|

Avaliação DCF Curtiss-Wright Corporation (CW) |

Totalmente Editável: Adapte-Se Às Suas Necessidades No Excel Ou Planilhas

Design Profissional: Modelos Confiáveis E Padrão Da Indústria

Pré-Construídos Para Uso Rápido E Eficiente

Compatível com MAC/PC, totalmente desbloqueado

Não É Necessária Experiência; Fácil De Seguir

Curtiss-Wright Corporation (CW) Bundle

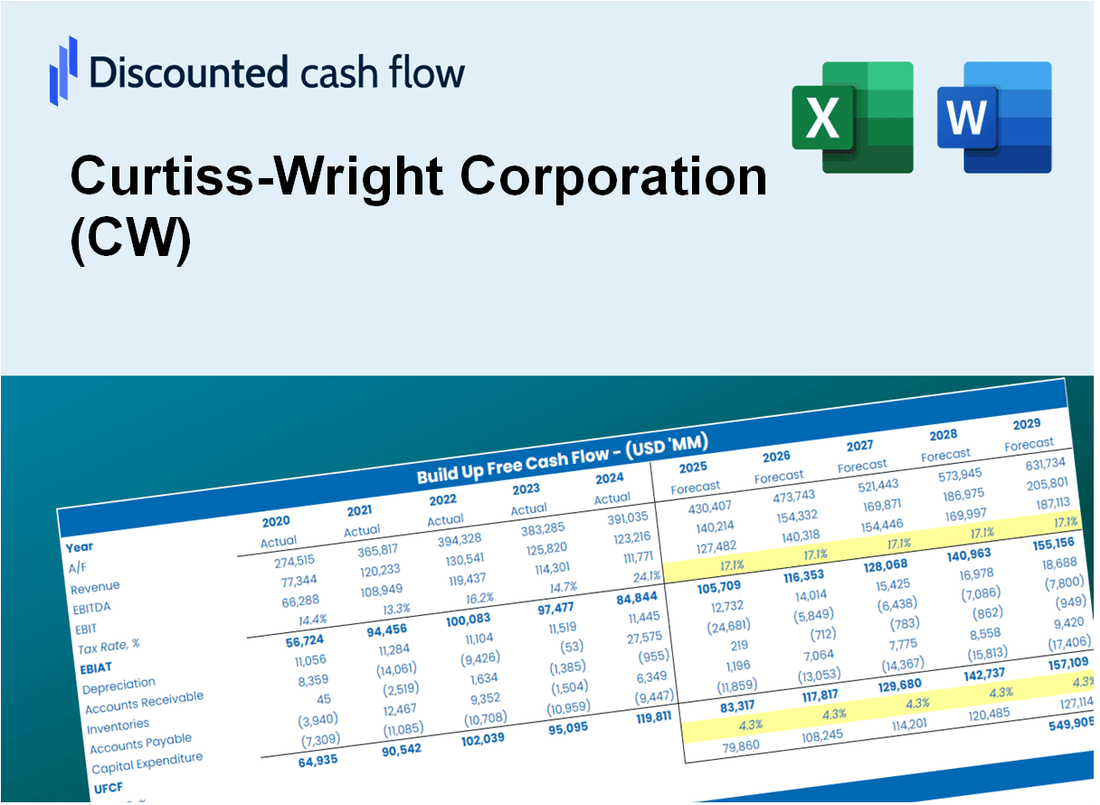

Obtenha informações sobre sua análise de avaliação Curtiss-Wright Corporation (CW) usando nossa sofisticada calculadora DCF! Apresentando dados em tempo real (CW), este modelo do Excel permite ajustar as previsões e suposições para determinar com precisão o valor intrínseco da corporação Curtiss-Wright.

What You Will Get

- Real CW Financials: Comprehensive historical and projected data for precise valuation.

- Customizable Inputs: Adjust WACC, tax rates, revenue growth, and capital expenditures as needed.

- Dynamic Calculations: Intrinsic value and NPV are computed in real-time.

- Scenario Analysis: Explore various scenarios to assess Curtiss-Wright's future performance.

- User-Friendly Interface: Designed for professionals while remaining approachable for newcomers.

Key Features

- Customizable Financial Inputs: Adjust essential variables such as revenue growth, operating margins, and capital investments.

- Instant DCF Valuation: Quickly computes intrinsic value, NPV, and other financial metrics.

- High-Precision Estimates: Leverages Curtiss-Wright's (CW) actual financial data for accurate valuation results.

- Effortless Scenario Testing: Easily evaluate various assumptions and analyze different outcomes.

- Efficiency Booster: Streamline your process by avoiding the creation of intricate valuation models from the ground up.

How It Works

- Step 1: Download the Excel file.

- Step 2: Review pre-entered Curtiss-Wright Corporation (CW) data (historical and projected).

- Step 3: Adjust key assumptions (yellow cells) based on your analysis.

- Step 4: View automatic recalculations for Curtiss-Wright Corporation (CW)’s intrinsic value.

- Step 5: Use the outputs for investment decisions or reporting.

Why Choose This Calculator for Curtiss-Wright Corporation (CW)?

- User-Friendly Interface: Tailored for both novice and seasoned users.

- Customizable Inputs: Effortlessly adjust parameters to suit your analysis needs.

- Real-Time Updates: Observe immediate changes to Curtiss-Wright's valuation with input modifications.

- Preloaded Data: Comes equipped with Curtiss-Wright's actual financial metrics for swift evaluations.

- Endorsed by Experts: Favored by investors and analysts for making well-informed choices.

Who Should Use This Product?

- Individual Investors: Make informed decisions about buying or selling Curtiss-Wright Corporation (CW) stock.

- Financial Analysts: Streamline valuation processes with ready-to-use financial models specific to Curtiss-Wright Corporation (CW).

- Consultants: Deliver professional valuation insights regarding Curtiss-Wright Corporation (CW) to clients quickly and accurately.

- Business Owners: Understand how companies like Curtiss-Wright Corporation (CW) are valued to guide your own strategy.

- Finance Students: Learn valuation techniques using real-world data and scenarios related to Curtiss-Wright Corporation (CW).

What the Template Contains

- Pre-Filled Data: Includes Curtiss-Wright Corporation’s historical financials and forecasts.

- Discounted Cash Flow Model: Editable DCF valuation model with automatic calculations.

- Weighted Average Cost of Capital (WACC): A dedicated sheet for calculating WACC based on custom inputs.

- Key Financial Ratios: Analyze Curtiss-Wright Corporation’s profitability, efficiency, and leverage.

- Customizable Inputs: Edit revenue growth, margins, and tax rates with ease.

- Clear Dashboard: Charts and tables summarizing key valuation results.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.