|

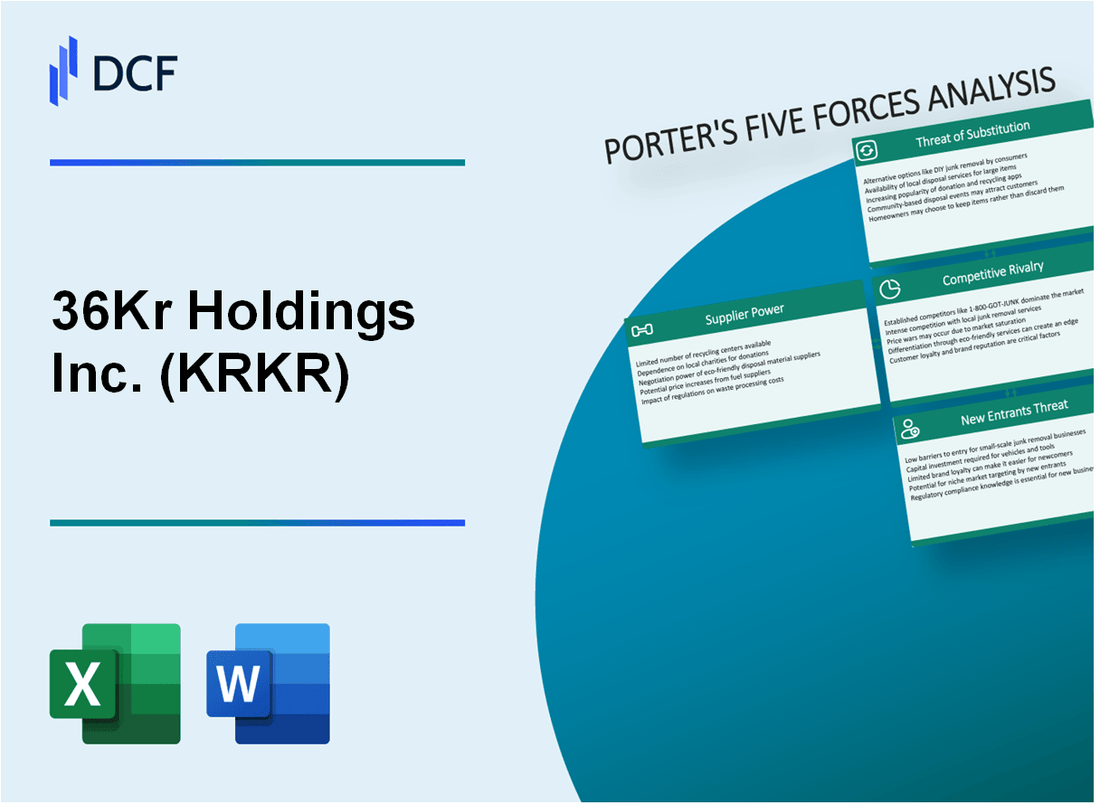

36KR Holdings Inc. (KRKR): 5 Analyse des forces [Jan-2025 MISE À JOUR] |

Entièrement Modifiable: Adapté À Vos Besoins Dans Excel Ou Sheets

Conception Professionnelle: Modèles Fiables Et Conformes Aux Normes Du Secteur

Pré-Construits Pour Une Utilisation Rapide Et Efficace

Compatible MAC/PC, entièrement débloqué

Aucune Expertise N'Est Requise; Facile À Suivre

36Kr Holdings Inc. (KRKR) Bundle

Dans le paysage dynamique des médias technologiques chinoises, 36KR Holdings Inc. se tient au carrefour de l'innovation, de la concurrence et des défis stratégiques. En disséquant le cadre des cinq forces de Michael Porter, nous dévoilons l'écosystème complexe qui façonne le positionnement concurrentiel de 36 KR, révélant l'équilibre délicat entre la puissance du fournisseur, la dynamique des clients, la rivalité du marché, les substituts potentiels et les obstacles à l'entrée qui définissent son paysage stratégique en 2024.

36KR Holdings Inc. (KRKR) - Five Forces de Porter: Pouvoir de négociation des fournisseurs

Nombre limité d'infrastructures technologiques et de fournisseurs de services cloud

Au quatrième trimestre 2023, le marché mondial des infrastructures cloud est dominé par trois principaux fournisseurs:

| Fournisseur | Part de marché | Revenus annuels |

|---|---|---|

| Amazon Web Services (AWS) | 32% | 80,1 milliards de dollars |

| Microsoft Azure | 21% | 54,3 milliards de dollars |

| Google Cloud | 10% | 23,5 milliards de dollars |

Dépendance potentielle à l'égard des partenaires clés de la création de contenu et de la technologie des médias

36 KR Holdings fait face à des contraintes potentielles des fournisseurs avec les partenaires technologiques de contenu numérique:

- Les coûts du système de gestion de contenu varient de 1 500 $ à 25 000 $ par an

- Les plateformes d'analyse des médias en moyenne 3 000 $ à 15 000 $ par an

- Frais de licence de technologie de streaming vidéo: 5 000 $ à 50 000 $ par mois

Marché concentré des fournisseurs de technologies de publicité et de marketing numériques

| Plateforme de publicité numérique | Part de marché mondial | Revenus publicitaires annuels |

|---|---|---|

| Publicités Google | 28.6% | 209,5 milliards de dollars |

| Publicités Facebook | 23.8% | 114,9 milliards de dollars |

| Publicité Amazon | 13.3% | 37,7 milliards de dollars |

Coûts de commutation modérés pour les services médiatiques et technologiques spécialisés

Dépenses de migration des services technologiques estimés:

- Coût de migration des infrastructures cloud: 50 000 $ à 500 000 $

- Transition du système de gestion de contenu: 25 000 $ à 150 000 $

- Commutation de plate-forme de technologie des médias: 30 000 $ à 200 000 $

36KR Holdings Inc. (KRKR) - Porter's Five Forces: Bargaining Power of Clients

Composition de la clientèle

36KR Holdings Inc. dessert 3 247 clients d'entreprise dans tous les secteurs de la technologie, des startup et des médias au quatrième trimestre 2023.

| Segment de clientèle | Nombre de clients | Pourcentage |

|---|---|---|

| Entreprises technologiques | 1,542 | 47.5% |

| Écosystème de démarrage | 987 | 30.4% |

| Organisations de médias | 718 | 22.1% |

Dynamique de commutation client

Coût moyen de commutation du client estimé à 2 750 $ par migration entre les plateformes de médias numériques.

- Temps de commutation de plate-forme de contenu numérique: 4-6 semaines

- Période de transition du service d'information: 3-5 semaines

- Taux de renouvellement du contrat moyen: 78,3%

Pressions des prix du marché

Contenu numérique et service d'information Gamme de prix moyenne: 1 200 $ - 4 500 $ par abonnement annuel.

| Niveau de service | Tarification annuelle | Part de marché |

|---|---|---|

| Niveau de base | $1,200 - $2,500 | 42% |

| Niveau supérieur | $2,600 - $4,500 | 58% |

Demande de services spécialisés

Taux de croissance du marché des services de technologie et des médias: 14,7% en 2023.

- La demande de rapport spécialisée a augmenté de 22,6%

- Le service de renseignement personnalisé demande 17,3%

- Taux d'adoption de la solution d'intelligence d'entreprise: 63,5%

36KR Holdings Inc. (KRKR) - Five Forces de Porter: Rivalité compétitive

Paysage concurrentiel dans les médias technologiques chinoises et les services d'information

36KR Holdings Inc. opère dans un écosystème de médias numériques hautement compétitif avec les principaux concurrents suivants:

| Concurrent | Part de marché | Revenus annuels |

|---|---|---|

| Tencent News | 22.5% | 3,2 milliards de dollars |

| Sina Tech | 18.7% | 2,1 milliards de dollars |

| 36KR Holdings | 7.3% | 87,6 millions de dollars |

Concours de plate-forme de médias numériques

Le paysage de la plate-forme de médias numériques comprend plusieurs acteurs avec des capacités technologiques importantes:

- Les plateformes de nouvelles technologiques de ByTedance

- Services d'information sur la technologie NetEase

- Canaux multimédias technologiques de Baidu

Innovation et positionnement du marché

Métriques compétitives pour l'innovation technologique:

| Métrique d'innovation | 36KR Holdings | Moyenne de l'industrie |

|---|---|---|

| Investissement en R&D | 12,4% des revenus | 9.7% |

| Nouvelles plateformes de contenu | 3 lancé en 2023 | 2,1 moyenne |

Contenu et capacités technologiques

Répartition des investissements dans la création et la technologie du contenu:

- Budget de création de contenu: 22,3 millions de dollars en 2023

- Investissement infrastructure technologique: 15,6 millions de dollars

- Développement de l'IA et de l'apprentissage automatique: 7,2 millions de dollars

36KR Holdings Inc. (KRKR) - Five Forces de Porter: menace de substituts

Émergente des médias numériques et plateformes d'information numériques

En 2024, le paysage des médias numériques présente des défis de substitution importants à 36 KR. Selon Statista, le marché mondial des médias numériques devrait atteindre 395,8 milliards de dollars en 2024, avec plusieurs plateformes émergentes en concurrence pour l'attention des utilisateurs.

| Type de plate-forme | Utilisateurs actifs mensuels | Part de marché |

|---|---|---|

| Sites Web de nouvelles technologiques | 87,3 millions | 24.5% |

| Plateformes d'information de démarrage | 62,7 millions | 17.9% |

| Blogs technologiques | 53,4 millions | 15.2% |

Popularité croissante des réseaux sociaux et des canaux de contenu court

Les plateformes de médias sociaux sont devenues des substituts de contenu importants, les données en temps réel indiquant un engagement substantiel des utilisateurs.

- LinkedIn: 875 millions d'utilisateurs professionnels à l'échelle mondiale

- Twitter: 396,5 millions d'utilisateurs actifs mensuels

- Tiktok: 1,5 milliard d'utilisateurs actifs mensuels

Disponibilité croissante des nouvelles et des ressources de démarrage gratuites de la technologie en ligne

Les ressources en ligne gratuites continuent de contester les plateformes de contenu payant. Selon les récentes études de consommation de contenu numérique, 67,3% des consommateurs de nouvelles technologiques préfèrent les plateformes gratuites.

| Source de contenu gratuite | Taux d'engagement des utilisateurs | Fréquence de mise à jour du contenu |

|---|---|---|

| Github | 58.6% | De temps |

| Moyen | 42.3% | Tous les jours |

| Canaux technologiques reddit | 73.2% | En temps réel |

Perturbation potentielle des plateformes de génération de contenu axées sur l'IA

Les plateformes de génération de contenu AI évoluent rapidement, présentant des menaces de substitution substantielles.

- Chatgpt: 100 millions d'utilisateurs actifs hebdomadaires

- Google Bard: 45,6 millions d'utilisateurs mensuels

- Marché de la génération de contenu d'IA: prévu de atteindre 407,1 millions de dollars en 2024

36KR Holdings Inc. (KRKR) - Five Forces de Porter: menace de nouveaux entrants

Exigences d'investissement initiales élevées

36 KR Holdings nécessite environ 15,2 millions de dollars d'investissement d'infrastructure technologique initial. Les coûts d'infrastructure technologique pour les plateformes médiatiques en Chine se situent entre 10 et 20 millions de dollars pour le développement complet des écosystèmes numériques.

| Composant d'infrastructure | Investissement estimé |

|---|---|

| Infrastructure de cloud computing | 5,6 millions de dollars |

| Systèmes de gestion de contenu | 3,8 millions de dollars |

| Plateformes d'analyse de données | 4,2 millions de dollars |

| Systèmes de cybersécurité | 1,6 million de dollars |

Complexité réglementaire

Le secteur de la technologie des médias chinois implique 37 exigences réglementaires distinctes. La conformité coûte en moyenne 2,3 millions de dollars par an pour les nouveaux entrants du marché.

Capacités de création de contenu

- Nécessite au moins 50 créateurs de contenu spécialisés

- Coûts de production de contenu annuelle moyens moyens: 1,7 million de dollars

- L'expertise de contenu technologique exige une expérience professionnelle de plus de 5 ans

Barrières de reconnaissance de la marque

36 KR Holdings possède 62,4% de reconnaissance du marché Dans le paysage des médias technologiques chinois. Valeur estimée de la marque: 42,6 millions de dollars.

Exigences d'expertise technologique

| Domaine de l'expertise | Niveau de qualification minimum |

|---|---|

| Génération de contenu AI | Certification avancée d'apprentissage automatique |

| Analyse des données | Doctorat ou expérience professionnelle équivalente |

| Gestion de la plate-forme numérique | Plus de 10 ans d'expérience dans les médias technologiques |

36Kr Holdings Inc. (KRKR) - Porter's Five Forces: Competitive rivalry

You're looking at a market where scale and platform power dictate survival, and for 36Kr Holdings Inc., the rivalry is definitely fierce. We see this intense pressure from general business media outlets and, perhaps more significantly, the massive tech-backed platforms that dominate content distribution in China.

The stock market's view on this rivalry is pretty clear when you check the valuation. As of September 2025, 36Kr Holdings Inc.'s price-to-sales (P/S) ratio sat at just 0.5x. Honestly, that low multiple suggests the market sees significant competitive headwinds or a lack of pricing power, especially when you consider that half the companies in the U.S. Interactive Media and Services industry trade above a 1.4x P/S ratio.

This competitive intensity is reflected in 36Kr Holdings Inc.'s own top-line performance. While the broader China Digital Media market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.8% from 2025 to 2030, 36Kr Holdings Inc.'s revenue has been contracting. For instance, total revenues in the first half of 2025 were RMB93.2 million (US$13.0 million), down from RMB102.4 million in the first half of 2024. That's a tough comparison, and looking back, the company posted a 32% revenue decline last year, with revenue from three years ago falling 27% overall.

Still, 36Kr Holdings Inc. is fighting back by trying to shift its value proposition away from just traffic volume. Differentiation is now centered on leveraging AI and expanding into industrial services. This pivot is crucial for carving out defensible space.

Here's a quick look at how the H1 2025 performance reflects this strategic shift amid the rivalry:

| Metric | H1 2025 Value | H1 2024 Value | Change |

|---|---|---|---|

| Total Revenues | RMB93.2 million (US$13.0 million) | RMB102.4 million | Decrease |

| Online Advertising Revenue | RMB74.5 million (US$10.4 million) | RMB80.4 million | Decrease |

| Operating Expenses | RMB55.86 million (US$7.8 million) | RMB117.0 million | Decreased 52.3% |

| Gross Profit Margin | 54.4% | 44.4% | Up 10 percentage points |

| Net Loss | RMB4.8 million (US$0.7 million) | RMB95.9 million | Decreased 95% |

The focus on technology is showing up in specific revenue streams. Advertising revenue specifically from their AI/large-model offerings expanded by over 50% year-over-year in the first half of 2025. That's a concrete example of where they are trying to build a moat.

Despite the revenue contraction, the content ecosystem is still growing its reach, which is the foundation for their service expansion. You can see this in the follower growth:

- Followers as of June 30, 2025: 36.6 million

- Year-over-year follower growth: 9.9%

- WeChat Channels followers surge: 69% year-over-year

- "Waves" official account followers expansion: 44% year-over-year

- Views for "WAVES" and 2025 AI Partner Summit: Over 100 million each

The overall Chinese media sector revenue in 2023 hit RMB3.15 trillion. So, 36Kr Holdings Inc. is competing for a slice of a massive but highly fragmented and contested pie, where giants like ByteDance and Tencent are major forces in content discovery.

Finance: draft 13-week cash view by Friday.

36Kr Holdings Inc. (KRKR) - Porter's Five Forces: Threat of substitutes

You're analyzing the competitive landscape for 36Kr Holdings Inc. (KRKR) and the threat of substitutes is definitely a major factor, especially given the shift in how businesses and consumers access information and services. Substitutes here are anything that can fulfill the same core need-information, market intelligence, or B2B marketing reach-using a different method or platform. The pressure is high because many of these substitutes are either free or leverage massive, established networks.

Companies are increasingly building in-house content and direct-to-customer marketing teams.

The trend toward self-sufficiency in content creation means fewer companies need to rely on third-party media platforms for their brand narrative. This is supported by the sheer volume of businesses in China; by March 2025, the number of private enterprises in China exceeded 57 million, accounting for 92.3 percent of all businesses nationwide. Over 40 percent of the newly-established private firms in Q1 2025 were related to new technologies, products, business forms, and models. This growth in tech-savvy businesses fuels the internal capacity to produce content. Furthermore, B2B companies are now using livestreaming for internal training and product launches, adding value through content-driven engagement.

- B2B marketing on Douyin now involves industrial KOLs.

- Brands use AI-powered virtual ambassadors for 24/7 presence.

- Internal training via livestreaming is a growing B2B use case.

Professional consulting and market research firms substitute enterprise value-added services.

36Kr Holdings Inc. generates revenue from enterprise value-added services, but specialized consulting firms offer a direct alternative for deep-dive intelligence. The global AI Consulting and Support Services market was valued at US$14 billion in 2024 and is projected to reach US$72.8 billion by 2030. The Asia-Pacific region, which includes China, is expected to record the fastest Compound Annual Growth Rate (CAGR) of 36.9% between 2024 and 2030. This rapid expansion shows that companies are spending heavily on external, specialized AI and strategy services, which directly competes with 36Kr's high-value offerings, such as its 36Kr corporate Omni intelligence service covering over 7,800 public companies.

Here's a quick look at the scale of the substitute market for enterprise intelligence:

| Metric | Value (Global/Asia-Pacific) | Year/Period |

|---|---|---|

| AI Consulting Market Value (2024) | US$14 billion | 2024 |

| AI Consulting Market Value (2030 Forecast) | US$72.8 billion | 2030 |

| Asia-Pacific CAGR | 36.9% | 2024-2030 |

Free, high-quality content from general news aggregators is a constant threat.

General news aggregators, like Google News or Yahoo News, offer a broad, often free, alternative to specialized content platforms. While specific Chinese market share data is hard to pin down, the global trend shows aggregators outperforming traditional outlets in certain segments. The overall digital newspaper publishing market is expected to grow at a CAGR of 4.1% from 2025 to 2029, suggesting a large, accessible pool of general content. The threat is amplified by a general decline in trust for traditional media, pushing users toward fragmented alternative sources, including aggregators and personality-led content.

Direct PR via platforms like WeChat Channels and Douyin is a powerful substitute.

The shift to social and video platforms directly challenges 36Kr Holdings Inc.'s core distribution model. The proportion of people consuming social video for news grew from 52% in 2020 to 65% in 2025 across surveyed markets. This indicates a massive, engaged audience that can be reached directly by brands or influencers, bypassing specialized media entirely. 36Kr Holdings Inc. itself is heavily invested in these channels, which underscores their power as substitutes:

- WeChat Channels followers surged by 69% year-over-year (H1 2025).

- Followers of the "Waves" official account expanded by 44% year-over-year (H1 2025).

- Video followers exceeded 9.52 million by the end of H1 2025.

- Event IPs like "WAVES" garnered over 100 million views.

While 36Kr Holdings Inc. is successfully using these platforms, their existence means any competitor can also use them to reach the same audience. For instance, the company's total revenue for the first half of 2025 was RMB 93.2 million, with online advertising making up RMB 74.5 million. A significant portion of that advertising spend could easily be diverted to direct brand promotion on Douyin or WeChat Channels, acting as a substitute for traditional media placements.

36Kr Holdings Inc. (KRKR) - Porter's Five Forces: Threat of new entrants

When you look at the landscape for new players trying to break into the New Economy information space in China, you see a real tug-of-war. On one side, the cost to just start making basic online content is incredibly low, especially now with accessible AI tools. Honestly, anyone with a laptop can spin up a blog or a basic video channel today.

But that's where the comparison ends, because 36Kr Holdings Inc. has built up significant moats that make replicating their scale and authority a different beast entirely. Their established brand acts as a massive hurdle. As of June 30, 2025, 36Kr Holdings Inc. reported over 36.57 million followers, which is a 9.9% increase year-over-year and marks their 17th consecutive quarter of growth in this metric. That kind of sustained audience accumulation takes years and significant operational spend-they spent RMB 55.9 million on operating expenses in the first half of 2025 alone, even after cutting costs by 52.3%.

This established digital footprint translates directly into market access that a startup lacks. Consider the specific channel penetration:

- WeChat Channels followers surged by 69% year-over-year.

- Followers of the "Waves" official account expanded by 44% year-over-year.

- The "WAVES" IP achieved over 100 million views.

So, while the barrier to entry for content is low, the barrier to entry for reaching the right audience at this magnitude is very high. New entrants face a steep climb to achieve this level of organic reach and brand trust within the New Economy niche.

The regulatory environment in China definitely tilts the scales in favor of incumbents like 36Kr Holdings Inc. that have already navigated the complex licensing maze for media and data services. For any new entity aiming to operate commercially, especially with cross-border implications, the licensing requirements are stringent. Here's a quick look at the regulatory environment that new entrants must contend with, which is far more complex than just setting up a website:

| Regulatory Requirement/Service Type | Typical Barrier for New Entrants | 36Kr Holdings Inc. Context |

|---|---|---|

| ICP License (For-Profit Information Services) | Often requires a joint venture with foreign shareholding capped at 50% for non-domestic entities. | Operates primarily through a Variable Interest Entity (VIE) structure, a common but legally tested method for PRC compliance. |

| VATS License (e.g., Online Data Processing) | Foreign ownership historically capped at 50% for the common B25 license. | Leverages comprehensive database and strong data analytics capabilities, suggesting existing compliance for its enterprise services. |

| IDC License (Country-Wide Operation) | Minimum registered capital of no less than RMB 10 million. | As a media and services platform, it must adhere to these infrastructure-related telecom rules if it operates its own data centers. |

Furthermore, the proprietary data and analytics assets that 36Kr Holdings Inc. has developed create a data moat that is difficult to replicate quickly. This isn't just about reporting news; it's about proprietary intelligence. For example, their AI-driven tools are already deeply embedded with their existing user base. Their "36Kr Corporate Omni Intelligence" platform has already engaged a cumulative user base of 25,000 individuals, including 4,220 paying subscribers as of H1 2025. Also, their AI meeting coverage has documented nearly 1,000 companies to date. A new entrant would need to build this data corpus from scratch, which is a massive undertaking in terms of time, data acquisition costs, and securing the necessary regulatory approvals to handle that volume of sensitive corporate information.

The company's successful pivot into AI commercialization also raises the bar. They launched their Doubao AI agent, which saw a consistent 10% weekly increase in user interactions in H1 2025. This shows they are not just using AI; they are integrating it into monetizable services, forcing new entrants to compete not just on content quality, but on the sophistication and proven adoption of their AI-enhanced offerings.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.