|

Seria Co., Ltd. (2782.T) Avaliação DCF |

Totalmente Editável: Adapte-Se Às Suas Necessidades No Excel Ou Planilhas

Design Profissional: Modelos Confiáveis E Padrão Da Indústria

Pré-Construídos Para Uso Rápido E Eficiente

Compatível com MAC/PC, totalmente desbloqueado

Não É Necessária Experiência; Fácil De Seguir

Seria Co., Ltd. (2782.T) Bundle

O Potencial Financeiro da Explore Seria Co., Ltd. (2782T) com nossa calculadora DCF amigável! Digite suas suposições sobre crescimento, margens e despesas para calcular o valor intrínseco da Seria Co., Ltd. (2782T) e refinar sua abordagem de investimento.

What Awaits You

- Flexible Forecast Inputs: Seamlessly adjust parameters (growth %, profit margins, WACC) to explore various scenarios.

- Actual Financial Data: Seria Co., Ltd.'s (2782T) financial information pre-loaded to accelerate your analysis.

- Automated DCF Calculations: The template computes Net Present Value (NPV) and intrinsic value automatically.

- Professional and Customizable: A refined Excel model tailored to fit your valuation requirements.

- Designed for Analysts and Investors: Perfect for evaluating projections, validating strategies, and optimizing your time.

Key Features

- Authentic Financial Data for Seria Co., Ltd.: Comes preloaded with Seria's historical financial performance and future projections.

- Comprehensive Customization Options: Tailor revenue growth, profit margins, weighted average cost of capital (WACC), tax rates, and capital expenditures to your needs.

- Interactive Valuation Framework: Automatically calculates updates to Net Present Value (NPV) and intrinsic value according to your adjustments.

- Flexible Scenario Analysis: Develop various forecasting scenarios to explore different valuation possibilities.

- User-Centric Interface: Designed with simplicity in mind, making it accessible for both experts and newcomers.

How It Functions

- Step 1: Download the ready-to-use Excel template featuring Seria Co., Ltd. (2782T) data.

- Step 2: Navigate through the pre-populated sheets to grasp the essential metrics.

- Step 3: Modify forecasts and assumptions in the editable yellow cells (WACC, growth, margins).

- Step 4: Quickly view the updated results, including the intrinsic value of Seria Co., Ltd. (2782T).

- Step 5: Utilize the outputs to make well-informed investment choices or create reports.

Why Choose This Calculator for Seria Co., Ltd. (2782T)?

- User-Friendly Interface: Perfectly suited for both novice and seasoned users.

- Customizable Inputs: Adjust parameters to tailor your analysis according to your needs.

- Real-Time Valuation Updates: Instantly observe changes to Seria Co., Ltd.’s valuation with every input modification.

- Preloaded Data: Comes with Seria Co., Ltd.'s actual financial data for swift analysis.

- Preferred by Industry Experts: Trusted by investors and analysts for making well-informed decisions.

Who Should Benefit from Seria Co., Ltd. ([2782T])?

- Institutional Investors: Develop comprehensive and trustworthy valuation models for investment assessments.

- Corporate Strategy Teams: Evaluate valuation scenarios to inform strategic decision-making.

- Financial Consultants: Deliver precise valuation analyses for clients interested in Seria Co., Ltd. ([2782T]).

- Academics and Students: Leverage real-world data for hands-on learning and teaching in financial modeling.

- Market Analysts: Gain insights into the valuation processes of prominent firms like Seria Co., Ltd. ([2782T]).

What the Template Contains

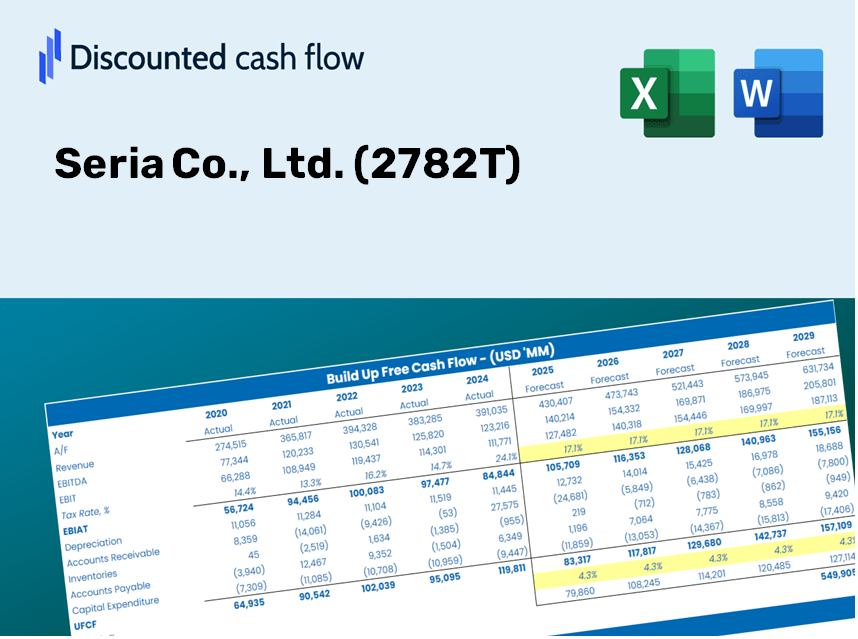

- Operating and Balance Sheet Data: Pre-filled Seria Co., Ltd. (2782T) historical data and forecasts, including revenue, EBITDA, EBIT, and capital expenditures.

- WACC Calculation: A dedicated sheet for Weighted Average Cost of Capital (WACC), featuring parameters such as Beta, risk-free rate, and share price.

- DCF Valuation (Unlevered and Levered): Customizable Discounted Cash Flow models that display intrinsic value with comprehensive calculations.

- Financial Statements: Pre-loaded financial statements (annual and quarterly) to facilitate in-depth analysis.

- Key Ratios: Includes profitability, leverage, and efficiency ratios for Seria Co., Ltd. (2782T).

- Dashboard and Charts: Visual overview of valuation outcomes and assumptions for easy analysis of results.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.