|

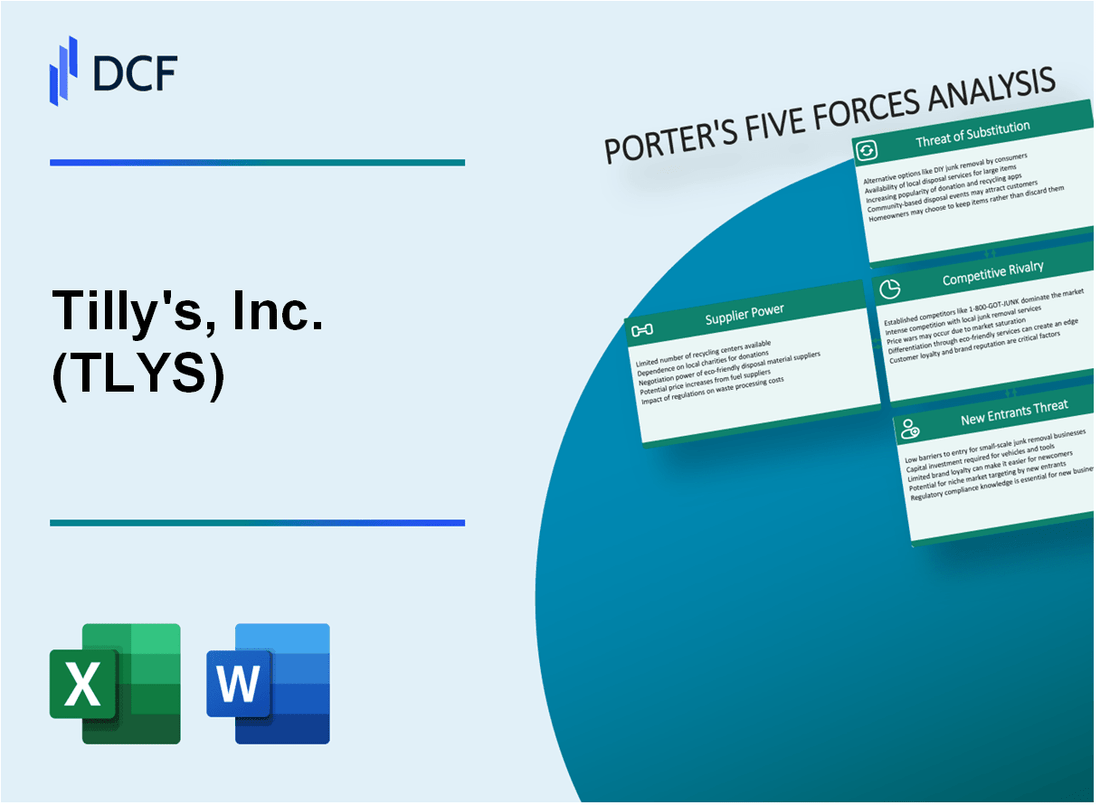

Tilly's, Inc. (TLYS): 5 forças Análise [Jan-2025 Atualizada] |

Totalmente Editável: Adapte-Se Às Suas Necessidades No Excel Ou Planilhas

Design Profissional: Modelos Confiáveis E Padrão Da Indústria

Pré-Construídos Para Uso Rápido E Eficiente

Compatível com MAC/PC, totalmente desbloqueado

Não É Necessária Experiência; Fácil De Seguir

Tilly's, Inc. (TLYS) Bundle

No mundo em ritmo acelerado do varejo de moda adolescente e adulto jovem, a Tilly's, Inc. navega em um cenário competitivo complexo, onde a sobrevivência exige uma visão estratégica. Ao dissecar a estrutura das cinco forças de Michael Porter, revelaremos a intrincada dinâmica que molda o posicionamento competitivo de Tilly em 2024 - explorando como os relacionamentos com fornecedores, comportamentos de clientes, rivalidades de mercado, substitutos em potencial e novos participantes influenciam coletivamente o potencial estratégico da empresa e a resiliência do mercado.

Tilly's, Inc. (TLYS) - As cinco forças de Porter: poder de barganha dos fornecedores

Número limitado de fabricantes de roupas e vestuário

Em 2024, as fontes de Tilly de aproximadamente 87 fabricantes de roupas e vestuário diferentes em todo o mundo. Os 5 principais fornecedores representam 62% do inventário total de produtos da empresa.

| Categoria de fornecedores | Número de fornecedores | Porcentagem do inventário total |

|---|---|---|

| Fabricantes domésticos | 24 | 38% |

| Fabricantes internacionais | 63 | 62% |

Dependência de fornecedores -chave

A Tilly depende de 12 fornecedores principais para linhas de roupas orientadas para jovens, com um valor médio de contrato de US $ 3,2 milhões por fornecedor em 2023.

- Principais fornecedores de moda juvenil: 12

- Valor médio do contrato: US $ 3.200.000

- Valor total do contrato de fornecedores: US $ 38,4 milhões

Potencial concentração de fornecedores

Categoria de produto Remoção de concentração de fornecedores:

| Categoria de produto | Número de fornecedores especializados | Risco de concentração |

|---|---|---|

| Streetwear | 15 | Alto |

| Vestuário de surf/skate | 8 | Moderado |

| Acessórios | 22 | Baixo |

Custos de troca de fornecedores

Custos de troca de fornecedores para Tilly's em 2024:

- Custo médio de adaptação do projeto: US $ 127.500

- Despesas de verificação de conformidade da qualidade: US $ 85.300

- Custo total estimado de comutação por fornecedor: US $ 212.800

- Duração típica do contrato de fornecedores: 18-24 meses

Os custos de troca moderados criam um barreira estratégica Isso limita as mudanças rápidas do fornecedor, mantendo a qualidade do produto e o design da integridade.

Tilly's, Inc. (TLYS) - As cinco forças de Porter: poder de barganha dos clientes

Análise demográfica jovem e sensível ao preço

O alvo demográfico de Tilly de jovens de 16 a 24 anos demonstra sensibilidade significativa ao preço. De acordo com a pesquisa adolescente do outono de Piper Sandler, 72% dos adolescentes priorizam o preço ao fazer compras de roupas.

| Faixa etária | Gastos médios | Sensibilidade ao preço |

|---|---|---|

| 16-19 anos | US $ 98 por mês | Alto |

| 20-24 anos | US $ 127 por mês | Moderado |

Alternativas de compras on -line

A competição de varejo on -line afeta significativamente o poder de barganha do cliente. As vendas de roupas de comércio eletrônico atingiram US $ 185,4 bilhões em 2023, representando 36,4% do total de vendas de vestuário.

- Amazon Fashion: Receita anual de US $ 31,8 bilhões

- ASOS: Receita anual de US $ 4,2 bilhões

- Zalando: Receita anual de US $ 10,7 bilhões

Influência de compra de mídia social

As plataformas de mídia social levam as decisões de compra do mercado -alvo de Tilly. Os recursos de compras do Instagram influenciaram 49% dos comportamentos de compra da Gen Z em 2023.

| Plataforma | Influência de compra | Valor médio do pedido |

|---|---|---|

| 49% | $78 | |

| Tiktok | 37% | $65 |

Recursos de comparação de preços

87% dos consumidores usam ferramentas de comparação de preços antes de fazer compras de moda, reduzindo os custos de troca de clientes e aumentando o poder de barganha.

- NOTE DE VARENHO: 60 milhões de usuários mensais

- Mel: 17 milhões de usuários ativos

- PriceGrabber: 25 milhões de visitantes mensais

Tilly's, Inc. (Tlys) - Five Forces de Porter: Rivalidade Competitiva

Concorrência intensa em segmento de roupas para adolescentes e jovens adultos

No terceiro trimestre de 2023, a Tilly relatou as vendas líquidas de US $ 134,7 milhões, refletindo o desafio cenário competitivo em roupas de varejo adolescentes e jovens adultos.

| Concorrente | Quota de mercado | Receita anual |

|---|---|---|

| Águia americana | 14.2% | US $ 4,57 bilhões (2022) |

| Zumiez | 7.8% | US $ 1,03 bilhão (2022) |

| Tilly's | 3.5% | US $ 521,9 milhões (2022) |

Análise de concorrência direta

As principais pressões competitivas incluem:

- A forte presença da marca da American Eagle

- Esportes de ação especializados e posicionamento de moda de rua de Zumiez

- Estratégias de preços agressivos dos varejistas on -line

Pressão competitiva de varejo on -line

A participação de mercado de moda rápida global de Shein atingiu 28% em 2023, impactando significativamente os varejistas tradicionais como a Tilly's.

| Varejista on -line | Participação de mercado global | Vendas on -line anuais |

|---|---|---|

| Shein | 28% | US $ 30,8 bilhões (2022) |

| Moda Nova | 12% | US $ 750 milhões (2022) |

Desafios da margem de lucro

A Tilly's relatou uma margem bruta de 33,4% no terceiro trimestre de 2023, em comparação com a média da indústria de 36,7%, indicando pressão competitiva significativa.

Estratégias de diferenciação da marca

- Plataformas de comércio online e móveis expandidas

- Iniciativas de marketing digital aprimorado

- Variedade de mercadorias direcionadas

Tilly's, Inc. (TLYS) - As cinco forças de Porter: ameaça de substitutos

Crescer plataformas de comércio eletrônico que oferecem estilos de roupas semelhantes

A partir do quarto trimestre de 2023, as vendas globais de varejo de moda on -line atingiram US $ 759,7 bilhões. Plataformas de comércio eletrônico como Shein, Fashion Nova e Zara Online Store capturaram 22,3% da participação no mercado da moda juvenil competindo diretamente com os segmentos de produtos da Tilly.

| Plataforma de comércio eletrônico | Penetração de mercado | Faixa de preço médio |

|---|---|---|

| Shein | 12.5% | $15-$45 |

| Moda Nova | 7.8% | $25-$65 |

| Zara Online | 9.2% | $35-$85 |

Rise de mercados on -line

A Amazon Fashion gerou US $ 31,8 bilhões em receita de roupas e acessórios em 2023, representando um aumento de 17,6% em relação ao ano anterior.

- Participação de mercado da Amazon Fashion em roupas para jovens: 15,4%

- Valor médio da transação: US $ 52,30

- Taxa de crescimento anual: 12,9%

Plataformas de roupas de segunda mão

A Thredup registrou US $ 387 milhões em receita para 2023, com o mercado de revenda crescendo 11x mais rápido que o mercado tradicional de roupas de varejo.

| Plataforma | 2023 Receita | Crescimento do mercado |

|---|---|---|

| Thredup | US $ 387 milhões | 24.6% |

| Poshmark | US $ 267 milhões | 18.3% |

Tendências de moda de mídia social

A Tiktok Shop gerou US $ 4,4 bilhões em vendas de moda durante 2023, com 67% dos usuários de 16 a 24 anos tomando decisões de compra com base em recomendações de plataforma.

Serviços de roupas baseadas em assinatura

O Stitch Fix reportou US $ 2,1 bilhões em receita para 2023, com 4,2 milhões de assinantes ativos representando um aumento de 9,3% em relação a 2022.

- Valor médio de assinatura: US $ 64 por mês

- Taxa de retenção de clientes: 67,5%

- Projeção anual de crescimento: 11,2%

Tilly's, Inc. (TLYS) - As cinco forças de Porter: ameaça de novos participantes

Baixas barreiras à entrada no mercado de roupas de varejo on -line

A partir do quarto trimestre de 2023, o mercado de roupas de comércio eletrônico apresentou barreiras mínimas de entrada com vendas globais de roupas on-line, atingindo US $ 759,5 bilhões.

| Métrica de mercado | Valor |

|---|---|

| Tamanho do mercado global de roupas de comércio eletrônico | US $ 759,5 bilhões |

| Custo de configuração da loja digital inicial média | $5,000 - $10,000 |

| Shopify Store Cost Monthly | $29 - $299 |

Requisitos de capital mínimos para fachadas de lojas digitais

- O modelo de dropshipping requer investimento mínimo de inventário inicial

- As plataformas de marketing digital permitem publicidade direcionada de US $ 500 mensalmente

- As plataformas de mídia social fornecem canais de marketing gratuitos

Aumentando a facilidade de estabelecer marcas diretas ao consumidor

Em 2023, 67% das marcas verticais nativas digitalmente foram lançadas com sucesso com menos de US $ 100.000 capital inicial.

Tecnologia que permite o rápido desenvolvimento da marca

| Plataforma de tecnologia | Custo mensal |

|---|---|

| Shopify | $29 - $299 |

| WooCommerce | Custos de hospedagem gratuitos + |

| BigCommerce | $39 - $299 |

Potencial para a penetração do mercado de nicho

Em 2023, as marcas de moda de nicho capturaram 22% da participação de mercado de roupas on -line com estratégias de marketing direcionadas.

- Alcance de publicidade do Instagram: 1,4 bilhão de usuários

- Tiktok Fashion Content Engagement: 67% dos usuários

- Custo médio de aquisição de clientes: US $ 15 - $ 25

Tilly's, Inc. (TLYS) - Porter's Five Forces: Competitive rivalry

You're analyzing the competitive landscape for Tilly's, Inc. (TLYS), and the rivalry force is definitely showing pressure. This segment of specialty retail is crowded, meaning Tilly's, Inc. must fight hard for every dollar against established, larger players. Honestly, being a small-cap entity in this space means you lack the scale advantages your bigger rivals enjoy.

The competitive intensity is evident when you look at the top-line performance. For the second quarter of fiscal 2025, Tilly's, Inc. reported total net sales of $151.3 million, which was a 7.1% decrease year-over-year. This contraction in sales, even amid operational improvements, signals that market share is being ceded to competitors like Urban Outfitters and Zumiez, who operate with greater diversification and scale.

The financial structure of Tilly's, Inc. highlights this vulnerability. While the company managed to post a GAAP net income of $3.2 million in Q2 2025, or $0.10 per diluted share, the broader context shows fragility. For instance, the trailing twelve months show a net loss, with a trailing EPS of -$1.52. Furthermore, one report indicated a negative net margin of -8.69% for the second quarter in a context that emphasizes vulnerability [1 from second search]. The operating margin for Q2 2025 was 1.8%, which is thin protection when facing well-capitalized competitors.

Tilly's, Inc. is actively managing its physical footprint, which is a direct response to the high fixed costs associated with intense rivalry. The company operated 232 total stores as of August 2, 2025, a reduction of 15 locations, or 6.1%, compared to the 247 stores at the end of the second quarter last year. This consolidation is a necessary action to reduce overhead, but it shrinks the physical touchpoints available to compete.

Here is a quick look at the key financial and operational metrics that frame this competitive pressure:

| Metric | Value (Q2 FY2025) | Comparison/Context |

| Total Net Sales | $151.3 million | Decreased 7.1% year-over-year |

| Net Income (GAAP) | $3.2 million | Reversed a $0.1 million loss from Q2 2024 |

| Operating Margin | 1.8% | Up from a 0.5% loss last year |

| Net Margin (Reported Context) | -8.69% | Indicates overall trailing/contextual pressure [1 from second search] |

| Total Stores (Aug 2, 2025) | 232 | Down 15 stores from 247 last year |

The pressure from the competitive set manifests in several ways that you need to watch closely:

- Comparable net sales for Q2 2025 decreased by 4.5%.

- Physical store net sales fell 7.3% to $122.7 million.

- E-commerce net sales decreased by 6.6% to $28.5 million.

- The company's trailing twelve-month revenue stood at $549.6 million, dwarfed by larger sector players.

- Occupancy costs decreased by $1.7 million due to fewer stores [1 from second search].

The reliance on external brands and platforms is another point of friction. A third-party vendor decision in August 2025 removed $1.8 million in net sales from the e-commerce channel for that month alone. This reliance on third-party brand performance and distribution decisions directly impacts Tilly's, Inc.'s ability to maintain consistent sales momentum against rivals who may have stronger, proprietary product lines.

Tilly's, Inc. (TLYS) - Porter's Five Forces: Threat of substitutes

The threat of substitutes for Tilly's, Inc. remains substantial, driven by a highly fragmented and increasingly value-oriented consumer base that has readily adopted lower-cost, faster, or more circular alternatives for apparel acquisition. This pressure is not abstract; it is quantifiable in the performance metrics of its direct and indirect competitors.

Deep-discount retailers like TJX and Ross Stores offer significant price substitution pressure.

The success of off-price retailers in fiscal year 2025 clearly demonstrates consumers trading down from mid-tier specialty stores like Tilly's, Inc. While Tilly's, Inc. reported a comparable net sales decrease of 4.5% in its second quarter of fiscal 2025, competitors focused on value delivered strong growth. For instance, The TJX Companies, Inc. (parent to TJ Maxx and Marshalls) reported consolidated comparable store sales growth of 3% for its third quarter of fiscal 2025, with its Marmaxx division (including TJ Maxx, Marshalls, Sierra, and e-commerce) seeing sales rise 7%. Ross Stores, Inc. was even stronger, posting same-store sales growth of 7% in its third quarter of fiscal 2025, on total sales that jumped 10% to $5.6 billion. Even the largest discounter, Walmart, reported comparable sales growth of 4.5% in its third quarter, while Target's comp sales fell 2.7%. This divergence shows that when consumers are cautious, they actively seek out the deep-discount channel, directly pulling dollars away from specialty retailers like Tilly's, Inc., which reported total net sales of only $151.3 million for the same quarter.

Here's a quick comparison of the value-focused competitors' recent performance:

| Competitor | Metric | Value (Late 2025 Data) |

|---|---|---|

| The TJX Companies, Inc. (TJX) | Q3 FY25 Consolidated Comp Sales Growth | 3% |

| Ross Stores, Inc. (ROST) | Q3 FY25 Same-Store Sales Growth | 7% |

| Walmart (WMT) | Q3 FY25 Comparable Sales Growth | 4.5% |

| Tilly's, Inc. (TLYS) | Q2 FY25 Comparable Net Sales Change (YoY) | -4.5% |

| The TJX Companies, Inc. (TJX) | Q3 FY25 Net Sales | $14.1 billion |

| Ross Stores, Inc. (ROST) | Q3 FY25 Net Sales | $5.6 billion |

Fast fashion and pure-play e-commerce brands offer quicker trend cycles and lower barriers to purchase.

The speed and sheer volume offered by fast fashion and pure-play e-commerce giants present a structural threat. The global fast fashion market was valued at approximately $150 billion in 2025, with a compound annual growth rate (CAGR) around 10%. Furthermore, the broader fashion e-commerce market was valued at $799.3 billion in 2025. These digital-first competitors excel at rapidly translating micro-trends into available product, often via mobile platforms, as 70% of fashion e-commerce sales happen on mobile devices. This immediacy is critical for the younger demographic that Tilly's, Inc. targets. What this estimate hides is the consumer behavior shift: 86% of Gen Z and millennials are trading down their purchases for better value and pricing, making the low barrier to entry and constant novelty of fast fashion highly attractive substitutes.

- Global fast fashion market size (2025): $161.7 billion

- Global fashion e-commerce sales (2025): $883 billion

- Ecommerce share of global fashion retail sales (2025): 21%

- Percentage of Gen Z/Millennials trading down for value: 86%

Resale and rental platforms provide cost-effective alternatives for the value-conscious consumer.

The circular economy is no longer niche; it is a mainstream substitute, especially when consumers are budget-constrained. The high-end rental and resale market was projected to grow five times by 2025, significantly outpacing new apparel growth. By 2025, resale is expected to account for 10% of the global apparel market. This trend is fueled by both environmental awareness and cost-consciousness, with 59% of consumers stating they will not buy an apparel item if they cannot find a good deal. The overall global resale market, valued around $200 billion in 2023, is forecast to hit $400 billion by 2027. For context, H&M's resale partnership with Sellpy targeted €90 million in resales in 2023, showing the scale that even established players are capturing through circular models. If onboarding takes 14+ days, churn risk rises, and these platforms offer instant gratification for value seekers.

The growth trajectory of resale outpaces traditional retail.

| Resale/Circular Metric | Value/Projection |

|---|---|

| High-End Rental/Resale Growth by 2025 (vs. new apparel) | 5x |

| Resale Share of Global Apparel Market (2025 Estimate) | 10% |

| Global Resale Market Valuation (2027 Forecast) | $400 billion |

| Predicted Annual Resale Growth (Next 5 Years) | 12-15% |

| Consumers Not Buying Without a Deal | 59% |

Finance: draft 13-week cash view by Friday.

Tilly's, Inc. (TLYS) - Porter's Five Forces: Threat of new entrants

You're looking at the barriers to entry for a new competitor trying to grab a piece of the youth apparel market Tilly's, Inc. currently serves. The threat level here is a mix, leaning toward moderate because while digital entry is cheap, establishing a physical footprint and brand trust takes serious capital and time.

Low capital required to launch an online-only apparel brand for the youth market

Honestly, the digital door is wide open. Launching an online-only brand in the youth market doesn't require the massive upfront investment of a brick-and-mortar operation. For a new entrant using a print-on-demand (POD) model, startup costs can be incredibly low. We see estimates suggesting a small-batch clothing line can start with as little as $500-$1,000, covering basic store setup and minimal initial marketing spend. Even a more robust launch using a POD or dropshipping model, which includes basic branding and a website, is estimated in the $5,000 - $15,000 range. To be fair, if a new player aims for small-batch production rather than POD, the total startup costs for a small to mid-sized brand in 2025 generally range from $20,000 to $150,000. The youth apparel market itself is huge, expected to surpass $300 billion globally by 2025, so the potential reward for a successful digital entrant is significant.

Tilly's' network of 232 physical stores creates a moderate capital barrier for new brick-and-mortar rivals

While e-commerce is low-barrier, establishing a physical presence still demands significant capital, which acts as a brake on direct, full-scale rivals. Tilly's, Inc. currently operates a network of 230 physical stores as of November 1, 2025, spread across 33 states. A competitor looking to match this footprint would face substantial costs related to leasing, build-outs, and staffing across multiple markets. For context, Tilly's Q2 2025 net sales from physical stores were $208.6 million in the first half of fiscal 2025, showing the revenue scale required to support such a network. Furthermore, Tilly's has been actively rationalizing its footprint, having closed 15 locations year-over-year by Q2 2025, suggesting that even for an incumbent, maintaining the physical network is a costly, ongoing capital decision.

Established relationships with iconic global brands are difficult for new entrants to replicate quickly

This is where Tilly's, Inc. has a durable advantage. They carry an extensive assortment of iconic global, emerging, and proprietary brands. Securing these key vendor relationships requires established credibility, proven sales volume, and often, favorable payment terms that new, unproven entities simply cannot secure overnight. The importance of these relationships is underscored by recent operational risk; in August fiscal 2025, a third-party vendor altered distribution strategies, which directly removed $1.8 million from Tilly's e-commerce net sales. This event shows the direct financial impact of vendor decisions, and a new entrant would have to build relationships strong enough to secure allocation from these same brands while navigating potential exclusivity or volume requirements.

Here's a quick look at the scale of Tilly's physical presence versus its recent sales performance, which new entrants must overcome:

| Metric | Value as of Late 2025 Data |

| Total Physical Stores (as of Nov 1, 2025) | 230 |

| States with Physical Stores | 33 |

| Q2 2025 Total Net Sales | $151.3 million |

| Q2 2025 Physical Store Net Sales (81.1% of total) | Approximately $122.7 million |

| Market Capitalization (Recent Report) | $35.26 million |

The fragmented market requires high initial marketing spend to achieve brand recognition

The youth apparel space is highly fragmented, meaning that even if a new brand launches cheaply online, achieving meaningful visibility is expensive. While the overall kidswear market is large, capturing attention requires cutting through significant noise. New entrants must budget for substantial customer acquisition costs to break through. For example, while a minimal budget for a POD launch is low, the marketing launch budget alone for a moderate brand can range from $1,000 to $15,000. To compete with Tilly's, which has established brand awareness through its physical footprint and years of marketing, a digital-only rival must spend aggressively to drive traffic. Tilly's itself is actively trying to enhance awareness, noting its TikTok following quadrupled to 169,000 since the start of Q2 2025, showing the ongoing need for digital marketing investment.

Key factors influencing a new entrant's marketing hurdle include:

- Digital launch costs can start as low as $500 for a basic store.

- Branding elements like logo design can cost between $250 to $1,500.

- The need to compete against established brand recognition.

- The necessity to build trust, especially regarding product safety and sourcing.

Finance: draft 13-week cash view by Friday.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.