|

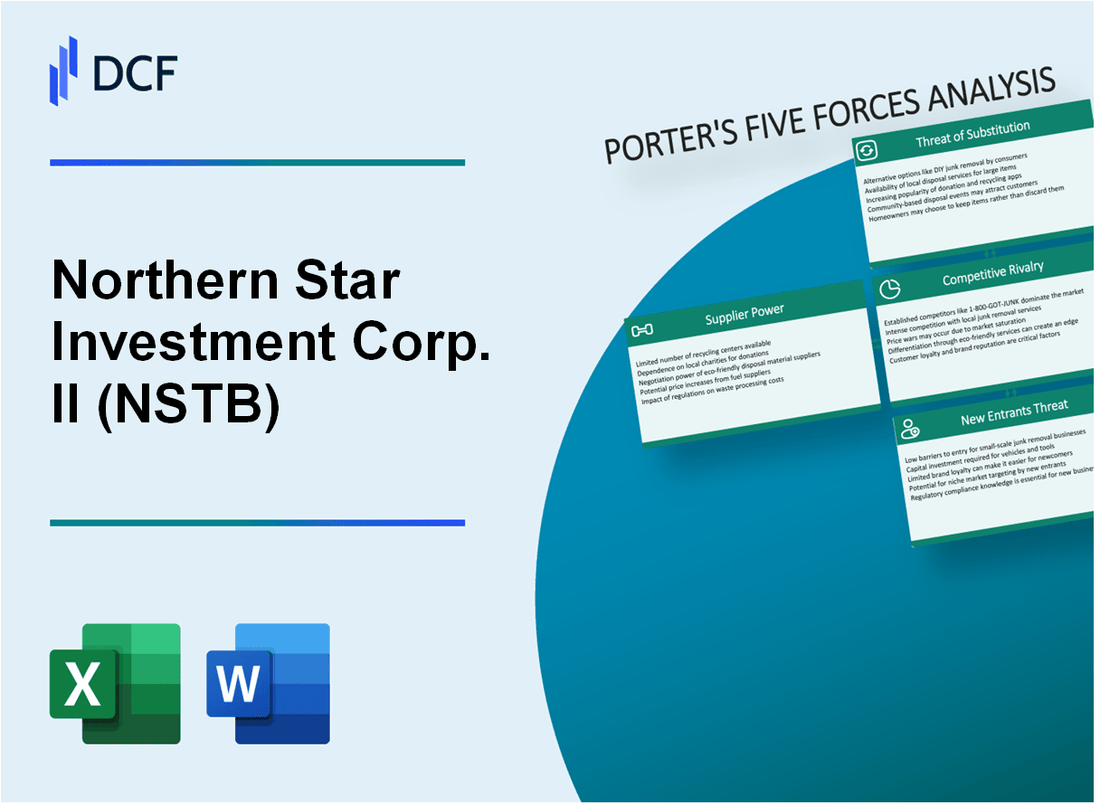

Northern Star Investment Corp. II (NSTB): 5 forças Análise [Jan-2025 Atualizada] |

Totalmente Editável: Adapte-Se Às Suas Necessidades No Excel Ou Planilhas

Design Profissional: Modelos Confiáveis E Padrão Da Indústria

Pré-Construídos Para Uso Rápido E Eficiente

Compatível com MAC/PC, totalmente desbloqueado

Não É Necessária Experiência; Fácil De Seguir

Northern Star Investment Corp. II (NSTB) Bundle

No mundo dinâmico de empresas de aquisição de fins especiais (SPACs), a Northern Star Investment Corp. II (NSTB) navega em um cenário complexo de desafios e oportunidades estratégicas. À medida que os investidores e analistas de mercado examinam a intrincada dinâmica dos investimentos no SPAC, a estrutura das cinco forças de Michael Porter revela uma imagem diferenciada de pressões competitivas, dinâmica de fornecedores e clientes e possíveis interrupções no mercado que poderiam fazer ou quebrar esse veículo de investimento inovador.

Northern Star Investment Corp. II (NSTB) - As cinco forças de Porter: poder de barganha dos fornecedores

Número limitado de gerentes especializados de investimento em SPAC

A partir de 2024, existem aproximadamente 71 gerentes ativos de investimento do SPAC no mercado. A Northern Star Investment Corp. II enfrenta uma paisagem de fornecedores concentrada com requisitos específicos de experiência.

| Categoria | Métrica | Valor |

|---|---|---|

| Total de gerentes SPAC | Profissionais ativos | 71 |

| Especializada experiência em SPAC | Profissionais com experiência profunda | 37 |

Altos conhecimentos necessários para a formação e gerenciamento do SPAC

A gestão do SPAC requer habilidades especializadas significativas com qualificações específicas:

- Experiência mínima de 7 a 10 anos de investimento bancário

- Capacidades avançadas de modelagem financeira

- Histórico comprovado em negociações de fusão

- Especialização em conformidade regulatória da SEC

Mudando os custos de talento de investimento

| Fator de custo de comutação | Custo estimado |

|---|---|

| Despesas de recrutamento | $125,000 - $250,000 |

| Período de transição | 3-6 meses |

Restrições na obtenção de metas de fusão de alta qualidade

Os dados do mercado indicam desafios significativos na identificação de metas de fusão adequadas:

- Apenas 22% dos SPACs completam com sucesso fusões dentro de 24 meses

- Taxa de sucesso -alvo da fusão: 38% dos possíveis candidatos

- Tempo médio para identificar alvo de fusão adequado: 14-18 meses

Northern Star Investment Corp. II (NSTB) - As cinco forças de Porter: poder de barganha dos clientes

Os investidores têm várias opções de investimento em SPAC

No quarto trimestre 2023, havia 124 espaçamentos ativos buscando metas de fusão no mercado. Northern Star Investment Corp. II (NSTB) compete com essas alternativas para o capital dos investidores.

| Categoria SPAC | Número de Spacs ativos | Capital total levantado |

|---|---|---|

| Spacs focados em tecnologia | 42 | US $ 6,3 bilhões |

| Spacs de saúde | 31 | US $ 4,7 bilhões |

| SPACs de consumidor/varejo | 24 | US $ 3,2 bilhões |

Baixos custos de transação para mudar entre espaçamentos

Comissão média de corretagem para negociações SPAC: US $ 0,65 por transação. Plataformas on-line como a Robinhhood oferecem negociações de comissão zero para investimentos no SPAC.

- Mínimo de investimento spac típico: US $ 10 por ação

- Volume de negociação média para SPACs: 250.000 ações diariamente

- Índice de liquidez para estoques SPAC: 1,8 vezes a média de mercado

Alta transparência no desempenho do investimento SPAC

Métricas de desempenho histórico da NSTB:

| Métrica de desempenho | Valor |

|---|---|

| Retorno total desde o IPO | 12.4% |

| Proporção de Sharpe | 1.2 |

| Índice de Volatilidade | 0.75 |

Sofisticação de investidores em crescimento na avaliação de oportunidades de SPAC

Demografia de investidores para investimentos no SPAC em 2023:

- Investidores de varejo: 62% da participação no mercado do SPAC

- Investidores institucionais: 38% da participação no mercado do SPAC

- Tempo médio de pesquisa de investidores por SPAC: 3,5 horas

Principais métricas comparativas para NSTB: - Taxa de retenção de investidores: 68% - Duração média do investimento: 9,2 meses - Desempenho comparativo contra o índice SPAC: +2,3%

Northern Star Investment Corp. II (NSTB) - As cinco forças de Porter: rivalidade competitiva

Número crescente de espacas no mercado

Em 2021, foram concluídos 613 ofertas públicas iniciais do SPAC (IPOs), arrecadando US $ 162,5 bilhões. Até 2022, o número caiu para 86 SPACs, com receitas totais de US $ 12,1 bilhões. No terceiro trimestre de 2023, apenas 34 IPOs SPAC foram registrados, totalizando US $ 3,4 bilhões.

| Ano | Número de IPOs SPAC | Produtos totais |

|---|---|---|

| 2021 | 613 | US $ 162,5 bilhões |

| 2022 | 86 | US $ 12,1 bilhões |

| Q3 2023 | 34 | US $ 3,4 bilhões |

Concorrência intensa por alvos atraentes de fusão

Em dezembro de 2023, aproximadamente 333 SPACs estão buscando ativamente metas de fusão, com cerca de US $ 74,3 bilhões em capital esperando para serem implantados.

- Tamanho médio de negócios do SPAC em 2023: US $ 330 milhões

- Hora mediana para concluir uma combinação de negócios: 18 meses

- Setores com maior atividade de fusão SPAC: tecnologia, saúde, serviços financeiros

Pressão para diferenciar estratégias de investimento

Áreas de foco de investimento exclusivas para SPACs em 2023:

- Inteligência artificial e aprendizado de máquina

- Tecnologias de energia renovável

- Inovações de segurança cibernética

- Tecnologias de veículos elétricos e bateria

Prazo compactado para concluir combinações de negócios

Prazo médio para conclusão da fusão do SPAC em 2023: 12-15 meses, abaixo dos 18 a 24 meses em 2021.

| Ano | Tempo médio de conclusão da fusão | Porcentagem de espaços que atendem ao prazo |

|---|---|---|

| 2021 | 18-24 meses | 62% |

| 2023 | 12-15 meses | 47% |

Northern Star Investment Corp. II (NSTB) - As cinco forças de Porter: ameaça de substitutos

Mercado de IPO tradicional como alternativa

A partir do quarto trimestre de 2023, o mercado global de IPO levantou US $ 80,3 bilhões em 313 acordos, representando um declínio de 22% em relação ao trimestre anterior. O tamanho médio do IPO foi de US $ 256,5 milhões.

| Métrica do mercado de IPO | 2023 valor |

|---|---|

| O IPO total prossegue | US $ 80,3 bilhões |

| Número de ofertas de IPO | 313 |

| Tamanho médio de IPO | US $ 256,5 milhões |

Investimentos de capital de private equity e risco

Em 2023, os investimentos globais de private equity totalizaram US $ 1,1 trilhão, com investimentos em capital de risco atingindo US $ 285 bilhões.

- Total de investimentos em private equity: US $ 1,1 trilhão

- Investimentos de capital de risco: US $ 285 bilhões

- Tamanho médio do negócio de capital de risco: US $ 15,2 milhões

Opções de listagem direta

As listagens diretas aumentaram para 47 transações em 2023, com o produto total de US $ 12,6 bilhões.

| Métrica de listagem direta | 2023 valor |

|---|---|

| Listagens diretas totais | 47 |

| Produtos totais | US $ 12,6 bilhões |

Cenário de investimento de criptomoeda

A capitalização de mercado global de criptomoedas atingiu US $ 1,7 trilhão em dezembro de 2023, com volumes diários de negociação com média de US $ 50 bilhões.

- Mercado de criptomoedas Cap: US $ 1,7 trilhão

- Volume médio de negociação diária: US $ 50 bilhões

- Número de criptomoedas: 22.904

Northern Star Investment Corp. II (NSTB) - As cinco forças de Porter: ameaça de novos participantes

Barreiras à formação de SPAC

No quarto trimestre de 2023, o mercado da SPAC viu 31 novos Spacs lançados, com um aumento médio inicial de capital de US $ 172,5 milhões. O processo de formação requer barreiras iniciais mínimas, com custos de registro da SEC aproximadamente US $ 50.000 a US $ 75.000.

| Métrica de formação SPAC | 2023 dados |

|---|---|

| Novos lançamentos do SPAC | 31 no quarto trimestre 2023 |

| Aumento médio de capital inicial | US $ 172,5 milhões |

| Custo inicial de registro da SEC | $50,000 - $75,000 |

Desafios de conformidade regulatória

Os principais requisitos de conformidade regulatória incluem:

- Sec Formulário S -1 Custos: US $ 25.000 - $ 50.000

- Despesas de conformidade em andamento: US $ 500.000 anualmente

- Auditorias financeiras obrigatórias: US $ 100.000 - US $ 250.000 por auditoria

Requisitos de capital para SPAC competitivo

O lançamento de um SPAC competitivo requer investimento substancial de capital:

| Requisito de capital | Quantia |

|---|---|

| Capital inicial mínimo | US $ 100 milhões |

| Investimento típico de patrocinador | US $ 5 a 10 milhões |

| Taxas de subscrição | 5,5% do aumento total |

Reputação e confiança do investidor

Métricas de confiança dos investidores para investimentos no SPAC em 2023:

- Valor médio de confiança do SPAC: US $ 230 milhões

- Transações bem-sucedidas de S-SPAC: 42%

- Taxa de resgate do investidor: 65,3%

Northern Star Investment Corp. II (NSTB) - Porter's Five Forces: Competitive rivalry

The competitive rivalry facing Northern Star Investment Corp. II (NSTB), especially in its current iteration as a post-liquidation shell, is intense. You are competing in a market saturated with similar vehicles, all vying for the attention of a limited pool of quality private operating companies seeking a public listing.

High rivalry exists among a glut of distressed SPACs and liquidated shells seeking deals in late 2025.

The market is characterized by a large supply of shells. While Northern Star Investment Corp. II (NSTB) liquidated its trust account in early 2024, distributing $10.48 per share to holders of its 1,620,989 remaining public shares, it made the unusual choice to continue operating as a shell on the pink sheets. This decision places it in direct competition with other shells that may have retained better capital structures or more favorable exchange listings. The overall SPAC market saw a rebound, with 81 new SPAC IPOs tracked by one firm as of August 20, 2025, up from 57 for all of 2024. However, this competition is not without casualties; nearly 20% of SPACs led by well-known sponsors still faced liquidation in 2025.

Competition from low-priced stock creates a race to the bottom for merger valuation.

The market sentiment has crushed valuations for deals that have closed. For many targets, the perceived value of a public listing via a shell is severely depressed compared to the peak years. The sheer volume of low-priced equity floating around, including the 11.62 million shares associated with NSTB, forces any remaining shell to offer highly attractive terms to a potential merger partner. The data shows that the median performance for de-SPAC transactions in 2025 reflects a steep decline of about 75% from the standard $10 IPO price. This environment pressures sponsors to accept lower implied valuations for their targets just to get a deal across the finish line.

You need to understand the landscape of the competition you are up against:

- Redemption Pressure: Approximately 95% of SPAC funds have been redeemed in closed deals in 2025.

- Valuation Hurdle: Over 90% of completed SPAC mergers trade below the initial $10 offer price as of early May 2025.

- Post-Liquidation Status: NSTB is now trading on the pink sheets, a less desirable venue than the NASDAQ, where most new 2024 SPACs listed.

Direct competition from other established shell vehicles that have retained better liquidity or exchange listings.

NSTB's move to liquidate its trust means it can only offer a public listing, not the built-in cash trust that was the primary attraction for targets in earlier years. This immediately puts it at a disadvantage against shells that still hold significant trust value or maintain listings on major exchanges. The competition is fierce among vehicles that can offer a more robust platform. For context on the overall market:

| Metric | 2021 Peak (Context) | 2024 Activity | 2025 YTD (Partial) |

|---|---|---|---|

| SPAC IPOs (Count) | 613 | 57 | Close to 100 (Q1-Q3) |

| SPAC IPO Proceeds (USD) | N/A (63% of all IPOs) | $9.6 billion | Approx. $20,760 million (Q1-Q3) |

| Post-Merger Trading (Below $10) | N/A | N/A | Over 90% (as of May 2025) |

The management team's reputation is a key differentiator against other sponsor groups in a crowded, low-quality field.

Reputation matters, and for Northern Star Investment Corp. II (NSTB), the history is a clear headwind. The company settled charges with the Securities and Exchange Commission (SEC) for material misrepresentations in its IPO disclosures, agreeing to pay a $1.5 million penalty contingent on closing a merger. This regulatory action, stemming from pre-IPO discussions with a target, directly impacts the perceived trustworthiness of the sponsor group when negotiating with a prospective private company. While the failed merger with Apex Fintech Solutions-which had a valuation struck at $4.7 billion-was terminated, the subsequent SEC settlement creates a significant hurdle when trying to differentiate your shell from others in a field where investors are now much more discerning.

Northern Star Investment Corp. II (NSTB) - Porter's Five Forces: Threat of substitutes

For Northern Star Investment Corp. II (NSTB), which continues its corporate existence as a shell trading on the OTC Pink sheets following its trust liquidation, the threat of substitutes for its intended business combination-a de-SPAC transaction-is substantial and multifaceted as of late 2025.

A traditional Initial Public Offering (IPO) remains the gold standard substitute for quality private companies. While the SPAC route is often marketed as faster, a traditional IPO typically takes 12-18 months to complete, compared to the 3-6 months average for a SPAC merger, though the actual combined timeline can blur. The cost structure also differs; IPO underwriting spreads average between 7% for deals under $100 million and 5-6% for larger transactions. Still, the credibility and market-driven price discovery of a successful IPO draw high-quality targets away from shell vehicles like Northern Star Investment Corp. II (NSTB). In Q1 2025 alone, global traditional IPOs raised $29.3 billion across 291 deals, signaling a robust, albeit volatile, alternative path.

Direct listings offer a simpler, less-dilutive path to public markets for mature, well-known targets. While direct listings avoid the underwriting fees and sponsor promote dilution inherent in a SPAC IPO, the market trend in 2022-2025 shows that companies opting for this route have generally been microcap stocks. For instance, companies like Cloudastructure and Functional Brands utilized this path in 2025, suggesting it is less of a threat to a large, growth-oriented target that might otherwise seek a SPAC. The key difference in first-day return calculation-from the offer price in an IPO versus the opening trade in a direct listing-further separates the investor experience.

Private equity or venture capital funding provides capital without the regulatory burden of a public shell merger. This substitute is powerful because private capital pools are deep. S&P reported that total uncommitted capital, or dry powder, reached a record $2.62 trillion in July 2024, creating immense pressure for deployment. Furthermore, secondary market transaction volume reached $160 billion in 2024, indicating that liquidity is increasingly being found privately, keeping companies private for longer. For a target company, staying private allows it to avoid the scrutiny that Northern Star Investment Corp. II (NSTB) faced, including the $1.5 million SEC settlement it agreed to in January 2024.

Target companies can use other, less-damaged shell companies with cleaner histories and better public market access. Northern Star Investment Corp. II (NSTB) itself is an example of a shell with a complicated history, having liquidated its trust and now trading on the OTC Pink sheets, which limits access to more prestigious exchanges. In contrast, sister SPACs like Northern Star III and IV were delisted from the NYSE and sought a Nasdaq listing prior to or in connection with a merger. The market saw 122 new SPAC IPOs in 2025, raising $25.19 billion, with an average raise of $205.2 million, meaning targets have many other, potentially cleaner, vehicles to choose from.

| Substitute Path | Key Metric/Data Point (Late 2025 Context) | Relevance to NSTB Threat Level |

|---|---|---|

| Traditional IPO Timeline | Average execution time of 12-18 months. | High: Offers a more established, credible route, though slower. |

| SPAC IPO Capital Raised (2025 YTD) | $25.19 billion raised across 122 IPOs. | Medium: Indicates capital is flowing to new SPACs, bypassing older shells. |

| Private Market Dry Powder | Record $2.62 trillion as of July 2024. | High: Significant capital available privately, reducing the need to go public. |

| Direct Listing Profile | Companies listing via this route have generally been microcap stocks (2022-2025). | Low to Medium: Less of a threat for a large, established target seeking significant capital. |

| NSTB Post-Liquidation Status | Trades on the OTC Pink sheets. | High: Inferior listing venue compared to NYSE/Nasdaq, making cleaner shells more attractive. |

The competitive landscape for a target company is defined by these trade-offs:

- Traditional IPOs: 12-18 month timeline vs. SPAC speed.

- Direct Listings: Simpler structure, but often for microcap firms.

- Private Capital: $2.62 trillion in dry powder available privately.

- Alternative Shells: Many new 2025 SPACs with cleaner records available.

- Litigation Risk: De-SPACs face a 17% likelihood of an SCA vs. 13% for new IPOs.

Finance: draft updated risk assessment on OTC listing discount by Friday.

Northern Star Investment Corp. II (NSTB) - Porter's Five Forces: Threat of new entrants

You're analyzing the threat of new entrants into the business of Northern Star Investment Corp. II (NSTB) as a post-liquidation shell entity. The barrier to entry here isn't starting from scratch with an Initial Public Offering (IPO); it's about acquiring an existing, publicly-listed vehicle. Honestly, the landscape is shaped by both new issuance and the recycling of old ones.

New SPAC formation has definitely picked up steam in 2025 after the lull of 2023-2024, but the market is still seeing shell companies created through the liquidation of older SPACs, like what happened with Northern Star Investment Corp. II. As of November 24, 2025, the market saw 122 SPAC IPOs year-to-date, raising \$25,037.9 million in gross proceeds. This contrasts with the 57 IPOs in all of 2024. Still, when a SPAC like Northern Star Investment Corp. II liquidates its trust, the remaining corporate shell can be acquired, offering a shortcut to the public markets for a new sponsor.

The main cost barrier for a traditional SPAC-the trust capital-is effectively removed for an acquirer of a shell like Northern Star Investment Corp. II. When Northern Star Investment Corp. II liquidated its trust in early 2024, the distribution to public shareholders was approximately \$10.48 per share. This means the primary asset backing the initial public float is gone, but the public listing structure remains. The sponsor and officers waived their right to this distribution, leaving the retained shares as the basis for a potential future transaction.

Here's a quick look at the capital dynamics influencing new entrants:

| Metric | Value (as of late 2025/YTD) | Context |

|---|---|---|

| Northern Star Investment Corp. II Trust Distribution (Historical) | \$10.48 per share | The cost basis distributed to original public shareholders. |

| 2025 YTD SPAC IPO Gross Proceeds | \$25,037.9 million | Indicates renewed capital flow into new SPACs. |

| 2025 YTD SPAC IPO Count | 122 | Shows a resurgence in new formation activity. |

| Serial Sponsor Lead in 2025 IPOs (Q2-2025) | 80% | New entrants face competition from experienced teams. |

| Northern Star Investment Corp. II Post-Liquidation Price (Example) | \$0.010 | Illustrates the low market valuation of a post-trust shell. |

Regulatory changes create a shifting landscape that affects every potential new entrant, whether they launch a new SPAC or acquire a shell. The SEC finalized new rules that became effective July 1, 2024, with enhanced Inline XBRL tagging requirements starting June 30, 2025. These rules specifically target de-SPAC transactions to align them more closely with traditional IPO disclosures.

The key regulatory shifts impacting new entrants include:

- Enhanced disclosure on sponsor compensation.

- Mandatory disclosure of conflicts of interest.

- New requirements regarding dilution analysis.

- Rule 145a deeming the transaction a sale of securities.

- Increased liability exposure for projections used.

New sponsors can enter the market by acquiring existing, cheaper shell entities like Northern Star Investment Corp. II, which has already navigated the initial listing process and is now trading on the OTC Pink. This path bypasses the current regulatory scrutiny applied to new SPAC IPOs, though the subsequent de-SPAC transaction will still fall under the new rules. The low trading price of \$0.010 for NSTB as of late 2025 suggests a very low acquisition cost for the corporate shell itself, assuming the sponsor can negotiate a deal that retains the public shareholders. If onboarding takes 14+ days, churn risk rises, but for a shell acquisition, the speed of a reverse merger is the key advantage over a fresh IPO.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.