|

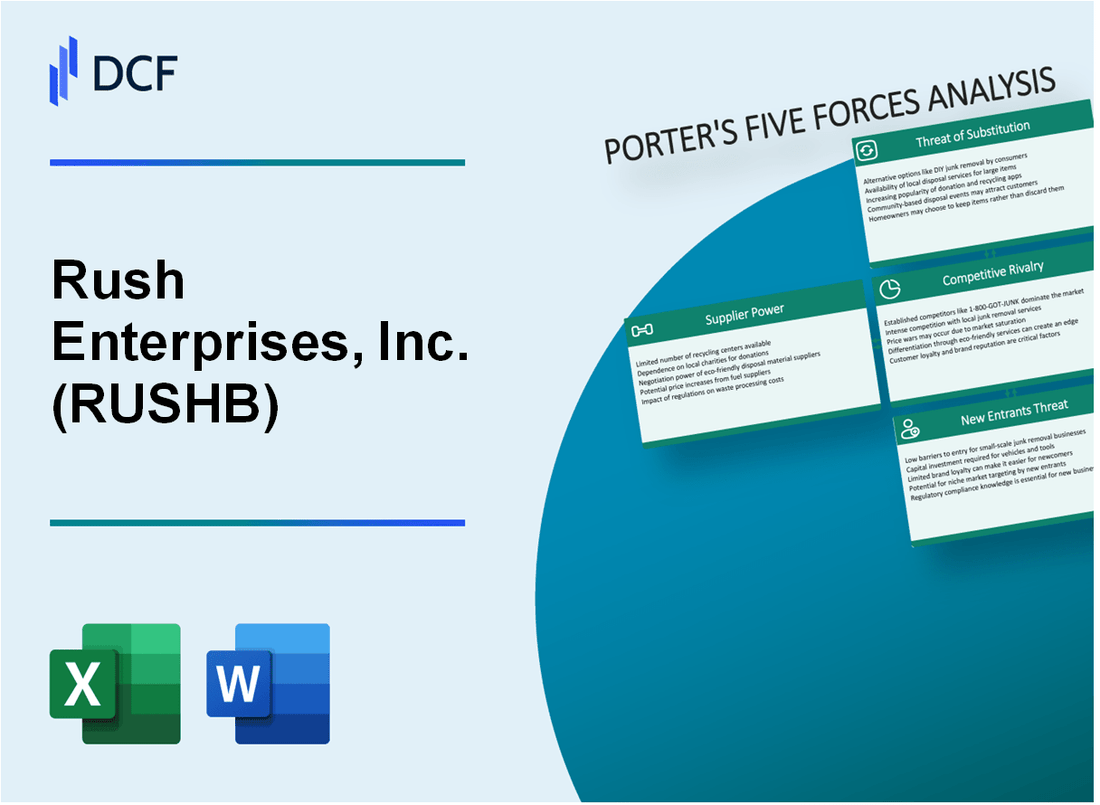

Rush Enterprises, Inc. (RushB): 5 forças Análise [Jan-2025 Atualizada] |

Totalmente Editável: Adapte-Se Às Suas Necessidades No Excel Ou Planilhas

Design Profissional: Modelos Confiáveis E Padrão Da Indústria

Pré-Construídos Para Uso Rápido E Eficiente

Compatível com MAC/PC, totalmente desbloqueado

Não É Necessária Experiência; Fácil De Seguir

Rush Enterprises, Inc. (RUSHB) Bundle

Mergulhe no cenário estratégico da Rush Enterprises, Inc. (RushB), onde a intrincada dinâmica do poder do fornecedor, relacionamentos com clientes, concorrência de mercado, interrupção tecnológica e barreiras da indústria convergem para moldar um ecossistema de veículos comerciais complexos. Como participante líder no sudoeste dos Estados Unidos, as empresas Rush navegam em um mercado desafiador definido por fabricantes limitados, tecnologias de transporte em evolução e pressões competitivas intensas que exigem agilidade estratégica e ofertas inovadoras de serviços.

Rush Enterprises, Inc. (Rushb) - Five Forces de Porter: Power de barganha dos fornecedores

Número limitado de caminhões pesados e fabricantes de veículos comerciais

A partir de 2024, o mercado de fabricação de caminhões e veículos comerciais pesados é dominado por alguns participantes importantes:

| Fabricante | Quota de mercado | Volume anual de produção |

|---|---|---|

| Peterbilt | 22.5% | 87.600 veículos |

| Kenworth | 19.3% | 75.200 veículos |

| Navistar | 16.7% | 65.000 veículos |

Dependência de fornecedores -chave

A Rush Enterprises conta criticamente nesses fabricantes:

- Peterbilt (subsidiária Paccar): fornece 38,6% do inventário de caminhões da Rush

- Kenworth (subsidiária da Paccar): suprimentos 32,4% do inventário de caminhões

- Navistar: contribui com 18,9% da aquisição de veículos comerciais

Contratos de fornecimento de longo prazo

| Fornecedor | Duração do contrato | Estrutura de preços |

|---|---|---|

| Peterbilt | 7 anos | Preços fixos com ajuste anual de 2,5% |

| Kenworth | 5 anos | Descontos baseados em volume |

Impacto da rede de peças e serviços

Rush Enterprises mantém uma rede de serviços abrangente com:

- 117 localizações de concessionária em 13 estados

- Mais de 1.200 técnicos de serviço certificados

- US $ 284 milhões investidos em inventário de peças (2023 ano fiscal)

Rush Enterprises, Inc. (Rushb) - Five Forces de Porter: Power de clientes de clientes

Composição da base de clientes

A Rush Enterprises atende clientes em três setores primários:

- Transporte: 42% da base total de clientes

- Construção: 33% da base total de clientes

- Agricultura: 25% da base total de clientes

Dinâmica de preços de mercado

| Segmento de clientes | Sensibilidade média ao preço | Alavancagem de negociação |

|---|---|---|

| Pequenas empresas | Alto (75% orientado a preços) | Baixo |

| Frotas médias | Moderado (52% sensível ao preço) | Médio |

| Grandes frotas comerciais | Baixo (35% orientado a preços) | Alto |

Métricas de fidelidade do cliente

A Rush Enterprises mantém 68% taxa de retenção de clientes através de ofertas abrangentes de serviços.

Estratégia de preços de frota

Grandes clientes comerciais recebem descontos de preços baseados em volume, que variam de 12% a 22% com base no volume anual de compra de equipamentos.

Impacto do pacote de serviço

- Manutenção abrangente: reduz os custos de troca de clientes

- Suporte técnico 24/7: aumenta a dependência do cliente

- Opções de financiamento personalizado: aprimora a retenção de clientes

Rush Enterprises, Inc. (Rushb) - Five Forces de Porter: Rivalidade Competitiva

Cenário de concorrência de mercado

A partir de 2024, a Rush Enterprises enfrenta uma pressão competitiva significativa no mercado de vendas de caminhões e equipamentos comerciais. A empresa compete diretamente com várias redes nacionais de concessionárias.

| Concorrente | Presença de mercado | Receita anual (2023) |

|---|---|---|

| Leasing de caminhão Penske | Em todo o país | US $ 8,4 bilhões |

| Paccar Inc. | Global | US $ 26,9 bilhões |

| Rush Enterprises | Sudoeste dos Estados Unidos | US $ 8,1 bilhões |

Fragmentação de mercado

O mercado de vendas de caminhões e equipamentos comerciais demonstra fragmentação significativa com vários players regionais e nacionais.

- Tamanho total do mercado de caminhões comerciais: US $ 350 bilhões

- Número de redes regionais de concessionária: 47

- Índice de concentração de mercado: 0,35 (moderadamente fragmentado)

Estratégias de diferenciação competitiva

A Rush Enterprises se distingue por meio de ofertas abrangentes de serviços:

- Extensa rede de serviços: 114 locais de serviço completo

- Suporte de pós -venda: Assistência técnica 24/7

- Força regional do mercado: 75% de participação de mercado no sudoeste dos Estados Unidos

Desempenho regional no mercado

| Região | Quota de mercado | Contribuição da receita |

|---|---|---|

| Texas | 42% | US $ 3,4 bilhões |

| Novo México | 22% | US $ 1,8 bilhão |

| Oklahoma | 11% | US $ 0,9 bilhão |

Rush Enterprises, Inc. (Rushb) - Five Forces de Porter: Ameanda de substitutos

Modos de transporte alternativos

De acordo com as associações de caminhões americanas, o volume de frete ferroviário em 2022 foi de 1,81 trilhão de toneladas. Os volumes de remessa intermodais atingiram 14,47 milhões de contêineres em 2022.

| Modo de transporte | Quota de mercado (%) | Volume anual |

|---|---|---|

| Caminhão | 72.5% | 11,84 bilhões de toneladas |

| Trilho | 16.2% | 1,81 trilhão de toneladas |

| Intermodal | 11.3% | 14,47 milhões de contêineres |

Tecnologias de veículos elétricos e autônomos

As vendas de veículos comerciais elétricos em 2023 atingiram 72.000 unidades globalmente. Os investimentos autônomos de tecnologia de caminhões totalizaram US $ 2,3 bilhões em financiamento de capital de risco durante 2022.

- Mercado de caminhões elétricos projetados para crescer a 36,2% de CAGR até 2030

- Tecnologia de caminhão autônomo de nível 4 que deve atingir 15% de penetração no mercado até 2030

Opções de aluguel e leasing

O tamanho do mercado de aluguel de caminhões comerciais foi de US $ 56,4 bilhões em 2022. A taxa de penetração de arrendamento de equipamentos atingiu 39% para veículos comerciais.

| Categoria de leasing | Valor de mercado | Crescimento anual |

|---|---|---|

| Aluguel de caminhões comerciais | US $ 56,4 bilhões | 8.7% |

| Arrendamento de equipamentos | US $ 39,2 bilhões | 6.5% |

Plataformas de logística emergentes

As plataformas de correspondência digital de frete geraram US $ 3,6 bilhões em receita em 2022. O investimento em tecnologia em plataformas de logística atingiu US $ 12,4 bilhões em todo o mundo.

- 87% das empresas de logística que exploram a transformação digital

- Plataformas de logística baseadas em nuvem crescendo a 22,3% anualmente

Rush Enterprises, Inc. (Rushb) - Five Forces de Porter: Ameanda de novos participantes

Altos requisitos de capital para estabelecer redes de concessionária

A Rush Enterprises requer um investimento inicial estimado em US $ 15-25 milhões para estabelecer uma única rede comercial de concessionária de caminhões. A empresa opera 139 locais de concessionária em 13 estados a partir de 2023.

| Categoria de investimento | Faixa de custo estimada |

|---|---|

| Construção da instalação | US $ 5-8 milhões |

| Inventário inicial | US $ 4-6 milhões |

| Infraestrutura de serviço | US $ 3-5 milhões |

| Capital de giro | US $ 3-6 milhões |

Relacionamentos estabelecidos com os principais fabricantes de caminhões

A Rush Enterprises mantém parcerias de longo prazo com os principais fabricantes:

- Peterbilt (relação primária do fabricante)

- Kenworth

- Caminhões daf

Ambiente regulatório complexo em vendas de veículos comerciais

Os custos de conformidade regulatórios para novos participantes incluem:

- Conformidade de emissões da EPA: US $ 500.000 a US $ 1,2 milhão anualmente

- Licenciamento de veículos comerciais estaduais: US $ 75.000 a US $ 150.000

- Requisitos de Administração de Segurança de Transportador Federal: US $ 250.000 a US $ 500.000 Configuração inicial

Investimento inicial significativo em infraestrutura e instalações de serviço

Rush Enterprises 'Service Infrastructure Investment Breakdown:

| Componente de infraestrutura de serviço | Investimento médio |

|---|---|

| Equipamento de diagnóstico | US $ 1,2-1,8 milhão |

| Reparar baías | US $ 2-3 milhões por local |

| Treinamento técnico | US $ 500.000 a US $ 750.000 anualmente |

Rush Enterprises, Inc. (RUSHB) - Porter's Five Forces: Competitive rivalry

The competitive rivalry within the new truck sales arena for Rush Enterprises, Inc. is definitely high, driven by a tough operating environment as of late 2025. You see this pressure reflected in the broader market data; U.S. Class 8 retail truck sales for the third quarter of 2025 totaled 54,078 units, which was a 18.9% drop compared to the same period last year. Furthermore, ACT Research forecasts the full-year 2025 U.S. retail sales for new Class 8 trucks to land around 216,300 units, representing a 12.5% decrease from 2024 figures.

This environment naturally leads to intense price competition because industry supply is catching up to, and in some segments exceeding, weak demand. Carriers are feeling the pinch from depressed freight rates and overcapacity, which directly impacts their willingness to replace equipment. For instance, in October 2025, Class 8 production fell sharply to 17,367 units year-over-year, a clear signal that Original Equipment Manufacturers (OEMs) are slowing builds to manage excess inventories. This inventory overhang is also softening secondary markets; used truck resale values saw average retail prices fall 3.5% month-over-month in October 2025.

Still, Rush Enterprises, Inc. holds a significant scale advantage as the largest network of commercial vehicle dealerships in North America. This scale helps them navigate the sales contraction better than smaller players. In the third quarter of 2025, Rush sold 3,120 new Class 8 trucks in the U.S., which translated to a 5.8% market share for the quarter. This positioning allows Rush to maintain a relatively stronger footing even when the overall market is contracting, as their vocational demand remained more stable.

The competitive battleground is clearly shifting toward the aftermarket segment, where operational efficiency becomes the key differentiator. Rush's aftermarket products and services business remained resilient, contributing approximately 63.7% of the Company's total gross profit in Q3 2025. The absorption ratio, which measures how much fixed overhead is covered by aftermarket gross profit, stood at 129.3% for the third quarter of 2025, down slightly from 132.6% in Q3 2024. This metric shows how effectively Rush is using its service and parts operations to absorb fixed costs amid weak new truck sales. Aftermarket parts, service, and collision center revenues hit $642.7 million in the quarter, marking a 1.5% increase year-over-year.

Here are some key operational and market statistics from the third quarter of 2025 for Rush Enterprises, Inc.:

- U.S. Class 8 Truck Sales Volume: 3,120 units

- U.S. Class 8 Market Share (Q3 2025): 5.8%

- Absorption Ratio (Q3 2025): 129.3%

- Aftermarket Gross Profit Contribution: Approx. 63.7%

- Q3 2025 Aftermarket Revenue: $642.7 million

- Q3 2025 Total Revenue: $1.881 billion

To give you a clearer picture of the segment performance driving this rivalry dynamic, look at this breakdown:

| Segment Metric | Q3 2025 Value | Year-over-Year Change |

| New U.S. Class 8 Sales (Units) | 3,120 | Down 11.0% |

| U.S. Class 8 Market Share | 5.8% | Data not provided for YoY change in share |

| Aftermarket Revenue | $642.7 million | Up 1.5% |

| Rush Truck Leasing Revenue | $93.3 million | Up 4.7% |

| Used Commercial Vehicle Sales (Units) | 1,814 | Flat |

The overall industry picture for new truck sales is one of contraction and caution, so you need to watch how effectively Rush maintains its service revenue stream. Finance: draft 13-week cash view by Friday.

Rush Enterprises, Inc. (RUSHB) - Porter's Five Forces: Threat of substitutes

The threat of substitutes for Rush Enterprises, Inc. centers on alternatives customers use instead of purchasing new commercial vehicles from the company's primary sales channels. This pressure is multifaceted, coming from used equipment, internal service offerings, and evolving powertrain technologies.

The threat from used truck sales is definitely present, which customers favor during economic downturns and freight recessions. For instance, in the third quarter of 2025, Rush Enterprises delivered 1,814 used commercial vehicles, showing that this segment serves as an immediate alternative to new purchases when capital expenditure budgets tighten. You see this dynamic play out when freight rates are depressed, as they were in Q3 2025.

A significant internal substitution force comes from Rush Enterprises' own leasing and rental operations. This segment acts as a substitute for outright ownership and new purchases. For the third quarter of 2025, this internal alternative generated $93.3 million in revenue. This revenue stream is less cyclical than new vehicle sales, offering a more predictable financial buffer when the new truck market softens.

Fleet life extension through aftermarket maintenance is a primary substitute for new vehicle purchases. When operators choose to repair and maintain existing assets rather than replace them, it directly impacts new unit sales volume. The resilience of this substitute is evident in the consistent revenue generated by Rush Enterprises' parts, service, and collision centers. Here's a look at the recent revenue trend for this substitute service:

| Period Ended | Aftermarket Revenue (Millions USD) | New Class 8 Truck Deliveries (U.S.) Q3 2025 |

|---|---|---|

| Q1 2025 | $619.1 | N/A |

| Q2 2025 | $636.3 | N/A |

| Q3 2025 | $642.7 | 3,215 |

Emerging electric vehicle (EV) sales represent a long-term substitute, challenging the traditional diesel-powered fleet. Still, Rush Enterprises is actively mitigating this by positioning itself within the transition. The company is already representing EV manufacturers and offering alternative fuel solutions, such as CNG fuel systems through its investment in Cummins Clean Fuel Technologies, Inc. This proactive stance helps manage the long-term substitution risk.

The key substitutes and their financial context for Rush Enterprises, Inc. as of late 2025 include:

- Used commercial vehicle sales volume in Q3 2025: 1,814 units delivered.

- Leasing and Rental revenue in Q3 2025: $93.3 million.

- Aftermarket revenue in Q3 2025: $642.7 million.

- New Class 8 truck sales volume in Q3 2025: 3,215 units delivered.

- The company's absorption ratio in Q3 2025 was 129.3%, indicating the service/aftermarket business is covering fixed costs well.

Finance: draft 13-week cash view by Friday.

Rush Enterprises, Inc. (RUSHB) - Porter's Five Forces: Threat of new entrants

The threat of new entrants for Rush Enterprises, Inc. remains decidedly low, primarily due to the sheer scale and capital intensity required to replicate its established commercial vehicle dealership footprint. New players face immediate, massive hurdles that deter all but the most heavily capitalized and connected entities.

Low threat due to extremely high capital requirements for a national dealership network (over 150 locations). Establishing a comparable footprint means securing significant financing for real property, facility build-outs, and, critically, inventory. A new entrant must be prepared for a cash-intensive start; a general guideline suggests working capital requirements can be estimated at $1,000 to $1,500 per new vehicle projected for annual sales, plus the need to set aside at least 6 months of working capital to cover ongoing debts and operational obligations. Rush Enterprises, Inc. already occupies over 6.5 million square feet of premium facilities, a physical scale that is prohibitively expensive to duplicate quickly.

Significant barrier from exclusive OEM franchise agreements, which are difficult for new players to secure. Truck manufacturers often favor consolidation, promoting scenarios where a single dealership group monopolizes a single market or even an entire region. New entrants, especially those not in the manufacturer's inner circle, face the risk of manufacturers exercising their right of first approval under existing dealer agreements to veto a sale or assign the franchise to a favored dealer. This contrasts with the car segment, where franchisors often restrict the number of like-kind franchises a dealer can own in a specific market.

Regulatory complexity and the need for a large base of certified technicians (over 2,850) create high operational hurdles. Maintaining the necessary service capability requires a massive, specialized workforce. Rush Enterprises, Inc. supports its operations with over 2,850 factory-trained technicians across the U.S. and Canada, alongside more than 2,600 service bays. Recruiting, training, and retaining this level of technical expertise presents a continuous, high-cost barrier to entry. You simply cannot open a full-service center without that human capital ready to go.

Rush Enterprises, Inc.'s scale in parts inventory, valued at over $340 million, is a major barrier to entry for smaller competitors. This massive inventory of genuine OEM and aftermarket parts, which the company reported at $340 million as of July 2025, ensures immediate parts availability for its customer base. A new entrant would need comparable capital just to stock the necessary components to support the required service operations, a necessity underscored by the fact that aftermarket products and services accounted for approximately 63.7% of the Company's total gross profit in the third quarter of 2025.

The current competitive landscape for Rush Enterprises, Inc. regarding new entrants can be summarized by these structural requirements:

- Capital Outlay: Inventory and facility costs are measured in the hundreds of millions.

- OEM Relationships: Franchise agreements favor established, large-scale operators.

- Human Capital: Need for thousands of specialized, factory-trained technicians.

- Parts Scale: Inventory valued at $340 million is required for immediate support.

- Network Size: Replicating over 150 strategically located facilities is immense.

| Barrier Component | Rush Enterprises, Inc. Scale (Late 2025 Data) | New Entrant Hurdle |

|---|---|---|

| Dealership Network Size | Over 150 locations in 23 states and Ontario | Requires multi-state real estate acquisition and facility build-out. |

| Parts Inventory Value | $340 million in genuine OEM and aftermarket parts | Massive working capital tied up in inventory before first sale. |

| Service Technician Base | Over 2,850 factory-trained technicians | High operational hurdle for specialized, certified labor recruitment. |

| OEM Approval Process | Manufacturers favor single-group regional monopolies | New entrants face rejection or assignment to favored dealers. |

The financial commitment to simply match the existing scale of Rush Enterprises, Inc. is a near-insurmountable initial barrier. Finance: draft 13-week cash view by Friday.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.