |

| Used Commercial Vehicle Sales (Units) | 1,814 | Flat |

The overall industry picture for new truck sales is one of contraction and caution, so you need to watch how effectively Rush maintains its service revenue stream. Finance: draft 13-week cash view by Friday.

Rush Enterprises, Inc. (RUSHB) - Porter's Five Forces: Threat of substitutes

The threat of substitutes for Rush Enterprises, Inc. centers on alternatives customers use instead of purchasing new commercial vehicles from the company's primary sales channels. This pressure is multifaceted, coming from used equipment, internal service offerings, and evolving powertrain technologies.

The threat from used truck sales is definitely present, which customers favor during economic downturns and freight recessions. For instance, in the third quarter of 2025, Rush Enterprises delivered 1,814 used commercial vehicles, showing that this segment serves as an immediate alternative to new purchases when capital expenditure budgets tighten. You see this dynamic play out when freight rates are depressed, as they were in Q3 2025.

A significant internal substitution force comes from Rush Enterprises' own leasing and rental operations. This segment acts as a substitute for outright ownership and new purchases. For the third quarter of 2025, this internal alternative generated $93.3 million in revenue. This revenue stream is less cyclical than new vehicle sales, offering a more predictable financial buffer when the new truck market softens.

Fleet life extension through aftermarket maintenance is a primary substitute for new vehicle purchases. When operators choose to repair and maintain existing assets rather than replace them, it directly impacts new unit sales volume. The resilience of this substitute is evident in the consistent revenue generated by Rush Enterprises' parts, service, and collision centers. Here's a look at the recent revenue trend for this substitute service:

| Period Ended | Aftermarket Revenue (Millions USD) | New Class 8 Truck Deliveries (U.S.) Q3 2025 |

|---|---|---|

| Q1 2025 | $619.1 | N/A |

| Q2 2025 | $636.3 | N/A |

| Q3 2025 | $642.7 | 3,215 |

Emerging electric vehicle (EV) sales represent a long-term substitute, challenging the traditional diesel-powered fleet. Still, Rush Enterprises is actively mitigating this by positioning itself within the transition. The company is already representing EV manufacturers and offering alternative fuel solutions, such as CNG fuel systems through its investment in Cummins Clean Fuel Technologies, Inc. This proactive stance helps manage the long-term substitution risk.

The key substitutes and their financial context for Rush Enterprises, Inc. as of late 2025 include:

- Used commercial vehicle sales volume in Q3 2025: 1,814 units delivered.

- Leasing and Rental revenue in Q3 2025: $93.3 million.

- Aftermarket revenue in Q3 2025: $642.7 million.

- New Class 8 truck sales volume in Q3 2025: 3,215 units delivered.

- The company's absorption ratio in Q3 2025 was 129.3%, indicating the service/aftermarket business is covering fixed costs well.

Finance: draft 13-week cash view by Friday.

Rush Enterprises, Inc. (RUSHB) - Porter's Five Forces: Threat of new entrants

The threat of new entrants for Rush Enterprises, Inc. remains decidedly low, primarily due to the sheer scale and capital intensity required to replicate its established commercial vehicle dealership footprint. New players face immediate, massive hurdles that deter all but the most heavily capitalized and connected entities.

Low threat due to extremely high capital requirements for a national dealership network (over 150 locations). Establishing a comparable footprint means securing significant financing for real property, facility build-outs, and, critically, inventory. A new entrant must be prepared for a cash-intensive start; a general guideline suggests working capital requirements can be estimated at $1,000 to $1,500 per new vehicle projected for annual sales, plus the need to set aside at least 6 months of working capital to cover ongoing debts and operational obligations. Rush Enterprises, Inc. already occupies over 6.5 million square feet of premium facilities, a physical scale that is prohibitively expensive to duplicate quickly.

Significant barrier from exclusive OEM franchise agreements, which are difficult for new players to secure. Truck manufacturers often favor consolidation, promoting scenarios where a single dealership group monopolizes a single market or even an entire region. New entrants, especially those not in the manufacturer's inner circle, face the risk of manufacturers exercising their right of first approval under existing dealer agreements to veto a sale or assign the franchise to a favored dealer. This contrasts with the car segment, where franchisors often restrict the number of like-kind franchises a dealer can own in a specific market.

Regulatory complexity and the need for a large base of certified technicians (over 2,850) create high operational hurdles. Maintaining the necessary service capability requires a massive, specialized workforce. Rush Enterprises, Inc. supports its operations with over 2,850 factory-trained technicians across the U.S. and Canada, alongside more than 2,600 service bays. Recruiting, training, and retaining this level of technical expertise presents a continuous, high-cost barrier to entry. You simply cannot open a full-service center without that human capital ready to go.

Rush Enterprises, Inc.'s scale in parts inventory, valued at over $340 million, is a major barrier to entry for smaller competitors. This massive inventory of genuine OEM and aftermarket parts, which the company reported at $340 million as of July 2025, ensures immediate parts availability for its customer base. A new entrant would need comparable capital just to stock the necessary components to support the required service operations, a necessity underscored by the fact that aftermarket products and services accounted for approximately 63.7% of the Company's total gross profit in the third quarter of 2025.

The current competitive landscape for Rush Enterprises, Inc. regarding new entrants can be summarized by these structural requirements:

- Capital Outlay: Inventory and facility costs are measured in the hundreds of millions.

- OEM Relationships: Franchise agreements favor established, large-scale operators.

- Human Capital: Need for thousands of specialized, factory-trained technicians.

- Parts Scale: Inventory valued at $340 million is required for immediate support.

- Network Size: Replicating over 150 strategically located facilities is immense.

| Barrier Component | Rush Enterprises, Inc. Scale (Late 2025 Data) | New Entrant Hurdle |

|---|---|---|

| Dealership Network Size | Over 150 locations in 23 states and Ontario | Requires multi-state real estate acquisition and facility build-out. |

| Parts Inventory Value | $340 million in genuine OEM and aftermarket parts | Massive working capital tied up in inventory before first sale. |

| Service Technician Base | Over 2,850 factory-trained technicians | High operational hurdle for specialized, certified labor recruitment. |

| OEM Approval Process | Manufacturers favor single-group regional monopolies | New entrants face rejection or assignment to favored dealers. |

The financial commitment to simply match the existing scale of Rush Enterprises, Inc. is a near-insurmountable initial barrier. Finance: draft 13-week cash view by Friday.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.