|

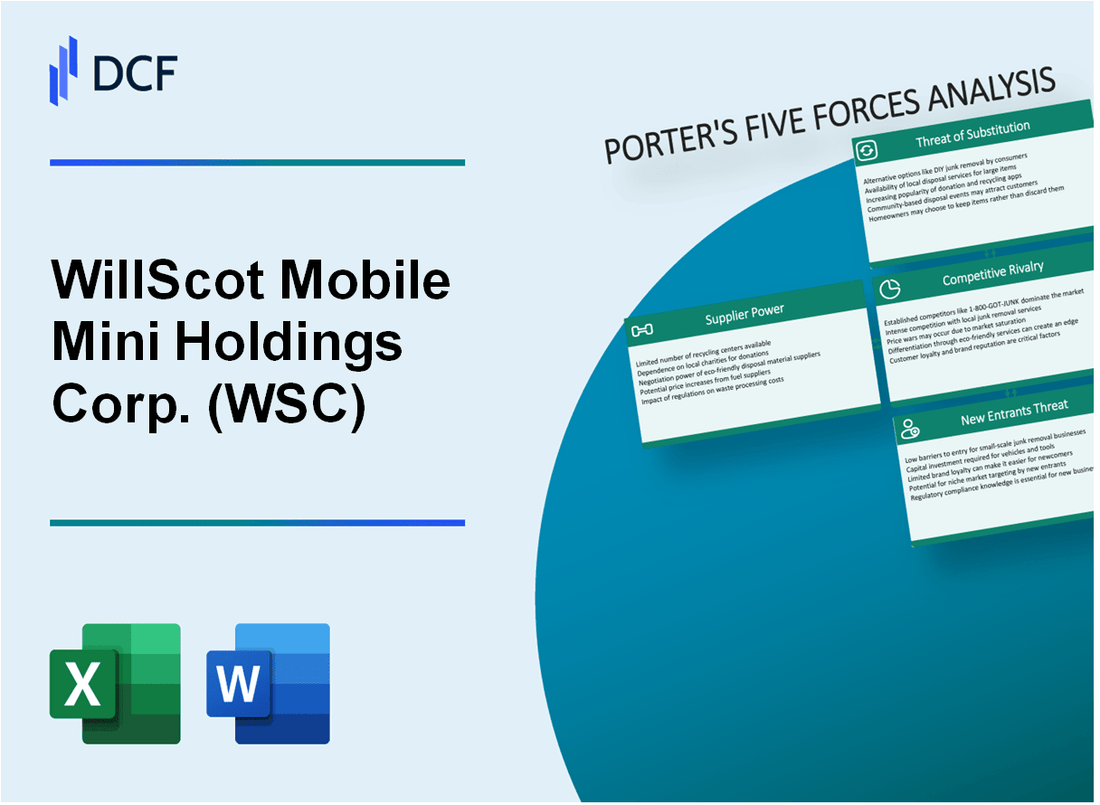

Willscot Mobile Mini Holdings Corp. (WSC): 5 forças Análise [Jan-2025 Atualizada] |

Totalmente Editável: Adapte-Se Às Suas Necessidades No Excel Ou Planilhas

Design Profissional: Modelos Confiáveis E Padrão Da Indústria

Pré-Construídos Para Uso Rápido E Eficiente

Compatível com MAC/PC, totalmente desbloqueado

Não É Necessária Experiência; Fácil De Seguir

WillScot Mobile Mini Holdings Corp. (WSC) Bundle

No mundo dinâmico das soluções espaciais móveis, a Willscot Mobile Mini Holdings Corp. (WSC) navega em um cenário comercial complexo moldado pela estrutura das cinco forças de Michael Porter. Desde a intrincada dança das negociações de fornecedores até os desafios estratégicos do relacionamento com os clientes e da concorrência do mercado, essa análise revela os fatores críticos que impulsionam o posicionamento competitivo da empresa em 2024. Mergulhe na perspectiva de um insider sobre como o WSC gerencia o delicado equilíbrio de forças de mercado que define sua Abordagem estratégica no setor de escritórios móveis e contêineres de armazenamento.

WILLSCOT Mobile Mini Holdings Corp. (WSC) - As cinco forças de Porter: poder de barganha dos fornecedores

Número limitado de fabricantes especializados de escritórios móveis e contêineres de armazenamento

A partir de 2024, o mercado global de fabricação de escritórios móveis e armazenamento é caracterizado por uma base de fornecedores concentrada. Segundo relatos do setor, apenas 3-5 grandes fabricantes dominam o setor de equipamentos de construção modular especializado.

| Fabricante | Quota de mercado | Capacidade de produção global |

|---|---|---|

| Modspace Industries | 27% | 45.000 unidades/ano |

| WillScot Fornecedor preferido | 22% | 38.000 unidades/ano |

| Soluções globais de contêineres | 18% | 32.000 unidades/ano |

Altos custos de comutação para WillScot

Os custos de comutação do WILLSCOT são estimados em US $ 4,2 milhões por reconfiguração da linha de fabricação, com 6-8 meses adicionais de tempo de inatividade de produção.

- Equipamento de soldagem especializado: US $ 1,5 milhão

- Custos de reformulação: US $ 1,7 milhão

- Despesas de recertificação: US $ 1 milhão

Restrições da cadeia de suprimentos em materiais de construção modulares

Restrições de suprimento de aço e alumínio Impacto a produção de contêineres. Os dados atuais do mercado indicam:

| Material | 2024 Volatilidade dos preços | Disponibilidade global de suprimentos |

|---|---|---|

| Aço estrutural | ±12.5% | 87% da demanda atendida |

| Folhas de alumínio | ±15.3% | 82% da demanda atendida |

Dependência de fornecedores de aço e alumínio -chave

O WillScot depende de três fornecedores de metal primário:

- ArcelorMittal: 42% dos requisitos de aço

- Nucor Corporation: 33% dos requisitos de aço

- Kaiser Aluminium: 25% dos requisitos de alumínio

Custos médios de aquisição de metal para 2024: US $ 1.275 por tonelada métrica para aço estrutural, US $ 2.450 por tonelada métrica para alumínio.

WILLSCOT Mobile Mini Holdings Corp. (WSC) - As cinco forças de Porter: Power de clientes dos clientes

Composição da base de clientes

A partir de 2024, a Willscot Mobile Mini Holdings Corp. atende clientes em vários setores:

- Construção: 38% do portfólio total de clientes

- Energia: 22% do portfólio total de clientes

- Governo: 17% do portfólio total de clientes

- Industrial: 23% do portfólio total de clientes

Análise de concentração de clientes

| Setor | Número de clientes | Valor médio do contrato |

|---|---|---|

| Construção | 4,750 | $85,600 |

| Energia | 2,300 | $129,400 |

| Governo | 1,850 | $112,700 |

| Industrial | 3,100 | $97,300 |

Métricas de sensibilidade ao preço

A elasticidade do preço do aluguel entre os setores indica sensibilidade moderada ao preço:

- Setor de construção Sensibilidade do preço: 0.4

- Setor de energia sensibilidade ao preço: 0.3

- Sensibilidade ao preço do setor governamental: 0.2

- Sensibilidade ao preço do setor industrial: 0,5

Duração do contrato e retenção de clientes

| Duração do contrato | Taxa de retenção de clientes | Probabilidade de renovação |

|---|---|---|

| 3-6 meses | 62% | 45% |

| 6 a 12 meses | 78% | 68% |

| 12-24 meses | 85% | 82% |

Impacto de personalização

Opções de personalização reduzem a probabilidade de troca de clientes por 37% em todos os setores de serviço.

Willscot Mobile Mini Holdings Corp. (WSC) - As cinco forças de Porter: rivalidade competitiva

Cenário de concorrência de mercado

A Willscot Mobile Mini Holdings Corp. opera em um mercado competitivo de soluções de espaço móvel e de armazenamento com a seguinte dinâmica competitiva:

| Concorrente | Quota de mercado | Receita (2023) |

|---|---|---|

| WILLSCOT Mobile Mini | 35% | US $ 3,85 bilhões |

| McGrath RentCorp | 22% | US $ 1,62 bilhão |

| Participações espaciais modulares | 18% | US $ 1,24 bilhão |

Dinâmica competitiva

As principais características competitivas incluem:

- Concentração moderada de mercado com 3-4 players primários

- Consolidação de mercado em andamento através de fusões estratégicas

- Mercado endereçável total estimado em US $ 8,7 bilhões em 2024

Estratégias competitivas

As estratégias de diferenciação se concentram em:

- Cobertura geográfica: Rede de Serviço Nacional

- Qualidade de serviço: Soluções modulares abrangentes

- Integração de tecnologia: Sistemas avançados de gerenciamento de frotas

| Fator competitivo | Willscot Mobile Mini Performance |

|---|---|

| Alcance geográfico | 50 estados, Canadá, México |

| Tamanho da frota | 140.000 mais de unidades |

| Taxa de retenção de clientes | 87% |

WILLSCOT Mobile Mini Holdings Corp. (WSC) - As cinco forças de Porter: ameaça de substitutos

Espaços de escritório tradicionais de tijolo e argamassa como alternativa

No quarto trimestre 2023, os escritórios tradicionais representavam 52,3% das soluções de espaço de trabalho nos Estados Unidos. A taxa média de arrendamento imobiliário comercial foi de US $ 38,52 por pé quadrado nas principais áreas metropolitanas.

| Tipo de espaço de escritório | Quota de mercado | Custo médio por metro quadrado |

|---|---|---|

| Escritórios tradicionais | 52.3% | $38.52 |

| Escritórios móveis | 22.7% | $27.85 |

Tendências de trabalho remotas emergentes

As estatísticas de trabalho remoto indicam 28,2% dos funcionários em período integral que trabalhavam híbridos ou totalmente remotos a partir de 2023. O mercado global de trabalho remoto projetado para atingir US $ 4,7 trilhões até 2027.

- 28,2% da força de trabalho em modelos remotos/híbridos

- US $ 4,7 trilhões do mercado de trabalho remoto projetado até 2027

- 47% de empresas que permitem acordos de trabalho flexíveis

Construção modular permanente

O mercado de construção modular avaliado em US $ 82,3 bilhões em 2023, com um CAGR projetado de 6,5% a 2028.

| Tipo de construção | Valor de mercado 2023 | CAGR projetado |

|---|---|---|

| Construção modular permanente | US $ 82,3 bilhões | 6.5% |

Ferramentas de colaboração digital

O mercado global de software de colaboração digital atingiu US $ 26,7 bilhões em 2023, com um crescimento esperado para US $ 48,5 bilhões até 2026.

- US $ 26,7 bilhões no mercado de colaboração digital em 2023

- US $ 48,5 bilhões no mercado projetado até 2026

- Equipes da Microsoft: 270 milhões de usuários ativos

- Zoom: 300 milhões de participantes diários de reunião

WILLSCOT Mobile Mini Holdings Corp. (WSC) - As cinco forças de Porter: ameaça de novos participantes

Requisitos de capital inicial para infraestrutura espacial móvel

A Willscot Mobile Mini Holdings Corp. registrou ativos totais de US $ 5,8 bilhões em 31 de dezembro de 2023. A infraestrutura de espaço modular móvel requer investimento significativo de capital inicial.

| Categoria de investimento de capital | Faixa de custo estimada |

|---|---|

| Frota de escritório móvel | US $ 2,3 bilhões - US $ 2,7 bilhões |

| Equipamento de construção modular | US $ 750 milhões - US $ 1,1 bilhão |

| Infraestrutura de logística | US $ 400 milhões - US $ 600 milhões |

Investimento de fabricação e logística

A Willscot Mobile Mini registrou US $ 1,4 bilhão em propriedade, planta e equipamento em 2023, demonstrando investimentos substanciais de infraestrutura.

- Instalações de fabricação em todo o país: 97 locais

- Frota total de unidades móveis: aproximadamente 165.000

- Despesas operacionais anuais de logística: US $ 320 milhões

Reputação da marca e economias de escala

O Willscot Mobile Mini gerou US $ 3,9 bilhões em receita para 2023, com uma capitalização de mercado de US $ 7,2 bilhões, criando barreiras significativas de entrada.

| Métrica de vantagem competitiva | 2023 valor |

|---|---|

| Quota de mercado | 42.5% |

| Taxa de retenção de clientes | 88% |

| Duração média do contrato | 18-24 meses |

Complexidade da conformidade regulatória

Os custos de conformidade para construção modular e arrendamento de equipamentos requerem investimento substancial.

- Despesas anuais de conformidade regulatória: US $ 45 milhões

- Certificações regulatórias mantidas: 12 diferentes padrões do setor

- Pessoal de conformidade: 87 profissionais em tempo integral

WillScot Mobile Mini Holdings Corp. (WSC) - Porter's Five Forces: Competitive rivalry

You're analyzing the competitive heat in the modular space sector, and for WillScot Mobile Mini Holdings Corp., rivalry is definitely a major factor, even with its leading position. The intensity here is set by scale, capital requirements, and market fragmentation.

WillScot Mobile Mini Holdings Corp. is the clear North American market leader in modular space solutions, holding approximately 50% share in that segment. This scale is significant in a market estimated to be valued at USD 3.82 Bn in 2025 for the Modular Storage System segment alone. Still, the competition is far from absent.

Rivalry is intense, featuring large, established competitors and a host of regional players. While WillScot Mobile Mini Holdings Corp. had entered into a definitive agreement to acquire McGrath RentCorp for $3.8 billion, that transaction was mutually terminated in September 2024 due to regulatory hurdles. McGrath RentCorp remains a major competitor, even outside of a combined entity. On the regional side, players like Pac-Van, Inc., which has over 50 offices across Canada and the United States, compete for local and specialized contracts. This mix of national scale and local agility keeps pricing competitive.

The structure of this business inherently fuels competitive pressure. Competitors face high fixed costs tied up in fleet capital-the physical assets like modular offices and storage containers-and ongoing maintenance expenses. Here's the quick math: maintaining high utilization across this massive asset base is non-negotiable. If utilization dips, the fixed cost per unit rises, forcing companies to cut rental prices to keep the assets moving and generating revenue. This dynamic was evident in the third quarter of 2025.

The soft market conditions in late 2025 underscore this pressure. WillScot Mobile Mini Holdings Corp.'s leasing revenue declined 4.7% year-over-year to $434 million in Q3 2025, which signals a soft, competitive market where volume or pricing power is constrained. The total revenue for the quarter was $567 million, with Adjusted EBITDA at $243 million and a margin of 42.9%. This revenue softness puts pressure on everyone to fight for every contract.

Key competitive dynamics driving rivalry include:

- Fleet utilization rates are critical to covering high fixed costs.

- The need to deploy capital efficiently to maintain fleet quality.

- Competition on service offerings beyond just the physical unit.

- The presence of numerous regional players like Pac-Van, Inc.

The financial performance in Q3 2025 reflects this environment:

| Metric | Q3 2025 Actual Amount | Year-over-Year Change |

| Leasing Revenue | $434 million | -4.7% |

| Total Revenue | $567 million | -6% |

| Adjusted EBITDA | $243 million | -9% |

| Adjusted EBITDA Margin | 42.9% | Decline from Q2 2025 sequential improvement |

What this estimate hides is the ongoing integration challenge for WillScot Mobile Mini Holdings Corp. following the abandoned McGrath RentCorp deal, which could free up management focus but also leaves a large competitor independent. Finance: draft 13-week cash view by Friday.

WillScot Mobile Mini Holdings Corp. (WSC) - Porter's Five Forces: Threat of substitutes

The threat of substitutes for WillScot Mobile Mini Holdings Corp. is significant, stemming from both the temporary office/modular space segment and the portable storage segment. You need to understand these alternatives because they directly influence customer choice and pricing power in the approximately $20 billion North American flexible space solutions market where WillScot Mobile Mini Holdings Corp. operates.

Traditional on-site construction of temporary offices or permanent buildings are the primary substitutes for WillScot Mobile Mini Holdings Corp.'s modular space offerings. While WillScot Mobile Mini Holdings Corp. offers speed and predictability, traditional construction remains an alternative, especially for projects where speed is less critical than specific site customization. Here's a quick look at the trade-offs you see when comparing these methods:

| Factor | Traditional On-Site Construction | New Modular Construction Methods (General Industry) |

|---|---|---|

| Typical Timeline | 6 months to 2 years, depending on complexity. | Can be delivered and installed in as little as 12-16 weeks. |

| Cost Predictability | Lower; vulnerable to fluctuating material prices and weather delays. | Higher; factory-controlled settings reduce on-site variables. |

| Cost Comparison | Generally higher. | Often 10 to 20 percent cheaper than conventional construction. |

| Time Reduction | Longer lead times. | Can reduce construction time by up to 70 percent. |

New modular construction methods, which are a substitute for WillScot Mobile Mini Holdings Corp.'s own modular offerings, present a mixed threat. They offer higher quality and greater cost predictability, but they still contend with high labor costs and standardization issues that WillScot Mobile Mini Holdings Corp. must manage within its own operations. The industry trend shows that while modular construction can be cheaper, the final cost depends heavily on design and customization.

Self-storage facilities and informal storage lots compete directly with the portable storage segment of WillScot Mobile Mini Holdings Corp. The broader self-storage market is large and growing, which indicates strong underlying demand for storage that could be captured by these alternatives. For instance, the United States Self-Storage Market size is estimated at $45.41 billion in 2025 and is projected to reach $57.53 billion by 2030. Furthermore, the container-based and mobile formats within that self-storage market-which are direct substitutes for portable storage-exhibit an annual growth rate of 6.2%.

WillScot Mobile Mini Holdings Corp. actively mitigates this substitution threat via its Value-Added Products and Services (VAPS). This strategy is key to defending revenue, especially when unit volumes are soft. You can see the financial impact of this focus:

- Value-added products and services (VAPS) comprised 17% of WillScot Mobile Mini Holdings Corp.'s total revenue in Q1 2025.

- The company is targeting a long-term VAPS penetration of 20-25%.

- Higher average monthly rates, inclusive of VAPS, helped offset lower units on rent in 2024.

- In Q2 2025, average monthly rates for portable storage units increased by 7.2% year-over-year.

The success of VAPS, which increases the utility and stickiness of the rental contract, helps WillScot Mobile Mini Holdings Corp. drive higher average monthly rates, which is crucial when the volume of units on rent declines. For example, Q3 2025 leasing revenue was $434 million, supported by rate increases even as units on rent declined.

WillScot Mobile Mini Holdings Corp. (WSC) - Porter's Five Forces: Threat of new entrants

You're looking at the barriers to entry in the temporary space and storage market, and for WillScot Mobile Mini Holdings Corp., those barriers are quite high, frankly. A new competitor can't just decide to start tomorrow; they have to match the sheer physical scale this business demands.

High Capital Investment in Fleet and Footprint

Building a competitive fleet from scratch requires massive upfront capital. WillScot Mobile Mini Holdings Corp. operates a combined fleet of over 350,000 portable offices and storage containers, supported by a network of approximately 275 locations across North America and the UK. Think about the logistics: purchasing, maintaining, and deploying that many physical assets is a huge undertaking. For context on the investment required just to maintain and grow the existing asset base, WillScot Mobile Mini Holdings Corp. reported gross capital expenditures for fleet purchases in fiscal year 2024 totaled $401.7 million. That's a significant initial outlay before you even generate a dollar of revenue.

Economies of Scale and Operating Leverage

Once a company reaches the scale of WillScot Mobile Mini Holdings Corp., operating leverage kicks in, making it tough for smaller players to match pricing or profitability. The company's scale allows it to spread fixed costs-like corporate overhead, IT systems, and national sales efforts-over a much larger revenue base. This efficiency shows up clearly in the margins. For instance, WillScot Mobile Mini Holdings Corp. maintained an impressive gross profit margin of 54.3% in Q1 2025 and for the full year 2024. This high margin, driven by efficient asset utilization and the contribution of Value Added Products and Services (VAPS), is difficult for a new entrant to replicate quickly.

Here's a quick look at how the scale translates into financial strength, which new entrants lack:

| Metric | WillScot Mobile Mini Holdings Corp. Data Point (Late 2024/2025) |

|---|---|

| Fleet Size (Approximate Units) | Over 350,000 |

| Network Locations (Approximate) | Approximately 275 |

| Gross Profit Margin (Q1 2025) | 54.3% |

| Gross Capital Expenditures (FY 2024) | $401.7 million |

| Tuck-in Acquisition Spend (Q2 2025) | $134 million deployed |

Regulatory and Zoning Hurdles

In dense urban and suburban markets where demand is often highest, new entrants face significant non-financial barriers. Securing the necessary permits for storage yards or modular staging sites involves navigating complex local zoning laws and environmental regulations. These hurdles are often time-consuming and politically sensitive, especially in built-up areas. For a new regional player, establishing even a handful of compliant, well-located yards can take years.

Market Consolidation via Acquisition Strategy

WillScot Mobile Mini Holdings Corp. actively uses its financial strength to absorb smaller competitors, which raises the competitive bar for any remaining regional or local players looking to scale up. The company has a history of executing tuck-in mergers. For example, in the second half of 2021, they closed seven tuck-in acquisitions, adding 15,700 storage units and 5,800 modular units. More recently, in Q2 2025, the company deployed approximately $134 million towards tuck-in acquisitions, including a regional climate-controlled storage business. This continuous consolidation strategy means that a potential new entrant isn't just competing against an established giant; they are competing against a company that is actively buying up their potential growth avenues.

The threat of new entrants is definitely mitigated by the capital required to compete at scale. New entrants face:

- Massive upfront capital for fleet acquisition.

- The need to achieve scale for margin parity.

- Time-consuming regulatory approval processes.

- Direct competition from WSC's M&A activity.

It's a tough market to break into at scale, that's for sure.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.